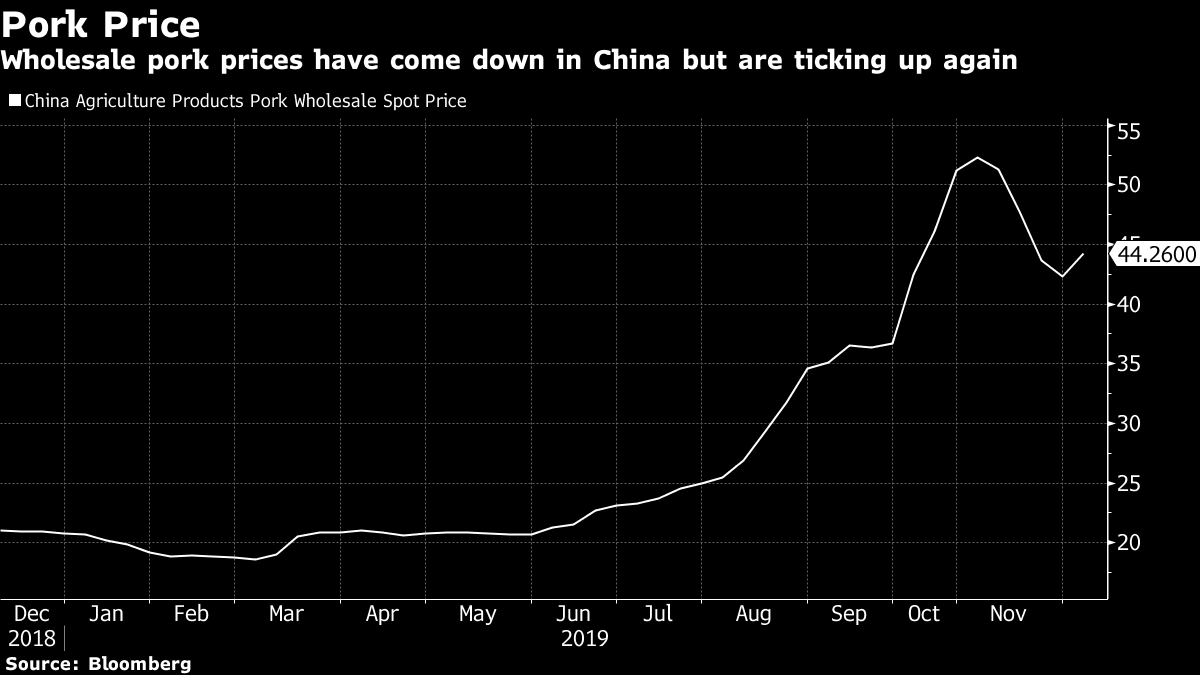

| Hong Kong's economy limps across the finish line as the year comes to a close, UBS's Iqbal Khan is planning a revamp for his super-rich clients, and Boeing's 737 Max crisis deepens. Here are some of the things people in markets are talking about today. Hong Kong's economy ends the year wounded, with the chances for stabilization in 2020 hanging on whether future protests are peaceful or lapse back into violence. Economists forecast a 1.3% contraction for 2019 and predict year-on-year declines will continue in the first two quarters of 2020. Yet the unrest has tapered in recent weeks after an electoral win for pro-democracy parties in November, and there's a chance that the contractions in visitor numbers and retail sales will ease up on a month-to-month basis. Businesses and households can look to the government's annual budget early next year as a potential source of fresh stimulus and structural support for the economy. Also, the preliminary trade deal reached between the U.S. and China could ease economic pressures for Hong Kong. Here's a snapshot of the economic pain Hong Kong's economy has weathered since last spring, from the political unrest as well as the effects of the U.S.-China trade war. Asian stocks looked set for gains Tuesday. U.S. equities hit new highs as the partial trade deal with China alleviated a key risk for investors heading into year-end, while Treasuries and the dollar fell. Futures pointed higher in Japan, Australia and Hong Kong, and the S&P 500 Index climbed Monday in the wake of the agreement and on signs of improving business sentiment. Meanwhile, the Federal Reserve Bank of New York's gauge of general business conditions in the next six months jumped to a five-month high, adding to the positive mood. The yen dipped amid the risk-on mood, and the offshore yuan extended an advance. Elsewhere, oil hovered near a three-month high. Bitcoin slipped below $7,000. The Stoxx Europe 600 also hit a new peak and the U.K.'s FTSE 100 Index reached a 19-week high. Less than three months after joining UBS Group, Iqbal Khan is starting to put his stamp on the world's biggest wealth manager. Khan and Tom Naratil, the two co-heads of wealth management at the Swiss lender, plan to break up the ultra high net worth business led by Joseph Stadler and set up a new unit specifically for rich clients who require investment banking services, people with knowledge of the matter said. The firm also plans to give wealth managers more autonomy in granting loans, in a bid to accelerate approvals and increase the business it does with clients, the people said, asking not to be identified as the matter is private. UBS is looking for ways to maintain its edge and reinvigorate its shares, which have trailed rivals over the past year. Khan — who joined after an acrimonious split with Credit Suisse Group AG in October — was tasked by Ermotti with devising a plan within 60 days of his appointment to boost profit. Boeing will temporarily halt production of the grounded 737 Max in January, a person familiar with the matter said, deepening the crisis engulfing the planemaker and posing a