| Welcome to your morning markets update, delivered every weekday before the European open. Good morning. The Fed is on hold, Lagarde speaks, European politics is having a busy end to the year and it's U.K. election day. Here's what's moving markets. No Change The U.S. Federal Reserve left its monetary policy stance unchanged and Chairman Jerome Powell said the economy and Fed policy are in a "good place." The message is clear: The Fed doesn't plan to make any significant changes to its stance unless there is a big shift in the health of the economy. Powell also focused closely on his belief that the labor market can improve more, despite unemployment standing at a 50-year low, marking himself out as a "job crusader." Stocks edged up and Treasury yields dipped after the announcement, while Asian stocks were mixed in Thursday's session and European stock futures are pointing to a slightly positive open. Enter Lagarde The European Central Bank's first policy meeting under its new president, Christine Lagarde, and particularly the press conference that follows, will be scoured forensically for any hints on her policy priorities and what she may deploy should an already-rocky economy take a turn for the worse. That's not the only central bank game in town on Thursday. The Swiss National Bank, nearing a half-decade of sub-zero rates, is expected to keep all unchanged as the debate over it keeping rates negative continues. And Turkey's central bank will announce its latest decision against the backdrop of a lira out of sync with other emerging-market currencies. Trade Bets The week rumbles on with investors hoping that their initial optimism about a delay to the tariffs the U.S. plans to put on Chinese goods on Sunday will prove well-founded. Yuan traders are betting just that. JPMorgan Chase & Co. boss Jamie Dimon thinks a phase one deal will be reached eventually, but warned about the impact those new tariffs would have if levied. The Europe-U.S. trade picture seems a little more ominous, with Europe moving to seek an upgrade to existing legislation that would allow it to target nations that are undermining global rules, a decision clearly aimed at the U.S. Talks, Protests and Elections A little political roundup to keep up to date. In Germany, Chancellor Angela Merkel will meet with the new leaders of her coalition partners after they demanded a series of concessions to keep the pact alive. France is set to face intensified protests over pension reforms that President Emmanuel Macron has pushed ahead with, in spite of the opposition. In Spain, acting Prime Minister Pedro Sanchez has been invited by the king to form a government. And Israel faces a third election in less than a year after neither of its major parties managed to form a government. Coming Up… The U.K. votes today. Here's a guide to how the results will come in. Eyes will also remain trained on Riyadh and Saudi Aramco flirting with a $2 trillion valuation. Elsewhere, euro-area industrial production data and inflation numbers from Germany and France are on the slate, though the ECB decision will supersede all of that. A hot European stock in the shape of grocery delivery firm Ocado Group Plc gives a trading statement, and the updates from U.K. outsourcer Serco Group Plc and electronics retailer Dixons Carphone Plc are likely to attract attention too. What We've Been Reading This is what's caught our eye over the past 24 hours. - Silicon Valley is always listening.

- JPMorgan advises shorting gold, buying stocks in 2020.

- You can now adopt a piece of Venice.

- Netflix is making a TV series about Spotify.

- Carlos Ghosn prepares for trial.

- CBD-infused tea is coming to Canada, from a beer giant.

- Bankrupt American brands thriving in Japan.

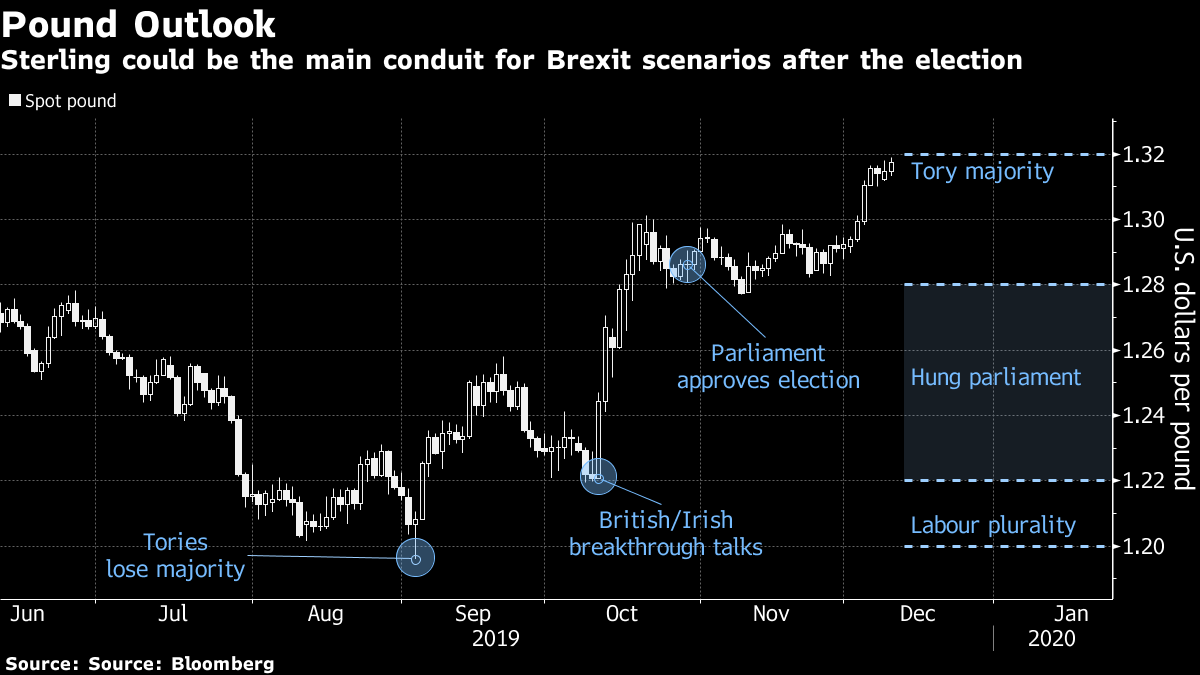

And finally, here's what Cormac Mullen is interested in this morning With the urns about to open in the key U.K. general election, my colleagues on the Bloomberg Markets Live blog have been spitballing the potential outcomes and how each might affect financial assets. Under their base case assumption of a Conservative majority, sterling could struggle for further upside and gilts could see initial losses. Smaller, domestic stocks could be the big beneficiaries with the export-heavy FTSE 100 likely to be as influenced by the outcome of the U.S.-China trade talks as the vote. Meanwhile, a hung parliament would of course prolong the political and economic uncertainty that has crippled the pound since the referendum and it could quickly fall to the $1.22-$1.28 range seen before the EU withdrawal pact was agreed, according to the Markets Live team. Gilts could rally and domestic stocks would likely take a hit from the uncertainty. And of course there is the worst-case scenario for investors of a coalition led by the Labour Party. As investors would no doubt demand higher risk premiums for fear of a nationalization of everything from rail to utilities and telecoms, the pound would be roiled and long-end yields would push higher. Whatever the result, it will be a long day ahead for political junkies and traders alike.  Cormac Mullen is a cross-asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. |

Post a Comment