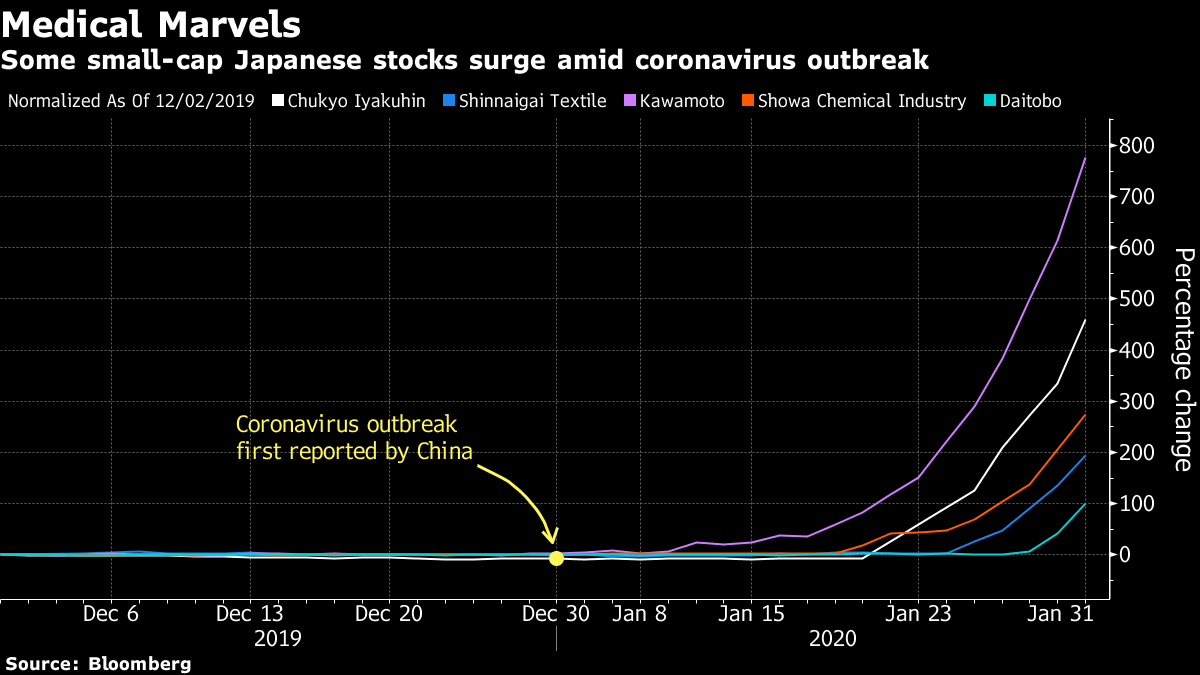

| Welcome to your morning markets update, delivered every weekday before the European open. Good morning. China's stock market reacted to the coronavirus outbreak as key institutions devised plans to stem its impact, and while Brexit may well have already happened, the real negotiations are only just beginning. Here's what's moving markets. Chinese Stocks Crash China's CSI 300 Index plunged as much as 9% as trading resumed in Shanghai following the extended Lunar New Year holiday, even after Beijing unveiled a raft of measures aimed at stemming the financial impact of the spreading coronavirus. China pledged aid to companies hit by the outbreak and added a net 150 billion yuan ($21.7 billion) into money markets, while banks were told to lend more and not call in loans to companies in Hubei and other affected regions. The death toll has now surpassed 360, with confirmed cases in the country topping 17,000. In Europe, stock futures are suggesting a higher open. OPEC Weighs Options It's not just money markets that might need support amid the coronavirus outbreak. OPEC and its allies are considering how to respond, with Russia signalling for the first time it's open to Saudi Arabia's push for an emergency meeting, which could take place this month. Brent crude futures sank overnight after a report saying Chinese oil demand has dropped by about three million barrels a day, or 20% of total consumption, in probably the largest demand shock the oil market has suffered since the global financial crisis. Johnson's Speech Alongside handling the fallout of yet another London terrorism incident, Boris Johnson is preparing for his first speech on Brexit since Britain left the European Union last week. The U.K. prime minister will tell business leaders and diplomats later that he's prepared to quit talks over a future trading relationship with the EU if they don't go his way, while Brussels negotiators, meanwhile, are also set to publish their own mandate today. Here's the state of the British economy, ahead of the discussions. The pound edged lower this morning, as the Brexit battle resumes. Closing Arguments U.S. senators will hear closing arguments in Donald Trump's impeachment trial later, followed by two days of debating before a vote Wednesday that's expected to see the president acquitted the day after he delivers his State of the Union address. Republicans have been defending their votes to prevent new witnesses being called, with polling released on Sunday showing voters remain divided along partisan lines about the case. Here's a recap of how we got here. Coming Up… Heavyweights from every sector release earnings this week, but as usual, Monday's slate is light. First-quarter earnings from MRI scanner-maker Siemens Healthineers AG missed estimates, while budget airline Ryanair Holdings Plc posted a profit for its winter low season but said an earnings boost from Boeing Co.'s grounded 737 Max jetliner probably won't kick in for another year. There's a big deal in the payments industry, with Worldline SA agreeing to buy Ingenico Group SA for $8.65 billion. Elsewhere, there's purchasing managers index data due in this region and the closely watched Institute for Supply Management's manufacturing numbers coming from the U.S. What We've Been Reading This is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morning The much anticipated and even feared reopening of China's financial markets took place Monday, and for the most part assets across the rest of the world were relatively non-plussed. Chinese stock futures traded in Singapore had fallen about 7% since the Lunar New Year holiday, so the 8% or so decline when cash equities started trading was about right, taking into account the U.S. sell-off on Friday. The support measures from China's government no doubt played their part in capping losses -- the PBOC sent a clear signal that rate cuts are coming -- though traders across Asia and beyond will be eyeing the rapidly weakening yuan with trepidation. And the sense remains that it's too early to make a definitive call on where to next for markets, with the deadly coronavirus outbreak showing no signs of slowing. Some investors are managing to benefit, however. Last week, a few Japanese small-cap stocks saw their shares surge as retail investors went all-in on the medical sector. Chukyo Iyakuhin Co., which sells household medicines, saw its share price almost triple in the span of five days, while Kawamoto Corp., a manufacturer of medical products including face masks, more than doubled. Fiber and textile makers Shinnaigai Textile Ltd. and Daitobo Co. also saw their shares climb to the highest in five years, amid intense demand for masks.  Cormac Mullen is a Cross-Asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment