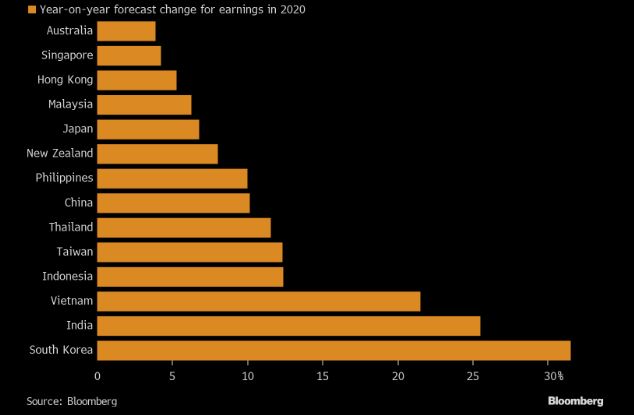

| Iran fallout continues, China has a new top official in Hong Kong and Australia suffers of the worst days yet of its bushfire crisis. Here are some of the things people in markets are talking about today. Tensions following the U.S. killing of top Iranian general Qassem Soleimani continue. Iran said Sunday it would no longer abide by any limits on its enrichment of uranium and Iraq's parliament voted to expel U.S. troops from the country. President Donald Trump told U.S. lawmakers he was prepared to strike Iran "in a disproportionate manner" if the Islamic Republic hits any U.S. target, while Secretary of State Michael Pompeo said that any moves taken against Tehran would be "lawful." Soleimani was as revered at home as he was reviled in some quarters abroad. His death dealt yet another blow to world powers' crumbling nuclear deal with Iran. Sunday's action looked like the historic deal's death-knell. Financial markets are likely to face a volatile start to the week in Asia after geopolitical tensions flared in the Middle East. Futures in Japan dipped with traders returning after an extended holiday last week. They also slipped in Sydney and Hong Kong. Gold and Treasuries climbed in a flight to safety, and the yen also advanced. All the Middle East's major equity gauges fell Sunday and the S&P 500 Index posted its biggest loss in a month Friday. Oil surged on Friday, and is set for a bumpy week as the U.S. warned Iran may attack Saudi Arabia again. China has appointed a new top official in Hong Kong, signaling its intention to restore law and order to the city after almost seven months of social unrest. Luo Huining will take over from Wang Zhimin as the Hong Kong liaison office director, according to a two-sentence government statement issued on Saturday. He's a party stalwart with no experience in Hong Kong, but credited by Chinese media with bringing stability to the mainland province of Shanxi during his stint as party secretary there. With support for the protests undiminished after months of violent unrest, speculation of Wang's removal from the position had been growing. On Sunday, dozens of people were arrested in the New Territories after an approved march; police fired tear gas in response to a petrol-bomb attack on a police station. As unrest continues, some of the city's anxious parents are eyeing Singapore schools. Catastrophic wildfires destroyed hundreds of properties across southeastern Australia on Saturday, with conditions expected to worsen during the week. Some blazes grew so large over the weekend that they generated dry thunderstorms and thousands of people, including tourists, have evacuated a 350-kilometer (217-mile) stretch of coastline as well as dangerous inland areas to escape the intensifying fires. Qantas Airways canceled 27 flights Sunday afternoon arriving in and departing from Canberra, where air pollution was at least four times higher than the minimum threshold for "hazardous." Prime Minister Scott Morrison announced Saturday an unprecedented level of military support to boost firefighting and recovery efforts as the national death toll since September rose to 23. Federal aviation regulators are considering requiring pilots to complete simulator training before they can operate Boeing's 737 MAX jets again, the Wall Street Journal reported, citing government and industry officials familiar with the matter. The Federal Aviation Administration originally rejected the idea, but in recent weeks officials said there has been increased interest among agency and industry safety experts in requiring such training. The FAA's formal decision isn't expected until at least February, and the situation remains "fluid," according to the Journal. The planes have been grounded since March after two crashes within months of each other killed hundreds of people. What We've Been Reading This is what's caught our eye over the past 24 hours. And finally, here's what David's interested in this morning Heartbreak's a terrible thing. If you've believed in something only to be left disappointed, it's totally understandable to feel like you never want to love again. Well, the forecasts for earnings growth this year are out and they look pretty good. As they should, since most of the Asia-Pacific region saw earnings contract in 2019 and hence will be coming off a low base in 2020. But the consensus this time last year was that earnings per share would glide higher. Fast-forward 12 months and we ended up with a double-digit drop on both MSCI Asia Pacific and MSCI Asia Pacific Ex-Japan. So can we trust these forecasts after getting burned last time around?  I asked that question to many equity analysts who joined us on Bloomberg TV last month, some of whom were partly behind these forecasts. The general view is we can probably attach a much higher degree of confidence to this year's projections since there are fewer moving parts. (If you're interested in hearing more, here are clips from the interviews we had with HSBC and Nomura.) Growth forecasts were too optimistic in late 2018. There were even predictions that the Fed would hike rates in 2019, when — as you might recall — the opposite happened. Analysts say this time is different. If they're even just a few degrees closer to being right this time, we'll be fine. You can follow Bloomberg's David Ingles at @DavidInglesTV. The best in-depth reporting from Asia Pacific and beyond, delivered to your inbox every Friday. Sign up here for The Reading List, a new weekly email coming soon. Before it's here, it's on the Bloomberg Terminal. Find out how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. |

Post a Comment