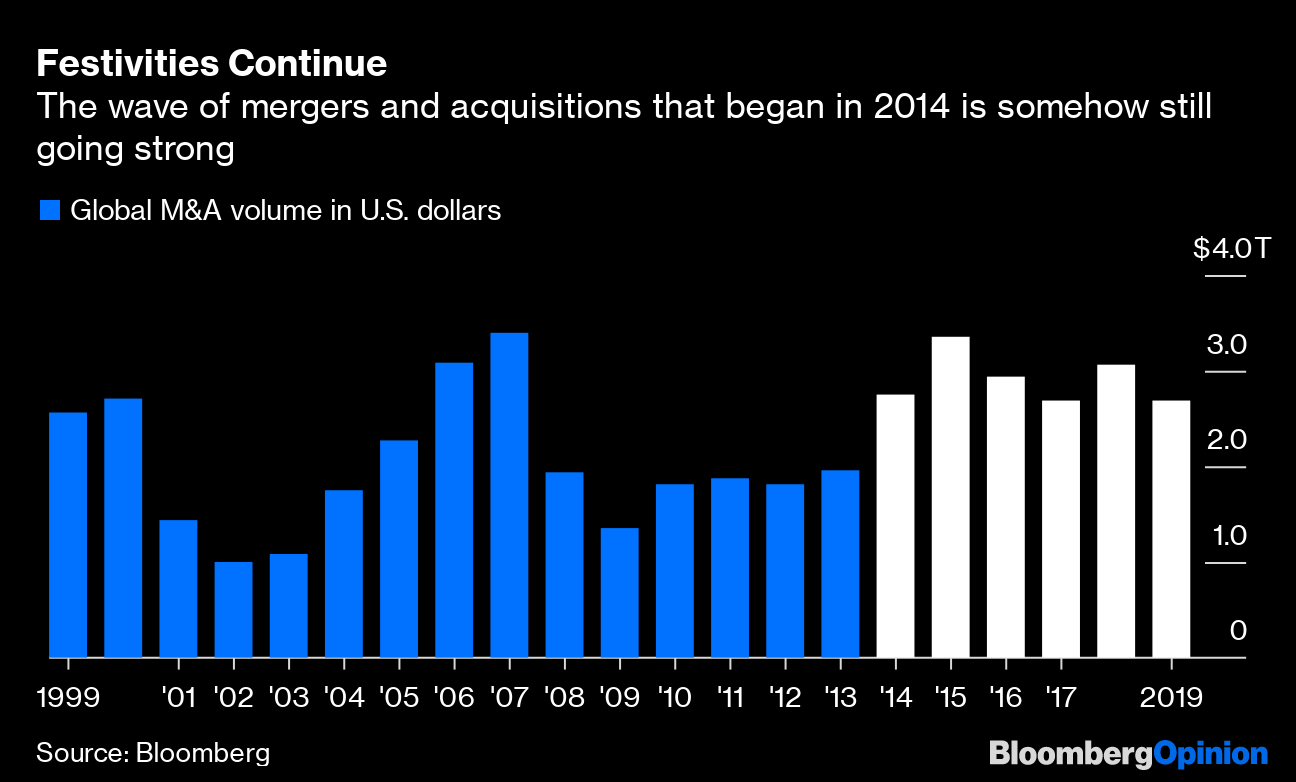

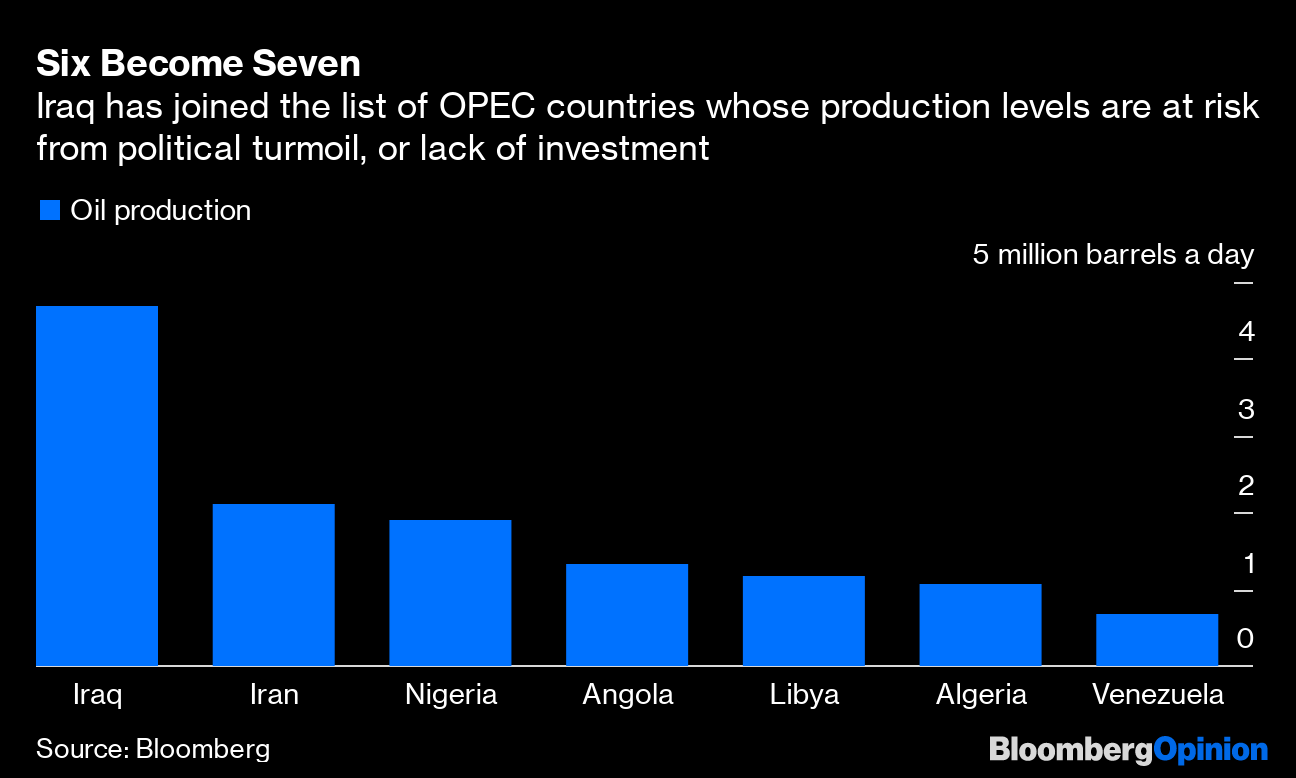

| This is Bloomberg Opinion Today, a supergroup of Bloomberg Opinion's opinions. Sign up here. Today's Agenda  If It's a Monday in 2019, It's a Merger Day In the End Times, we may scrabble across a scorched hellscape, just ahead of the cannibal hordes. But even in those dark days, you can be sure M&A bankers will find ways to make money. These are just the pre-End Times, which are still decent economically in the U.S., making it a great time for some M&A. (Bad economic times are also great times for M&A, for survival reasons. And when these deals go bad, it's a great time for some reverse M&A, done by the same bankers.) Today saw $56 billion in corporate deals announced by drugmakers, brokerages and more, notes Tara Lachapelle, with history's biggest LBO waiting in the wings. We're in an absolutely bonkers five-year run of corporate coupling that shows no sign of stopping:  And this is all happening despite, or maybe because of, the never-quite-dead-yet trade war and lingering agita about an economic slowdown. Whatever happens next, M&A bankers win, Tara writes, even if some investors in these deals end up feeling like they've been visited by those cannibal hordes. Bloomberg Opinion writers weighed in on the day's biggest deals: We Might Not Make It If these are great days for M&A bankers, they're far less fantastic for unicorn herders. In just a few months, the one-time special-est, unicorn-iest unicorn of them all, WeWork, scrapped its IPO, ditched its CEO and took a bailout from its biggest investor, SoftBank Group Corp. But not to worry, SoftBank says, fixing The We Co. will be "simple." Shira Ovide begs to differ, noting WeWork doesn't see cash flow turning positive until 2023, which is an awfully long time to survive while the company burns through an awful lot of cash. Another former unicorn, Uber Technologies Inc., has watched its