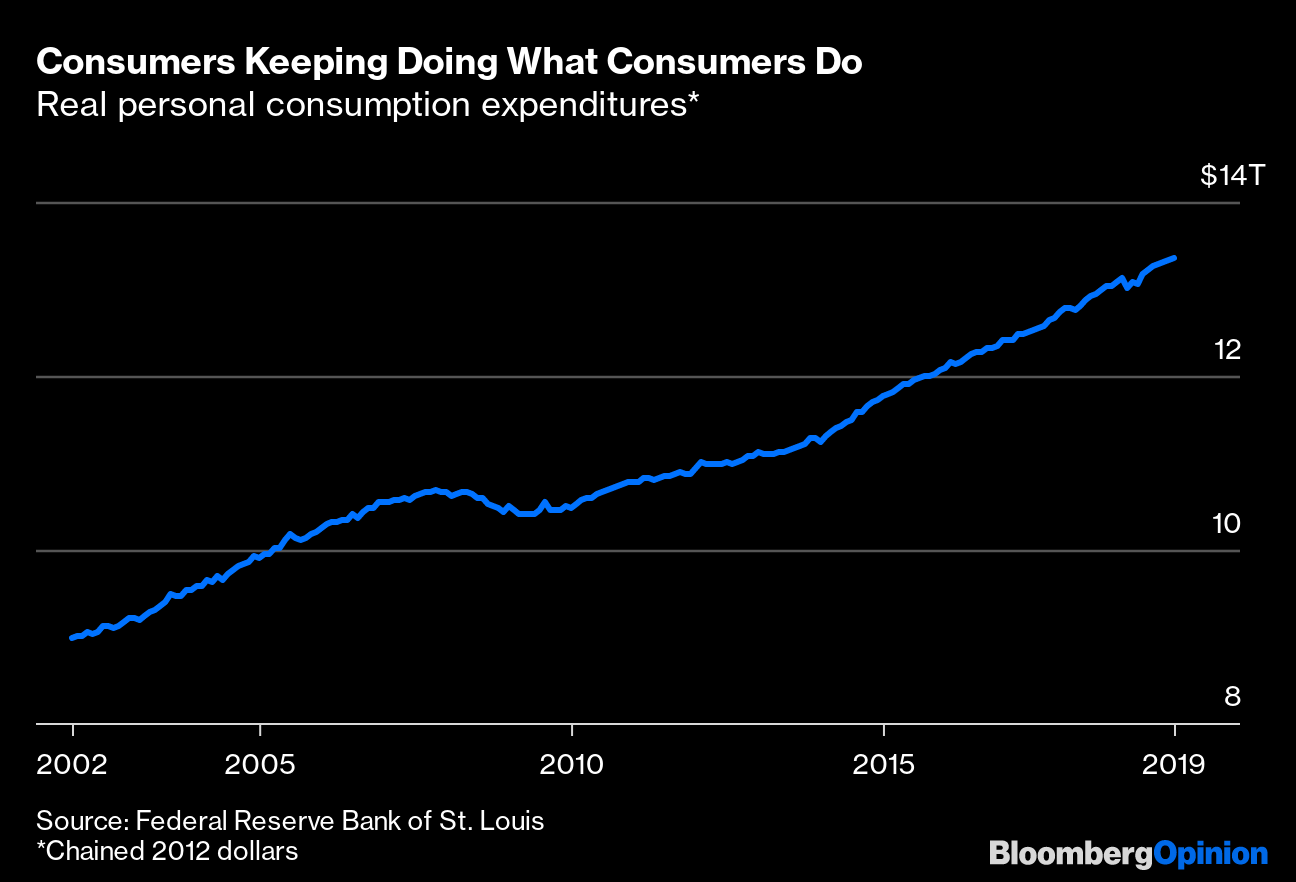

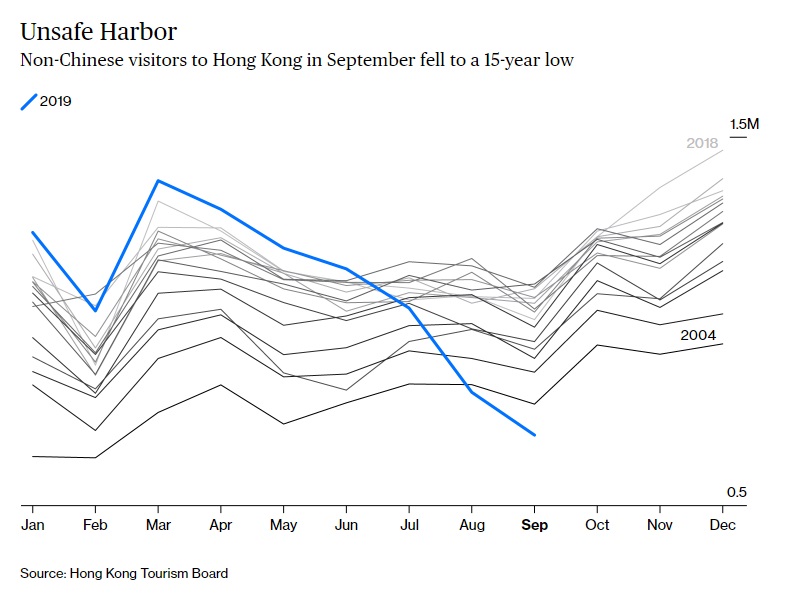

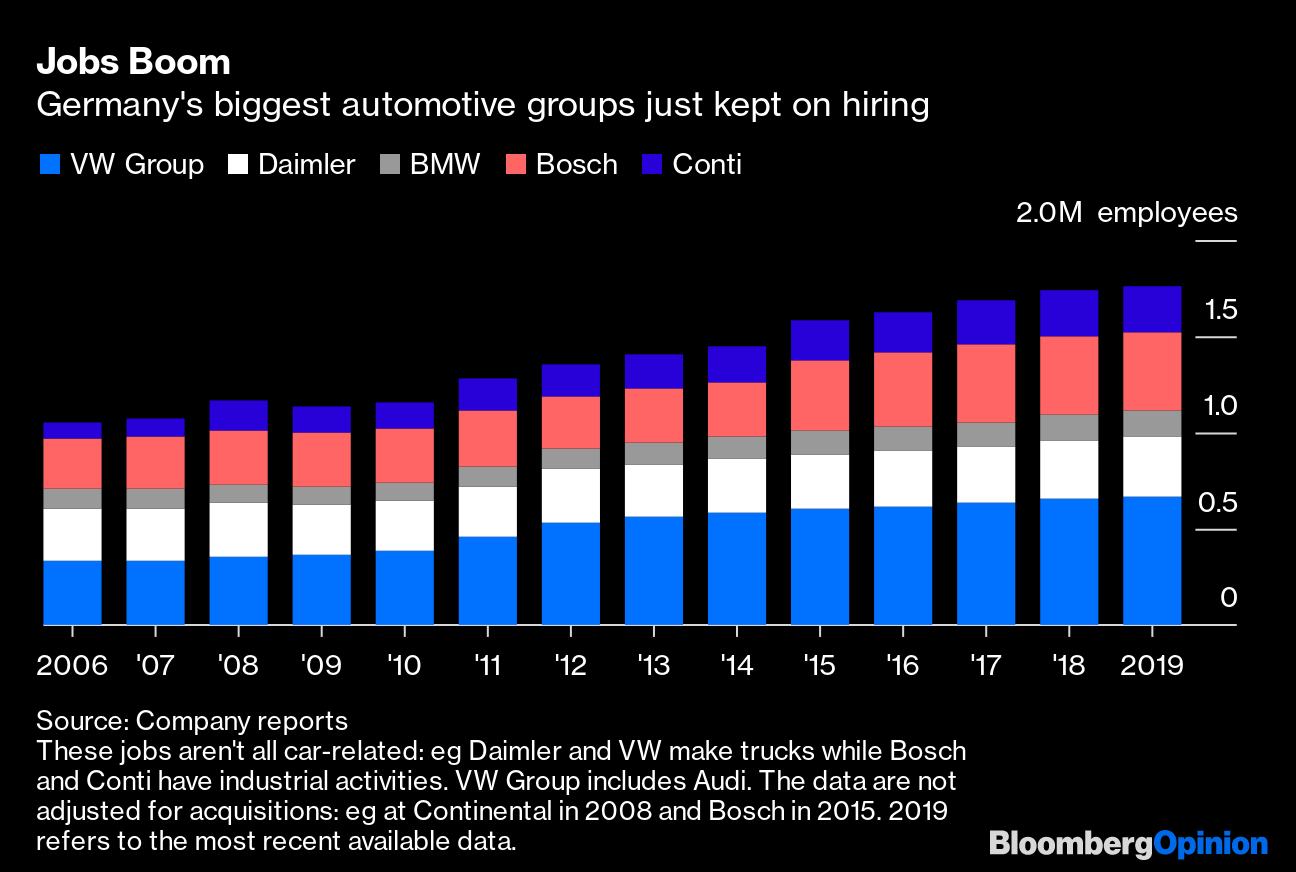

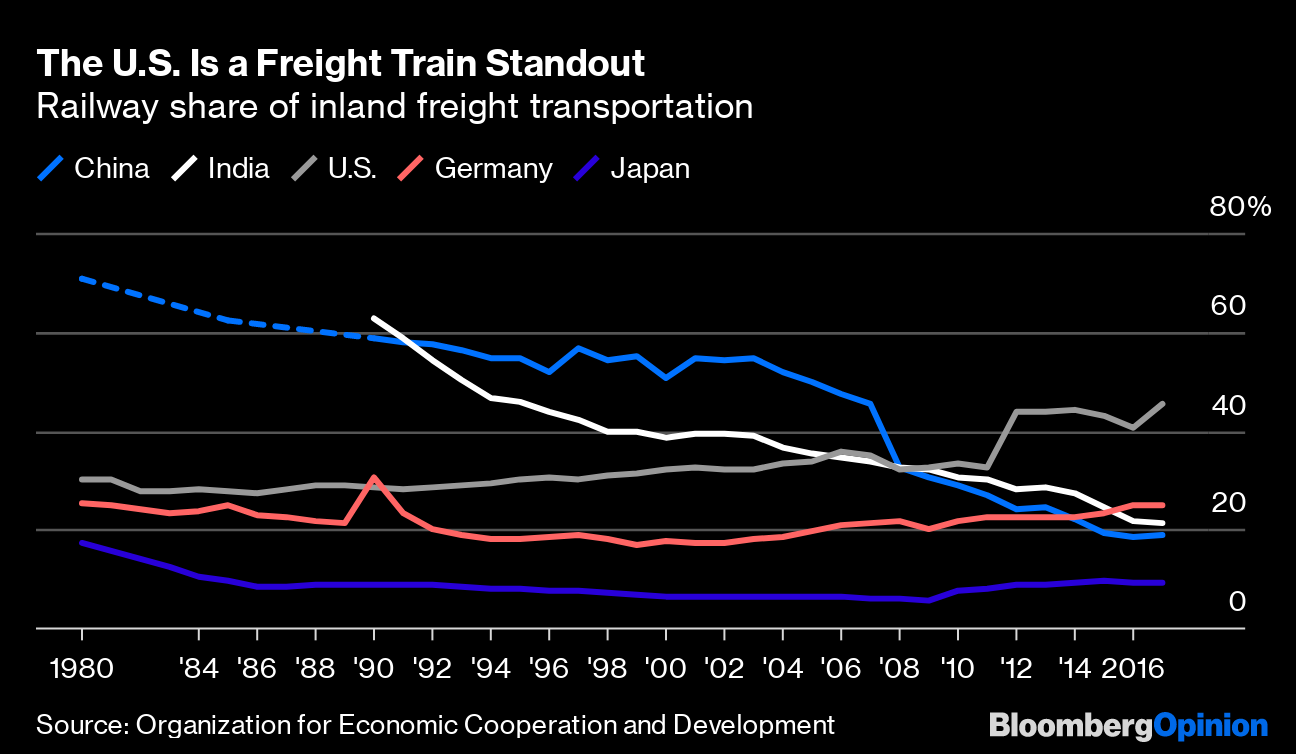

| This is Bloomberg Opinion Today, a chocolate-factory tour of Bloomberg Opinion's opinions. Sign up here. Today's Agenda  Cyber Monday Trade War Special: 20% More Trade War! You have to hand it to President Donald Trump: He consistently comes up with novel ways to freak out markets. Today it was an out-of-left-field, 6 a.m. tweet reinstating tariffs on steel from Brazil and Argentina. Those two countries happen to be selling a lot of food to China — business that used to go to American farmers until Trump launched his trade war with China, causing Beijing to seek other soybean connections. Trump accused Brazil and Argentina of winning agribusiness by weakening their currencies, which … is not how any of this works, writes John Authers. Those countries' currencies have weakened because their economies have weakened, John notes. Argentina, in particular, would be thrilled to have a stronger currency, to end its crushing inflation. Trump keeps showing he understands how to make markets rise and fall with threats and promises about the trade war. But he also keeps showing he doesn't understand trade. Or currencies. Markets have also started to lose hope Trump will ever strike a "phase one" deal with China to cool off the trade war. But any such superficial deal — trading big farm purchases for tariff rollbacks, say — could leave economies and markets worse off, warns Christopher Smart. Because then they'd have to face the reality that, without a defter negotiating approach by the U.S., China won't change its behavior, and the hard feelings will only grow. Further Trade War Repercussion Reading: MSCI is right to raise the bar for letting new Chinese stocks into its indices. — Nisha Gopalan Recession Watch: The Re-En-Watchening Because this newsletter is all about accountability, I must admit that, as 2019 began, I pointed out markets were flashing recession warning signs all over the place. Eleven months later — oops, no recession! But it's not as if the flashing has stopped. The "yield curve" — the gap between short- and long-term interest rates — "inverted" this year, with short rates rising above long rates, a freakish occurrence that typically signals economic doom. Still — no recession. As Noah Smith points out, we can thank the ever-consuming U.S. consumer, the Very Hungry Caterpillar of the global economy, for this resilience:  Of course, recessions don't immediately follow warnings such as the inverted yield curve. And the parts of the economy that make and ship stuff have been in recession for a while now, as today's factory readout from the Institute for Supply Management confirms. And John Authers points out there are even signs of trouble for those die-hard consumers. Will they be enough to cause a recession, making certain market indicators and newsletter writers look less dumb? We'll know inside of a year. Further Economics Reading: The Fed may soon take a new, more dovish approach to inflation. — Tim Duy Hong Kong Faces a Less-Special Future Trump last week risked heating up the trade war several degrees by signing a law supporting Hong Kong's pro-democracy protesters. To everybody's relief, China responded in a measured way that kept the conflict at its current medium boil. But this settles neither China-U.S. tensions nor any uncertainty about Hong Kong. The bill Trump signed puts the city's special trade status in question, and the occasionally violent unrest imperils its future as Asia's financial center, writes David Fickling. It's the first of a four-part series, with crunchy graphics by Elaine He, exploring what cities might take its place.  OPEC+ Engages in Selective Data Reading OPEC and some oil-rich frenemies such as Russia will meet in Vienna later this week to talk about whether to cut oil production even more, to keep trying to build a floor under black gold's price. For a spell last week it looked as if the cartel planned to sit pat, owing to forecasts showing U.S. shale-oil production plateauing next year. But as Julian Lee notes, a different reading of the data isn't as friendly to OPEC: Production might flatten, but only after a notable jump first. Further Oil Reading: Apache's wildcat play has markets saying "OK Boomer." — Liam Denning Telltale Charts Daimler AG's Mercedes-Benz and Volkswagen AG these days look like American automakers did after the financial crisis, writes Chris Bryant: Both are in dire need of downsizing.  