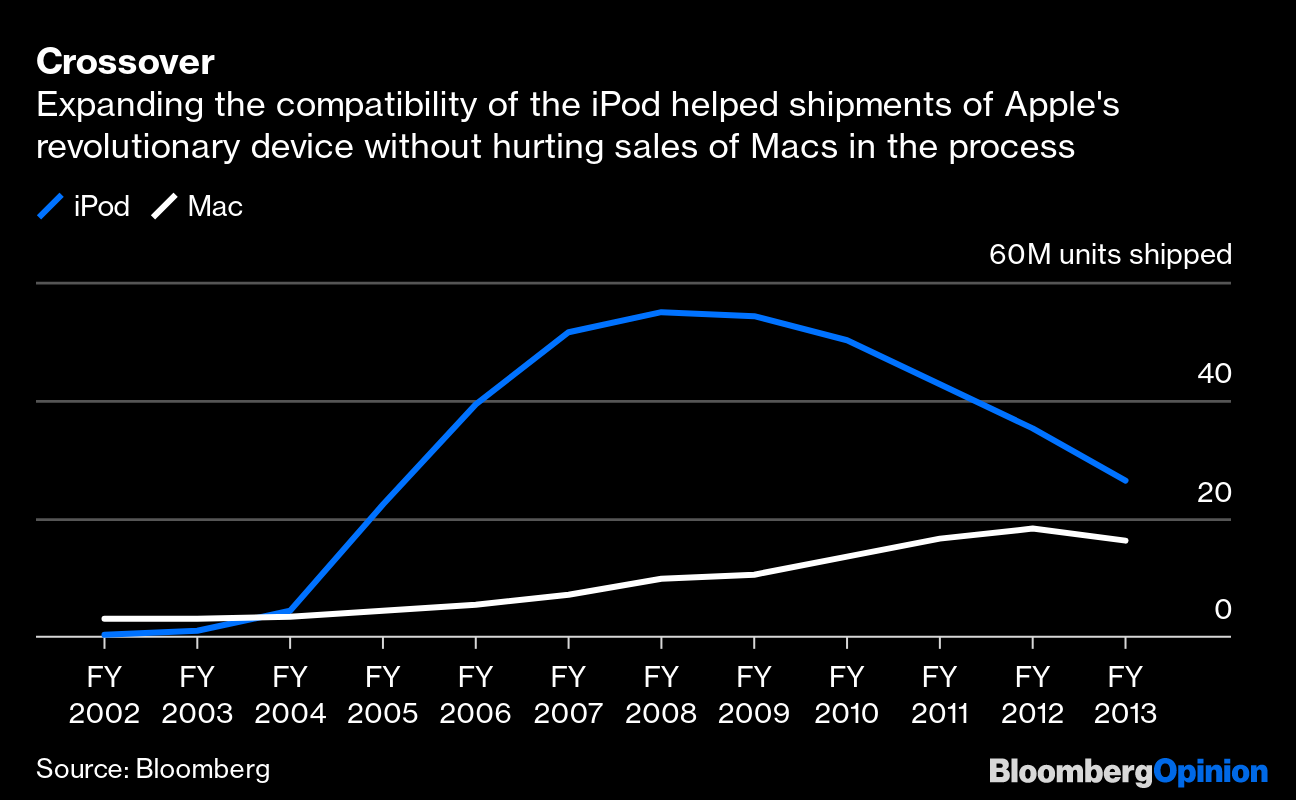

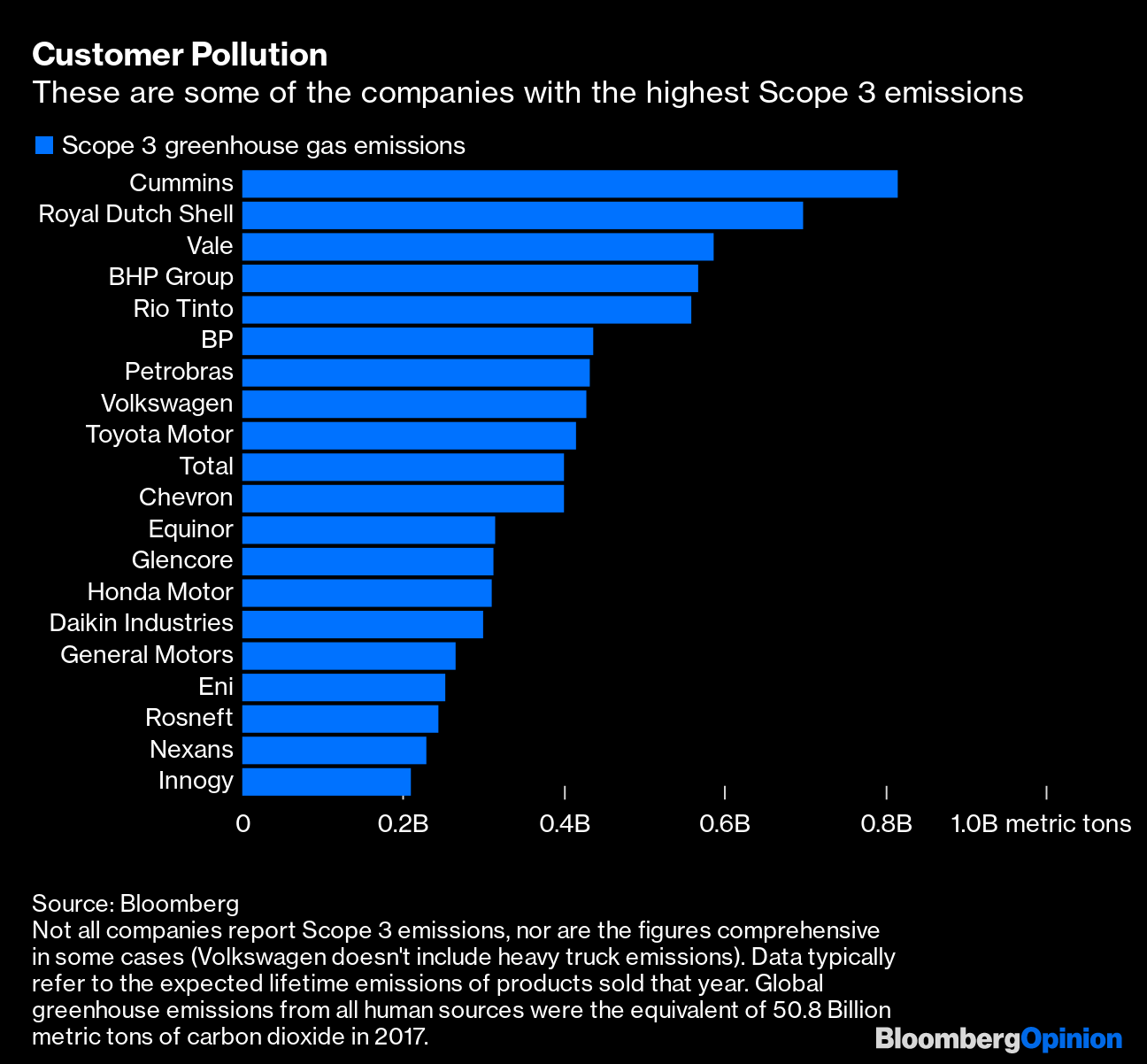

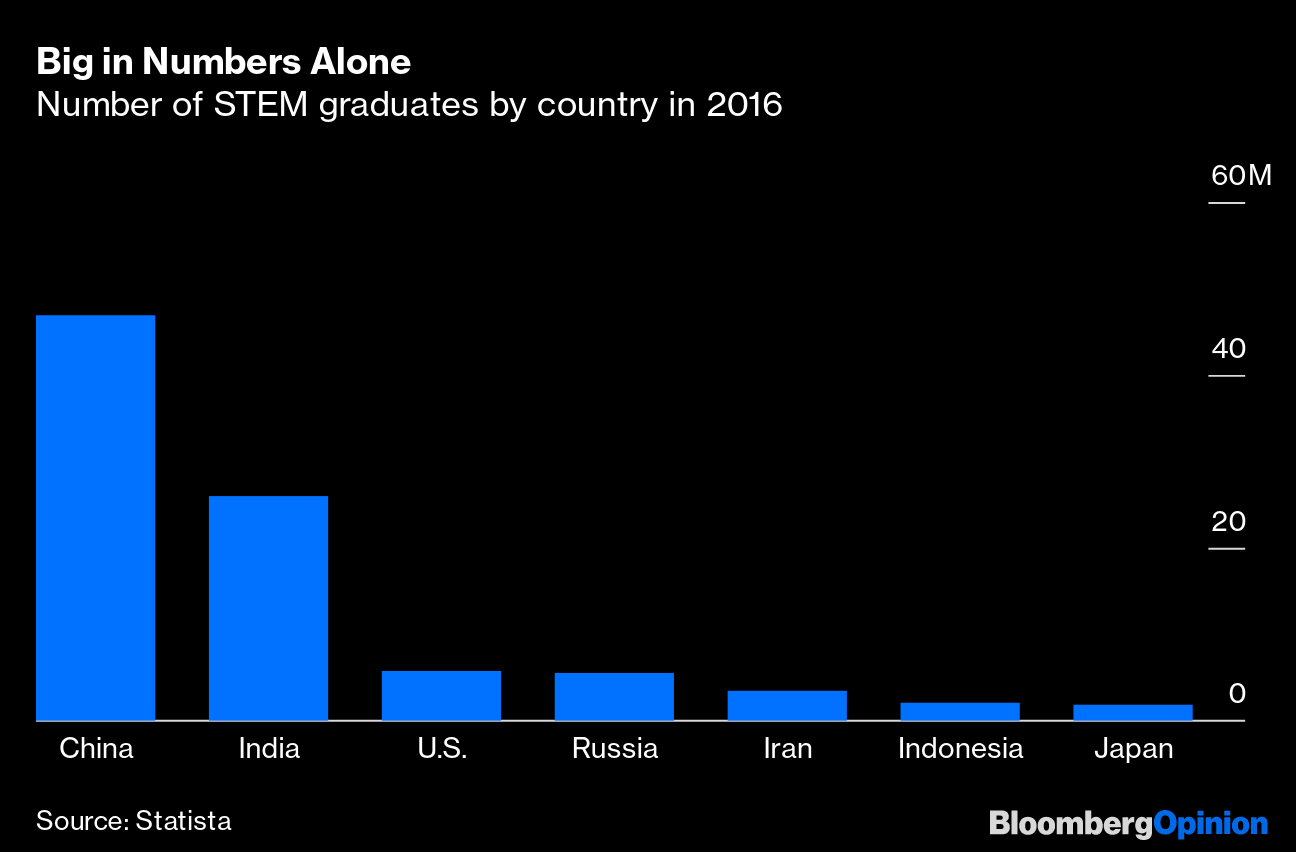

| This is Bloomberg Opinion Today, a zharkoye of Bloomberg Opinion's opinions. Sign up here. Today's Agenda  It gets better. Photographer: Chris Hondros/Hulton Archive/Getty Images The Stages of Corporate Grief As Leo Tolstoy once did not exactly write, each unhappy company is unhappy in its own way. But if there's anything like a Kübler-Ross model for publicly traded businesses going through hard times, then we saw three stages of it today. AT&T Inc. is currently in the, let's call it, OOPS, SURE HOPE THIS WORKS OUT part of the cycle. The mobile-phone provider is just coming off an $85 billion acquisition of entertainment behemoth Time Warner. It's currently like a python digesting a pig that might be too big; like, fatally so. In its latest results, AT&T did meet key milestones it had set for itself in this process, notes Tara Lachapelle. But these involve so much pain you still have to wonder if it's really worth the effort. L Brands Inc., parent company of Victoria's Secret and Bath & Body Works, is in a HMM, THIS ISN'T WORKING OUT stage. Founder Les Wexner may step down as CEO because of his ties to sex trafficker Jeffrey Epstein. And the company is thinking of ditching the increasingly retro-in-a-bad-way Victoria's Secret, notes Andrea Felsted. A private equity buyer could really help here, but good luck finding one. General Electric Co., meanwhile, is finally in a HEY, MAYBE THIS WILL WORK OUT place, after years spent in a far grimmer stage that cut its market cap