stock price tumble since its IPO. The trend continued today, after regulators in London, a major Uber market, took away the ride-sharing company's license. Again. This came even though Uber had cleaned up its act since London's first revocation, and Leonid Bershidsky warns it's a sign Uber still struggles to balance breakneck growth with passenger safety and other issues. Saving the Planet Isn't as Easy as It Sounds If we're to avoid (even more) catastrophic global warming, we'll have to do more than slap up some solar panels and buy some cybertrucks. Cutting back on the world's beef consumption will also probably be necessary, given the sheer carbon-intensity of raising cows. The good news, writes David Fickling, is that beef demand seems to be tapering off, even in the developing world. We'll also probably need to do more to price carbon, which can be politically unpopular and make the companies and people asked to pay the price unhappy. European steel makers, for example, have lately blamed the skyrocketing cost of carbon permits for their troubles. They're being disingenuous, though, writes Chris Bryant; they've actually made a ton of money on these credits. Further Green Reading: Making palm oil more expensive won't save the rainforests. — David Fickling Madison, Wisconsin Complicates One Trump Theory A common but reductive theory of President Donald Trump's 2016 win is that white voters in Rust Belt swing states helped him overcome the strength of minority voters elsewhere. But overwhelmingly white Dane County, Wisconsin, which includes Madison, also overwhelmingly voted for Hillary Clinton in 2016, writes Frank Wilkinson. The differences between places like Madison and rural stretches of the country — where Trump truly is strong with white voters — offers a sharper lesson about this country's real political stress points. Further Politics Reading: Everybody assumes the GOP will acquit Trump, but that's still not a certainty. — Jonathan Bernstein Telltale Charts Don't buy Goldman Sachs's warning of a "baby bear market" for bonds, writes Brian Chappatta; the bank is just hyping up a modest call for a slight correction after a big year.  OPEC+ may come to regret not cutting oil production further when it meets next week, writes Julian Lee; though it may accidentally do it anyway.  Further Reading Hong Kong protesters' anti-mainland sentiments are turning off potential allies. — Shuli Ren A new study suggests rescuing migrants at sea makes it more appealing for smugglers to put more migrants at risk. — Ferdinando Giugliano There's no evidence negative interest rates do any good. — John Authers General Electric Co.'s new CFO may lack a "wow" factor, but then that's not what GE needs. — Brooke Sutherland The Internet appears to make it easier for companies to grab monopoly power, and our regulatory regime isn't equipped to deal with that. — Noah Smith Gene-editing technology will improve lives, but could forever change what it means to be human. — Mark Buchanan A vegan's lawsuit against Burger King over its "Impossible Whopper" claims has a good point. — Stephen Carter As Amtrak's dining car goes extinct, let's remember its long and wild history. — Stephen Mihm ICYMI A note from Bloomberg Opinion about our coverage during Mike Bloomberg's presidential campaign. Elizabeth Warren accused Bloomberg of trying to "buy a nomination." Ford Motor Co. challenged Tesla Inc. to a truck tug-of-war. The Beverly Hills setting of the "Godfather" horse-head scene is in bankruptcy protection. Kickers Minimum-wage job-loss fears haven't come true. Light pollution could be contributing to the insect apocalypse. How a legit "Star Wars: Rise of Skywalker" script ended up on eBay. My life as a child chef. Note: Please send scripts and complaints to Mark Gongloff at mgongloff1@bloomberg.net. Sign up here and follow us on Twitter and Facebook. |

Post a Comment