new threat to a vast web of suppliers. No furloughs or layoffs are planned for the 12,000 workers at the Seattle-area plant where 737 Max jets are built. Financial pressure on the company is rising, as almost 400 newly built aircraft languish in storage due to a global flying ban that began nine months ago. The timing of regulatory approval for the jet's return is uncertain. Executives have concluded that Boeing can no longer keep manufacturing the 737 at the present pace, said people familiar with the matter. A pause in output would probably be less disruptive than reducing already-pared production, sources said. China and Russia have circulated a draft resolution to the UN Security Council that would ease sanctions against North Korea for its nuclear program, even as Kim Jong Un's government threatens to take provocative action unless President Donald Trump relaxes the economic penalties by the end of this month. The draft resolution asks the Security Council to adjust sanctions against North Korea "in light" of the country's compliance with certain United Nations resolutions and for "humanitarian and livelihood" purposes, according to a draft provided by diplomats who asked not to be named. The resolution, which is expected to prompt negotiations among Security Council members starting on Tuesday, comes as Trump's envoy on North Korea countered Kim's threat of an unwelcome "Christmas gift" for Trump by urging renewed talks over denuclearization to usher in a "season of peace." What We've Been Reading This is what's caught our eye over the past 24 hours. And finally, here's what Tracy's interested in this morning There's something very "planned economy" about China's latest proposals to increase pig production in the face of the swine fever outbreak. First off, there's the title: "Three-Year Action Plan to Accelerate the Recovery and Development of Pig Production." That plan includes a whole host of measures like creating regional production targets, exploring "model" farms and methods of pig breeding, standardizing slaughtering techniques, and providing subsidies for farmers.  As the Dim Sums blog notes, this is quite a change for China's pork industry. "Imposing rigidities of the planned economy will undermine the efficiency of China's pork industry which has been one of the country's most-privatized, agile, and flexible sectors," the blog says. It's interesting that in times of an industry-wide crisis, the instinct of China's government is to reassert itself. Overall, pork prices have been coming down since the authorities started encouraging a ramp-up in production, but there remains a question mark over whether this is happening without the disease having been fully eradicated — and whether it will ultimately be effective. Pork prices are ticking up again this month. You can follow Bloomberg's Tracy Alloway at @tracyalloway. The best in-depth reporting from Asia Pacific and beyond, delivered to your inbox every Friday. Sign up here for The Reading List, a new weekly email coming soon. Before it's here, it's on the Bloomberg Terminal. Find out how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. |

Post a Comment