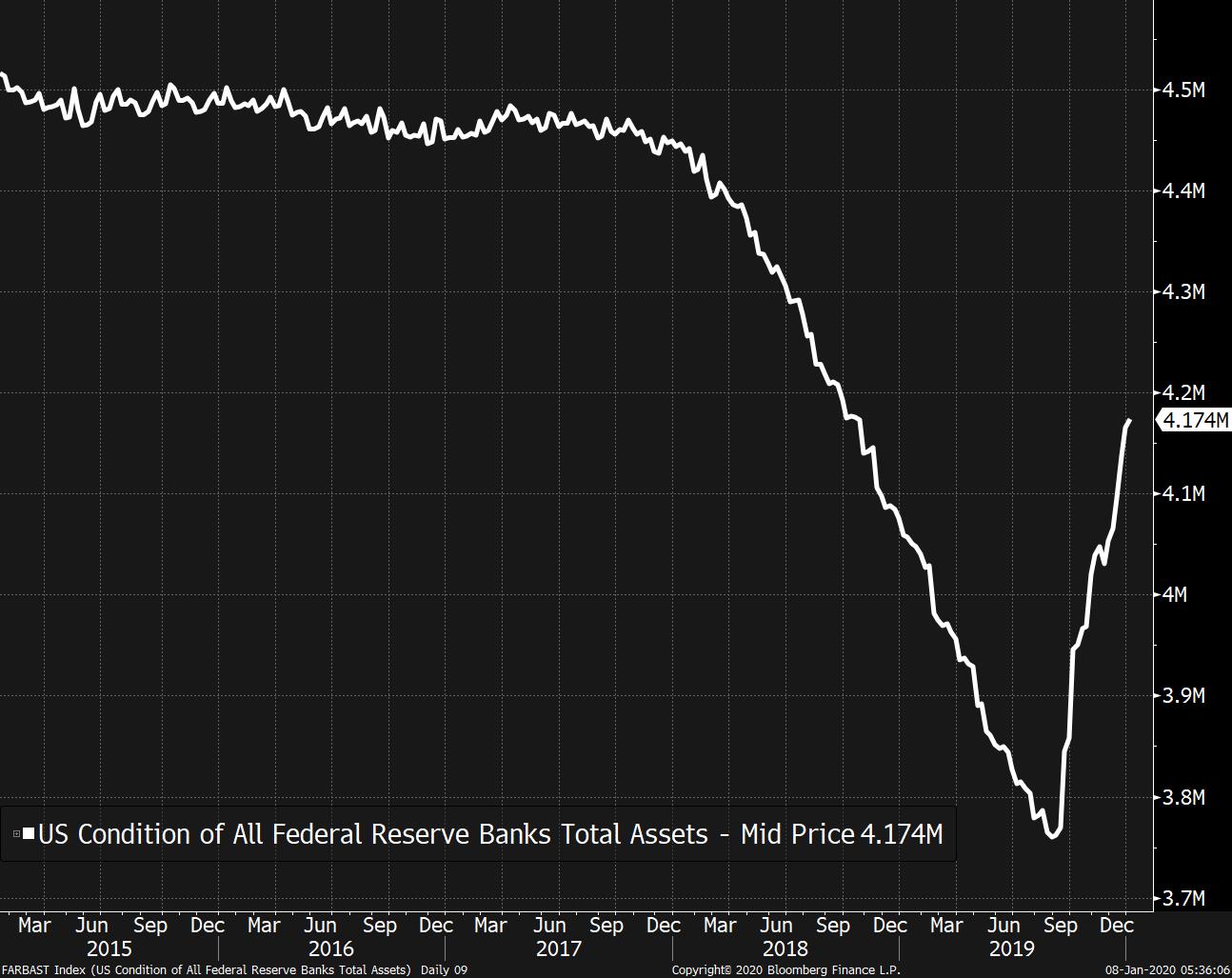

Iran strikes back, markets mostly shrug, and Ghosn ready to tell his story. Missile strikeIran fired more than a dozen missiles at U.S.-Iraqi airbases in retaliation for the killing of top Iranian general Qassem Soleimani. There's been no comment on any toll from the U.S., while the Iraqi prime minister's office said there were no casualties, with President Donald Trump tweeting that "all is well!" after the strike. Trump is due to make a statement this morning in Washington, with analysts seeing the development as a relatively measured response that could allow both sides to de-escalate the standoff. Boeing crashAlso in Iran, a Boeing Co. 737-800 jet bound for Ukraine crashed shortly after takeoff, killing all 167 passengers and nine crew on board. The plane was most likely brought down by an engine fire, according to Tehran authorities. The disaster comes at a tense time for both Boeing and Iran, with the crashed plane a predecessor of the company's grounded 733 Max jet. Given the current climate it may be difficult for officials from Boeing to take part in the investigation. To round off a very busy few hours in the country, the south of Iran was struck by an earthquake though the nearby nuclear reactor escaped damage, according to officials. Markets recoverGlobal equities and oil dropped in the immediate aftermath of the missile attack. However, markets soon pared those losses as hopes rose that the response could lead to a cooling of tensions. Overnight, the MSCI Asia Pacific Index dropped 0.8% while Europe's Stoxx 600 Index was 0.2% lower by 5:45 a.m. Eastern Time. S&P 500 futures had erased all losses to trade slightly higher, the 10-year Treasury yield was at 1.800% and Brent crude had reversed almost all of its $3-a-barrel surge. Ghosn speaksFormer chief executive officer of Nissan Motor Co. and Renault SA Carlos Ghosn is set to give a press conference in Beirut at 3:00 p.m. (8:00 a.m Eastern) today. While he has already hinted that he'll identify those he considers responsible for his downfall, it is likely that much of the media focus will be on how exactly he escaped Japan. Nissan, meanwhile, is preparing for a renewed legal and public relations battle as the company could come under further pressure to justify the investigation into its former leader. Coming up…It's payrolls week, so December ADP employment change numbers are due at 8:15 a.m. Already busy oil traders get some data to chew over when inventory date is released at 10:30 a.m. Fed Governor Lael Brainard is today's only Fed speaker. Consumer credit numbers for December are published at 3:00 p.m. Walgreens Boots Alliance Inc., Constellation Brands Inc., and Bed, Bath & Beyond Inc. are among the companies reporting earnings. What we've been readingThis is what's caught our eye over the last 24 hours. And finally, here's what Joe's interested in this morningAt the end of last year, the Federal Reserve started expanding its balance sheet again to address tension in the repo market. Fed officials were keen to point out that this was not a new round of QE and that the creation of new reserves was not about stimulating the economy. Instead the message was that banks have a regulatory requirement to hold a certain amount of money in reserves at the Fed, and so more needed to be created (by buying T-bills) to address that. But from my perspective, talking to people on TV and so on, the messaging war seems to have been lost. I have lost count of the numerous times I've heard mainstream people (not just gold bug, anti-Fed types) attribute the rise and the resilience of the stock market over the last several weeks to all this "increased liquidity." Personally I don't buy the link. Swapping one interest-bearing government asset (Fed reserves) for another one (T-bills) shouldn't have any substantive economic or market link. But regardless, that's the meme that's taken hold.  Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment