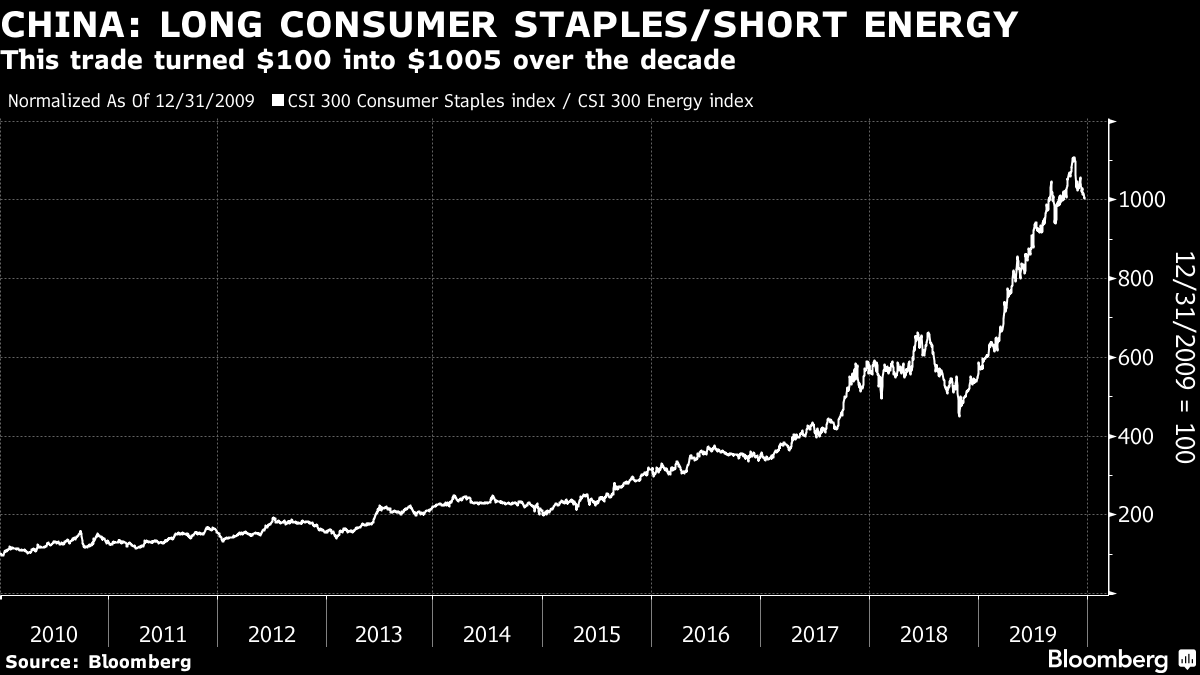

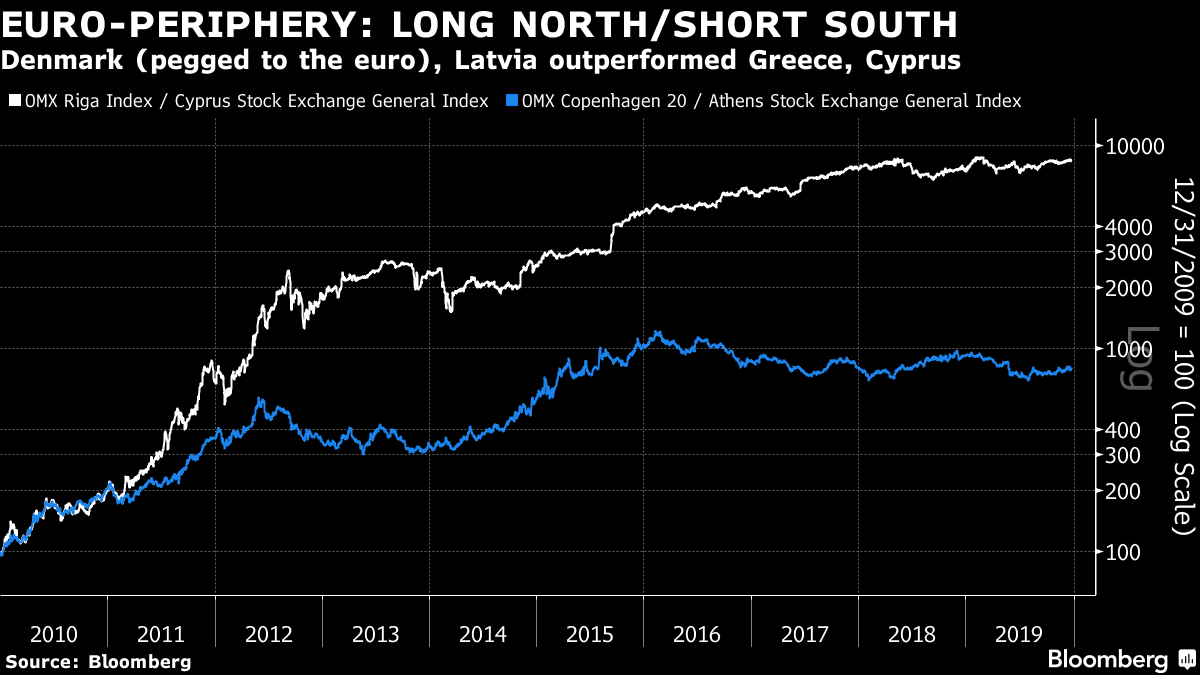

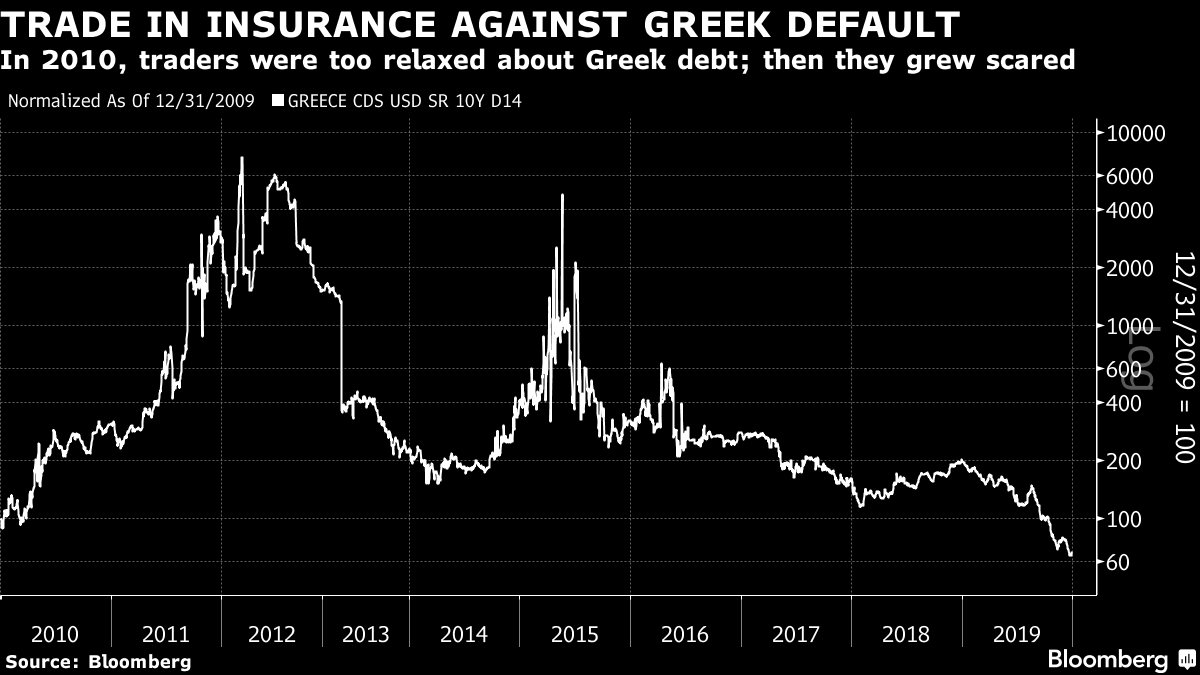

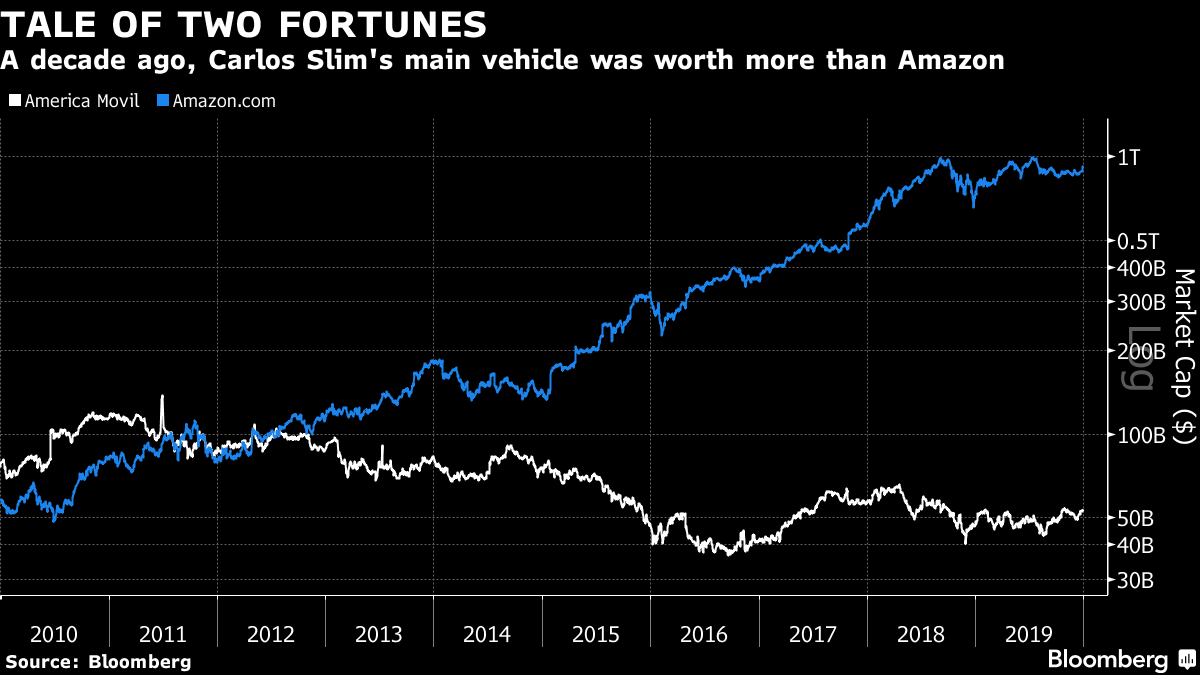

Hindsight Capital's Decade: A Detailed Report On Monday, we published an executive summary of the trades made this decade by Hindsight Capital LLC, the hedge fund that regularly beats all others because it has the benefit of hindsight — and which unfortunately doesn't exist. To satisfy some readers' craving for more information on the legendary investor, this newsletter will provide some Hindsight trades that didn't make the cut for Bloomberg Opinion. Their managers also discussed some of the most important themes to emerge from the decade, and the best trades for 2019, which turned out to be a trying year in which even those armed with perfect hindsight couldn't do much better than some passive index funds. Here then are those details: Betting on a Difficult Chinese Transition China is changing, and there were ways to profit from this within the Chinese stock market. The plan has always been to make the transition that Japan and South Korea made before, from an economy based on manufacturing exports to one led by domestic consumers. That is happening, albeit unevenly. Consumers are buying more, but it tends still to be consumer staples rather than the discretionary purchases that dominate in the west. That is unsurprising, as Chinese consumers still tend to be poor, even while the country remains rich. That is the challenge for the future. But in the 2010s, taking a long position in the CSI 300 Index of domestic stocks' consumer-staples gauge while shorting its energy index would have turned $100 into more than $1000.  As foreign funds were barred from diving deep into the A-shares market at the start of the decade, Hindsight also drew up trades on the Chinese transition that could be made in global markets. The critical point to grasp was that Chinese industrial groups would slow down, while U.S. manufacturing would revive. The results aren't yet being felt on the ground in the Rust Belt, and many of the jobs that U.S. industrial companies create are outside the U.S., but betting on the S&P 500 industrial sector while shorting the CSI 300's version, or the broader MSCI Asia ex-Japan version, more than tripled its money. And note that most of these gains had already been booked before the U.S.-China trade war broke out last year:  North Beats South on the Euro Zone's Periphery This was, as we surely all know, a disastrous decade for European economic integration. The U.K. is about to leave the European Union and intends also to leave the single market, which will have ramifications for supply chains across the continent. The euro zone sovereign crisis blew over without a default or an exit from the euro, so catastrophe was avoided. But it has had lasting effects on economic growth and on the health of the banking systems of the countries of the southern periphery. Less widely remarked is that the countries of the northern periphery have fared well, buoyed by the low interest rates that the European Central Bank was forced to administer. An extreme north-versus-south stock market trade of long Latvia/short Cyprus made 8,443%. For those who call foul as those markets are tiny, Hindsight also offered long Denmark (which retains its own currency but ties it firmly to the euro) and short Greece. That would have made 730%.  Greek Tragedy = Trading Opportunity Hindsight Capital generally wasn't allowed to trade during the decade; otherwise, the ability to trade with perfect knowledge of the future could produce infinite returns. But as there are exceptions to every rule, Hindsight managers were given one free pass on trading, and they chose a play on Greek debt. As the decade began, the pressures on the euro zone were obvious, and Greece had a new government — which soon admitted that the scale of its deficit was far greater than previously acknowledged. Utter panic ensued, along with two bailouts. Hindsight bought insurance against Greek default at the beginning of 2010, at a point when Greek debt was regarded as barely any riskier than German debt. This helped to turn $100 into more than $7400 by early 2012. Grasping that a default wouldn't be allowed to happen, at least for the purposes of the credit default swaps market, Hindsight then turned the trade around, and sold insurance, making another 99% by the end of the decade. Total profit from one trade: about $14,500 from an initial $100. The managers at Hindsight wouldn't tell me if they were prepared to share this money with the many miserable members of the Greek population who suffered through a decade of austerity and depression thanks to their own incompetent politicians and the machinations of politicians far away in Brussels, Frankfurt and Berlin.  The Man of the Moment This is a trade on individuals that Hindsight spotted. Entering the decade, Carlos Slim was the world's richest man, according to many surveys. A Mexican who started out as a property developer and then a tobacco distributor, he built his fortune by buying Mexico's fixed-line telecommunications monopoly during an ill-considered privatization campaign of the early 1990s, and parlaying it into total dominance of the much faster-growing mobile market in Mexico. He also spread into the rest of Latin America and bought a range of assets around the world. As the decade began, his main investment vehicle, America Movil, was bigger by market value than Amazon.com Inc., headed by Jeff Bezos. This is what has happened to the market value of those two companies since then:  Amazon was already a well-known story 10 years ago, but it has since gone from strength to strength. What happened to Slim? Growth has proved far more elusive, partly due to economic difficulties for many of the regions his companies cover, but mainly because Mexico finally reformed its competition laws during the decade to open the telecom market to greater competition. American and European companies now have a far stronger foothold, and the Slim empire is worth substantially less than it was before. Is it conceivable that the same thing might happen to Bezos's empire in the 2020s? Time will tell. But during the 2010s, Hindsight's Long Bezos/Short Slim trade, expressed through Long Amazon/Short America Movil, turned $100 into almost $2,250:  Metal Is the Measure It was difficult to make great money in metals, even for Hindsight Capital, because they all went down. The hedge fund preferred to short energy rather than metals for the decade, but the fortunes of precious and industrial metals during the 2010s still tell us something interesting. For the decade as a whole, it paid to bet on gold to lag the stock market, but beat the industrial metals whose price tends to act as a barometer of the global economy (and these days, the Chinese economy in particular). Using Bloomberg commodity indexes, the performance of industrial metals compared to precious metals was dreadful. There was a sharp recovery after the election of Donald Trump as U.S. president in 2016, but almost all of that gain has now been given back. To be clear, this is not good:  The Turn of August 2011 One point Hindsight's team wanted to make was that in many ways the key turning point of the decade came in August of 2011. Up until then, the initial post-crisis stock market gain had stalled, the Federal Reserve had felt forced to resort to a second dose of quantitative easing, and the euro zone had fallen into a severe crisis that was in many