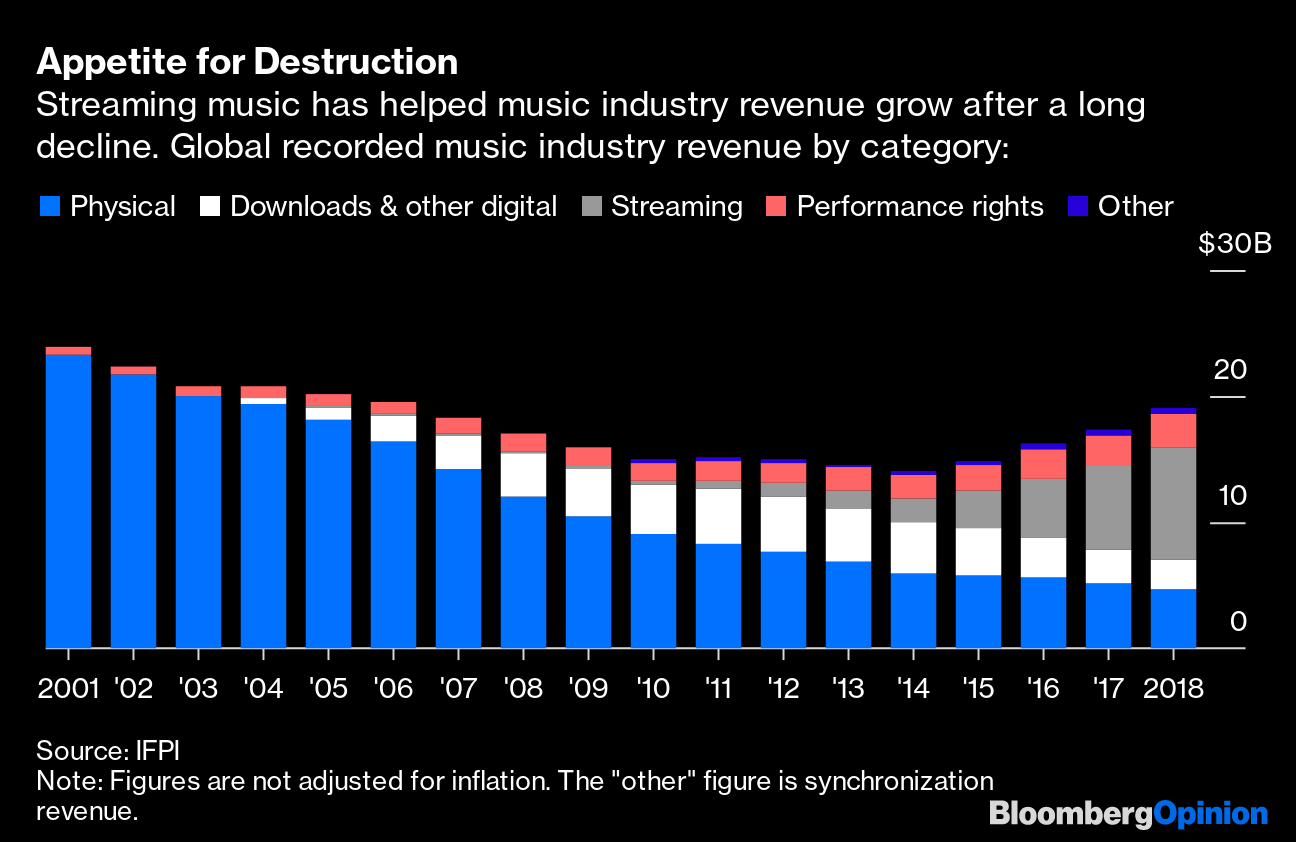

| This is Bloomberg Opinion Today, a shaky alliance of Bloomberg Opinion's opinions. Sign up here. Today's Agenda  Ghosn out of the machine. Photographer: LUDOVIC MARIN/AFP/Getty Images Gone Ghosn At some point every business journalist learns you pronounce Carlos Ghosn's last name by saying "ghost" but replacing the "t" with an "n." That little trick just got easier to remember. The former high mucky-muck of the Renault-Nissan-Mitsubishi Axis of Automaking, who has been caught in the Japanese legal system since he was arrested on charges of financial misconduct 13 months ago, today announced he had escaped to Lebanon, where he has citizenship. It's still not clear how he managed this — he was under house arrest and had surrendered his three passports — but we're going with the unconfirmed theory he was smuggled out in a giant musical-instrument box because that's the coolest theory. Ghosn has called the Japanese legal system "rigged," and it's certainly true that Japan hasn't treated Ghosn fairly, writes Chris Bryant. But it's also true Ghosn has explaining to do about the lavish spending that got him in trouble. It's been suggested he'd get a fairer trial in France, where he also has citizenship, than in Japan, where he's a noncitizen. If he truly wants to set the record straight, he'll catch the next private jet, or tuba case or whatever, to Paris. Forecasting Is Hard Tomorrow begins a new year and a new decade. Anybody claiming they know exactly what's to come in either one is lying. Even people who get paid a bunch of money to predict the future get it wrong relentlessly. Take bond-market gurus. Please! (That was a joke from 1920.) As Brian Chappatta points out, pretty much everybody got the bond market wrong in 2019. The overwhelming consensus was that interest rates would rise and bond returns would suffer. Turns out, not so much:  Many bond prognosticators seem to be setting themselves up for an encore in 2020. One issue is that the economy is even less forecastable than it used to be, writes Gary Shilling. Old economic cycles and patterns have broken down, meaning we can only watch out for specific catalysts to alter a freakishly sluggish but durable expansion. At least we can all pat ourselves on the back for predicting that the best-performing stock of the past decade would, of course, be a New Zealand dairy company. Tim Culpan explains bigger trends made this somewhat more likely than it sounds. Further Fearless Forecasting Reading: Canned air, K-Pop and Tesla Inc. are on the list of things Masayoshi Son should buy in 2020. — Tim Culpan Biden's Impeachment Dilemma Also difficult to predict is the timing and nature of