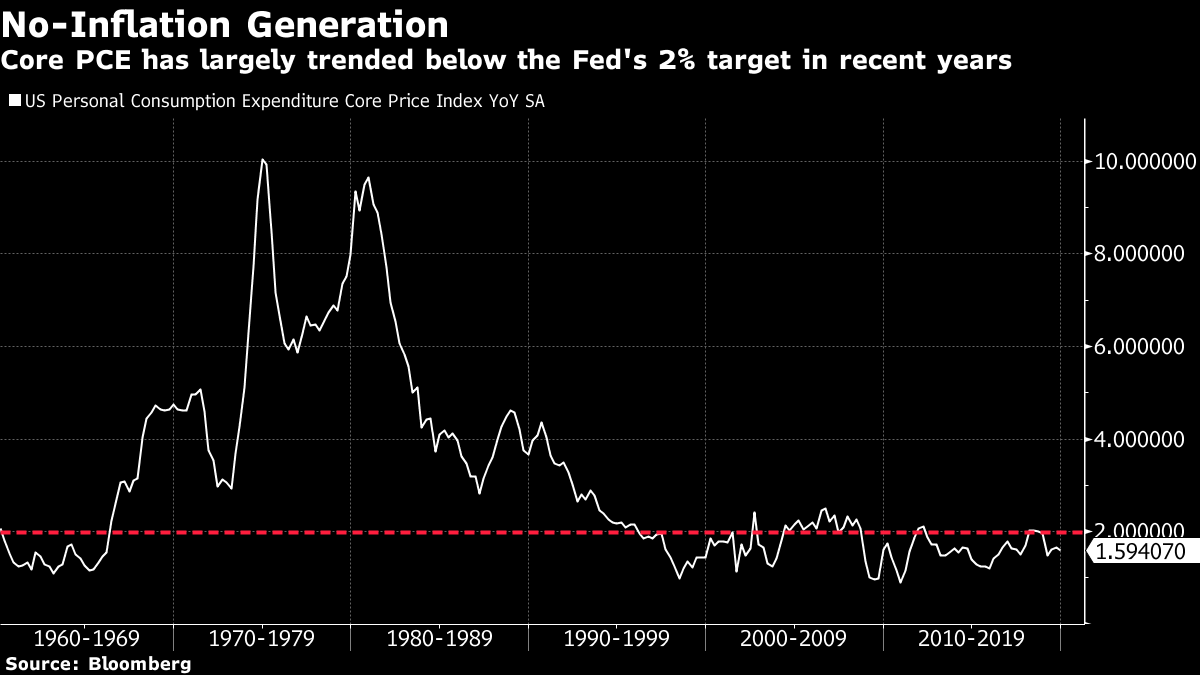

| New Trump trade comments throw uncertainty into the markets, Australian asset managers are gearing up for QE, and Sundar Pichai is now the CEO of both Google and Alphabet. Here are some of the things people in markets are talking about today. With a flurry of trade threats across three continents in the span of 24 hours, President Donald Trump reminded financial markets that he's comfortable heading into an election year using tariffs as his main tool of international economic leverage. "I don't have a deadline," Trump said Tuesday in London after being asked if he sees phase one of a trade deal with China concluding this year. "I like the idea of waiting until after the election for the China deal. But they want to make a deal now and we'll see whether not the deal is going to be right." The lack of urgency for an agreement in the 20-month-long dispute sent stocks tumbling across Europe and the U.S. as investors hunkered down ahead of the U.S. tariff hike that on on Dec. 15 would hit about $160 billion in Chinese imports, including smartphones, toys and children's clothing. U.S.-China tensions may be further aggravated by moves by American lawmakers to consider a bill of support for the Uighur minority in western China. On the note of uncertainty over this month's upcoming tariff deadline, stocks in Asia looked set for declines following the drop in U.S. equities and a surge in Treasuries. Futures fell in Japan, Hong Kong and Australia. The S&P 500 Index declined for a third day, though it pared some of its losses in afternoon trading. On top of signalling that he'd be willing to wait another year before striking an agreement with China, Trump also threatened levies on France after hitting steel from Brazil and Argentina. The surge in Treasuries drove yields down the most since August, and gold, the yen and the Swiss franc paced gains among haven assets. Australian bonds tracked the moves higher in early Wednesday trading. Elsewhere, oil rose as traders focused on the upcoming OPEC+ meeting that could lead to deeper supply cuts by some of the biggest crude producers. Australian asset managers are gearing up for what was once unthinkable: the prospect of quantitative easing in their own backyard. They've pored over the lessons from overseas and arrived at a different conclusion to central bank chief Philip Lowe, who has sought to damp expectations that QE is likely in Australia. Some, including QIC and Nikko Asset Management, are already buying assets on bets that interest-rate cuts won't be enough to combat slowing economic growth. The Reserve Bank of Australia has cut interest rates three times since June, to a record low 0.75%, amid a weakening in economic growth to the slowest pace in a decade. Lowe said in a speech on Nov. 26 that the key rate would need to go to 0.25% before he'd consider QE, and that even then, the hurdle to asset purchases would be high. But with unemployment that's too high to drive up wages and tepid gains in consumer prices, investors expect Lowe to be pushed outside his comfort zone. Sundar Pichai is now CEO of both Google and its parent company, Alphabet, as co-founders Larry Page and Sergey Brin relinquished their roles as CEO and president, the company said Tuesday. Page and Brin will remain active within the company, and continue as members of the board. "We are deeply committed to Google and Alphabet for the long term, and will remain actively involved as board members, shareholders and co-founders," Page and Brin wrote. "In addition, we plan to continue talking with Sundar regularly, especially on topics we're passionate about!" Page and Brin will continue to control Alphabet through special voting stock. Alphabet shares rose less than 1% in extended trading on Tuesday, and the stock closed at $1,294.74 in New York, leaving it up about 24% so far this year. China is hurtling toward another record year of onshore bond defaults, testing the government's ability to keep financial markets stable as the economy slows and companies struggle to repay unprecedented levels of debt. At least 15 defaults since the start of November have pushed this year's total to 120.4 billion yuan ($17.1 billion), within a hair's breadth of the 121.9 billion yuan annual record in 2018, according to data compiled by Bloomberg. While the defaulted notes amount to a small sliver of China's $4.4 trillion onshore corporate bond market, they've fueled concerns of potential contagion as investors struggle to gauge which companies have Beijing's support. What We've Been Reading This is what's caught our eye over the past 24 hours. And finally, here's what Tracy's interested in this morning Inter-generational tension has definitely become a thing in politics. You see it most in the U.S., where it's become a presidential campaign issue, and the U.K., where it cropped up in the Brexit vote. It hasn't been as much of a talking point in the field of economics but it feels like that could change soon. Economists at the Dallas Fed published a paper late last month exploring how age affects optimal inflation rates. The title of the research ("Generational War on Inflation") rather gives the whole thing away but the conclusion is essentially that old and young people may prefer different inflation rates because of the differences in their holdings of financial assets and wages.  It's sort of an obvious point but one that we rarely see — people typically discuss the benefits of a central bank changing interest rates to pursue a particular inflation target. If we think that inequality between generations is an issue (and of course, not everyone does) then we should better consider how economic policies affect different generations — and how those varying generational impacts can influence the economy overall. You can follow Bloomberg's Tracy Alloway at @tracyalloway. The best in-depth reporting from Asia Pacific and beyond, delivered to your inbox every Friday. Sign up here for The Reading List, a new weekly email coming soon. Before it's here, it's on the Bloomberg Terminal. Find out how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. |

Post a Comment