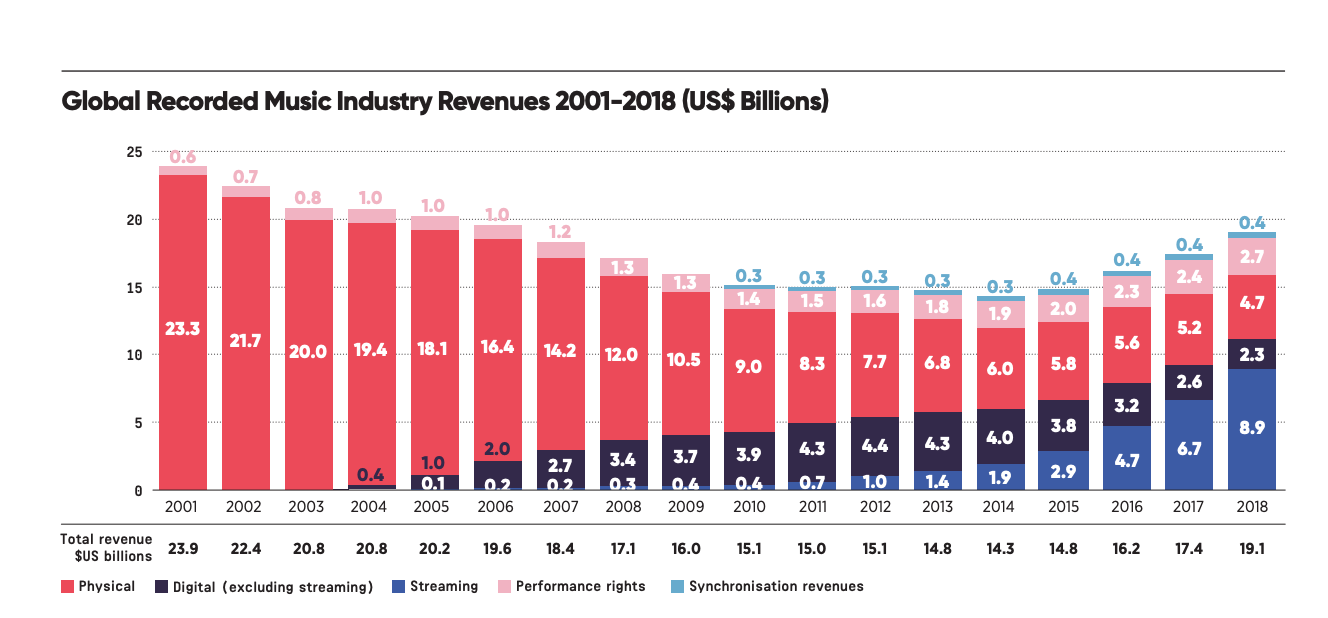

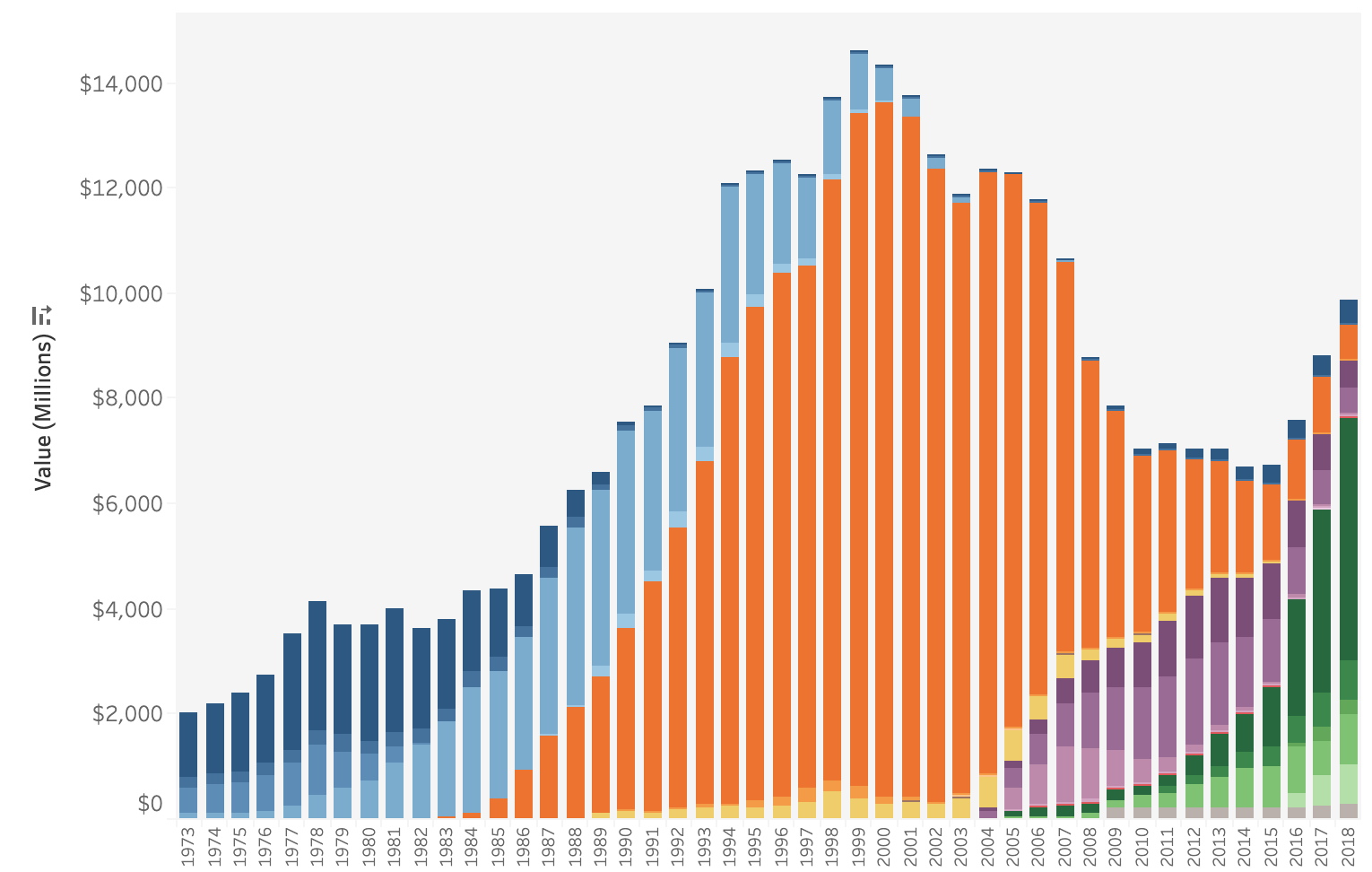

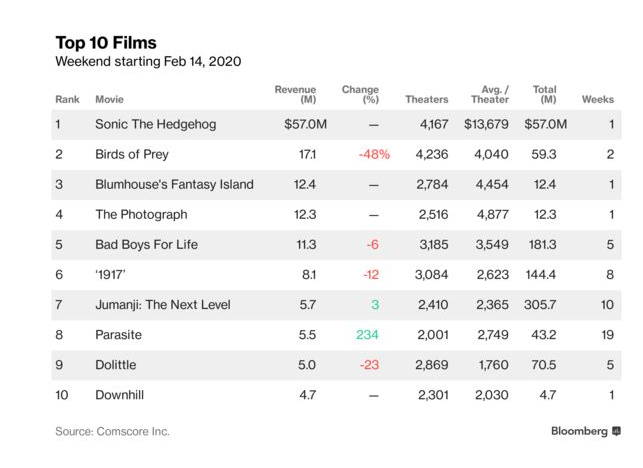

| Good afternoon from Los Angeles, wherever you may be. Sorry for being a couple days late with this. I needed a few days off from screens, and spent this past weekend drinking wine and overeating in Napa Valley. For this week's newsletter, we've hit the Bloomberg trifecta: pop stars, foreign billionaires and financial engineering. Just last week, French media giant Vivendi said it plans an initial public offering for Universal Music Group, the world's largest music company. UMG's record labels are home to Taylor Swift, Kanye West, Justin Bieber, Ariana Grande and Post Malone, to name a few. Vivendi, which owns UMG, said it would list shares some time in the next three years. That announcement arrived not long after Warner Music Group announced it was going public. Billionaire Len Blavatnik (net worth $25 billion) owns Warner, and has no plans to give up control. But he is going to sell a minority stake for a couple billion dollars, essentially recouping his entire purchase price in 2011 without surrendering his ticket to the Grammy Awards. Warner's labels are home to Cardi B, Ed Sheeran and Bruno Mars. Now the Universal announcement is a little ridiculous. Vivendi just spent three years publicly hemming and hawing over what to do with Universal. First it floated the idea of an IPO. Then it said it suggested it would sell a stake. Ultimately, Vivendi sold a minority stake to Tencent, the Chinese technology giant. And yet, after three years of getting its house in order and reviewing the books, Vivendi now needs another three years to think about listing shares! The suspicious among us would suggest Vivendi wanted to sell a stake in Universal to boost its stock price, or to raise money to buy back stock and cement the control of the Bollore family. The company's other assets are atrophying, and Universal is about all it's got. But I digress. Why are two of the three dominant music companies going public? To cash in on the streaming boom. Just look at this chart on the global recorded music business (courtesy of the IFPI):  After declining for more than a decade, sales cratered at $14.3 billion in 2014. They've grown the last five years, and likely surpassed $20 billion last year for the first time since 2005. What's driving this? Take a look at this very useful chart from the RIAA about the North American music business. Dark blue is vinyl. Light blue is cassettes. Orange is CDs. Purple is digital downloads. Green is streaming.  