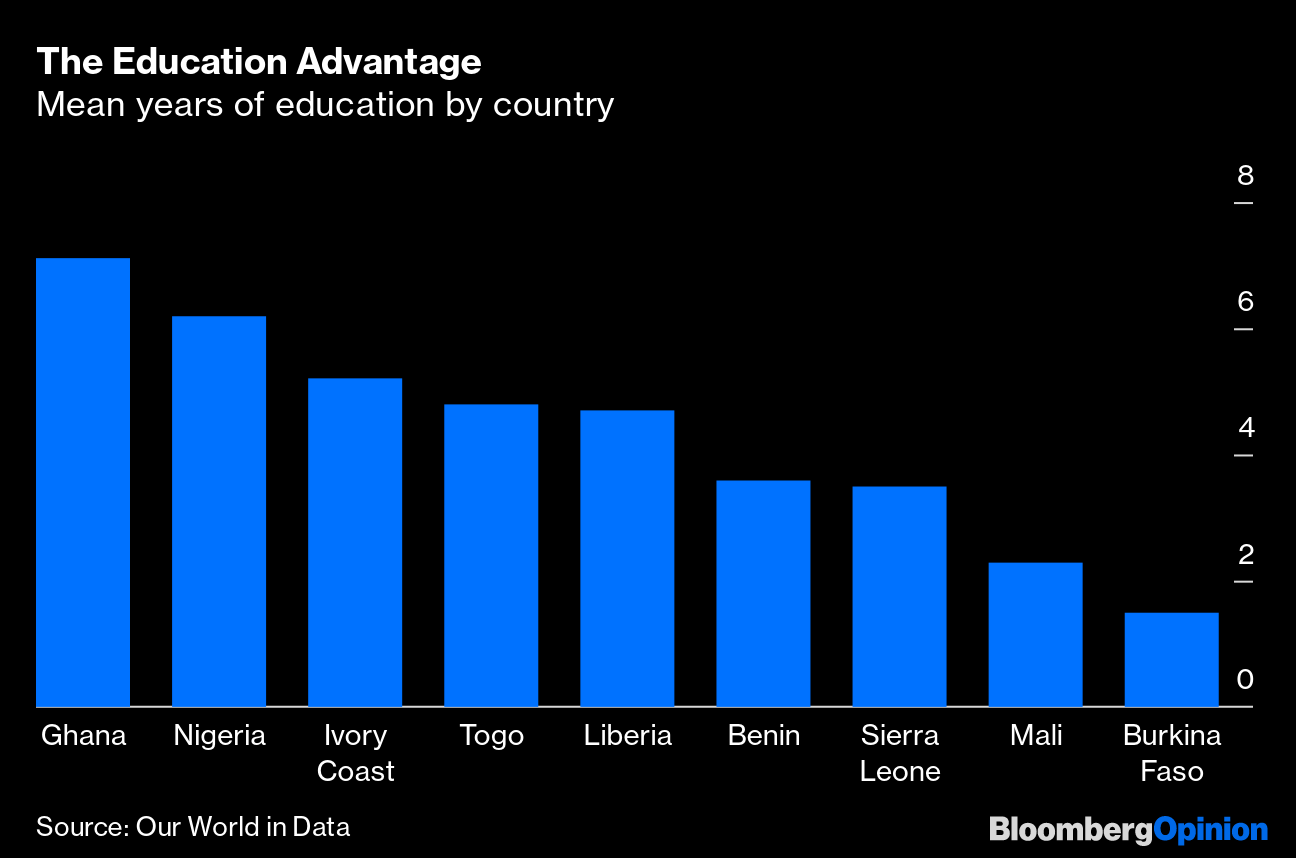

| This is Bloomberg Opinion Today, a 500-sheet roll of Bloomberg Opinion's opinions. Sign up here. Today's Agenda  Full of surprises. Photographer: Stringer/Getty Images AsiaPac Markets Should Seek a Second Virus Opinion The coronavirus holding China hostage keeps finding unpleasant ways to surprise. We first heard that Beijing had acted relatively quickly to control the disease, but then learned that it could have done much better. We heard that the virus has a lower death rate than SARS — which is thankfully still true — but also that it has now killed more than 900 people, more than SARS did, and it's still spreading. Markets, meanwhile, have bopped along believing central banks will paper over any economic damage with fresh stimulus while we wait, probably just a short while, for the crisis to end. But the disease could surprise us again, writes Mohamed El-Erian. Perhaps influenced by the financial crisis, many seem to think the economic rebound will be V-shaped. But this ignores the nature of the disruption in this case, writes Mohamed: Shutting down and restarting goods production takes much longer than shutting down and rebooting, say, credit trading. Markets aren't priced for a slow and painful recovery, warns John Authers. And the damage is already scarier than a glance at the relentlessly upbeat Dow would suggest. The virus, coming after months of protests and inept management, has left Hong Kong basically a failed state, writes Clara Ferreira Marques. There was even a toilet paper panic, for God's sake. Nothing less than the city's future as a financial hub is now in doubt. That seems a tad disruptive, like in a long-term way? Central banks have signaled they'll ride to the rescue, but also haven't exactly been rushing for their horses, writes Daniel Moss. They should be working together and doing more to stay ahead of the crisis. Better to risk doing too much than to be taken by surprise yet again. Further Markets-in-Coronavirus Reading: If It's Monday, There's a Primary Vote Coming We are now in the election-every-week phase of the 2020 presidential race. The Democrats are still cleaning up the mess Iowa made, but the battle has already moved on to New Hampshire, where there will be a primary tomorrow. Former front-runner Joe Biden's supporters are gamely singing modified Backstreet Boys songs to him, but he is in deep trouble, writes Francis Wilkinson. Apparently you can't just wander in as an elder statesman and be handed the government; they make you actually campaign for it. And that seems to be taking too much out of the former vice president. Biden's decline leaves an opening in the moderate-Democrat lane. Pete Buttigieg and Bloomberg LP founder Mike Bloomberg — who is also running for the nomination but not actively competing in New Hampshire — seem among the likeliest beneficiaries. But Senator Amy Klobuchar, who arguably won Friday night's debate, has jumped into third place in Granite State polling, notes Jonathan Bernstein. That might be enough to get her declared