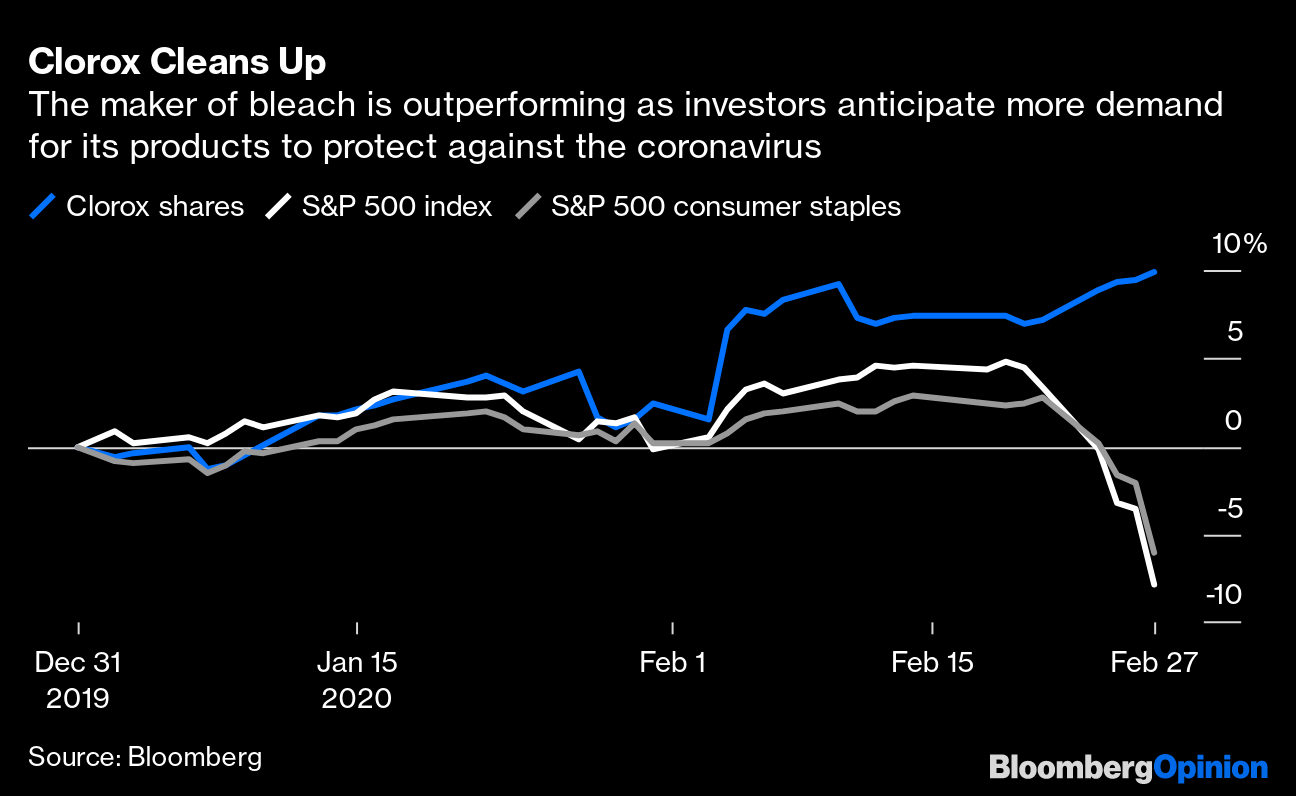

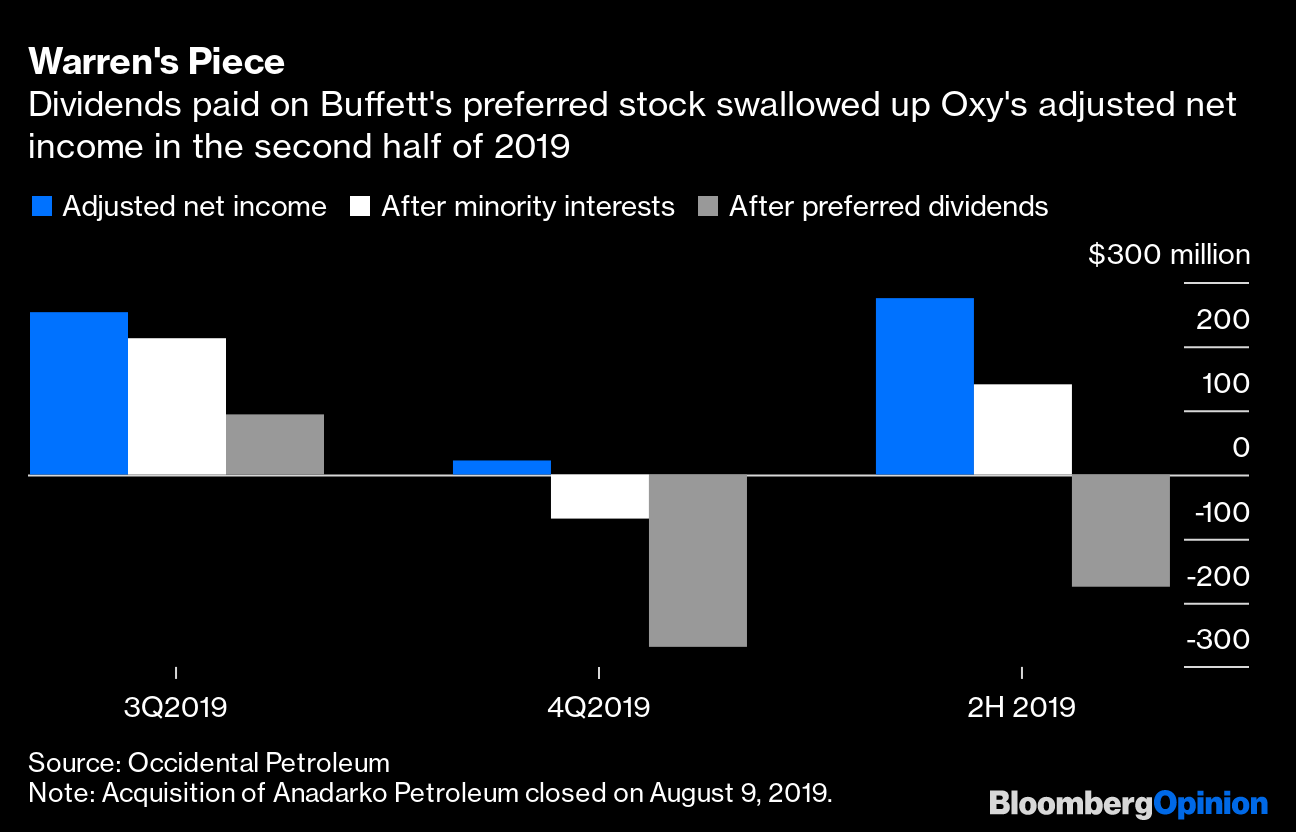

| This is Bloomberg Opinion Today, a coronavirus survival kit of Bloomberg Opinion's opinions. Sign up here. Today's Agenda  You might be fine getting on that plane. Photographer: SERGEI SUPINSKY/AFP/Getty Images Coronavirus: A Look on the Bright Side Regular readers, all eight of you, may have noticed this newsletter has been obsessed with coronavirus this week, decked head to toe in hazmat gear and frantically squirting hand sanitizer at everyone who comes near. We still are! But perhaps it is time, eleventy-zillion Dow Jones points later, for a little perspective. For one thing, the virus is still unlikely to cause a global recession or be as deadly as the Spanish flu, writes Marcus Ashworth. So that's good, right? Asset prices, after the most violent U.S. stock correction on record, are starting to price in such outcomes. And despite the market bloodshed, the financial system itself is functioning normally, writes Brian Chappatta. So this (probably) isn't 1918, and it's not 2008 either. In fact, there are many good reasons for the Federal Reserve to ignore the bleating of financial markets for an immediate rate cut, Brian Chappatta writes in a second column. For one thing, low interest rates have no proven vaccinatory effect. Still, the Fed will probably give markets what they want anyway (and Chairman Jerome Powell today hinted as much). So, win-win. Chinese stocks, meanwhile, are bizarrely calm despite the virtual shutdown of that economy, notes Shuli Ren; probably because investors know Beijing will make sure the money keeps flowing through the whole ordeal. As for you personally, you may be tempted to shelter in place until, say, 2021, just to be safe. But that's probably not necessary. For example, an airplane may be the last thing you want to ride right now, but Sarah Green Carmichael writes she isn't changing her plans to fly to the French Riviera in a couple of weeks. Simply being smart — washing your hands, not licking the in-flight magazine — could protect her and you from any diseases. Cass Sunstein suggests people are probably more worried about coronavirus than perhaps they should be, owing to a cognitive bias called "probability neglect," which makes us focus on outcomes more than probabilities. It's why we're swimming in lottery