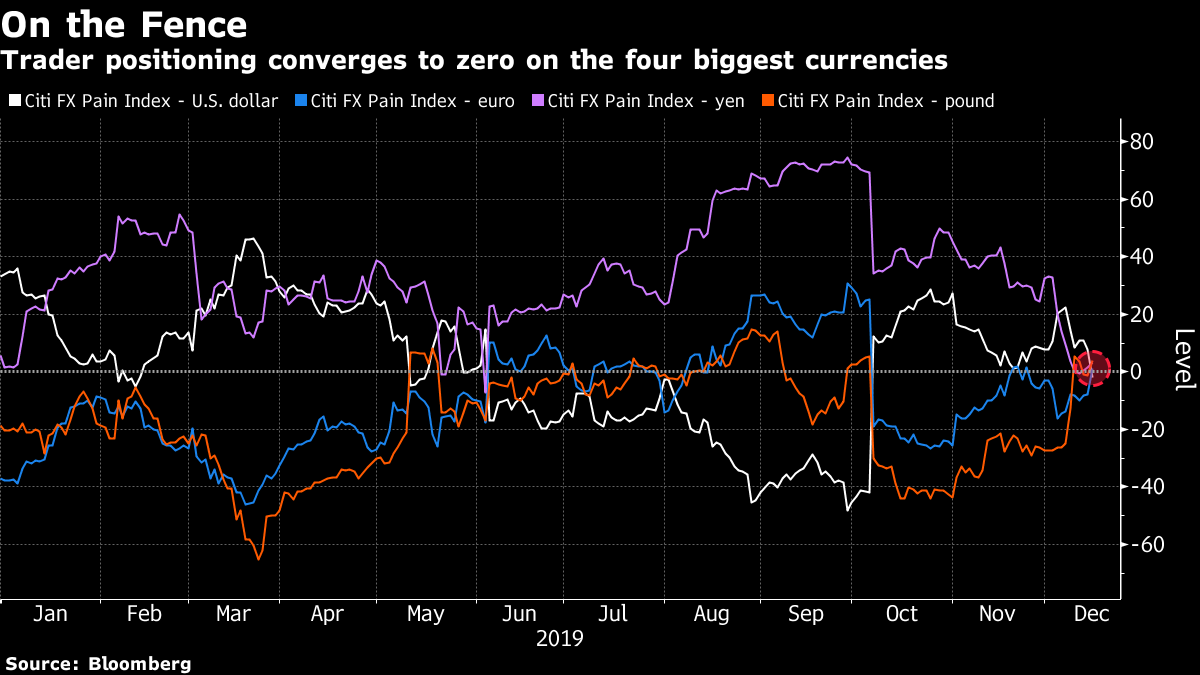

| Welcome to your morning markets update, delivered every weekday before the European open. Good morning. A U.K. credit rating boost couldn't stop the pound sliding, China injected billions into the financial system and FedEx's stock tumbled. Here's what's moving markets. U.K. Ratings Boost Ratings agencies S&P and Fitch both improved their assessment of the U.K.'s credit outlook Wednesday following Boris Johnson's majority win last week, but the pound continued its slump overnight, having firmly wiped out the rally that followed the victory. That's after Prime Minister Boris Johnson's plans to set a Brexit deadline of December 2020 spurred fresh no-deal fears. Meanwhile, there'll be no Swiss snow for Johnson to look forward to in January, as he won't be attending the World Economic Forum in Davos, choosing to concentrate instead on Brexit. China Injection Asian bourses traded mixed overnight, with a host of unknowns still clouding the U.S.-China trade deal, and as the People's Bank of China injected $29 billion into the financial system before an expected bout of tighter liquidity next month. The dollar crept higher against a basket of currencies despite President Donald Trump on Tuesday once again urging the U.S. central bank to use expansionary monetary policy to boost American exports. "Would be sooo great if the Fed would further lower interest rates and quantitative ease," he said in yet another tweet aimed at Fed Chairman Jerome Powell. FedEx Falls FedEx was the big mover in after-hours U.S. trading, plunging after the delivery firm cut its profit forecast for the second straight quarter as weak international demand hurt sales and the courier ramped up investment to handle soaring e-commerce deliveries. The results for the company's fiscal second quarter were "breathtakingly bad," with weakness in both the ground-delivery unit and air-cargo business, according to Deutsche Bank AG analysts. European rival Deutsche Post AG could be one to watch today. Impeachment Votes With the U.S. House of Representatives expected to vote to approve two articles of impeachment today, Trump laid out his defense against charges he abused his power and obstructed Congress while also ridiculing Democrats' allegations. He accused Nancy Pelosi of turning the House into a medieval "star chamber" in pursuit of his impeachment, lashing out at the speaker in a blistering, six-page letter and vowing her party would be punished by voters in the 2020 election. Coming Up… European Central Bank boss Christine Lagarde is speaking at a conference in Frankfurt, while we'll also get the latest reading of the German Ifo business climate index following miserable manufacturing statistics of late. Meanwhile, U.K. inflation numbers are likely to be overshadowed by politics and for FX traders the Czech central bank is seen making no change to its main interest rate. The earnings schedule is light, but keep an eye on shares of Fiat Chrysler Automobiles NV and PSA Group, after their boards approved another step toward a merger. What We've Been Reading This is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morning Spare a thought for global foreign exchange traders who are finishing the year with little conviction over what the world's biggest currencies will do next. Citigroup Inc.'s FX Pain Index for the dollar, euro, yen and pound - indicators of active trader positions have converged at essentially zero. With global currency volatility slumping to a more than five-year low, and market overhangs such as trade and Brexit somewhat resolved for now, the convergence suggests investors see little pickup in currency swings in early 2020. The lack of conviction comes as the chorus of strategists calling for a weaker greenback grows - the dollar is heading for its worst quarter since the start of 2018. But as Goldman Sachs pointed out last week, further dollar weakness from here would require strength in the euro and the yuan, neither of which has a compelling case in favor at the moment. It's more than likely traders have gone into wait-and-see mode for the new year. It might be some time before they are ready to put their money where their mouth is.  Cormac Mullen is a Cross-Asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. |

Post a Comment