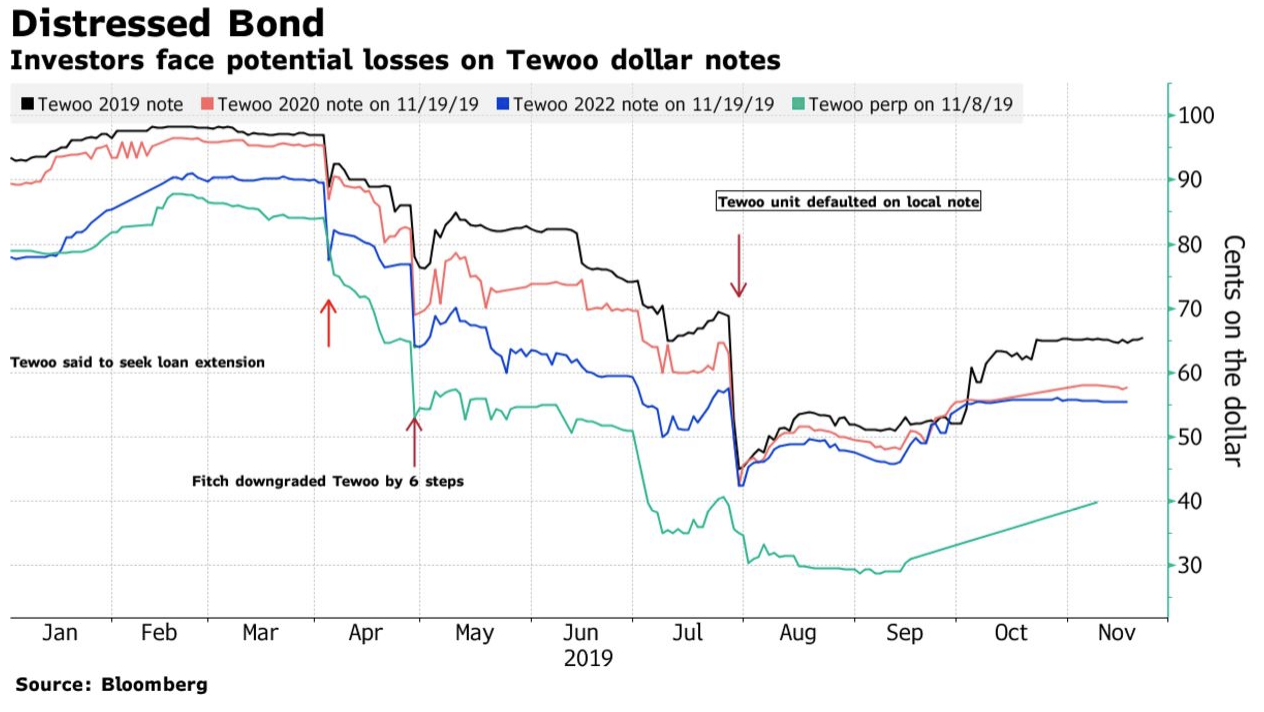

| Westpac's CEO steps down, SoftBank launches a $3 billion tender offer for WeWork, and markets gain again on hopes a trade deal is near. Here are some of the things people in markets are talking about today. Hartzer Resigns Westpac Chief Executive Officer Brian Hartzer has resigned after the lender was engulfed by allegations it committed the biggest violation of money-laundering laws in Australian history. After days of mounting pressure from shareholders and government ministers, Chairman Lindsay Maxsted announced Tuesday that Hartzer, 52, would step down Dec. 2. Chief Financial Officer Peter King will be acting CEO, while the bank undertakes a global search for a successor. The announcement comes six days after the nation's financial crimes agency accused Australia's second-largest lender of more than 23 million breaches of money-laundering laws, including failing to detect payments to child pornographers in the Philippines. Markets Optimistic Asian stocks are set to gain Tuesday amid optimism over China trade relations, and a fresh wave of merger and acquisition activity. The yen weakened and the dollar edged higher. Futures in Japan, Australia and Hong Kong were higher in early trading. The S&P 500 Index, Dow Jones Industrial Average and Nasdaq Composite Indexes reached all-time highs with tech shares leading gains. On the M&A front, Charles Schwab agreed to buy TD Ameritrade, while LVMH purchased U.S. jeweler Tiffany & Co. Meanwhile, yields on 10-year treasuries retreated, West Texas-grade oil drifted higher and Bitcoin dropped as much as 11% before paring the decline. Will Anything Change? In early June, Hong Kong Chief Executive Carrie Lam kicked off unprecedented chaos when she dismissed enormous crowds of Hong Kongers who marched peacefully to oppose legislation allowing extraditions to China. On Sunday, after months of turmoil and violent protests, the masses again spoke clearly and peacefully, giving 85% of 452 District Council seats to pro-democracy candidates. The following day Lam vowed to "listen to the opinions of members of the public humbly and seriously reflect." Investors looked on the bright side, sending Hong Kong's benchmark Hang Seng Index higher on the hope that the government would now soften its tone. But many people don't expect much to change, and early signals out of Beijing have not been encouraging. $3 Billion Offer SoftBank launched a long-awaited $3 billion tender offer for WeWork stock, according to people with knowledge of the matter. The offer expires April 1. Representatives for SoftBank and WeWork declined to comment on the matter. WeWork parent We Co. agreed to the tender offer from the Japanese conglomerate last month, one element of a $9.5 billion rescue package for the ailing office-sharing company. As part of SoftBank's proposal to buy existing shares, WeWork co-founder Adam Neumann is entitled to sell as much as $970 million worth of his stock. Besides the new equity injection and the tender offer, SoftBank's rescue package also includes about $5 billion in new debt financing. If the tender offer is completed to capacity, it will hand SoftBank almost 80% of WeWork, which is now valued at about $8 billion. Bear Bets For Harvey Norman, the most shorted stock on the benchmark S&P/ASX 200 Index, its upcoming annual meeting could be a contentious one amid a weak domestic economy and questions about corporate governance. One of Australia's biggest retailers has been in the cross hairs of short sellers as it battles an economy expanding at its slowest pace since the global financial crisis. "Short sellers often target AGMs in the expectation of a financial or trading update that disappoints," said Fiona Balzer, policy and advocacy manager for the Australian Shareholders' Association. It's not all smooth sailing for short sellers though, with Harvey Norman climbing 39% this year, outperforming the ASX 200's 19% advance. Still, none of the 10 analysts tracked by Bloomberg have a buy rating on the stock amid concerns about the value of its property assets and margin pressure. What We've Been Reading This is what's caught our eye over the past 24 hours. And finally, here's what Tracy's interested in this morning Something potentially very big is brewing in China's bond market. A state-owned enterprise is close to what amounts to a default on its dollar bonds, Bloomberg reports. Tewoo, a conglomerate based in the northern province of Tianjin, has proposed that investors either take a dramatic 64% haircut on its debt or accept massively delayed repayments and cut coupons. If it goes through, it would amount to the first de facto default on dollar-denominated debt at state-owned enterprises since the infamous GITIC bankruptcy in 1998.  Two weeks ago in this space, I mentioned the market distortions caused by perceived differences in the safety of private and state-owned companies in China. State-owned ones are viewed as implicitly guaranteed by the Chinese government. Defaults are rare, which sometimes gives them a massive funding advantage. So the question is whether China is willingly introducing defaults into the sector as it tries to evolve its capital markets and reduce the funding discrepancy, or whether China is being forced into a default by a weak fiscal position and a boatload of debt. You can follow Bloomberg's Tracy Alloway at @tracyalloway. The best in-depth reporting from Asia Pacific and beyond, delivered to your inbox every Friday. Sign up here for The Reading List, a new weekly email coming soon. Before it's here, it's on the Bloomberg Terminal. Find out how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. |

Post a Comment