tickets and hand sanitizer. You know, just in case. Coronavirus: OK, Back to the Bad Stuff Anyway, enough happy talk. The truth is there are still enough unknown unknowns out there to make the stock-market collapse more or less rational, as John Authers has written. Mohamed El-Erian posits there are four stages to this crisis, and we're still in the first, involving immediate economic pain. The second is characterized by feedback loops, in which early effects have worse knock-on effects. The third is the bottom, and the fourth will be the long-term economic damage, in some cases permanent. Similarly, the strict quarantines being imposed around the world may help fight the spread of the disease, but they also cause psychological harm that could be lasting, writes Adam Minter. They could even make patients and health workers behave in ways that hurt the response. They will also eventually lead to lawsuits, notes Noah Feldman, because lawyers. Finally, as we wrote yesterday, the virus is exposing the inadequacy of global leadership. China had a chance to stand out as a beacon of competence, but instead Beijing's worst traits have been on display, writes Hal Brands. That shouldn't help anybody's confidence. Further Coronavirus-Downside Reading: Industrial companies tragicomically stumbled from the trade-war disaster right into the virus disaster. — Brooke Sutherland (Maybe sign up for her newsletter.) Europe's Money Problem And then there's Europe. It's directly in the path of the coronavirus, with Italy and some other spots already suffering. The European Commission is mulling letting countries borrow more to deal with the crisis, but this isn't nearly enough, writes Ferdinando Giugliano. It would be far more helpful if Europe had a central pot of money it could use to help countries that already have too much debt. Italy, for example. But you'll never guess who stands in the way of this central pot of money. OK, you'll guess: It's Germany. Andreas Kluth points out the German word for "debt" is almost the same as the word for "guilt." That pretty much explains everything. The country absolutely refuses to give up its deep-rooted aversion to borrowing, despite the market currently paying it to do so. It's only hurting its economy and the rest of Europe, Andreas writes. Further European Reading: Boris Johnson apparently feels free to