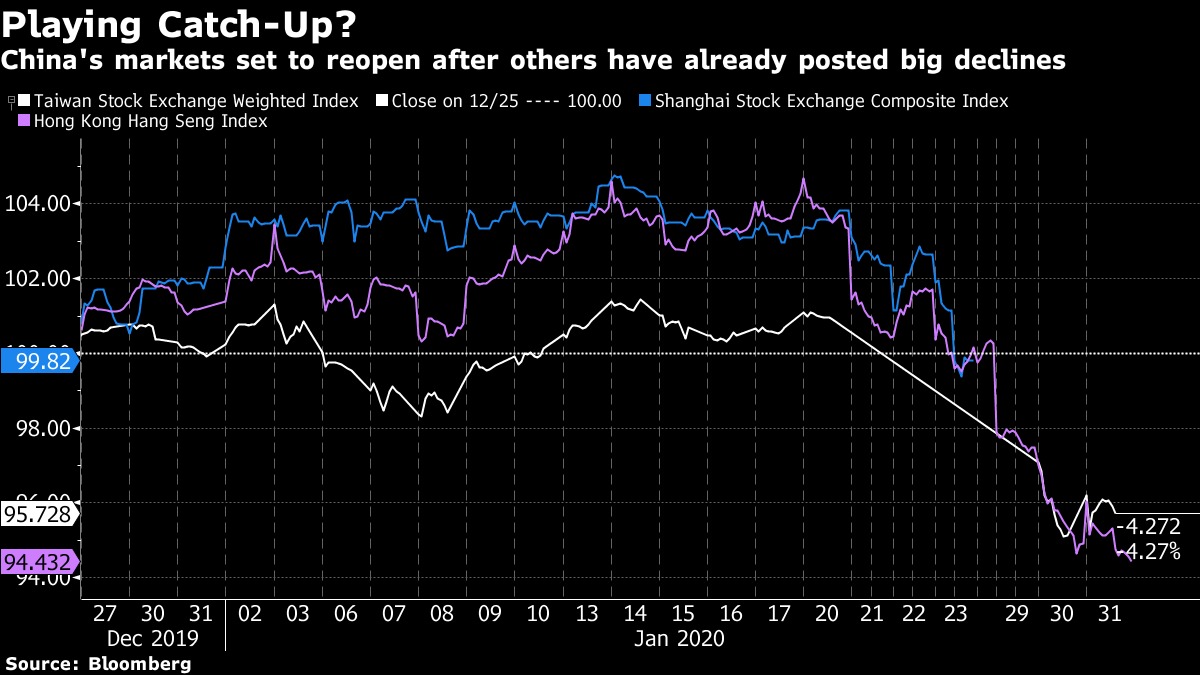

| Traders brace for a rough start to the week as Chinese markets reopen amid a spreading coronavirus, China announces a raft of measures designed to soften the blow, and in an odd twist, earnings are holding up well. Here's what's moving markets. Traders braced for the reopen of mainland Chinese markets on Monday, with stocks across the Asia-Pacific region set for further declines as the deadly virus outbreak showed no signs of slowing. Futures indicated declines in Tokyo, Hong Kong and Australia after the S&P 500 Index on Friday slumped 1.8%. Investors are also assessing intervention from China's central bank. The People's bank of China is providing more than $21 billion of liquidity in a bid to support markets and its economy, which may ease a global sell-off sparked by the spread of the coronavirus. The weekend's virus developments include the first fatality outside China. The offshore yuan was steady early Monday after weakening last week through 7 per dollar. China unveiled a raft of measures over the weekend to aid companies hit by the coronavirus outbreak and also shore up financial markets. Apart from the central bank's supply of cash to money markets, banks were told to lend more and not call in loans to companies in Hubei and other affected regions. In addition, night trading sessions for futures were suspended, some share pledge contracts can be extended, and there was a relaxation of asset-management rules, which were forcing banks to remove implicit guarantees for trillions of dollars of investments. The measures announced over the weekend were mostly targeted at the immediate problems facing the economy and markets, and aren't a large increase in stimulus, although that could change if the situation warrants. Traditional indicators have suddenly stopped mattering in a stock market driven by global health concerns. And for good reason: They can say little of value in assessing the worsening toll of the coronavirus. Should they start carrying weight again, investors will want to examine a little-noticed earnings trend that bodes well for bulls. Halfway into U.S. earnings season, analyst forecasts for S&P 500 profits are holding remarkably steady. At $175.30 a share, their 2020 estimate is down just 0.1% from three weeks ago. Sure, it fell. But the decline is almost always much larger during earnings season, as analysts align their rosy outlooks with emerging reality. Coming Up… Coronavirus aside, investors and traders will be keeping an eye this week on President Donald Trump's State of the Union address to a joint session of Congress. The 2020 Democratic nomination contest finally begins in Iowa, with numerous candidates in the running. Reserve Bank of India, Reserve Bank of Australia and the Bank of Russia announce rate decisions. Earnings season continues with Alphabet (Google) and Twitter among tech giants reporting, as well as Toyota and Uber among others. Boris Johnson plans to say he's prepared to quit talks over the U.K.'s future trade relationship with the European Union if he doesn't get what he wants. In his first speech since Britain formally left the EU, the prime minister will spell out to business leaders and diplomats on Monday his aims for negotiating the future trade terms with the bloc. Brussels negotiators are set to publish their own mandate the same day. Johnson will say he wants a comprehensive trade deal at least as good as Canada's agreement, but will be ready to take a looser arrangement like Australia's if talks fail, according to a U.K. official. What We've Been Reading This is what's caught our eye over the past 24 hours. And finally, here's what Tracy's interested in this morning China's stock market will open Monday for the first time since the start of the Lunar New Year holiday and have its first chance to react to the dramatic surge in coronavirus cases. Most people are expecting a big fall. Leverage in the form of margin loans was at an 11-month high before the holiday, which could exacerbate any slide, and China's market lacks many of the derivatives and volatility products that could function as a hedge to cushion the blow.  For China's government, which has staked its power on economic stability and a steady progression of wealth for citizens, the reopen will be a high-stakes event. Perhaps with that in mind, on Sunday they announced a raft of measures to soften the expected hit. They include extending share pledge contracts and liquidity injections that amount to 1.2 trillion yuan. As Bloomberg reports, that's by far the biggest single-day addition since at least 2004, when the data set began. I'm going to go ahead and state the obvious: Today will be interesting because it pits extreme market forces against the power of China's centralized authorities. You can follow Bloomberg's Tracy Alloway at @tracyalloway. Australia has some big decisions to make about its future. For a fresh perspective on the stories that matter, sign up for our weekly newsletter. |

Post a Comment