Streaming is now a little larger than half the size the CD business was at its peak, at least in the U.S. The delta is likely smaller outside the U.S. because CDs didn't catch on everywhere, but streaming may. These companies are selling shares because they think the growth will continue for years into the future. Or they think they can convince investors it will. Investors like to put their money into growing industries and sectors, or companies that reliably throw off cash to shareholders. The revival of music has stoked investor interest in streaming, and companies are paying huge multiples to buy songs and master recordings. Have we hit the peak? As of now, at least 200 million people pay for a streaming music service of some kind. Another couple billion people use YouTube, which last year paid $3 billion to the music industry. (The industry would note that is very little considering YouTube is probably worth as much as the three big music companies combined!) This growth depends on Spotify and YouTube being right about their productions. Hundreds of millions more people will have to pay for music, and advertising for on-demand audio and video will have to grow for years to come. – Lucas Shaw Meet the world's most popular kids channel  Cocomelon 13th birthday. Source: Cocomelon Jay Jeon is the most unassuming mogul I've ever met. Jeon, a 55-year-old Korean-American, started making 2D animated videos with his wife in the early 2000s to entertain his kids. A friend suggested he upload them to YouTube, which wasn't even owned by Google back then. His channel slowly gained a following, and got big enough for Jeon to quit his job as a commercial director. In 2017, after nearly a decade of making videos, the channel took off. Just take a look a these numbers: October 2017 122.5 million views December 2017 237.7 million views March 2018 555.7 million views July 2018 1.45 billion views October 2018 2 billion views In one year, the audience grew by almost 20x. And it isn't slowing down. Mark Bergen and I profiled his channel, now named Cocomelon, for the latest Businessweek. The WWE is in crisis  Photographer: Michael