Welcome to the Weekly Fix, the newsletter that's staying a safe distance from the anti-bond lynch mob as we head into 2020 – Cecile Gutscher and Sid Verma, cross-asset reporters

Fortune Tellers

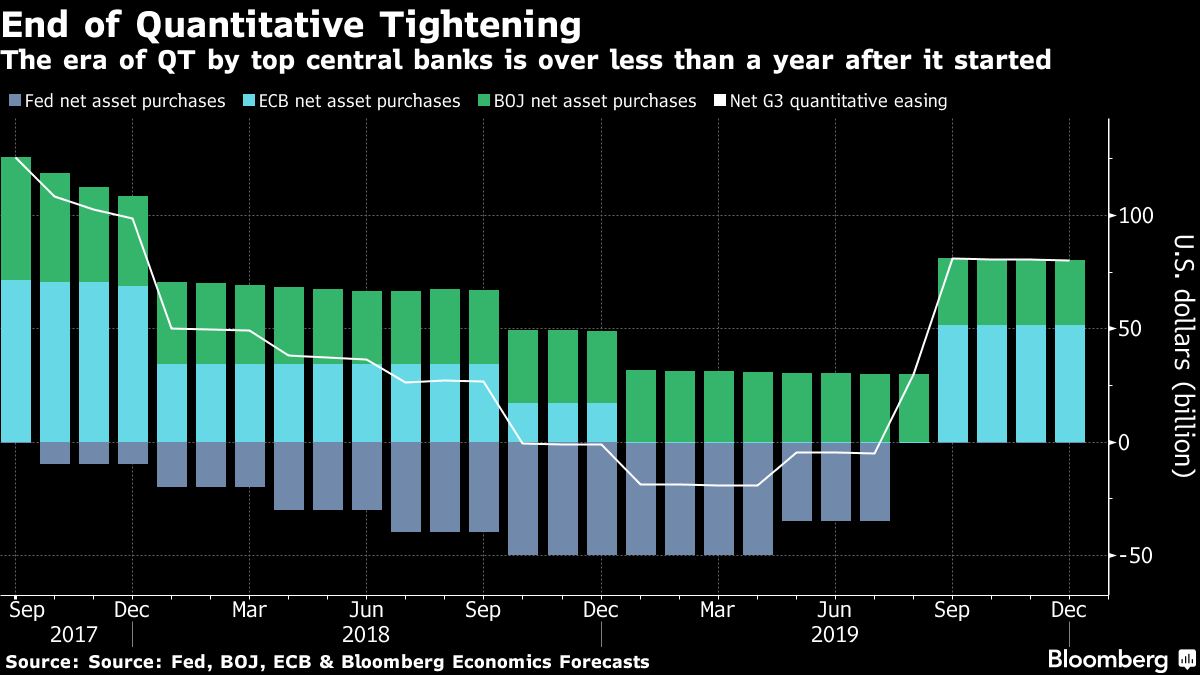

It's that magical time of year when the world's big investment banks start crystal-balling the next 12 months. But they are just as hostage to fate and its furies as the real fortune tellers. At this time last year, few could have predicted that half of the world's major central banks monitored by Bloomberg would have delivered interest-rate cuts, or have restarted asset purchases in order to reflate economies and shore up markets.

Both bond bulls and bears will find support in the latest prognostications. TD Securities and UBS Group expect renewed Federal Reserve easing to push 10-year U.S. yields closer to 1.5% than the current level of around 1.77%. JPMorgan Chase is looking for slightly above 2% at the end of next year.

Global growth is headed lower, trade tensions continue to simmer and consumer spending in the U.S is looking weak, according to the bond bulls. The bears counter that all the recent stimulus has extended the economic cycle -- spurring growth and inflation that will lift yields.

JPMorgan says that late-cycle concerns around excess leverage and weak growth are well in the background -- "a problem for another year.'' In the near-term, the bank's strategists see yields range-bound as "elevated downside risks mean markets are unlikely to price in a reversal of the Fed's recent easing even if past insurance-cut episodes suggest a potential for yields to move substantially higher."

