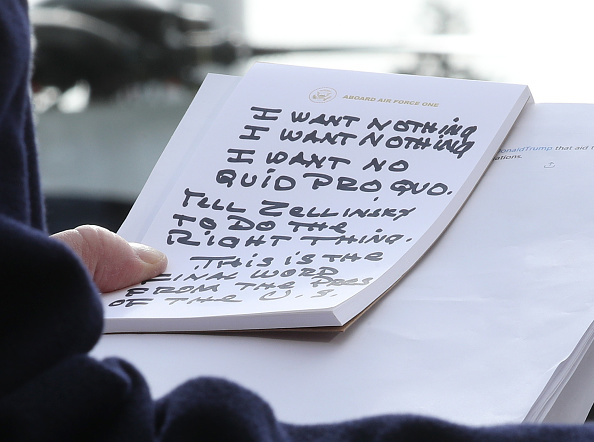

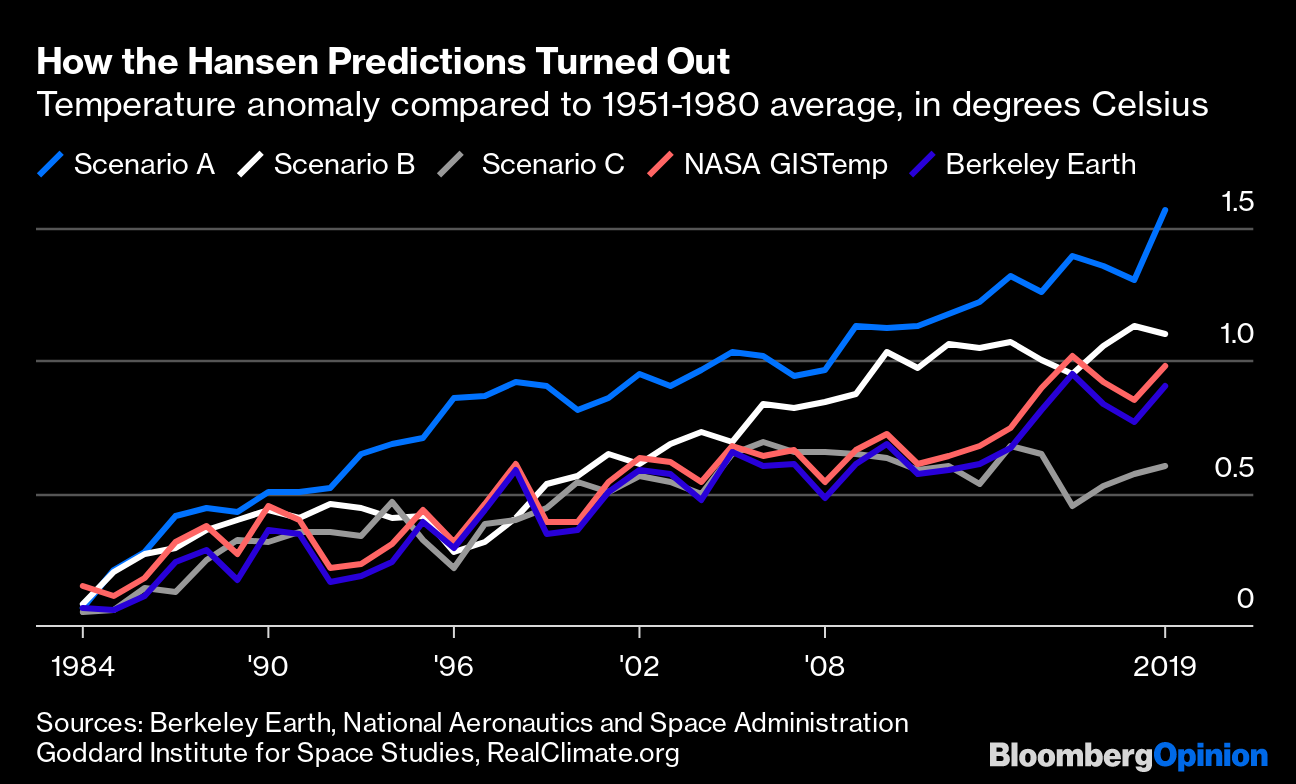

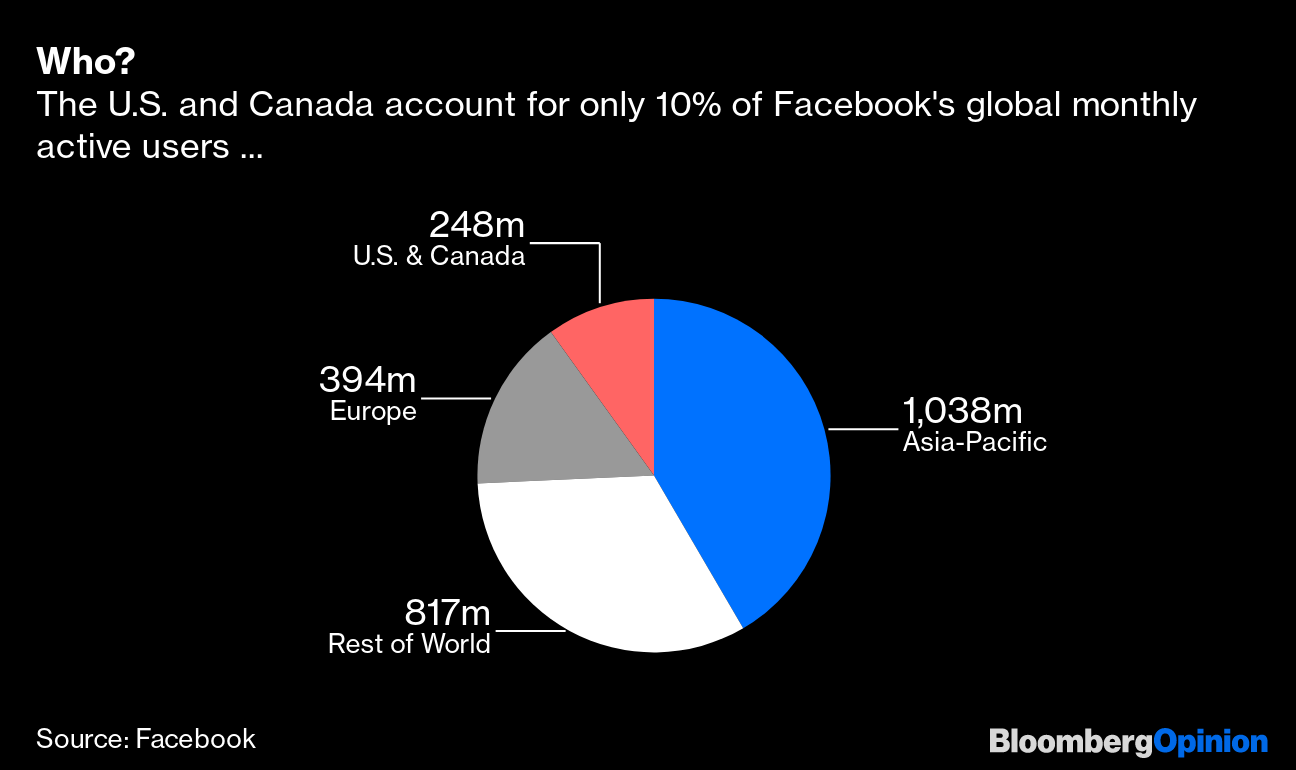

| This is Bloomberg Opinion Today, a mysterious drone swarm of Bloomberg Opinion's opinions. Sign up here. Today's Agenda  Back when he bothered to argue about the facts. Photographer: Mark Wilson/Getty Images North America Impeachment's Big Lesson: Trump Can Do Whatever Trump Wants President Donald Trump's impeachment trial is all over but the crying. What have we learned? One big thing: The president can do whatever the president wants, as long as he has 34 Senate votes and it's not expressly forbidden by statute (and probably even if it is). That is basically the defense's latest theory of the case, advanced by Trump lawyer Alan Dershowitz. He argued that "abuse of power" is not impeachable because it's not a crime. He also argued a president soliciting foreign help with his re-election campaign is totally fine, because he obviously thinks getting re-elected is good for the country. Both arguments are dangerous hogwash, writes Noah Feldman. The Founding Fathers considered abuse of power possibly the biggest reason to ever impeach a president. Tossing that out threatens our democracy. Richard Nixon must be green with envy right now, suggests Jonathan Bernstein. Because Trump is about to win acquittal after advancing the mostodious and cynical arguments in his defense (see above). Now we're about to find out what happens when Trump has utterly no fear of impeachment. "I suspect it isn't going to be pretty," Jonathan writes. Coronavirus Keeps Getting More Emergency-Like Commerce Secretary Wilbur Ross may think the Wuhan coronavirus will bring jobs back to America, but everybody else just wants it to go away. The World Health Organization today declared the outbreak a global health emergency. It's still much smaller and less deadly than SARS. But it continues to spread, turning up in India and the Philippines today, as the first U.S. case of human-to-human transmission was reported. Countries and companies are taking drastic measures: closing borders, canceling flights, closing up shop. But this fight will mainly be won or lost in hospitals, where most of the transmission happens, writes David Fickling. And the weapons may not be miracle drugs but little things such as hand-washing, quarantine and proper ventilation. This particular virus still seems unlikely to become a true pandemic — knock furiously on wood — but it's a good reminder of how unprepared we are for one of those. Defeating a pandemic will probably take more than attention to hygienic detail, suggests James Stavridis. For one thing, it will take the military, which has the skills, equipment and reach to handle such things and can cooperate across borders with other militaries. Probably all worthier efforts than mapping out plague-related job opportunities. Further Coronavirus Reading: It could be ugly when China's markets reopen on Monday. — Shuli Ren Time Is a Flat Circle, and the Yield Curve Is Inverted Again The Federal Reserve yesterday made a policy announcement that was essentially the sound of somebody rolling over in their sleep. The central bank is on autopilot, and markets are right along with it. It all feels a little too much like the blissful calm before the screeching chimp rodeo of the financial crisis, writes John Authers. One thing the Fed did make clear was that it came here to chew bubblegum and spark some inflation, and it's all out of bubblegum, writes Brian Chappatta. Not only will it not be raising interest rates any time in the foreseeable future, but its likeliest next move may be to cut rates again. Because, in case you missed it, the "yield curve" is once again inverted. Long-time readers will recall that this occurrence, when long-term interest rates are lower than short-term ones, is typically a recession indicator. The curve was inverted a bunch last year, and we haven't had a recession yet (although fourth-quarter GDP growth was meh). That may be because the Fed responded to last year's inversion with a series of rate cuts. The latest could make the Fed cut again, Brian Chappatta writes. Unpopular Health-Care Ideas Remember Martin Shkreli? I mean, of course you remember the smirking pharma bro who jacked up the price of a life-saving drug by 5,000% and then bought the Wu-Tang Clan's "Once Upon a Time in Shaolin" (along with the domain name MaxNisen.com, after Bloomberg Opinion's own pharma columnist Max Nisen). New York's Attorney General certainly hasn't forgotten him and is suing him over that drug-price hike. Shkreli is currently in jail (though not for the price hike), and Joe Nocera wonders if maybe there are more fertile legal fields our attorneys general could plow. Specifically, many Big Pharma companies use Shkreli-like tactics to keep drug prices ludicrously high. And yet regulators seem reluctant to go after them. Trump has promised to do something about drug prices, but has delivered little so far. Meanwhile, he has vigorously tried to do away with Obamacare and cut Medicaid benefits. His latest effort is repackaging a terrible old idea to "block grant" Medicaid to the states, which is fancy talk for cutting benefits. This idea is perpetually unpopular, making this a political gift to the Democrats, writes the aforementioned Max Nisen. It is also just bad policy. Telltale Charts James Hansen's 1988 climate forecast ("Scenario B" in the chart below) was controversial at the time but turned out to be shockingly on the money, writes Justin Fox.  Most Facebook Inc. users are outside of North America, and yet it squeezes little revenue out of those people, writes Tim Culpan.  Further Reading Tesla Inc.'s miniscule achievements keep being rewarded by mammoth stock rallies. — Liam Denning Socialism could work in an economy dominated by services such as health care and education. — Noah Smith Older people have the most interesting jobs in America, making the economy less dynamic. — Tyler Cowen Value stocks are dead, while junk bonds are hot. This makes no sense; they're basically the same thing. — Nir Kaissar Goldman Sachs Group Inc. is learning it's not easy to branch out from trading. — Elisa Martinuzzi Violence is the wrong response to Trump's peace plan, but Palestinians may feel it's all they've got. — Hussein Ibish ICYMI Trump's rape accuser wants a DNA sample. The F-35's gun can't shoot straight. Who wants to buy America's most expensive home? Kickers RIP to the Spitzer Space Telescope (h/t Ellen Kominers) These are the highest-resolution photos of the Sun ever taken. (h/t Scott Kominers) The Colorado mystery drones weren't real. Why kale might lower Alzheimer's risk. Note: Please send kale and complaints to Mark Gongloff at mgongloff1@bloomberg.net. Sign up here and follow us on Twitter and Facebook. Clarification: Yesterday's newsletter referred to the luxury-goods company LVMH as "LVMH Moet Louis Vuitton Cheesecake Factory SE." In a footnote that regrettably did not appear in the email, we clarified this was a joke. Cheesecake Factory is not part of the LVMH conglomerate, but is in fact a subsidiary of Apple Inc. We apologize for the confusion. |

Post a Comment