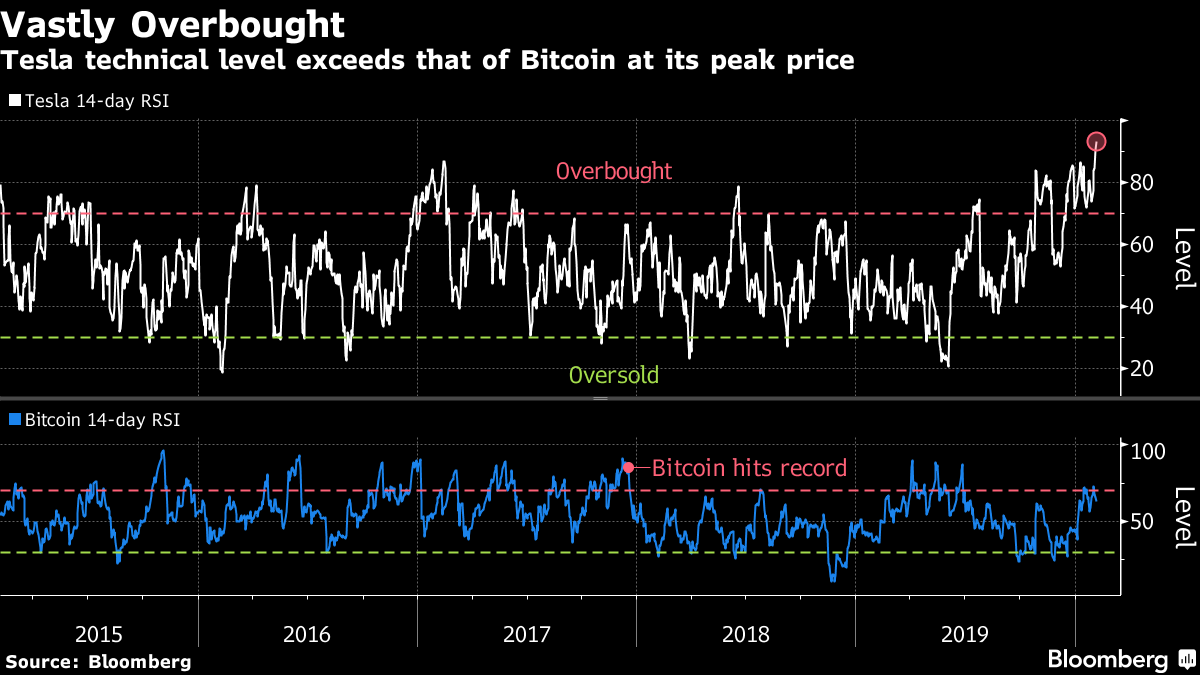

| Welcome to your morning markets update, delivered every weekday before the European open. Good morning. Tensions flared at the U.S. president's State of the Union address, Tesla Inc.'s rally is leaving Wall Street in awe, European earnings are rolling in and Asian stocks posted back-to-back gains. Here's what's moving markets. Trump's Address Donald Trump struck a characteristically triumphant tone in Tuesday's State of the Union address, staking his bid for re-election squarely on the U.S. economy on the eve of his likely acquittal in the Senate's impeachment trial. Tensions between the president and Nancy Pelosi were visible, with the House speaker seen ripping up a printed transcript of his speech. The address came on the same day a report said the U.S. is mulling a plan to withdraw from a global pact worth $1.7 trillion in government contracts, while over in Iowa, Pete Buttigieg maintained his lead in the Democratic caucuses following delays in reporting results. Tesla's Tear Tesla's rapid share surge is making headlines, with the market value of Elon Musk's electric-car company having more than doubled since the start of the year. Comparisons with old-school names like Ford Motor Co. continue. Ford, founded 100 years before the California-based group, slumped after projecting lower-than-expected profit last night, leaving its market value at about a quarter of Tesla's. There's still plenty for the bears to hold onto, however, with some noting that the stock is now more overbought than Bitcoin was at the height of its "bubble." Even Musk himself would short Tesla if he could, according to closely followed Citron Research. Earnings Arrive A big European earnings day has already begun with Germany's Siemens AG warning a market slump is set to continue amid a steep decline in the automotive, machine-building and energy businesses. French bank BNP Paribas SA posted a near 63% jump in fixed-income trading revenue after a rebound in rates and foreign-exchange activity, while Swiss engineering group ABB Ltd. joined a raft of companies to flag the potential for the coronavirus to impact their businesses. There's a swathe of reports still to come today, including from pharmaceutical giants Novo Nordisk A/S and GlaxoSmithKline Plc, and telecoms group Vodafone Group Plc. Back-to-Back Gains Asian stocks headed for their first back-to-back daily gains since fears about the coronavirus deepened last month, with some investors optimistic the impact to the global economy will prove short-lived, even as China's death toll continues to climb. The majority of reported cases and almost all the deaths are in the area where it started -- the Chinese city of Wuhan and surrounding Hubei province, but even so, kids visiting Tokyo Disney might want to forget about hugging their favorite oversize mascots. And for investors, while the outbreak has spurred much volatility, it's as if nobody told the foreign-exchange market. Coming Up… In New York later, Snapchat owner Snap Inc. and Tinder parent Match Group Inc. could both be in for significant share price drops after disappointing earnings reports last night. In this region, European Central Bank Vice President Luis de Guindos speaks in Frankfurt amid questions over the institution's inflation target, and Poland's central bank is expected to leave its interest rates unchanged. In macro data, we'll get composite purchasing managers index numbers from the euro area and the U.K. What We've Been Reading This is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morning Optimism swept the U.S. stock market and technology shares in particular on Tuesday. The Nasdaq's new record high was a pretty clear indication that a significant cohort of equity investors think concerns about the coronavirus are overblown. Once again buy-the-dip has proved the correct call -- how can you argue with an index that has just rebounded to an all-time high. Still, we need to talk about the elephant in the room -- and it's a big one -- the U.S. bond market. With benchmark Treasury yields still trading below 1.6%, it's clear a significant number of bond investors disagree with their equity cousins. The limited move upwards in bond yields suggests it would be unwise to chase the surge in stocks higher, at least for now. Further evidence that the anomaly is more on the equity side than the bond side is of course the move in Tesla. With all the caveats that come with the name -- short interest levels, momentum traders, outspoken bulls and bears -- it's hard not to see its parabolic rise as completely divorced from fundamentals. As my colleague Nancy Moran points out, Tesla is now more overbought than Bitcoin was at its peak in December 2017.  Cormac Mullen is a Cross-Asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment