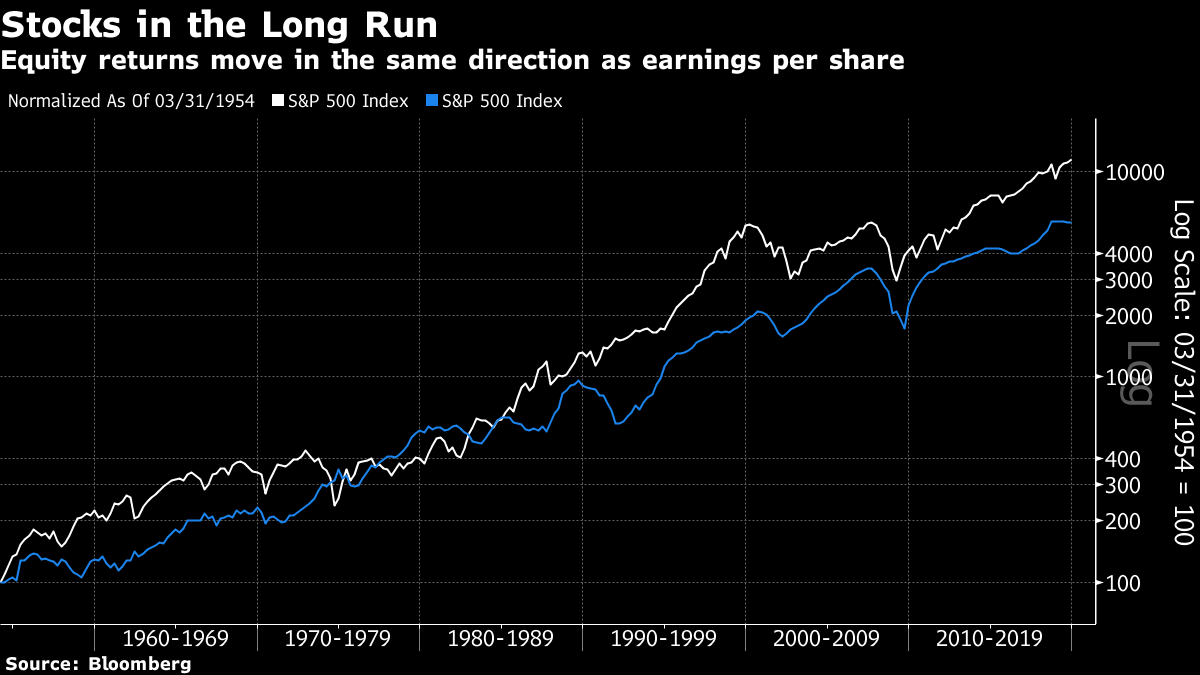

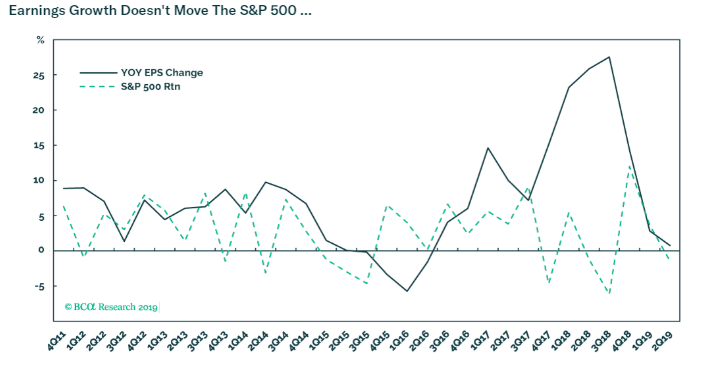

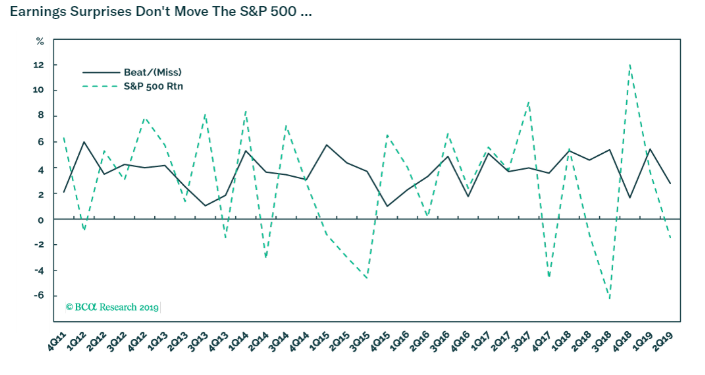

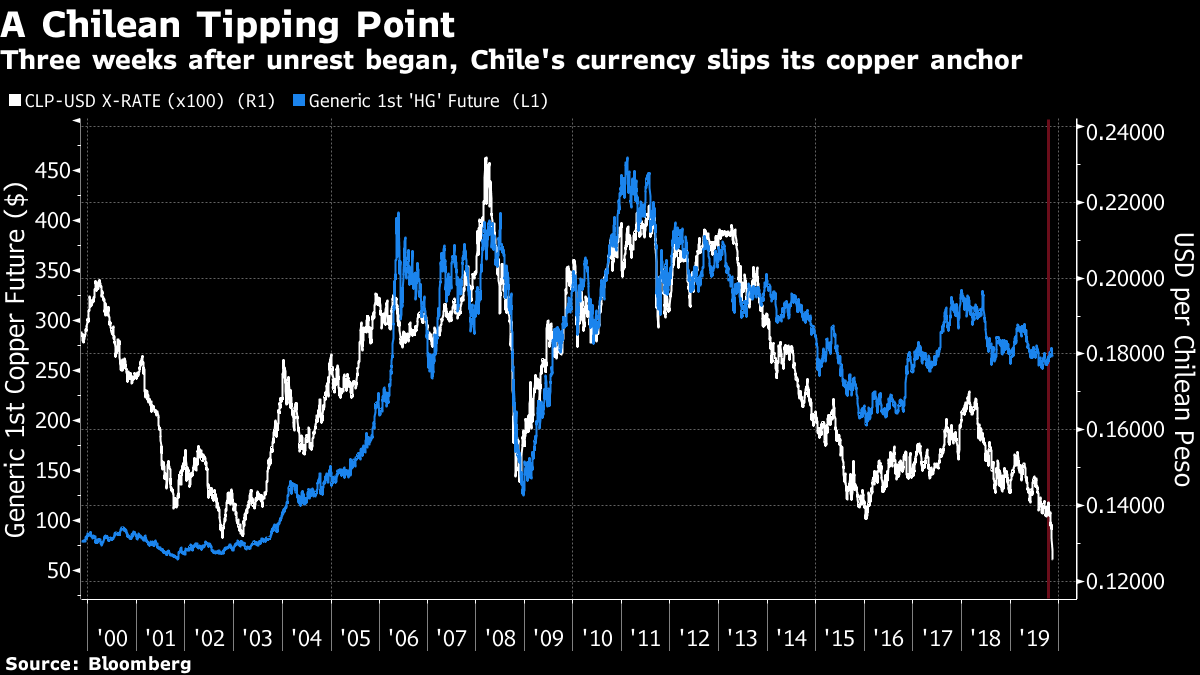

Earnings: Who Cares? As the third-quarter earnings season winds down, was it worth paying any attention? For individual stocks, the reporting period of course makes a difference. The comments that executives let drop on earnings calls can be very useful qualitative indicators of risks and opportunities ahead. And in the long run, profits are of course central to stock returns. The multiples that people will pay for those earnings will move over time, but in the long term, stock prices and earnings tend to move in the same direction:  But what about the short term? Some interesting numbers from BCA Research Inc. suggest we can safely ignore earnings as they have no impact on the direction of the market. While we have seen that profit growth matters in the very long run, it matters barely at all on a quarter-by-quarter basis. In the following chart, BCA compares the S&P 500's performance during a three-month period starting on the Monday after the second Friday of a quarter, which is when earnings season typically starts, with the increase in index earnings per share announced for that quarter. There was a vague-ish relationship (technical term) for a few years during the post-crisis decade, but none is discernible now:  A swift retort would be that markets attempt to incorporate new information before it is available. Thus last year's big spike in earnings per share was foreseeable, because it had been driven by the big overhaul in corporate tax, and so the actual announcement was a "lagging" indicator that had no impact on share prices. This would make sense, except that it turns out that there is no relationship between earnings surprises and index performance either:  Note that earnings always "surprise" positively thanks to the machinations of corporate investor relations departments, and the ongoing gullibility of stockbrokers' analysts. This tends to call the concept into question in any case, but the lack of relationship between particularly positive surprises and particularly strong share-price performance is obvious. What should we make of this? Certainly nobody is suggesting that anyone who does a traditional job of investing in a concentrated portfolio of stocks held for the long term should ignore earnings reports. They contain lots of information. But a few interesting possibilities emerge: Earnings matter less, and rates matter more, in the post-crisis world As BCA shows, moves in rates tend to move earnings. By affecting the mathematics of share buybacks, rates have a particularly strong effect on earnings per share. They also influence the attractiveness of dividend yields. So it is at least reasonable to argue that rates are swamping any signals we might receive from earnings announcements, at least for now. This doesn't affect the importance of earnings in the long run, but it does confirm the common sense intuition that in the short run rates appear to be driving everything. Maybe we don't need quarterly earnings reports More information is generally better than less. Companies need to keep their creditors and shareholders informed, and the law should force them to do so. But in aggregate, it is obvious that quarterly moves don't matter much. Several quarters showing a clear trend are needed before earnings reports have much effect on stocks. So maybe quarterly earnings reports are merely distracting noise for investors, and an irritating waste of time for the accountants and treasurers who should be helping to run a company? Fully audited annual reports with far more lightly audited updates in between, or legal requirements for announcements of changes beyond a set level of materiality, might make more sense. We certainly don't need quarterly guidance That leads to the clearest lesson, which is that guidance at best is a waste of time. There are various initiatives around the world trying to address the causes of short-termism among investors. Guidance is often named as a culprit in shifting companies toward a short-term mentality. Some large companies, such as Unilever under crusading CEO Paul Polman, are doing away with guidance altogether. BCA's research suggests that all other companies should follow. Producing guidance is pointless, as is the quarterly game of counting the companies that have beaten or failed to beat the expectations they set for themselves. Companies feel obliged to do it because it can help their share price. It would be better to let them get on with something more useful. Chile Tips Over Back on Oct. 25, Chile erupted suddenly and violently.I commented at the time that the message for the rest of the world was dire. If Latin America's most prosperous and stable country could suddenly descend into disorder, it could happen anywhere. But it is only this week that the Chilean peso has finally tipped over and gone into free-fall, prompting the central bank at last to intervene — with little success thus far. This week's sell-off has broken the peso's link with the price of copper, the country's most important export. This is how the Chilean peso has performed compared to copper over the last 20 years:  The images of violence have faded from television screens around the world, but it was only this week that significant peso selling was triggered. That was driven by the government's offer to consider re-drawing the country's constitution. As many protesters have pointed out, the country still has a constitution written by the dictator Augusto Pinochet, who fell from power peacefully almost 30 years ago. Replacing it opens the possibility of truly changing Chile as a country. For the protesters, this is a good thing. For foreign investors, evidently, it looks bad. Chile is a geographically isolated country, and these extraordinary events have caused almost no contagion so far. Emerging markets foreign exchange hit a low against the dollar on Aug. 30, according to JPMorgan Chase & Co. The peso's tumble is bringing EM FX as an asset class back close to that low but, as this Bloomberg screenshot shows, Chile is the only emerging country to have suffered a significant depreciation since then:  If there is contagion, it appears to be operating at the social level, rather than in markets. Neighboring Bolivia has now revolted against its own president, although the two situations have little in common. Bolivia is South America's poorest country, and Evo Morales, the president who has been ejected, is an indigenous coca-grower and left-wing populist. Chile's president, Sebastian Pinera, is also the country's richest man. It is also hard to draw a line between unrest in Chile and in other places that have erupted recently, such as Hong Kong and Lebanon. All have distinctive local causes and characteristics, and yet I continue to suspect that it is worth paying Chile a lot more attention. Meanwhile, I would like to nominate the Chilean-Argentinian peso exchange rate as the world's most exciting currency pair between neighboring countries. The two nations that share the southern cone have currencies that have diverged dramatically in recent years, thanks to the instability in Argentina. This week's tumble for the Chilean peso, while the Argentine peso has been strong for the last two months, has had no effect on the longer-term picture. Chile's peso has appreciated more than fivefold against its neighbor, even after this week's events. The relationship between Mexico and the U.S. seems tame by comparison:  Any Chilean business hoping to export across the spine of the Andes to Argentina is still going to find life much harder than a year ago, or five years ago. And if Chile really does become more like its neighbor, a possibility that evidently horrifies the international capital markets, Chilean assets have a lot further to fall. Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment