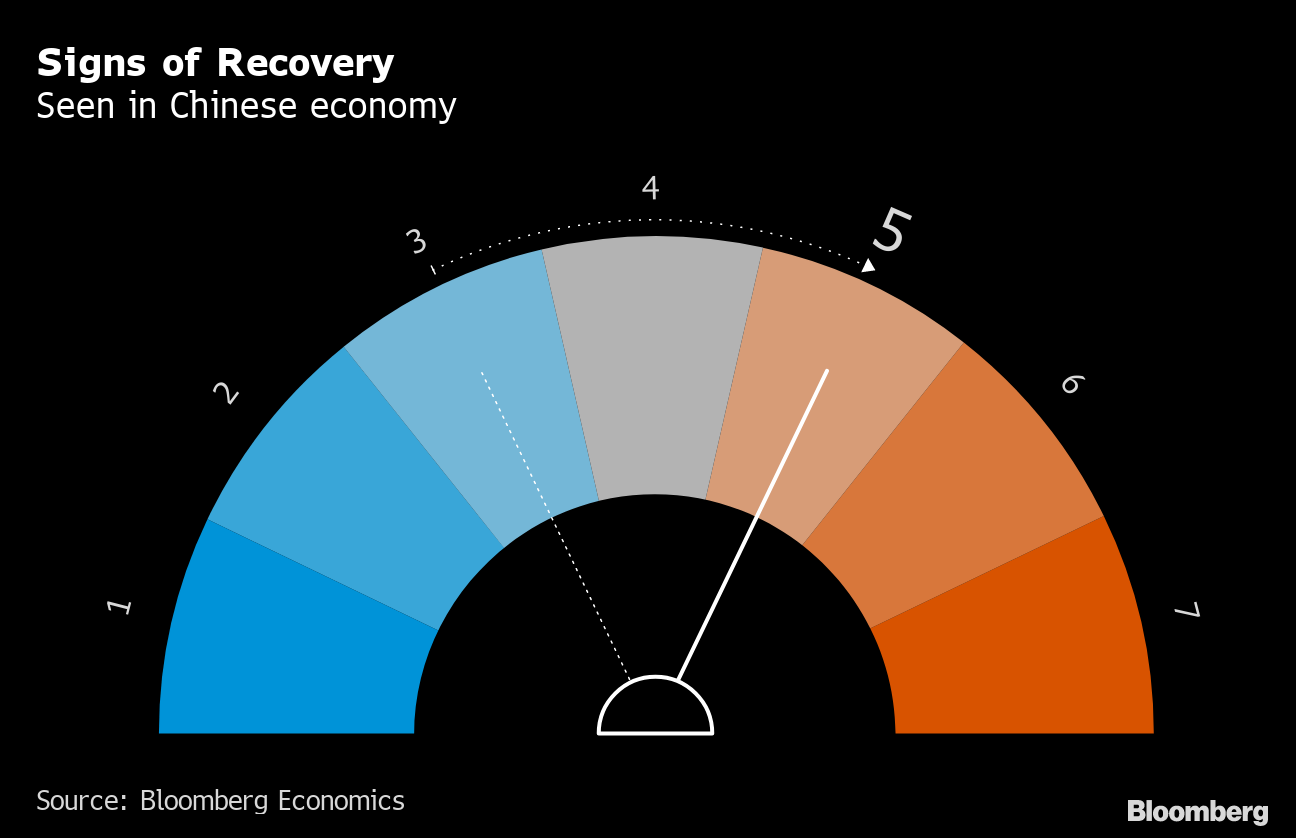

| The view from Beijing is looking a bit rosier. The testiest days of the trade war seem to have receded. Economic growth is stabilizing. Reforms are being unveiled and markets opened. So the worst is over, right? Well, the 2020 outlook isn't all rosy, to be sure. The situation in Hong Kong remains unpredictable. America's presidential election won't make the relationship with China any simpler or a phase-two trade deal any more likely. And Beijing is still trying to defuse the country's massive debt problem. But China does appear to be in a better place today than it was a year ago. As 2019 opened for business, the mood was acutely dour. It began with a contraction in Chinese manufacturing stoking concerns about growth, made all the worse when Apple announced a surprise cut to its sales forecast because of weakness in China. By comparison, the start to 2020 feels far more agreeable. Take trade for example. A phase-two deal seems tough, but phase-one looks like it's "in the bag," as White House adviser Peter Navarro might put it. What's more, the latest data indicate improving economic conditions. China's much-watched manufacturing sector showed expansion for a second consecutive month in December, after contracting in each of the six months prior. Other early indicators for China's economy, from copper prices to South Korean exports, suggest the same trend.  A group of earliest-available economic indicators compiled by Bloomberg show signs of recovery. Red shows conditions are warming up while blue notes cooling. There's even reason for optimism on a slightly longer horizon. In the final weeks of 2019, Beijing announced a slew of reforms aimed at revamping state-owned firms, supporting the private sector and ensuring the freer movement of labor. Those measures, together with earlier pledges to give foreign companies greater access to Chinese markets, could bolster growth for years to come. Of course, all of that could change with the blink of a tweet. But at least for now, there's an argument to be made for why Beijing should be feeling a bit more cheer heading into this year. Governing Hong Kong In his New Year address, President Xi Jinping defended the soundness of "One Country, Two Systems," the notion that different political systems can exist in a single sovereign state and the principle by which Beijing has ruled Hong Kong since its return to China two decades ago. That concept, formulated by the late Deng Xiaoping, has never been as challenged as it is now. Protesters in Hong Kong have accused Beijing of eroding it by seeking to align the city's system with the mainland's. Voters in Taiwan, seeing the unrest in Hong Kong, appear increasingly repelled by the prospects of a similar framework for themselves. Only in Macau do things appear to be going smoothly. If Xi's comments this week signal greater attention from Beijing on Hong Kong's ills, it may foreshadow some changes to how "One Country, Two Systems" is carried out. Any significant overhaul to the policy, however, seems remote. Tech War Conditions Huawei this week reported an 18% increase in 2019 revenue to about $120 billion. That would seem like not such a bad result given the company's starring role in the global tech war. Not so at Huawei, which announced plans to weed out under-performers and merge or downsize some units. "Survival will be our first priority," Eric Xu, one of three executives who take turns as rotating chairman, said in a memo to staff. It's a sentiment that echoes across much of China's tech sector. In addition to Huawei, the U.S. has also limited the access that Chinese companies including SenseTime, Megvii and Hikvision have to American components and software. Security concerns have likewise clouded the future of ByteDance's TikTok video app. Funding for startups has tightened as well, with the amount invested in 2019 dropping 50% from 2018. In such a climate, preparing for the worst seems a prudent course of action.  Gene Scientist Jailed The Chinese scientist who shocked the world in late 2018 when he revealed he'd edited the genes of newborn twins was sentenced to three years in prison this week and banned for life from working with reproductive technologies. While that might close the case of He Jiankui, it seems unlikely to dim the spotlight that his actions put on China's rapid push into genetics. To be fair, the resources being poured into research could well produce breakthrough treatments for cancer and many other illnesses. The concern is whether Beijing has sufficient safeguards in place to ensure that others do not cross ethical lines as He did. With his punishment, and pledges to strengthen scrutiny, Chinese authorities are keen to show they do. Time will tell. Tesla Deliveries Tesla invited the media out to its new multi-billion dollar plant in Shanghai this week to witness the delivery of its first 15 cars — all of which are to employees. One brave man getting a vehicle even used the occasion to propose to his girlfriend. (Thankfully she said yes.) Whether Tesla's fortunes in China are as happy is another question. The stock market is clearly optimistic, pushing Tesla's share price so high Elon Musk joked about it. Beijing is as well: Keen to show the world that China welcomes foreign investors, authorities have taken various steps to help, including a tax break for the cars made in China. The problem is demand. Sales of electric cars in China have contracted for five straight months, and while there's some evidence to suggest Tesla could buck that trend, market conditions don't immediately suggest a blockbuster beginning.  An employee hugs his girlfriend after proposing during the delivery ceremony at the Shanghai factory on Dec. 30. Photographer: Qilai Shen/Bloomberg What We're Reading: A few other things that got our attention: |

Post a Comment