trash EU trade talks and risk a no-deal Brexit. But he can't stay away from the table forever. — Therese Raphael The Turkey Problem Turkey is that annoying friend, you know the one, who finds what she thinks is a better set of friends and disses your old group. But then she falls out with the new friends and comes slinking back to you expecting sympathy? Sorry, Becky, shouldn't have been so thirsty! Anyway, in this scenario, Russia was Turkey's new friend, but now they are fighting over Syria, and Turkey suddenly wants missiles and love from its old rejected friends in NATO, and it's threatening to unleash a wave of immigrants if it doesn't get what it wants. It's hard to imagine the old squad exactly rushing to help, writes Bobby Ghosh. Turkey may be on its own for an uncomfortably long time. Bye, Felicia/Turkey! But James Stavridis suggests the old friends will eventually need to suck it up and take Turkey's side, or the situation will get infinitely worse in Syria. Telltale Charts A market-crushing pandemic that makes everybody want to wipe stuff down is great news for Clorox Co. It should savor the moment, though, because it won't last long, writes Tara Lachapelle.  Occidental Petroleum Corp. is finding that the price of getting Warren Buffett's help with a ludicrously expensive deal is that he eats all of your profits, writes Liam Denning.  Further Reading South Carolina's primary could narrow the Democratic race down to Joe Biden vs. Bernie Sanders. — Jonathan Bernstein Nikki Haley shouldn't push Republicans to embrace pure, uncut capitalism. — Ramesh Ponnuru The U.S. Supreme Court just gave investors a big incentive to ignore disclosure statements. — Stephen Carter This is a remarkably bad time for a $19 billion LBO. — Chris Hughes ICYMI The WHO raised global coronavirus risk to "very high." President Donald Trump only wants credit when markets rise. Billionaire family feud involves Ritz bugging. Kickers FINALLY, you can sleep inside Lucy the Elephant. Telescopes see the biggest explosion since the Big Bang. (h/t Scott Kominers for the first two kickers) "Blood snow" invades Antarctic island. (h/t Mike Smedley) Here's why our feet have arches. (h/t Alexandra Ivanoff) Note: Please send blood snow and complaints to Mark Gongloff at mgongloff1@bloomberg.net. Sign up here and follow us on Twitter and Facebook. |

Post a Comment