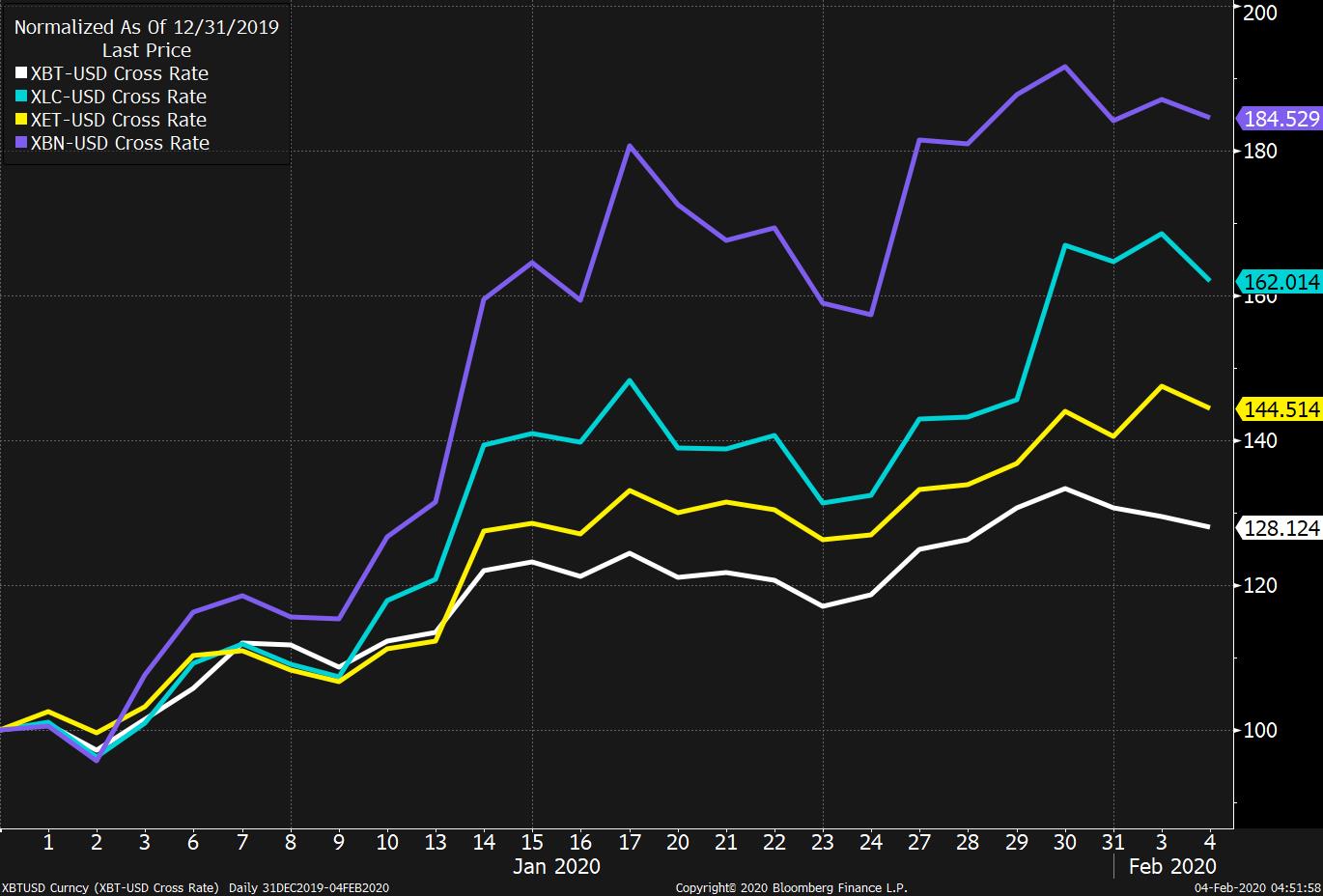

More warnings as coronavirus fallout worsens, Iowa keeps us waiting for vote result and oil recovers some ground on OPEC talks. Getting worseThe total number of coronavirus cases in China approached 20,500 with 425 deaths, while Hong Kong reported the second fatality outside the mainland. President Xi Jinping warned that the outbreak imperiled social stability in the world's most populous country. The People's Bank of China added liquidity to the market for a second day as the risks to the economy from the virus show little sign of abating. Casinos in Macau will close for 15 days, flight cancellations continue to mount and the list of companies warning about the effect on their bottom line grows longer. Can't countVoting in the Democratic presidential race got off to an inauspicious start in Iowa where new technology introduced to help make the process more transparent produced results that contained "inconsistencies." The party now says results will be announced at an unspecified point later today. Ahead of the official result, Pete Buttigieg said he was victorious, while Bernie Sanders's campaign released a ranking showing Sanders in first place. On the Republican side, President Donald Trump topped the GOP selection with 97% of the vote. OPECTechnical experts from the OPEC+ coalition are meeting in Vienna today to evaluate the impact from the virus outbreak on demand for oil. Demand for crude products in China appears to have plunged by 20% as cities are quarantined and factory production halted. Saudi Arabia has been pushing for a meeting to consider new production cuts to bolster oil prices in the face of the drop in demand. In the market this morning, a barrel of West Texas Intermediate for March delivery was trading at $50.77 by 5:45 a.m. Eastern Time, recovering from yesterday's plunge below $50 as investors now see increasing chances of further reductions in output. Markets riseChinese stocks did not have a repeat of yesterday's sell-off which is helping global equities make back some ground. Overnight the MSCI Asia Pacific Index added 1.1% while Japan's Topix index closed 0.7% higher. In Europe the Stoxx 600 Index had risen 1% by 5:45 a.m. with mining and energy stocks the best performers. S&P 500 futures pointed to a strong open, the 10-year Treasury yield was at 1.575% and gold slipped. Coming up…At 10:00 a.m., U.S. factory