| Welcome to your morning markets update, delivered every weekday before the European open. Good morning. Apple warns on its guidance, HSBC undertakes a big restructuring and the temperature of the German economy will be taken. Here's what's moving markets. Apple Warns The most significant of the coronavirus-driven warnings emerged with U.S. tech giant Apple Inc. saying it will not meet its March revenue guidance. iPhone production is ramping back up at a slower pace than anticipated and demand for the smartphone has been curtailed by the closure or reduced operating hours of its stores in China. The warning could impact Apple's European supply chain of semiconductor manufacturers and hit U.S. futures and bond yields. But it may also cause jitters for other sectors where quantifying the hit faced from the virus outbreak has been tough, now that it has clearly taken a bigger-than-expected toll on the world's most valuable company. HSBC Cuts Back It's been a busy morning for HSBC Holdings Plc too. The London-headquartered bank said it will take about $7.3 billion of charges and exit several businesses, in its most ambitious restructuring plan since the global financial crisis. Cutbacks at the Asia-focused firm will extend into parts of its European and U.S. investment-banking operations, as it targets a reduction in costs of $4.5 billion. This all comes as the group continues its search for a permanent chief executive and warns its 2020 performance may be hurt by the coronavirus outbreak and economic disruption in Hong Kong, where its stock fell as much as 3.2% following the update. German Sentiment The ZEW survey of German economic sentiment will arrive Tuesday at a time when the health of the European economy and the single currency is on market watchers' tongues. It comes after the Bundesbank warned that German exporters are likely to face pressure from the the coronavirus outbreak's disruption of global supply chains. Euro area countries are also engaged in budget talks this week and Germany has demanded compromise from all involved, with many governments still far apart ahead of the start of the talks on Thursday. Opening Positions The U.K. fired a broadside at the European Union over its proposals for a post-Brexit trade deal, saying that forcing Britain to remain bound by EU rules risks undermining democracy. David Frost, the U.K.'s chief negotiator, said that the EU's position "simply fails to see the point of what we are doing." The two will start negotiations proper next month and Frost's comments sparked concern that the gulf between the respective visions for the future relationship remains very wide, sending the pound lower. And on the domestic front, the U.K.'s new chancellor is said to be examining ripping up the spending framework of his predecessor. Coming Up… U.K. unemployment figures are on the way, before manufacturing data from the U.S. later in the day. Commodities trading giant Glencore Plc, Irish food company Kerry Group Plc and German building-materials provider HeidelbergCement AG top the earnings calendar alongside HSBC, though plenty of attention is likely to be paid to InterContinental Hotels Group Plc for insight into the hit the coronavirus has delivered to tourism. What We've Been Reading This is what's caught our eye over the past 24 hours. - The European stocks rally can continue, JPMorgan says.

- Tesla's Berlin factory is facing delays.

- Locust swarms ravaging East Africa.

- Wall Street is targeting the Nordics

- Frozen meat containers piling up in China.

- How Putin intends to start spending again.

- Robots that will return clothes you don't want.

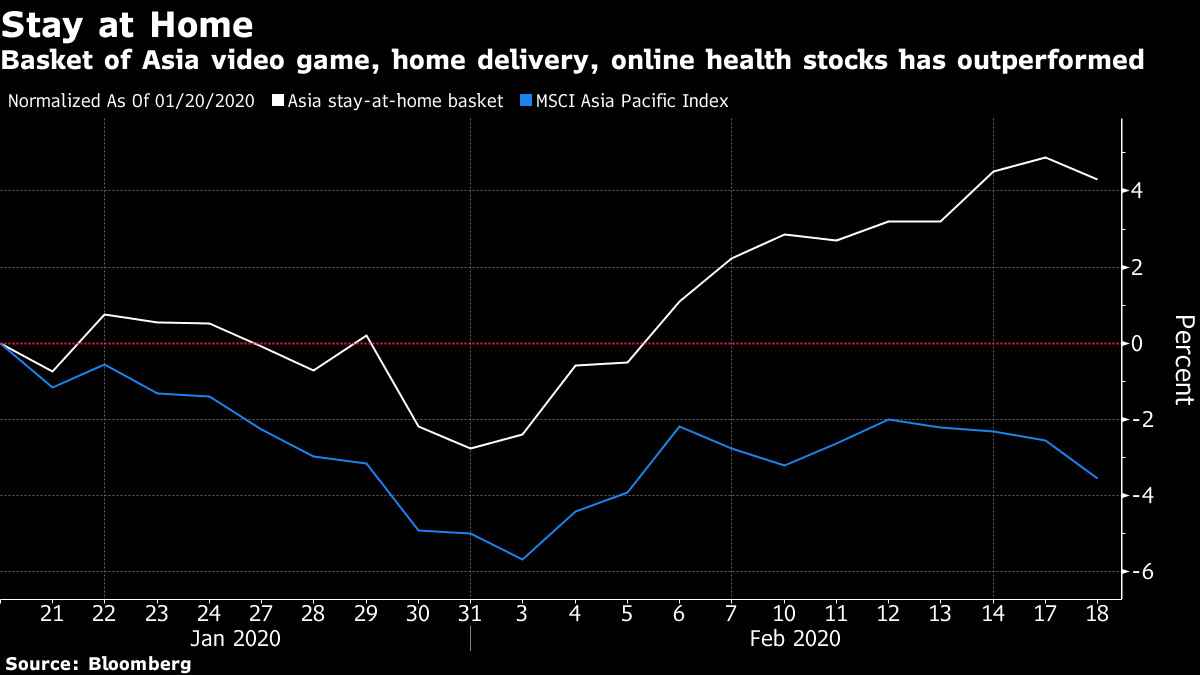

And finally, here's what Cormac Mullen is interested in this morning With the coronavirus still the main driver of markets worldwide, it's worth stepping back to see how its impact looks now, given the tentative recovery seen recently in many risk assets. A quick tally shows that global stock markets have clawed back about $3.6 trillion of the $4.5 trillion wiped out between the close of trading Jan. 20 — just before a slide in Hong Kong shares kicked off concerns among traders — and the lows seen Feb. 3. The legacy losses are mostly in Asia, with both U.S. and European benchmarks trading back above their Jan. 20 levels. Raw materials remain the hardest hit asset class, with the Bloomberg Commodity Spot Index slumping over 5%. Havens have rallied as investors seek safety with the Bloomberg Dollar Spot Index up over 1% and a global benchmark of government bonds up about 0.7%. For those worried the optimism is overdone in Europe and the U.S., and expect the virus to spread further, one pocket of the Asian stockmarket stands out. "Stay-at-home" stocks — those that benefit from people staying in — have been outperforming since the outbreak. A basket of Asian video game, internet-services and online health-care companies has easily beaten the broader market since late-January. The portfolio of 36 names has risen about 4% since then, compared with a near 4% drop in the MSCI Asia Pacific Index.  Cormac Mullen is a cross-asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment