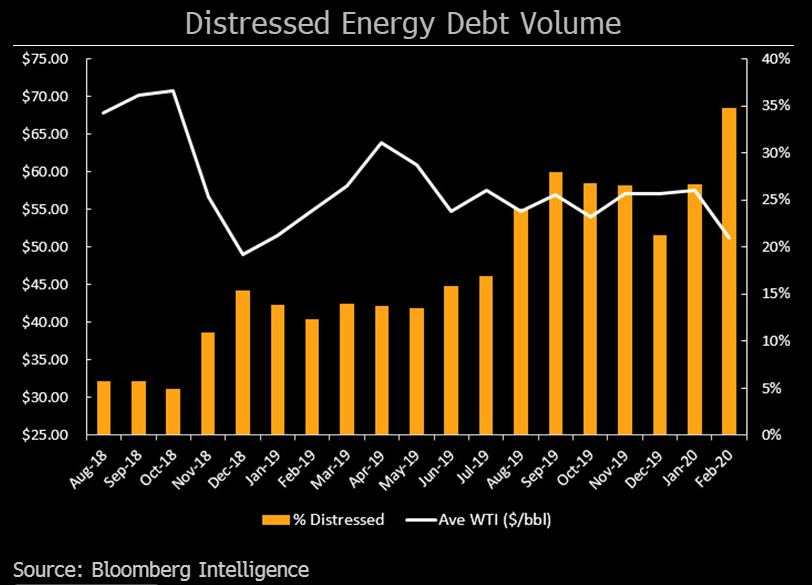

| Global shares are heading for the worst week since the financial crisis in 2008. U.S. health officials will let state and local health labs start testing for the virus. And a 2,800% surge in China stock options is showing a scarcity of hedges there. Here are some of the things people in markets are talking about today. Markets and economic forecasts keep falling on virus despair, with global shares down about 10% from this month's peak and headed for the worst week since the financial crisis in 2008. The sell-off looked set to extend through Asia on Friday as futures sank in Japan, Hong Kong and Australia, after the S&P 500 slumped over 4% Thursday amid news California was monitoring 8,400 people for signs of the virus. Haven assets continued to see demand and yields on 10-year U.S. and Australian government bonds hit fresh record lows. And that's not all: The world economy may be heading for its worst performance since the financial crisis — the Bank of America cut its forecast for 2020 global growth to 2.8%. Still, while American stocks are having their worst run in years, an unlikely source of solace may be China, where prices staged a stirring rebound. In another effort to prepare for a possible wider virus spread in the U.S., health officials there will let state and local health labs modify a coronavirus test that has been plagued by weeks of delays. The change should speed testing and allow state and local labs to start using hundreds of kits that were sent out earlier this month, rather than having to wait for an new version of the test to be sent by federal health authorities. The government and private companies are also developing new, improved tests for use by hospitals and public health labs. U.S. health authorities also moved to greatly expand the number of people who will be tested for the coronavirus, adding travelers from several new countries with outbreaks as well as people with unexplained, severe respiratory illnesses. California is currently monitoring 8,400 people for signs of exposure to the coronavirus after they traveled to Asia, Governor Gavin Newsom said. In China, the virus is exposing the nation's flawed health-care system, years after SARS. Currently, global deaths have surpassed 2,800, with more than 82,400 cases of infections. With all these new cases breaking out around the world, can we call it a pandemic yet? A 2,800% surge in China stock options is showing a desperation for hedges. How? In China's $7.8 trillion ocean of equities, there are only four options contracts, so it's perhaps no wonder that one of them, introduced just in December, saw extraordinary demand when Chinese markets were roiled by coronavirus fears on Feb. 3. As trading came back online after an extended holiday, traders rushed into put contracts on the Huatai-Pinebridge CSI 300 exchange-traded fund, which itself is linked to one of the nation's benchmark equity indexes. So much so, that contracts jumped 2,849% that day. While that speaks to the surge in concern during the Lunar New Year break about the hit to earnings and growth from the deadly epidemic, it also reflects a scarcity of hedges in the world's second-biggest stock market. With trading more volatile in recent weeks than any period since just after the epic 2015 bubble and its bursting, investors are calling for regulators to keep expanding the menu of options. Wearing a black suit and harness, Richard Branson once leaped from the roof of a Las Vegas casino to launch one of his ventures. His fortune headed in the same direction this week. The value of the British billionaire's stake in Virgin Galactic has fallen about $1.1 billion since the company reported widening losses in the fourth quarter from a year earlier. The firm's shares tumbled 24% to close at $21.97 in New York and have plunged 35% since Tuesday, but the Las Cruces, New Mexico-based firm is planning to resume ticket sales for future space flights to show Wall Street that affluent customers are willing to pay for such adventures. Space tourism is one of the latest bets from Branson, a serial creator of companies including everything from record labels to fizzy drinks to bridal gowns. Virgin Galactic was the first billionaire betting on space, following a merger with U.S. investment firm Social Capital Hedosophia four months ago. It's since become a highly speculative stock, more than doubling this year before Tuesday's after-market results as hedge funds and other investors predict it will establish a new space-tourism industry. Australia's Prime Minister Scott Morrison indicated the government is now considering targeted stimulus for sectors of the economy most severely impacted by the coronavirus outbreak. Treasury's advice is that any stimulus should be "targeted, modest and scalable," Morrison said in a televised interview with local media Friday. The tourism and education sectors have been particularly hit by the outbreak, with the government announcing yesterday that a ban on people traveling from mainland China will be extended by another week. The travel restrictions have left thousands of Chinese students, a key source of income for Australian universities, locked out of the country just as the academic year begins. The fallout from the virus could cost the tourism industry A$2 billion a month, according to a report to be released Friday by the Tourism Transport Forum, the Australian Financial Review reported. With the economy set to take a "significant" hit from the virus, Treasurer Josh Frydenberg is walking back the government's commitment to return the budget to surplus — a key election promise that helped sweep the party to victory in May last year. What We've Been Reading This is what's caught our eye over the past 24 hours. And finally, here's what Tracy's interested in this morning If you think of supply chains as a network where the existence of one component is used to create another product, then it's clear the concept can be applied to markets as well. For years, the booming corporate bond market was arguably the thing that helped create the bull run in stocks. Companies could tap the debt market for cheap funding and use the proceeds to finance share buybacks, dividend payouts and big M&A deals that pushed up the price of their stock. In some instances — such as with U.S. oil companies — debt financing was the difference between life or death as shale firms consistently spent more than they earned.  Now, with the U.S. and European corporate bond market grinding to a halt during the recent coronavirus-sparked turmoil, this market supply chain has been disrupted. That's a big deal precisely because of the dynamic described above, and it's one reason why the high-yield energy space is getting so much attention at the moment. If you think of the U.S. shale patch as an extreme example of the feedback loop between eager capital markets and buoyant share prices based on optimistic "growth" stories, then pain in the oil patch could easily become the harbinger of things to come across the wider market. You can follow Bloomberg's Tracy Alloway at @tracyalloway. The best in-depth reporting from Asia Pacific and beyond, delivered to your inbox every Friday. Sign up here for The Reading List. |

Post a Comment