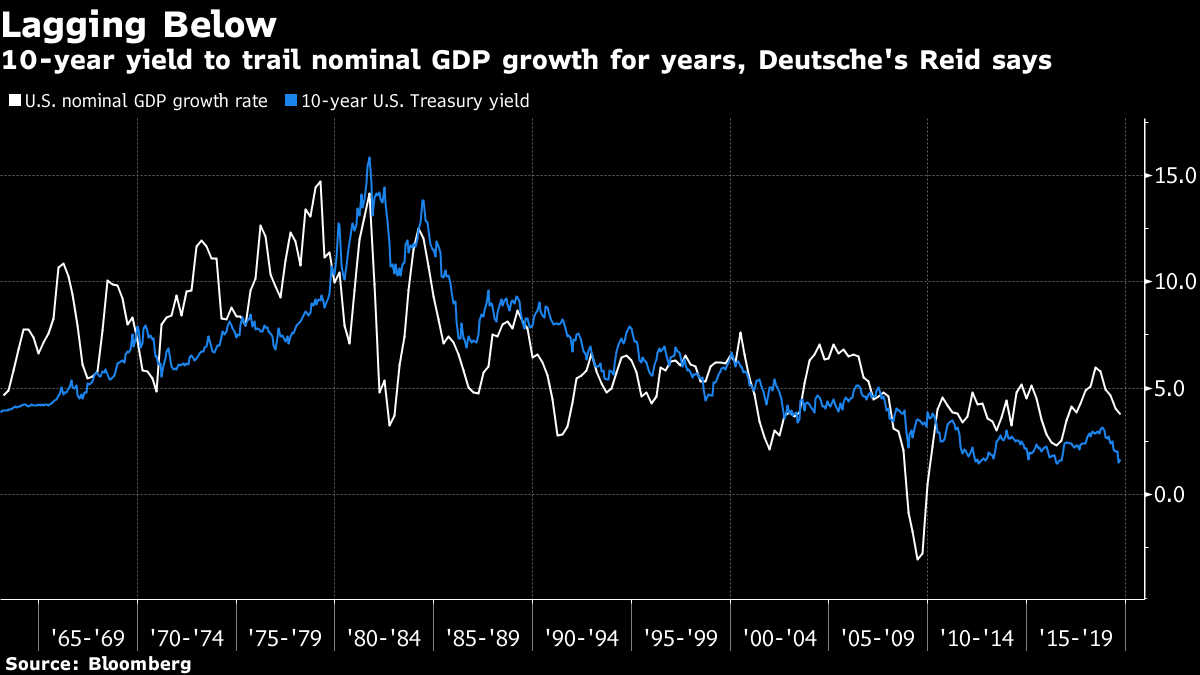

A big-picture projection comes from Deutsche Bank's Jim Reid. Treasury yields are likely to continue trailing U.S. nominal growth rates for decades as benchmark policy rates stay low, he said on Bloomberg TV.

At TD, Priya Misra's team is entering 2020 with a long 10-year position in their model portfolio. "Our view is that the Fed is likely to ease more than expected, placing risk assets under pressure due to slowing growth and election uncertainty," the group wrote in a note. Overseas funds will also keep coming to America seeking refuge from a world of negative yields. The foreign contribution of $372 billion in the first half of 2019 has "undoubtedly helped keep Treasury yields contained and compressed," according to Misra and colleagues.

They expect 10-year Treasury yields to bottom out in the first quarter at 1.45% but end the year at 1.6%. Their No. 1 theme is developed-market bond yields convergence, partly as fiscal easing -- cross reference U.K election promises -- pushes European rates higher.

Economists at UBS meanwhile expect a "limited" phase-one trade deal to lead the Fed to cut three more times, in contrast to market expectations of just one reduction. So it follows they have an even lower forecast for 10-year Treasury yields than TD, at 1.5% by year-end 2020.

M&G Investments remain largely in the bull camp.

"If you do believe that 2020 is the year for bond bears finally to triumph, I think you have to believe that a lot of very long term, established trends are about to come to an end simultaneously or significantly diminished," according to Bond Vigilantes blogger Jim Leaviss. Trends in demographics and globalization mean demand for bonds isn't likely to go away, according to this thinking. And a "30-year streak of `sell bonds' predictions" has yet to hit pay dirt, he says.

If you're still ready to say goodbye to fixed income, then Leaviss recommends joining "the January anti-bond mob with their pitchforks and flaming torches."

Before doing that, you might want to see how the U.S election pans out. Uncertain times and a vote where anything can happen mean the world's safest bet hasn't yet lost its luster for many.

Kaboom

This week Governor Lael Brainard dropped the bomb. In the Fed's mission to bring inflation back to the 2% target that it's missed for most of the past seven years, Brainard recommended pursuing a policy she dubbed "flexible inflation averaging."

The next time the Fed finds itself at the effective lower bound: "the Committee could commit to refrain from lifting off the ELB until full employment and 2 percent inflation are sustained for a year," she said in a speech. "This would imply supporting inflation a bit above 2% for some time to compensate for the period of under-performance."

Strategists at BMO Capital Markets point out that the Fed might never have raised rates this cycle under this directive. "This would be very aggressive forward guidance and speaks to the depth of concern in monetary policy circles about the response to the next downturn,'' they wrote after the speech.

That's not all. Brainard offered a separate idea to help the Fed stimulate if the central bank is again forced to cut overnight rates to zero: asset purchases to cap rates on short-to-medium range Treasury securities.

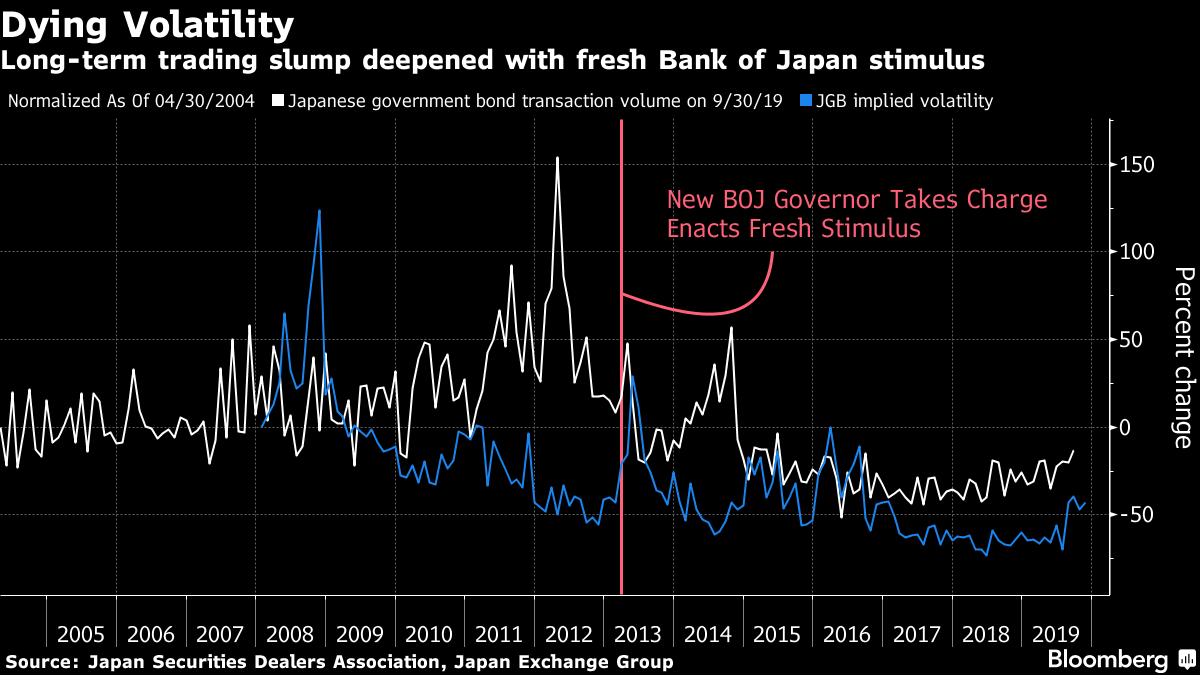

Those yield caps could be combined with a monetary commitment to delay raising the overnight rate until full employment and 2% inflation were achieved on a sustained basis, she said. In short, this would amount to Japan-style yield-curve control -- threatening bond-trading volumes and market price discovery.

Adding to the dovish tone, she also indicated the Fed might have been too hasty in raising rates in recent years.

"The reality is that the U.S. and global economy have not yet avoided secular stagnation, and it's going to require increasingly creative policy responses to avoid that fate," BMO strategists concluded.

Post a Comment