nearly in half. The faded industrial giant's latest results show real signs of a turnaround, writes Brooke Sutherland. Its stock may be a little too pricey now, but then that's sometimes a perk of being a happy company. Coronavirus Keeps Spreading Uncertainty Even a fairly sanguine company such as LVMH Moet Hennessy Louis Vuitton Cheesecake Factory SE must worry about the still-spreading Wuhan coronavirus. The long-named luxury giant today warned its outlook was clouded by uncertainty about the illness's reach and duration, though Andrea Felsted argues LVMH has the diversity and strength to weather a lengthy crisis. Stocks overall spent a second day ignoring the virus, despite fears it could spread asymptomatically, focusing instead on earnings and a somnambulantFed. Their Monday swoon was probably just a matter of coronavirus being a convenient excuse to sell anyway, suggests John Authers. For investors and, you know, humans who simply don't want to get sick, the risks of the virus are still impossible to quantify. One key variable is China, which does have more tools to fight the disease and its economic effects than it did during the SARS outbreak in 2003, Dan Moss notes. But it also has many more challenges than back then, when its economy was still booming. One particular issue for China is a shortage of primary care doctors, writes Adam Minter. That problem predates this particular virus and will probably outlast it. Apple's Best-Laid China Plans Go Awry Nobody would mistake Apple Inc. for an unhappy company; its stock price has gone more or less parabolic for the past year. Still, it