the impeachment trial of President Donald Trump. All we know is that we should get one some time next month, probably, but everything else is still up in the air. Republican Senator Susan Collins today said she's open to calling witnesses, something Democrats want, but that's probably not decisive. One witness some Republicans claim they want to hear from is Joe Biden, whose involvement with Ukraine was the obsession that led Trump to be impeached in the first place. Biden seems understandably reluctant, but Francis Wilkinson argues he should call Trump's bluff and agree to testify — as long as Trump does, too. Science Got Some Stuff Right It turns out the climate and weather are much easier to forecast than economic growth or impeachment trials. When the decade began, scientists knew global warming would intensify if we didn't change our ways, and that's just what happened, writes Faye Flam. Meanwhile, forecasting methods got even more accurate, giving scientists greater confidence in attributing extreme weather events to climate change. It might have been more difficult to predict the decade's most significant practical scientific breakthrough. No, we don't have flying cars. But the world is full of safe lithium-ion batteries, writes Mark Buchanan, solving what just a decade ago seemed like an intractable problem. Our world would look very different without them. Telltale Charts Vivendi's sale of part of its Universal Music Group is a sign of the music industry's recovery, writes Shira Ovide. But is it also the sign of a peak?  Further Reading Europe's far right had a tough year. It does better in opposition and theory than in governing and reality. — Leonid Bershidsky Latin America had a lost decade, but there are reasons to hope the next might be better. — Mac Margolis The oilfield-services sector is in for another year of pain. — Liam Denning Contrary to popular opinion, productivity and wage growth still seem connected, suggesting capitalism isn't broken. — Michael R. Strain The two best speakers of the past decade are Donald Trump and Greta Thunberg. — Tyler Cowen 2019 was a banner year for math geeks. — Scott Kominers ICYMI An Iraqi militia stormed the U.S. Embassy in Baghdad. Trump said he'll sign the phase-one trade deal with China on Jan. 15. The top nine dive watches of 2019. Kickers The best blobs of 2019. (h/t Mike Smedley) Let's visualize the amount of microplastic we eat. How an Alzheimer's "cabal" thwarted progress toward a cure. Note: This newsletter will be off tomorrow, back on Thursday. Please send blobs and complaints to Mark Gongloff at mgongloff1@bloomberg.net. Also, happy New Year! Sign up here and follow us on Twitter and Facebook. |

Post a Comment