| A quick reader's note on some exciting news: Starting next week, Good Business becomes part of a new daily climate newsletter from Bloomberg. You'll get the latest on critical scientific, financial and technological developments all week long, including Good Business every Wednesday. You can unsubscribe at any point or modify your email preferences on your account page.

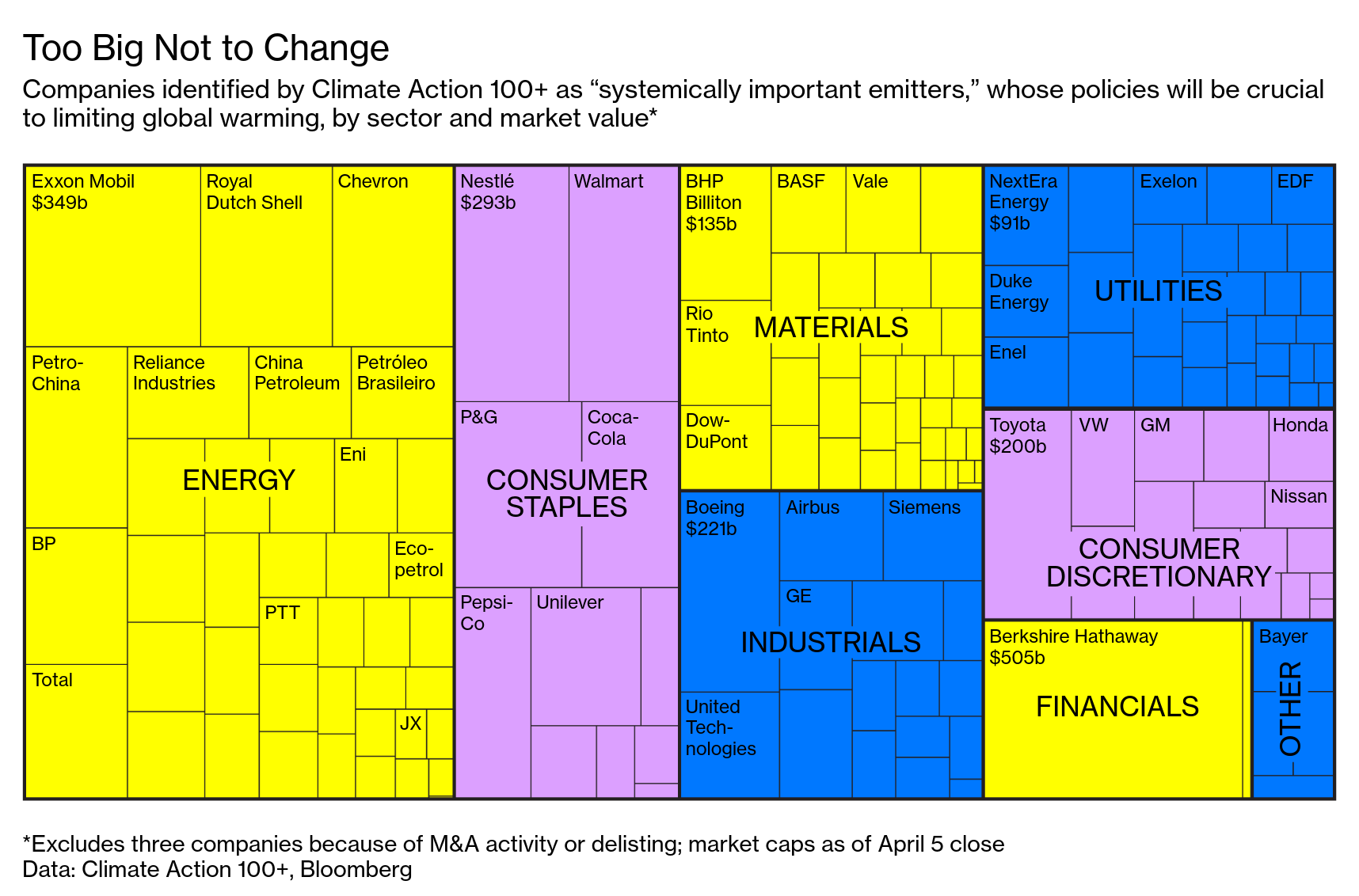

Inside: BlackRock's Fink says climate will now be at the center of its strategy. Europe pitches a $1 trillion green new deal. Coal's fortunes look bleak. Shipping's big bang. The Rooney rule didn't work in the NFL. Was Elon Musk's moonshot pay package really that crazy? —Emily Chasan Sustainable Finance In the race to combat investment risk from climate change, BlackRock is the turtle, not the hare. In CEO Larry Fink's annual letter this week, the $7 trillion asset manager pledged to put climate and sustainability at the center of its strategy. BlackRock warned that climate change will upend global finance sooner than most think, and plans to divest some coal holdings, joining more than 100 financial institutions and investors that already have restrictions on coal. It won't be easy for the firm to be green. It's BlackRock's job to try to be all things to all people, writes Bloomberg Opinion's Matt Levine and trillions of dollars of the firm's passive money