ways an extension of the financial implosion of 2008. Gold was rallying, showing deep skepticism of the measures that central banks were taking. At this point, a new wave of Republican representatives in Congress engaged in brinkmanship over whether to raise the federal debt limit amid mounting concern that the U.S. budget deficit would soon become unmanageable, and Standard & Poor's (now S&P Global Ratings) decided to downgrade U.S. Treasury debt from AAA. If we follow critics of fiat currencies and denominate the U.S. stock market in gold, rather than in dollars, this was the moment when it collapsed and reached a point of revulsion — and then went on a seven-year rally. (It was also the point when the U.S. stock market started to outstrip the rest of the world.) Commodities prices began to turn down, bringing emerging markets with them, and eventually, in early 2013, gold itself suffered a spectacular sell-off. Runaway inflation, investors now accepted, wasn't going to happen.  There is something concerning about the S&P 500 priced in gold chart. In dollar terms, the index has made a series of new records this year. In gold terms, it hasn't. In fact, it's beginning to look as though it might be settling into a downward trend. It also looked like this in 2016, when the Trump election revived sentiment. But as the decade ends, the story of the U.S. stock market in gold terms is disquieting. As ever, though, Hindsight Capital's managers wouldn't tell me anything about the 2020s. Hindsight Capital's 2019: A Difficult Year For a hedge fund gifted with perfect knowledge of the future, this has been a miserable year for Hindsight Capital. They made money, but it was one of those years when you could survive without their services. Simple exchange-traded funds were fine. Whether you wanted to buy U.S. stocks, stocks from the rest of the world, long-dated bonds, oil or gold, you made double-digit returns:  But as always, there were ways to do a bit better: Technology Advances, Traditional Retail Declines Department stores rebounded nicely in 2018, but this was obviously a dead-cat bounce. In 2019, the pain resumed. Consumers remained resolute, but they found ways to shop without going to a physical store. Those alternative ways of buying were powered by semiconductors. The SOX index of semiconductor shares has become the ultimate cyclical measure. After a poor 2018, the SOX index led cyclical sectors back upwards again, and gained 61%. Department stores dropped 29%. Put together, those trades made 126%:  The Opportunity in Political Disruption Greece led the world in populist unrest during the decade. It elected a far-left government in 2015, in understandable disgust at its corrupt traditional parties, and suffered through a dreadful crisis. In 2019, it returned to the old center-right party that had driven the economy into trouble in the first place, and elected as premier the son of a former prime minister. Its stock market led all others. Meanwhile Chile, one of the world's most stable countries since it shook off the Pinochet dictatorship 30 years ago, suddenly catapulted into extreme civil unrest, prompting the president to say the country was "at war." In consequence, it was one of the very few stock markets to lose for the year. Putting the trades together made 67%. There is some truth to the old saying that you should buy "when there's blood in the streets," but it is definitely not a good idea to buy just before it starts flowing:  Fracking Disrupts the Energy Market The fracking revolution happened a while ago now, but its effects are still creating opportunities in the energy market. It has helped create a massive surplus of natural gas, whose price dropped 43%. Meanwhile, the price of oil increased, with unleaded gasoline, in growing demand, gaining 49%. Shorting natural gas while going long in unleaded gasoline yielded 160%:  Cryptocurrency Never Dies Bitcoin has shown a propensity throughout its brief history for immense booms followed by crushing busts. In 2018 it bust. Therefore, it was an easy call to bet on it to boom again in 2019. It doubled for the year, having at one point more than tripled, without ever approaching the high it set at the end of 2017. Cryptocurrency enthusiasts might note that a currency needs to work as a means of exchange, and it will be very hard for cryptocurrency to establish itself as a means for pricing transactions while its value is as volatile as this. But for the time being it is a great story, and a great trading opportunity:  The Small Print This concludes the Hindsight Capital report for 2019. Remember that this particular hedge fund doesn't have to pay trading costs, and doesn't need to worry about risk-adjusted returns. The great advantage of knowing the future is that you need not worry about volatility along the way. And there is always available capacity for it to make its trades without affecting the market. Does Hindsight Capital exist? No. Is it a fair benchmark for real funds? No. And yet nevertheless, many of us torture ourselves with its returns. That is only human. And generally, the exercise shows that the rationale for all its trades did exist at the outset, without the benefit of hindsight. That is what hurts so much: The truth is always there in real time, and always clear with hindsight. But unfortunately, those of us who don't work for Hindsight Capital LLC have to guard against the risk that we will be wrong. Have a good new year. Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

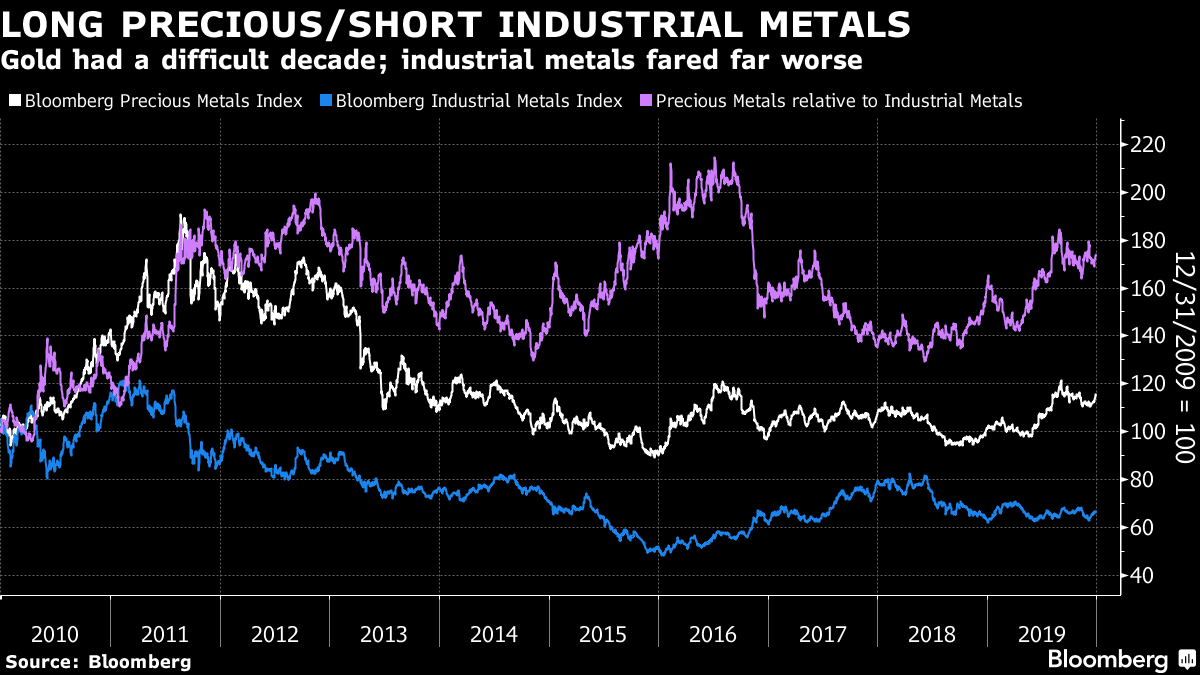

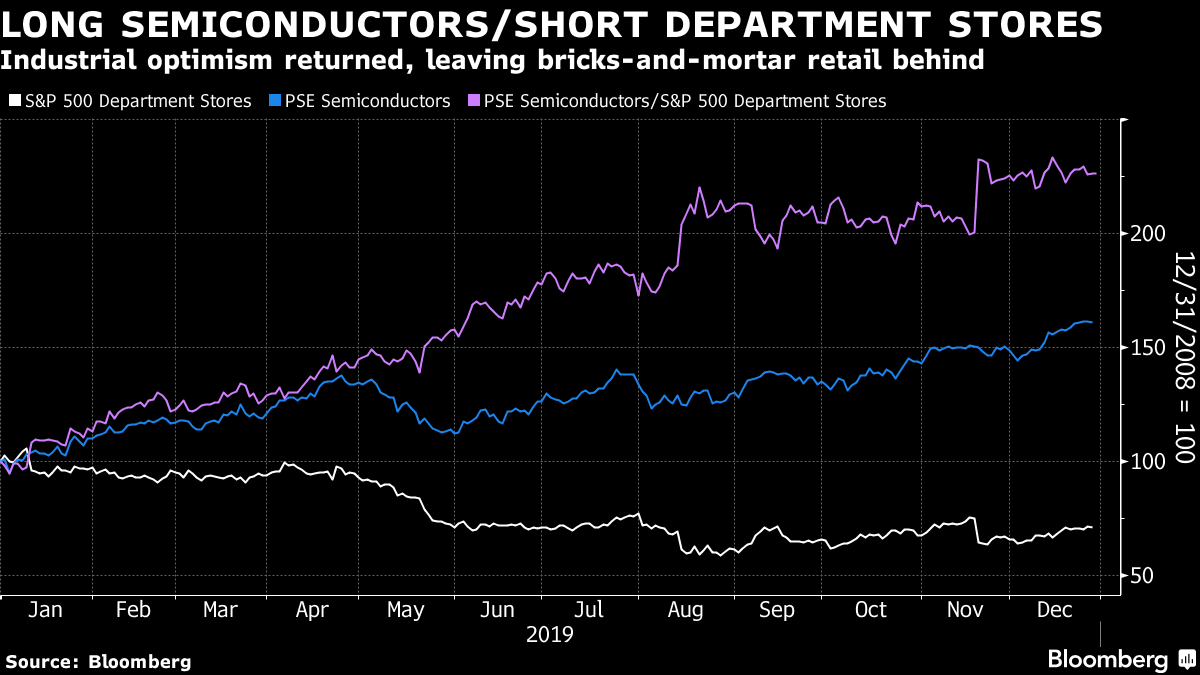

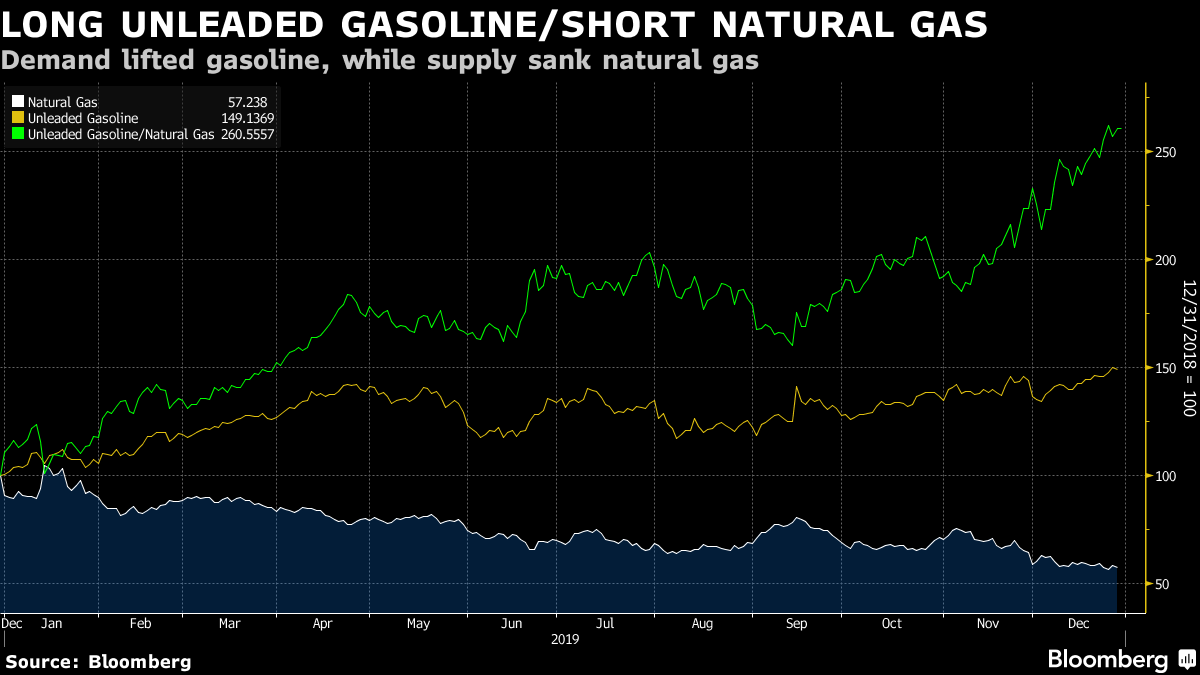

Post a Comment