| Panic well and truly over. As of the weekend, bond markets had reached a point of extreme negativity, stock markets were selling off having reached a point (in the U.S.) of extreme positivity, and the world braced nervously for the reopening of markets in China, a flood of economic data, and the spread of the most alarming new virus in decades. As of now, the bond market has dialed back the extremes. Yields have risen, long-term real yields have turned positive, and the Treasury yield curve is no longer inverted. As for the stock market, the S&P 500 closed Wednesday at a fresh all-time high. The opportunity to "buy on the dip" is over, and that dip was never as much as 4%. All of this without any unambiguously good news on the spread of the coronavirus, which has forced Chinese authorities into possibly the greatest quarantine exercise in history in the sprawling city of Wuhan, home to more than 11 million people. So what has made stock investors happy once more?

We can partly attribute the mood to the incoming economic data. Non-farm payrolls for January are still to come, but this week's data so far has largely reassured people that the U.S., and to a lesser extent Europe, had managed to recover from their last great fear emanating from China, a trade war. Manufacturing surveys are recovering from an alarmingly weak position. And the non-manufacturing survey today suggested business activity has completed a startling rebound, after briefly going into its worst funk in a decade as the trade talks intensified:

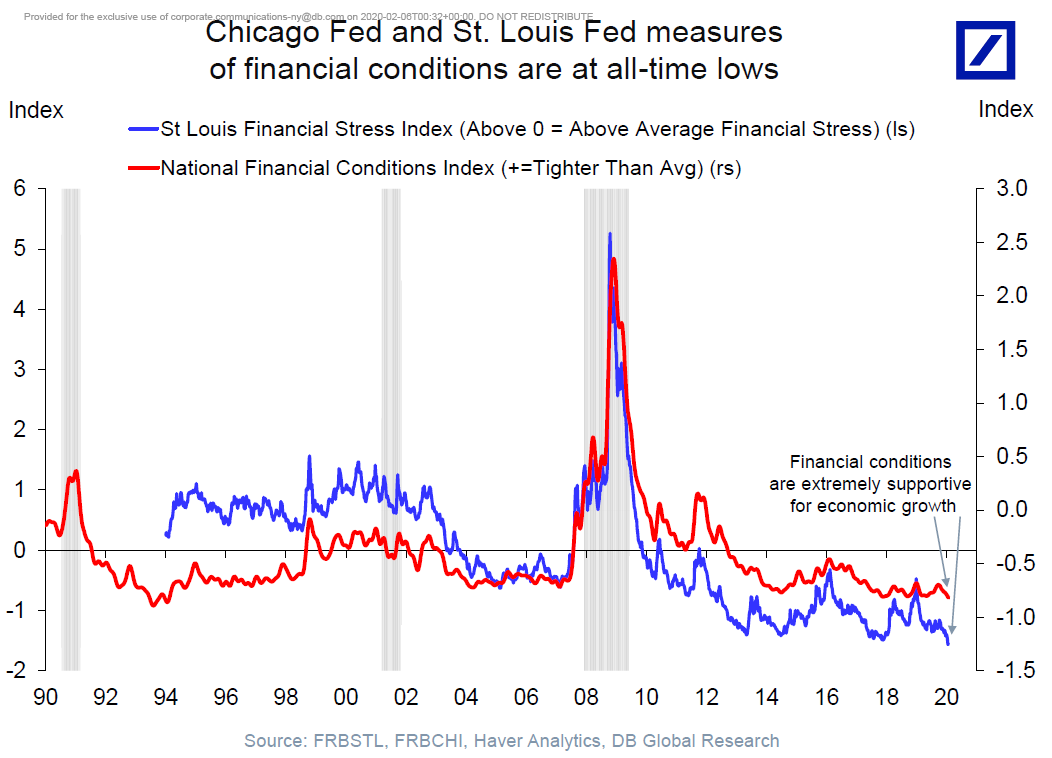

Even if the current scare is yet to be resolved, then, there is at least joy to be had from the end of the last one. We can all breathe more easily. Meanwhile, the effect of that scare, and the current one, has been to reduce financial stress to a remarkable extent. Both the Chicago and St Louis Federal Reserve banks maintain their own measures of financial stress, including gauges of bank credit and bond yields among others. And both agree that financial conditions are as easy as they have ever been since they started tracking them. This chart from Deutsche Bank AG's economist Torsten Slok combines both measures:  If conditions are that easy, of course people are in the mood to buy relatively risky assets, like stocks. Moreover, the belief is that the Federal Reserve — and many other central banks — is backed into a position where the only way it can move for the rest of this year is toward even easier conditions. In other words, it is definitely safe go back into the murky water. Why is it so safe? In part, the ongoing risks created by the virus outbreak bind the hands of any central bank that might have been tempted to try tightening financial conditions. Secondly, the Fed has boxed itself in. It is now making clear that its 2% inflation target is "symmetrical", and not a tight upper limit, making it all the harder to justify raising rates. With an election coming in November, and the Fed wanting to avoid the politically contentious step of raising rates during a campaign, investors are working on the assumption that the risks, unlike the Fed's inflation target, are asymmetric. Rates might go down, but there is no way they will rise. And so, the S&P 500 is back at a new record. P.S. One postscript: For those who don't click on the links, they often go to videos and songs I enjoy. Sometimes their relevance is tenuous, but I know that some readers enjoy them. The link on the word "breathe" is to a little-known U2 song of that name, which I hadn't listened to for a while. The lyrics turn out to be most relevant. This is the third verse: Sixteen of June, Chinese stocks are going up

And I'm coming down with some new Asian virus

Ju Ju man, Ju Ju man

Doc says you're fine, or dying

Please

Nine-oh-nine, St. John Divine on the line, my pulse is fine

But I'm running down the road like loose electricity

While the band in my head plays a striptease

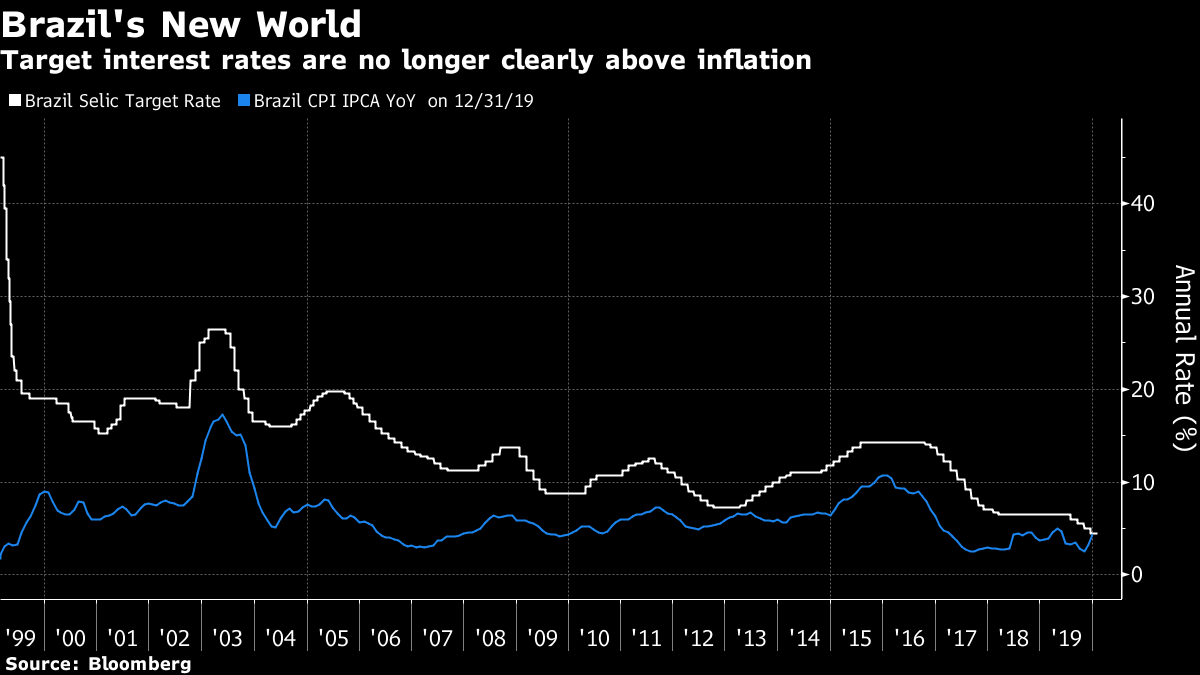

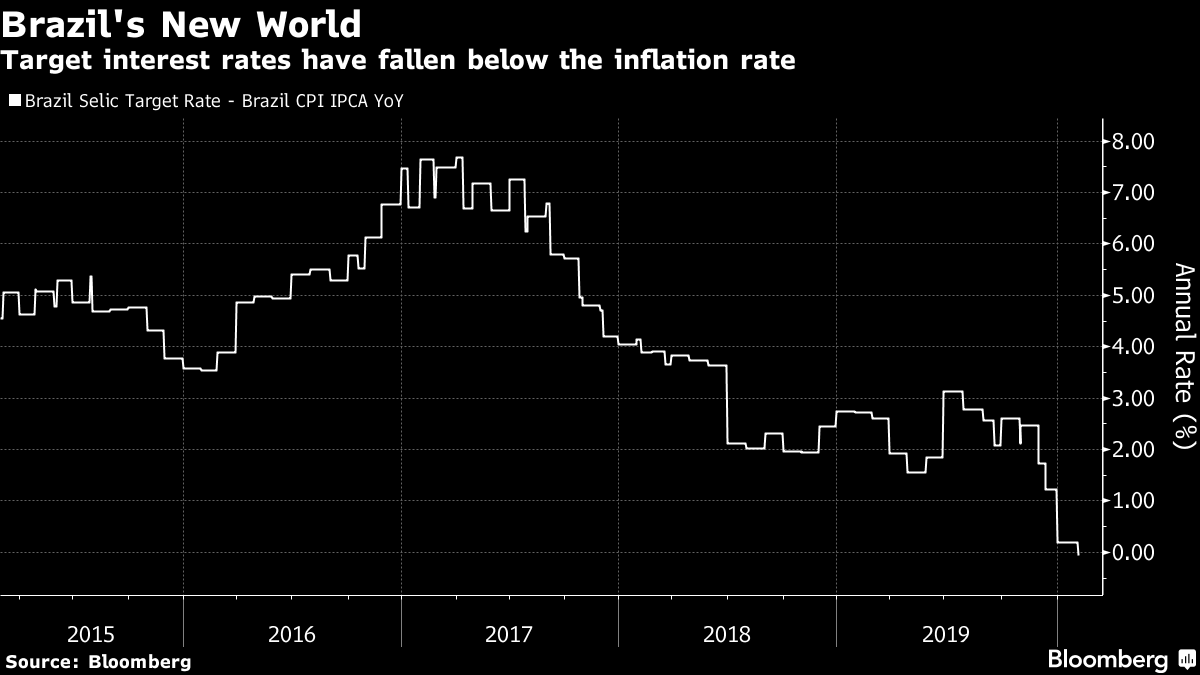

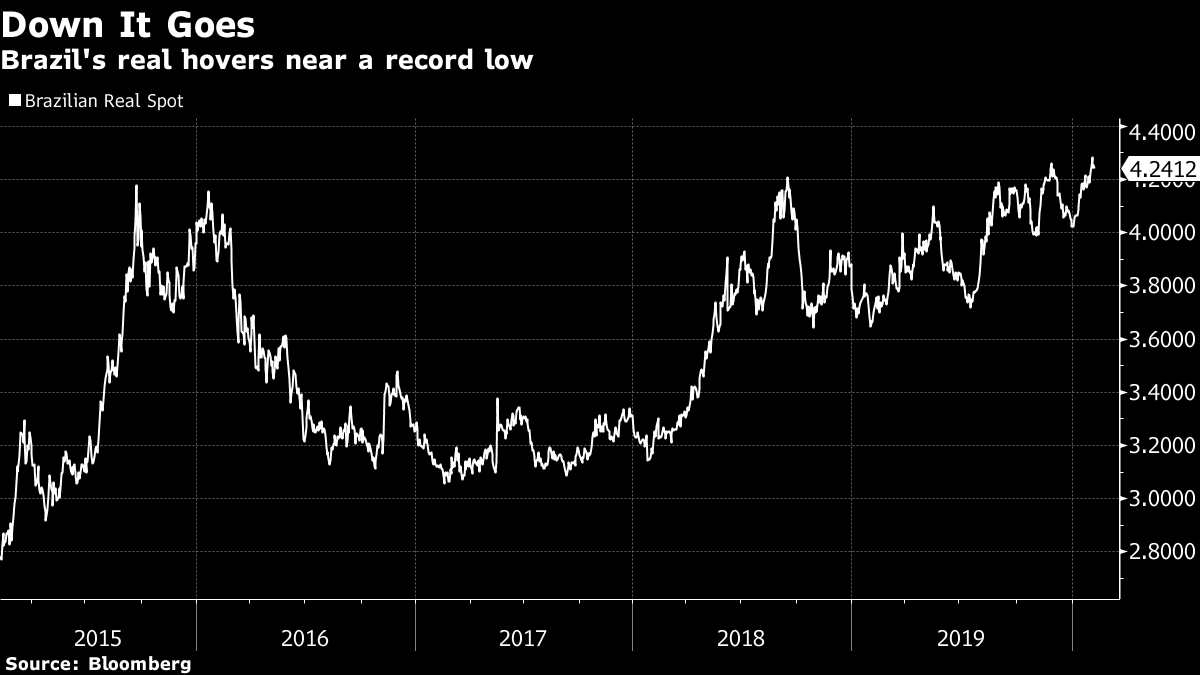

Make of this what you will. Maybe Bono was trying to offer us some investment advice. Or maybe it's gibberish. Probably the latter, but I commend it to your attention. Somewhere in there is a good description of the latest action on world markets. And as I know a lot of people can't abide anything by U2, I've spared you the risk of listening to this by accident. A Little Less Coffee in Brazil It isn't just in the U.S. that financial conditions are easy. Down in Sao Paulo, Brazil's central bank has just announced a cut in its target overnight rate known as the Selic, and this has brought it to a historic and symbolic milestone. The Selic has just dropped below the latest recorded level for consumer price inflation. So on the face of, Brazilian real interest rates are now negative:  This is a startling victory