won't be available for the climate fight. BlackRock holds 6% to 7% stakes in Exxon Mobil and Chevron, but that includes its passive funds. The move is proof that sustainability can move into the mainstream of capital markets as the big three index fund managers—BlackRock, Vanguard, and State Street — have become the most important players in corporate America—whether they like it or not. BlackRock this week also signed up for the Climate Action 100+ group that is pressing the world's biggest emitters to change, signaling a likely shift in its proxy votes.  The "question of our age" is how much societies are willing to sacrifice in economic growth to reverse climate change, according to a Deutsche Bank report.

The European Union unveiled a plan to mobilize at least 1 trillion euros ($1.1 trillion) over the next decade for a shift to a climate-neutral economy. Renewable energy spending needs to double by 2030 globally, Irena said.

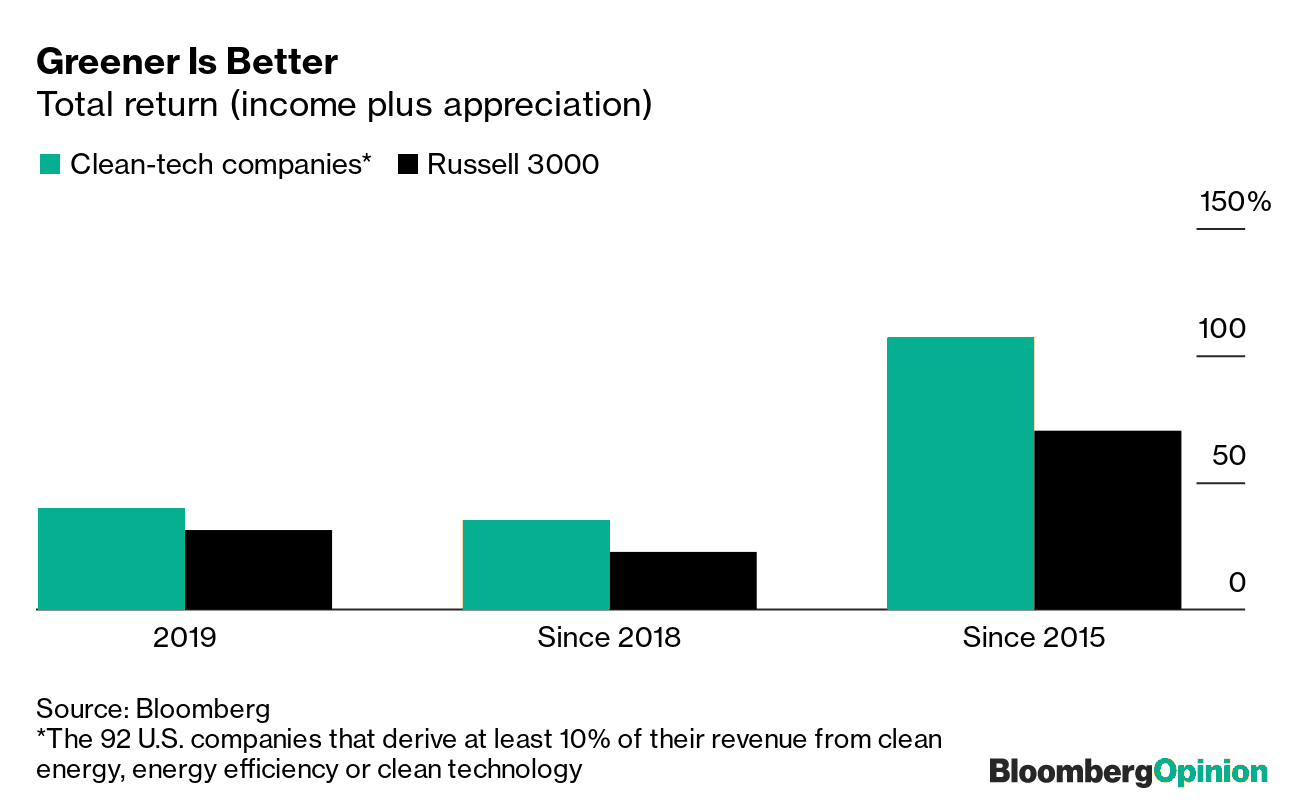

Investors are learning that clean tech pays, writes Bloomberg Opinion's Matthew Winkler. The American companies most reliant on embracing green technology are outperforming every broad measure of the stock market. While the S&P 500 gained 31% last year, clean tech companies were up 40%.  In Brief - Shorting U.S. shale companies turned out to be a good bet for hedge fund Westbeck Capital Management.

- Quant trader David Vogel is seeking $1.5 billion for a climate-change hedge fund that wants to use big data to wager on sustainability.

- CVC Growth Partners invested $200 million insustainability ratings companyEcoVadis in a bid to accelerate adoption.

- The New York State Common Retirement Fund hired Andrew Siwo as its first director of sustainable investments. Bridge Investment Group hired Matthew Jensen as Managing Director of ESG & Sustainability. EY said Steve Varley would be its first global vice chair for sustainability.

Environment Hydrogen fuel cells, which could help decarbonize trucking, trains and buses, saw a 40% jump in shipments last year. Hydrogen power plants are also becoming a reality and could price gas out of power markets by 2050.

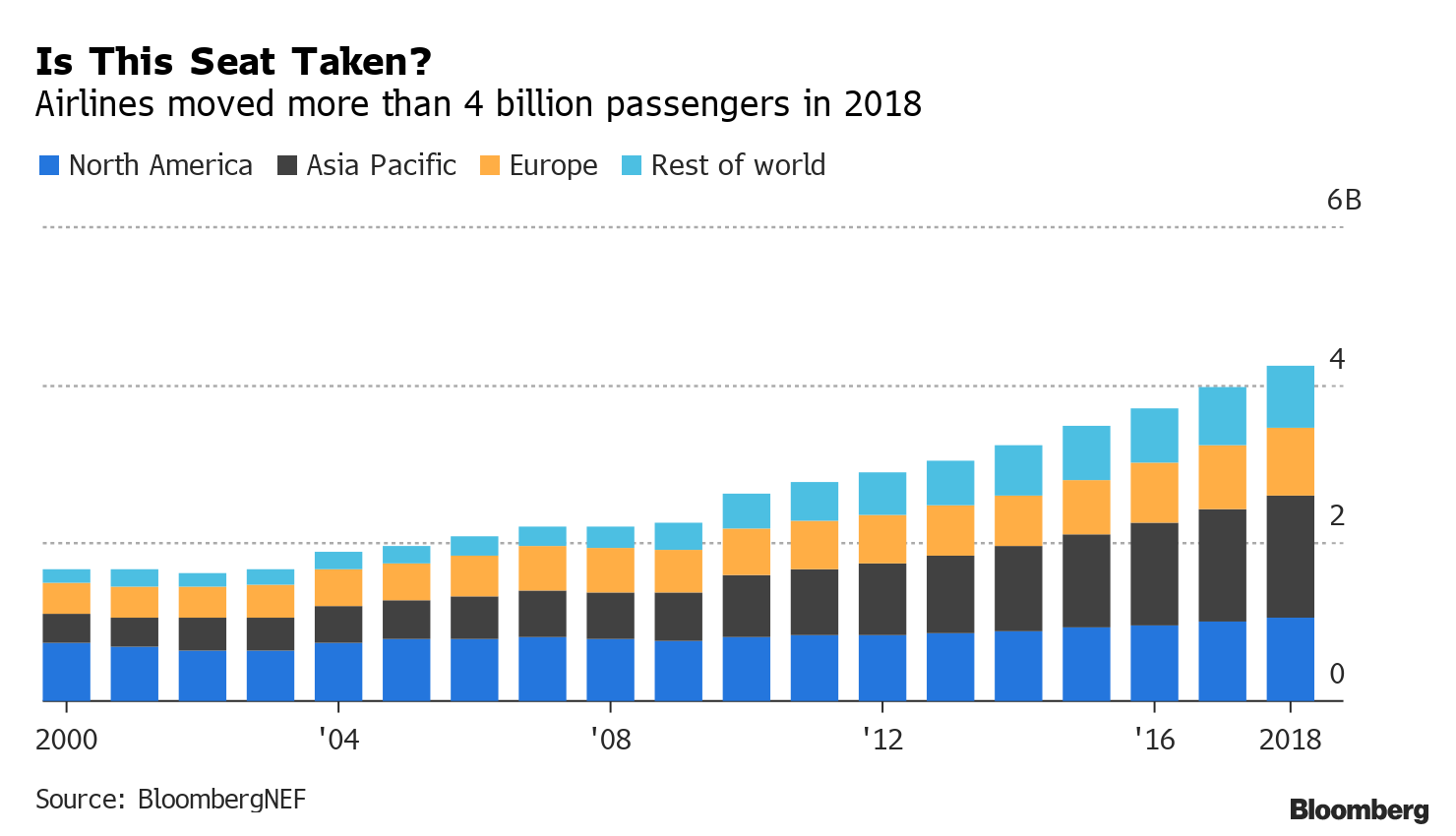

So much for flying shame. Air-travel passenger demand has more than doubled this century and topped 4 billion in 2018.  The global switch to cleaner shipping fuel has sent two global industries spinning.

The European Commission is considering a ban on plastic packaging.

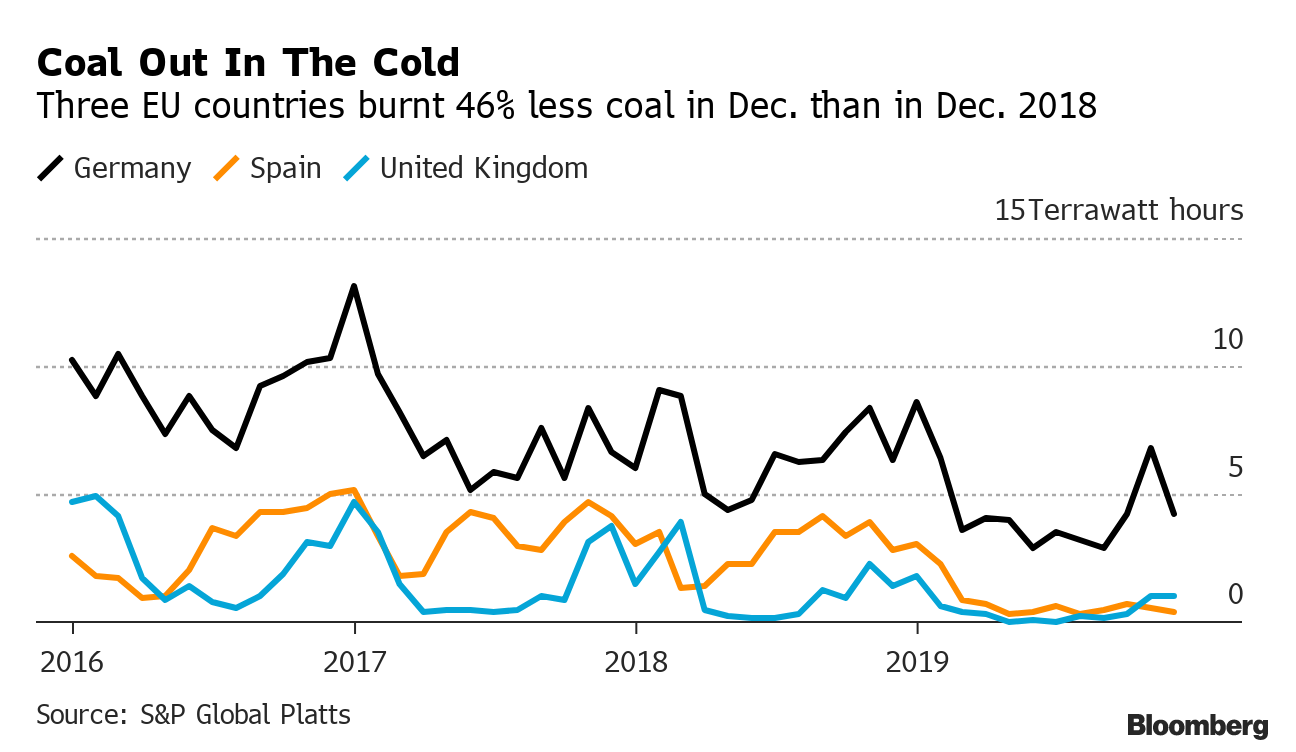

The economics for burning coal have collapsed in little more than a year since the commodity hit $100 a ton. Europe's goal of zeroing out carbon emissions by the middle of the century along with ever-cheaper wind and solar power and falling gas prices, pushed coal use across seven European economies to historic lows last year. Benchmark rates fell by almost a third and the prospects for 2020 look bleak.  Social Political differences at work might be good for fund managers' stock returns.

McDonald's and Beyond Meat are expanding their partnership in Canada.

The National Football League is famous for its "Rooney rule" where it require teams to interview at least one non-white candidate for every open head coaching position. The idea's caught on in the business world, but almost two decades later the NFL's crop of coaches has gotten whiter. Governance New York said it wouldn't appeal a ruling by a judge who rejected the state's claim that Exxon Mobil misled investors for years about internal planning on climate change risk.