orders and the final print of durable goods orders for December are published. Among the companies reporting earnings today are Ford Motor Co., Walt Disney Co. and ConocoPhillips Co. President Donald Trump will deliver his annual State of the Union address this evening, with the speech likely to take credit for the strong economy as he seeks to move past the impeachment battle. What we've been readingThis is what's caught our eye over the last 24 hours. And finally, here's what Joe's interested in this morningThe price of Bitcoin is up 28% so far this year, and that has believers happy for three distinct reasons. First, people always like when their investments go up, and they make money. Second, it fits with the narrative that Bitcoin is emerging as a haven asset that does well in the type of conditions that are conducive to Treasuries and gold. And third, it fits with the view Bitcoin will have a good year specifically because of the forthcoming halving that will see the amount of new issuance fall in half. Unfortunately it's not so clear cut, and a broader look at the crypto market shows that the rally isn't all it's cracked up to be. Below is a chart of the year-to-date performance of Bitcoin (white), Ether (yellow), Litecoin (teal), and Bitcoin Cash (purple). As you can see, Bitcoin has significantly underperformed other major altcoins. This fact undermines the big narratives. If the conditions driving Bitcoin were about a "flight to safety" then why has there been an even bigger flight to coins like Litecoin? Does anyone (let alone any serious Bitcoiner) really consider Litecoin to be a haven asset? Obviously that can't explain what's going on. What about the halving? Well Litecoin had its halving last year and the next one isn't until 2023. And Ethereum doesn't even have a halving. So that seriously undermines the idea that the rally this year is about some unique condition relating to a forthcoming drop in Bitcoin supply. So in the end what do we have? Basically it looks like yet another broad-based "crypto" pump, the likes of which we've seen dozens of times over the years. So of course Bitcoiners are happy about a short-term price rise. But so far it's been a bad year because the key narratives that believers want to push for the long-term aren't yet being fulfilled. In fact just the opposite.  Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment