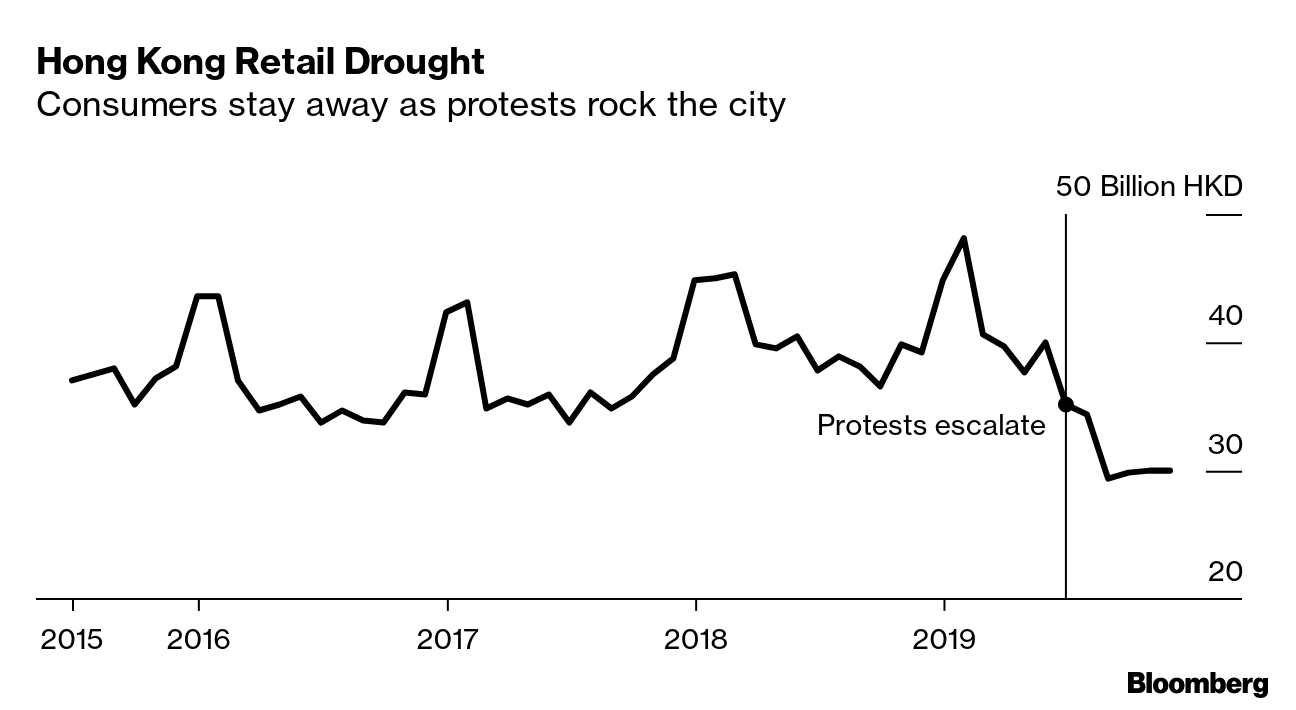

| There's more to the tensions between the U.S. and China than just trade, a point that'll be highlighted next week when Huawei is front and center. On Monday, a court in Vancouver will begin hearing the case of Meng Wanzhou, the Chinese tech giant's chief finance officer and daughter of the company's founder. The U.S. is seeking her extradition on charges of bank fraud, which they allege was committed when she lied to HSBC about Huawei's business in Iran. Meng's defense has called the allegations an attempt to "dress up" what is really a sanctions-violation complaint. And because violating American sanctions against Iran doesn't break any Canadian laws, a pre-condition for extradition, Meng should not be handed over, they argue.  Meng Wanzhou, chief financial officer of Huawei Technologies, center. Photographer: Trevor Hagan/Bloomberg It's not hard to imagine the mood in that courtroom being quite different from what we saw at the White House this past week, when President Donald Trump and Chinese Vice Premier Liu He signed the phase-one trade deal. Not only was it a rare moment of friendship in an increasingly competitive relationship, it was probably also fleeting. The list of pain points for U.S.-China ties is long and complicated. It is most tricky in the areas where business and national security appear to overlap. And that's where Huawei seems to find itself, stuck between American concerns that Beijing could use itsgear for spying and having a businesses that depends on a global market place. The charges against Meng aren't the only actions the U.S. has taken against Huawei. Strict limits have been put on what American companies can supply the firm, with signs those rules could get even tighter. The U.S., having banned Huawei from its 5G networks, is also pushing allies to do the same. That's forced many countries into a precarious choice between Washington and Beijing. The latest example of that delicate balance was British Prime Minister Boris Johnson hinting this week that the U.K. would only ban Huawei equipment from core areas of its high-speed wireless network. Ultimately, the question is how secure the U.S. can feel in a world where China not only challenges its dominance, but in some areas — such as 5G — surpasses it. That's not to say the outcome must be calamity, though it does suggest it'll be some time yet before we find out how this story ends. Taiwan's President Taiwan seems to be one of the few things that Democrats in the U.S. can agree with the Trump administration on. Former Vice President Joe Biden, who's also a leading Democratic candidate for president, congratulated Tsai Ing-wen on her landslide re-election victory shortly after U.S. Secretary of State Mike Pompeo did the same. American support has been essential to Taiwan's ability to stave off Beijing's push for unification and during her presidency, Tsai has sought to strengthen ties with Washington. That outreach is something she'll almost certainly continue in her second term, and given the current U.S.-China tensions, something that will find a welcoming audience in America. What it won't do is make Beijing's relationship with Washington any simpler. Hong Kong Shopping Chinese New Year is just a week away, though there probably won't be much holiday cheer for Hong Kong Kong's retailers. While the protests that have wracked the city for the past half year have calmed, tourists from the mainland have yet to return. In December, the number of Chinese travelers to Hong Kong plunged 51.5% from a year ago. The pain has been obvious. Chow Tai Fook, the world's second most-valuable jewelry chain, announced this week it's planning to close 15 stores in the city. That followed a report earlier this month that LVMH was closing its Louis Vuitton store in one of Hong Kong's most popular shopping districts. One bit of good news for retailers, meanwhile, has been that rents are at least falling.  Overcoming Swinegate Things are looking brighter for UBS's business in China. Last summer, the firm was mired in the uproar around economists Paul Donovan's "Chinese pig" quip in a note discussing the impact of African swine fever. China Railway Construction dropped UBS from a bond sale because of the controversy, which became known as "swinegate." This week, the Swiss bank hosted its annual China conference in Shanghai and saw a record turnout of participants. The timing couldn't be better. As part of the phase-one trade deal, Beijing is moving forward the timeline for opening its financial market for foreign investment banks. UBS isn't the only firm with high hopes. JPMorgan is seeking 100% control of its local fund management venture. Goldman Sachs plans to double its staff. Nomura is taking more office space in Shanghai. Savvy Dealmaker One of the most powerful things a corporate titan can have when it comes to dealmaking is a track record of making transactions pay off. That's what Geely's Li Shufu has, most notably in the success Volvo has had since he bought the company from Ford a decade ago. It's no surprise then that his name should come up as soon as there's a whiff of a deal in the auto industry. See for example this week when Geely emerged as a potential investorin Aston Martin. And what a great time it is to be a savvy dealmaker. With sales in China, the world's largest car market, contracting and the industry facing a tectonic shift toward electrification, the sorts of deals that open up stand to become ever more interesting.  Stable Economy And fresh off the press, data show China's economy weathering Donald Trump's tariff barrage. Gross domestic product rose 6% in the final quarter of 2019 from a year earlier, the same as in the previous three-month period and the median estimate. For the full year, growth came in at 6.1%, the slowest since 1990. December figures give some cause for optimism though, as industrial production perked up and retail sales held at an 8% growth rate. What We're Reading: And finally, a few other things that caught our attention: |

Post a Comment