N. Todaro/Getty Images North America Photographer: Michael N. Todaro/Getty Images North America Felix Gillette and Kamaron Leach for BW: The company's stock is down by one-third this year. Ticket sales from live events are slumping. A new wrestling rival that airs on WarnerMedia's TNT cable network, All Elite Wrestling, is poaching talent. WWE's long-running plan to conquer such overseas markets as India and the Middle East appears to have stalled. And the company's subscription streaming service, the WWE Network, lost roughly 160,000 subscribers, about a 10% decline, in the past year. Sonic boom  "Sonic the Hedgehog" grossed $70 million over the holiday weekend, taking the top spot in North America. ($57 million over the normal three-day weekend.) The film has grossed more than $100 million worldwide, a strong start. These numbers are notable for a few reasons. Paramount Pictures was in desperate need of a hit. The studio has been moribund for a couple years. And video game adaptations almost never work. The list of failures is long and the list of hits is short. Why did "Sonic" do so well? There are plenty of theories, but I am going with the simplest. There hasn't been a popular kids' movie since "Frozen II," so kids were starved. The No. 1 album and song in the U.S. both belong to Roddy Ricch. Read Billboard's story on how the artist has used YouTube to rise to the top of game, and Dan Rys's companion piece about how the relationship between YouTube and the music business has improved. 5 stories you might have missed - Spotify will pay more than $250 million for The Ringer.

- Colin Kaepernick will release a memoir and start a publishing company.

- Broadcast TV networks ordered fewer pilots than they did a year ago. But people had to choose between 646,152 unique program titles last year.

- A bunch of podcast producers are creating their own version of the Oscars.

- A federal judge blessed the merger of Sprint and T-Mobile.

Weekly playlist New music from Tame Impala. That is all. |

It was a great blog i had ever read.Thanks for sharing the blog, seems to be interesting and informative too.Could you help me finding more detail regarding Health Insurance Plans In India

ReplyDeleteYou have outdone yourself this time. It is probably the best, most short step by step guide that I have ever seen. https://theplaynews.com/

ReplyDelete