over inflation. Long a happy destination for "carry traders," Brazil's economic policymakers no longer seem preoccupied by inflation, but by growth; and that challenges many investors' presumptions. To be clear about this, it isn't long since the Selic was 7 percentage points above the most recent level of inflation:  It is hard to overstate how big a change this is. For the years ahead of the financial crisis, and for a number of years after it, the Brazilian carry trade was one of the most reliable ways for macro investors to make money. Borrowing in yen or even dollars and parking in the real made big profits, and also helped keep Brazil's currency unrealistically expensive. Note that it was a Brazilian finance minister who first complained about "currency wars." The profits for the carry traders were huge, and they are now gone:  Defending the currency isn't as important as it used to be, and policymakers made their cut even through the real is hovering near a record low:  It is easy to miss this historic moment amid so many other events around the world. Low rates have even conquered Latin America, where a number of the region's central banks have reached the point where they are "out of ammunition" — effectively unable to cut rates any further. The Brazilian central bank's monetary policy committee, known as Copom, has "closed the door" on further rate cuts this year, while forecasting that inflation will be 3.5% by year's end — which for Brazil is very low. With commodity prices low and likely to stay that way thanks to the coronavirus's effect on China, the traditional risk of an overheating economy in Brazil is nil. Instead, rates have been cut as far as the central bankers dare, in the hope of heading off stagnation. When even Brazil can cut target rates down to the inflation level, something very strange is afoot with the global economy. Victory over inflation isn't unalloyed good news. The International Monetary Fund expects final 2019 GDP growth for Latin America of 0.1%, which is dreadful. For more on this, you might view this discussion I had last week with Alejandro Werner, director for the western hemisphere at the IMF, at a New York meeting of the Americas Society/Council of the Americas. Like the U2 song, this might not be to everyone's taste, but it is very relevant for anyone interested in investing in Latin America. Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment