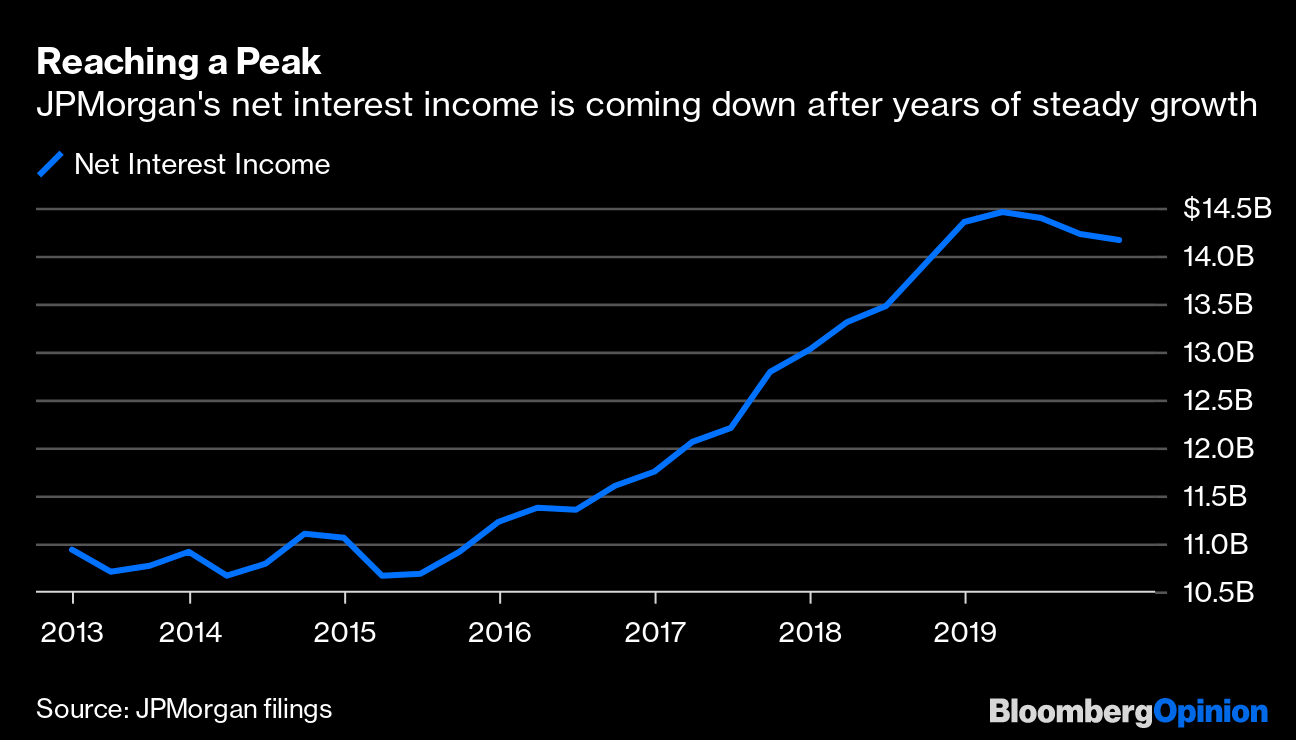

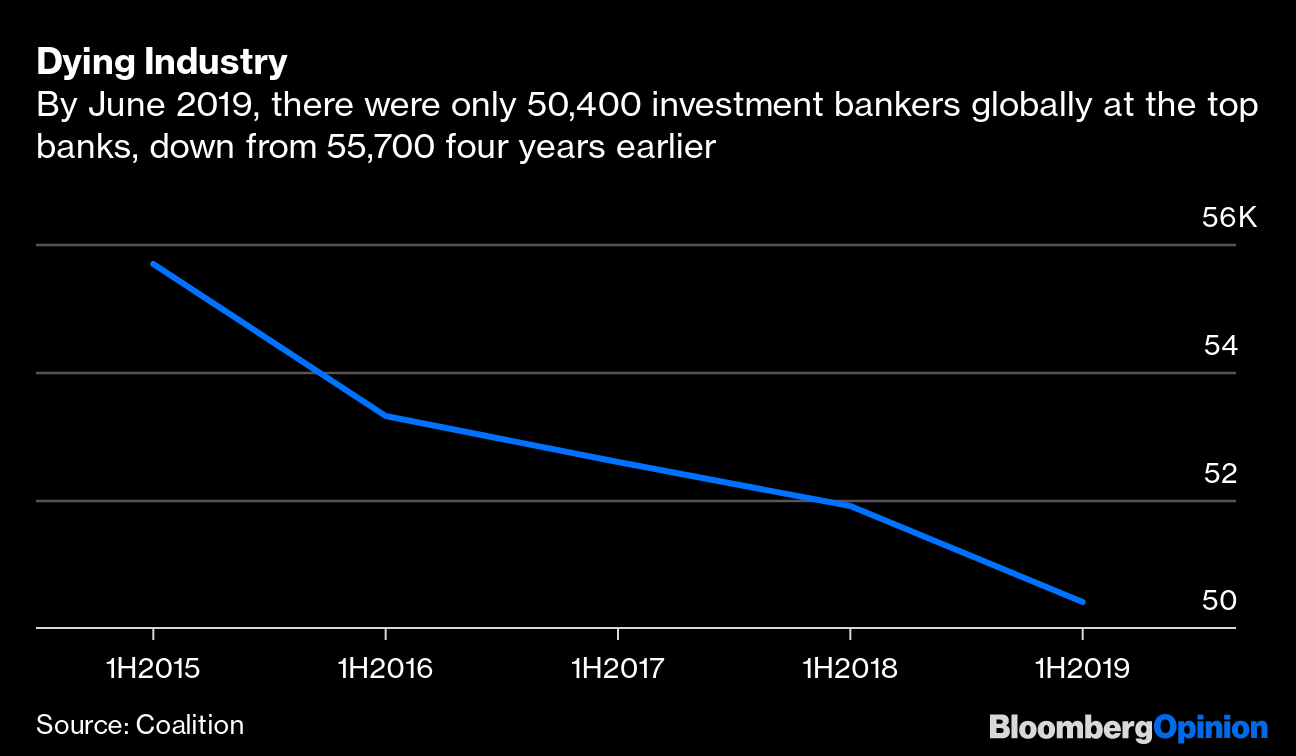

| This is Bloomberg Opinion Today, a bombe Alaska of Bloomberg Opinion's opinions. Sign up here. Today's Agenda  Larry Fink, CEO of BlackRock, and now in charge of climate because nobody else is doing it. Photographer: Bloomberg/Bloomberg A Tale of Two Climate Letters With Australia just always on fire now and the oceans hotter than ever in recorded history, the world is overdue for climate leadership. For now we'll have to settle for getting it from somebody most people have never heard of — though he happens to have $7 trillion of our money. Larry Fink is the founder of BlackRock Inc., the world's biggest money manager. In an annual letter to CEOs, he bemoaned climate change and listed ways his company planned to respond, including banishing coal investments from its actively managed portfolios. The "actively" part is the rub here: Most of what BlackRock manages is passive money, notes Mark Gilbert. It invests in funds that blindly mirror indexes, which could include coal miners, oil drillers and other climate menaces. Still, BlackRock has enough influence to push for, say, better governance at America's energy firms, writes Liam Denning. That could help curb some of their less-climate-friendly practices. More broadly, even if only at the margins, somebody with $7 trillion to invest can over time bend corporate behavior and investor preferences to its will, writes Matt Levine. Fink's epiphany followed months of hounding by climate protesters. Compare and contrast his reaction to that of Siemens CEO Joe Kaeser. He has also drawn public ire, for his company's investment in a coal project — in Australia; which, as we mentioned, is always on fire now. Rather than seeing the light, Kaeser wrote an epic, anguished letter explaining why it must go ahead, no matter how terribly he and various koalas might feel about it. But the project is bad from a business sense and just bad optics, writes David Fickling. A better leader would have recognized that. We might not need to care so much about what Larry Fink or Joe Kaeser do about climate change if our politicians did more. Though its contribution to global emissions is relatively small and shrinking, the U.S. can still boost its moral leadership and persuade other countries to follow, writes Noah Smith. Shutting down coal plants, upgrading the power grid, seeding the country with car-charging stations, making industry and buildings more energy-efficient: All would go further than even the most strongly worded letter. Boeing Keeps Hitting Itself Running Boeing Co. can't be easy. You've got to get the 737 Max back in the air. You've got to deal with daily info-dumps of embarrassing material; the latest batch shows employees mocking Indonesia's Lion Air for wanting more 737 Max training, just before the deadly Lion Air crash in 2018. But new Boeing CEO David Calhoun, crowned yesterday, will have plenty of cash