the "winner" of the primary, according to the bizarre way we have all agreed to look at these outcomes. Less-Than-Manic Merger Monday It's been a while since we've had a good Merger Monday. This, uh, isn't one. Oh, sure, there was a deal: Simon Property Group Inc. is taking control of Taubman Centers Inc. for $3.6 billion. This just isn't a particularly happy deal. Both companies operate these things known as "malls," which are echoing, empty places where Americans once purchased sweaters and orange drinks. Ha, no, people still go to malls, but not very much. Simon and Taubman are among the industry's survivors because they both run malls that are less depressing than most, notes Tara Lachapelle. But even they see grim days ahead. The day's other big deal news involved the Federal Trade Commission stopping Edgewell Personal Care Co. from buying direct-to-consumer razor-seller Harry's Inc. The FTC's logic here is shaky, writes Brooke Sutherland, but it sends a message to other DTC unicorns, that a purchase by a bigger rival is no longer a viable escape plan. Further Deal Reading: Xerox Holdings Corp.'s slightly sweetened bid for HP Inc. should get talks going. — Alex Webb Telltale Charts It only took like 40 years, but college textbook prices have finally stopped going parabolic, writes Justin Fox. But the relief may not be permanent.  Ghana could be the Japan of Africa, leading the continent's industrialization, writes Noah Smith. But it must keep trying to build a manufacturing base.  Further Reading Boris Johnson is trying to play 8-D chess, negotiating trade deals with several partners at once. He probably can't recoup what Brexit will cost the U.K. — Therese Raphael Germany's far right just took down Angela Merkel's chosen successor, throwing the country's politics into turmoil. — Andreas Kluth For signs of how much euphoria is driving markets, watch TikTok and Reddit, where skeptics are rare. — Conor Sen Stress-testing banks for CLO exposure won't reveal much, but any little bit of new info will help confidence. — Brian Chappatta Ross Douthat says we're decadent; nothing exemplifies decadence like our energy system. — Liam Denning Israeli politics may be too divided to ever form a government to accept President Donald Trump's peace plan. — Zev Chafets America's failing health-care system is killing new mothers. — Faye Flam ICYMI Trump's latest budget includes deep safety-net cuts but big defense spending. Rudy Giuliani is feeding Ukraine info straight to the Justice Department. More than 100 U.S. troops suffered brain injuriesin Iran's Jan. 8 attack in Iraq. Kickers British Airways plane uses storm to break transatlantic speed record. (h/t Ellen Kominers) FINALLY, somebody invents a trombone that shoots fire. (h/t Alexandra Ivanoff) This cherry-blossom tree is the biggest Lego sculpture on record. (h/t Scott Kominers) Every Oscar Best Picture winner, ranked. Note: Please send fire trombones and complaints to Mark Gongloff at mgongloff1@bloomberg.net. Sign up here and follow us on Twitter and Facebook. |

Post a Comment