America's rail system is pretty great — assuming you're, say, a refrigerator and not a passenger, writes Justin Fox.  Further Reading Angela Merkel's governing coalition may soon fall apart, and that's the best thing that could happen for Germany's stagnant politics. — Andreas Kluth The dream of an all-European army to replace NATO is an ancient one, and still won't work. — Andreas Kluth India's economy is in a screeching slowdown, thanks to Narendra Modi's policy failures. — Mihir Sharma Heart drugs are having a moment again, but they're risky and will take time to pay off for Big Pharma. — Max Nisen New research suggests big monopolistic companies are big and monopolistic because they're the most productive. — Peter Orszag It's not blackmail if you say the right lawyerly things. — Matt Levine ICYMI GOP congressman Duncan Hunter plans to plead guilty. The Supreme Court considers tossing a gun-rights case. Area hedge-fund manager looks to quantum computing for an edge. Kickers Scientists build bacteria that eat carbon dioxide. (h/t Scott Kominers) China's pork shortage causes Germany to sound the dreaded "schnitzel alarm." (h/t Mike Smedley) Farmers turn food waste into electricity. Kids these days are under constant surveillance. Note: Please send schnitzel and complaints to Mark Gongloff at mgongloff1@bloomberg.net. Technical problems delayed last Wednesday afternoon's newsletter until Friday morning. Sorry for any inconvenience this caused, but hopefully it gave you something to do while waiting on line at Walmart. Sign up here and follow us on Twitter and Facebook. |

Post a Comment