Elon Musk's moonshot pay package doesn't seem that crazy anymore, write Bloomberg's Anders Melin and Dana Hull. Tesla shares have been on a tear since October and surged above $500 this week, leaving analyst targets in the dust.  Note: Please send tips, suggestions and feedback to Emily Chasan at echasan1@bloomberg.net. To see this on the web, click here.

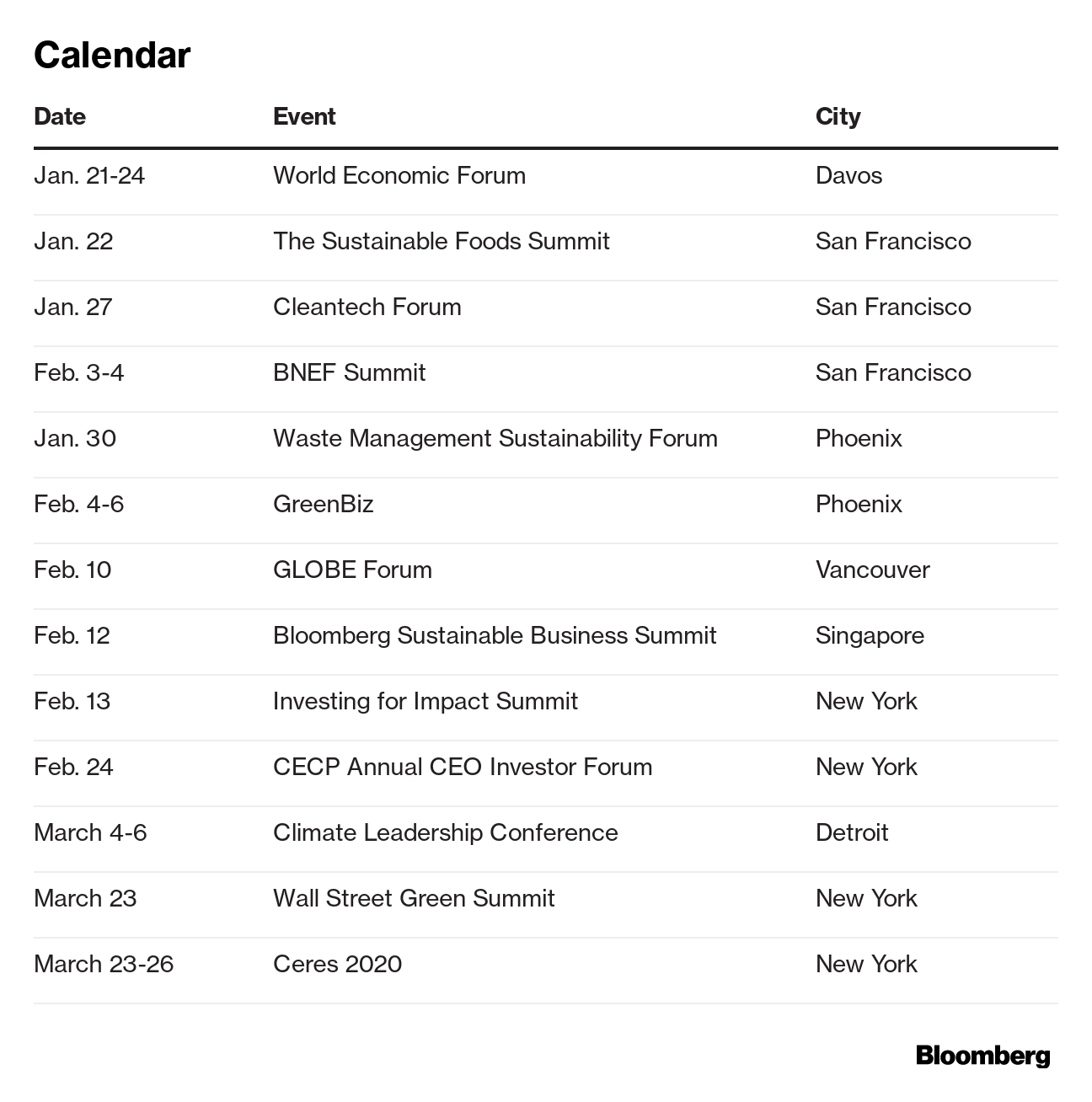

Bloomberg's signature Sustainable Business Summit series will come to Asia for the first time in 2020. Sign up here for the Feb. 12 event in Singapore. |

Post a Comment