has its challenges. China once seemed like a potential source of endless revenue growth for the company, writes Tim Culpan, but Apple's latest results show the reality is basically the opposite:  This development is especially revolting for Apple at a time when iPhone sales are flattening in older markets. It has been trying to adapt by selling more software and services and peripheral gewgaws. It could help itself even more, though, by unshackling its AirPods and Watch from the Mac ecosystem, Tim Culpan writes. This is exactly what it did with the iPod, boosting sales of both its music player and its Macs:  The World Has Turned and Left Milton Friedman Here About 50 years ago, the iconic economist Milton Friedman declared public companies shouldn't spend one second thinking about anything other than serving shareholders, regardless of the cost to society. Companies have lately started to reject that view and consider the needs of "stakeholders," a group that often includes people and communities that (gasp) don't own shares. This has Friedmanites up in arms, but Peter Orszag writes the world that shaped Friedman's views is long gone. For one thing, the government in 1970 was a much more aggressive caretaker of society's interests than it is now, and modern politics suggests it won't become more interventionist any time soon, pushing companies into doing some of the heavy lifting. Telltale Charts Total corporate greenhouse-gas emissions aren't always easy to track, especially once you consider how end products are used, writes Chris Bryant. We're only just starting to get a full accounting, which could lead to some uncomfortable results.  Despite some eye-popping headline numbers, the U.S. still dominates China in technology, writes Noah Smith. But it may not lead in the kind of technology China truly values, including facial recognition and AI.  Further Reading President Donald Trump's last-ditch impeachment defense is shaping up to be: OK, fine, he did it, but it's not impeachable. This is no defense at all. — Jonathan Bernstein The Fed's repo-market purchases haven't really boosted the stock market, so tapering them shouldn't hurt it. — Bill Dudley Remainers were never able to change enough people's minds after the first Brexit referendum. — Matt Singh World leaders are quietly working on a plan to make companies pay more in taxes. — Christopher Smart Goldman Sachs's foray into boring banking may make it more boring, or may make boring banking more exciting. — Matt Levine Government regulation helped fuel the rise of Big Milk, and now it's helping slowly kill it. — Stephen Mihm ICYMI A Russian billionaire's son rents a $500 apartment. Warren Buffett is out of the newspaper business. Andrew Yang says his supporters may go to Bernie Sanders in Iowa caucuses. Kickers The true story behind Semisonic's "Closing Time" will definitely not make you cry, nope. Lungs almost magically heal smoking damage, as long as you quit. (h/t Scott Kominers for the first two kickers) Area owl is "just too fat to fly." The iPad awkwardly turns 10. Note: Please send Iowa voters and complaints to Mark Gongloff at mgongloff1@bloomberg.net. Sign up here and follow us on Twitter and Facebook. |

Post a Comment