incentives, notes Brooke Sutherland. Far too many incentives, in fact: Not only will he get a $1.4 million salary and long-term, just-because bonuses of $7 million and $10 million in stock, he'll also get $7 million if he hits certain milestones this year, such as getting the 737 Max flying again. He'll even get a (smaller) bonus if he fails to get the Max back in the air this year. Given the importance of the Max to Boeing's future, you'd think it would be the main part of Calhoun's job, requiring no bonus. As Brooke puts it, "a mechanism already exists that compensates executives for doing what's expected of them in their job. It's called a salary." Dangling a huge bonus just gives Calhoun even more incentive to hurry the Max back into service as quickly as possible. It certainly sends a terrible signal, especially when you remember Calhoun has been on Boeing's board for this whole debacle. Read the whole thing. Soleimani's Killing: The Memos In the days since killing top Iranian commander Qassem Soleimani, Trump and his deputies have struggled to stick to a rationale. One story was that it was to stop an "imminent" threat to American lives, but there's been no evidence of that, and occasionally they've tossed the whole "imminent" thing. Memos written by an adviser to former Trump national security chief John Bolton suggest the administration considered killing Soleimani for months, writes Eli Lake, who got the memos from a source. Those documents suggest it was part of a broader plan by some administration officials to disrupt Iran's regime. It may be working. Telltale Charts JPMorgan Chase & Co. just turned in the best quarter ever for an American bank. The problem, Brian Chappatta notes, is what it does for an encore.  Investment banking is a rapidly shrinking industry — except in China, where American banks are bulking up, notes Nisha Gopalan. Need a job? Maybe brush up on your Mandarin.  Further Reading The stock market has rarely been so overextended. What could go wrong? — John Authers The yuan's recent strengthening has little to do with China's economic prospects. — Mohamed El-Erian Texas Governor Greg Abbot has no good reason to block refugees. — James Gibney When American global leadership is in short supply, you get results like Libya's endless war. — Leonid Bershidsky ICYMI Trump probably won't cut any China tariffs until after the election. Tesla Inc. is making Larry Ellison even richer. Rich families are being urged to sell their businesses while they can. Kickers Scientists use frog cells to make living robots. (h/t Uffe Galsgaard) Scientists find the oldest material on Earth, and it's not in my fridge! Seriously, folks, Physics predicts how spaghetti curls when it's boiled. (h/t Scott Kominers for the past two kickers) Adam Sandler is a good actor, actually. Note: Please send frog robots and complaints to Mark Gongloff at mgongloff1@bloomberg.net. Sign up here and follow us on Twitter and Facebook. |

Post a Comment