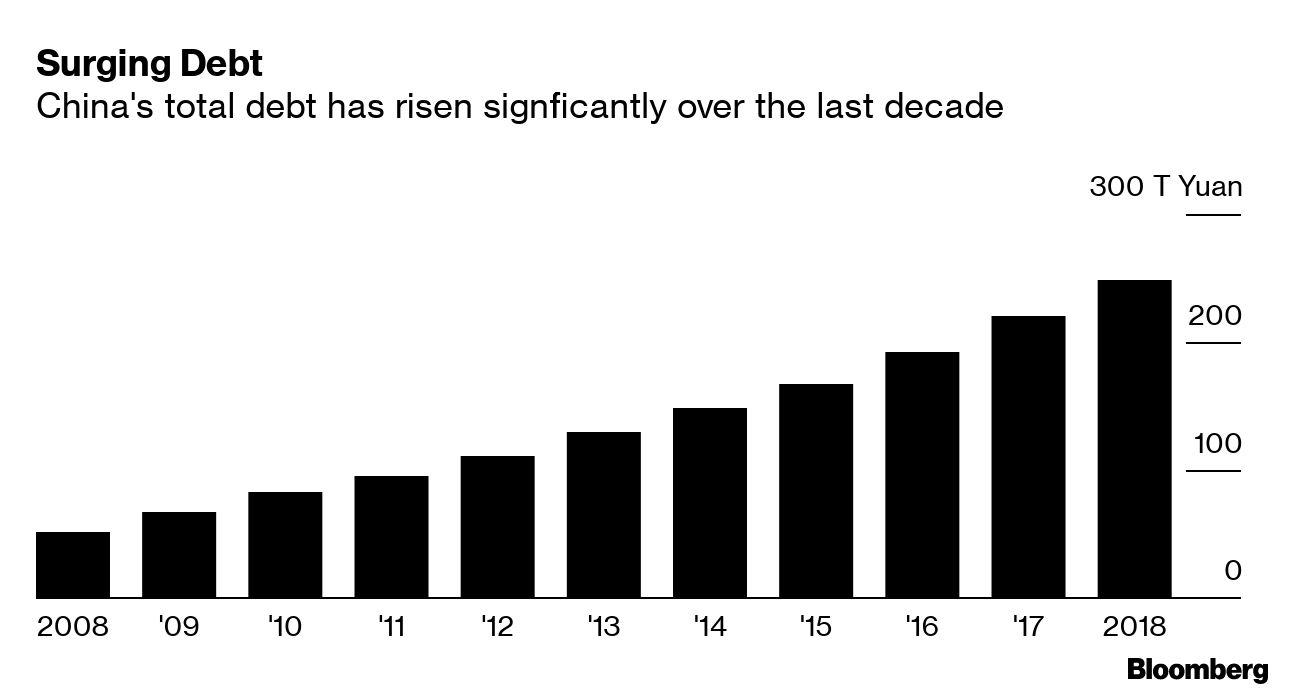

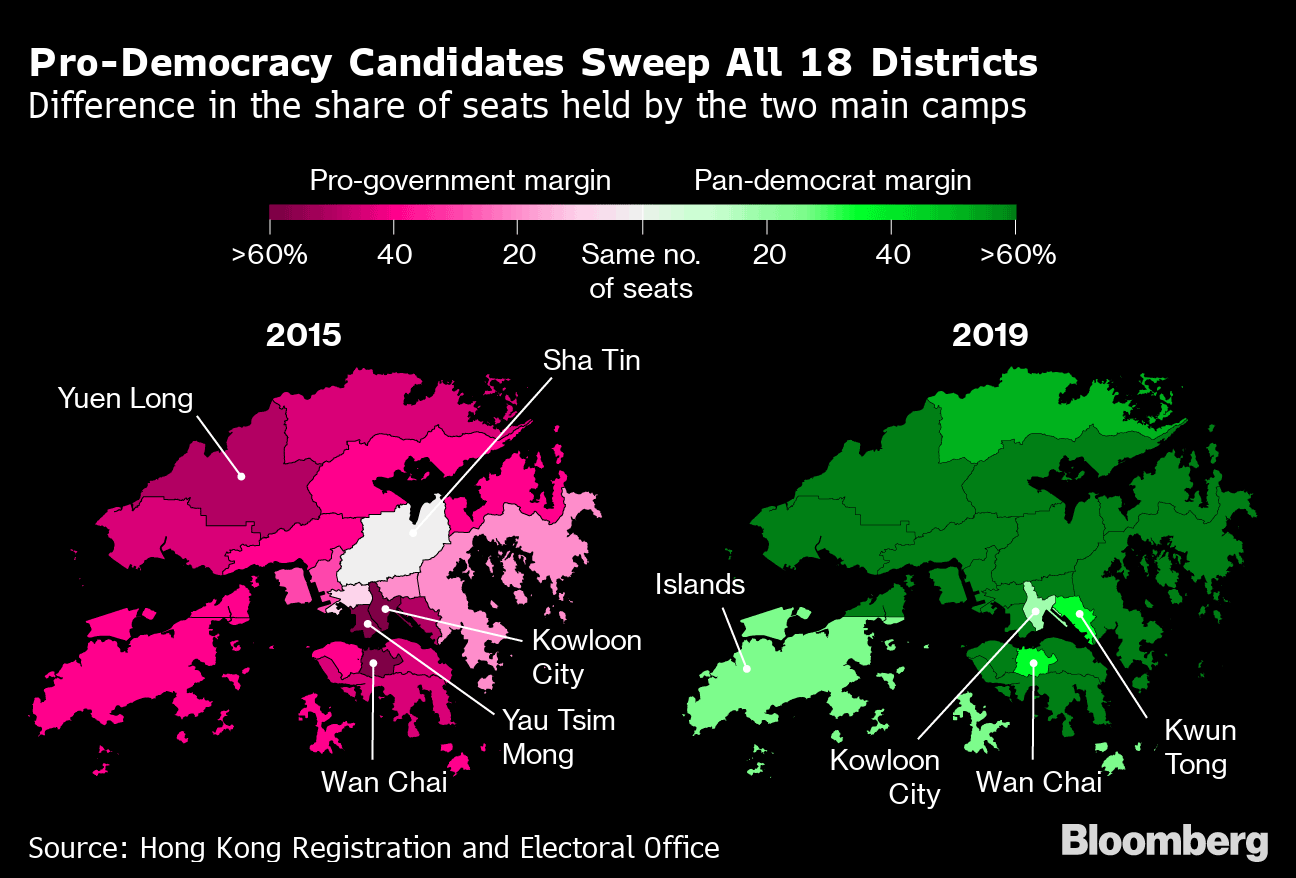

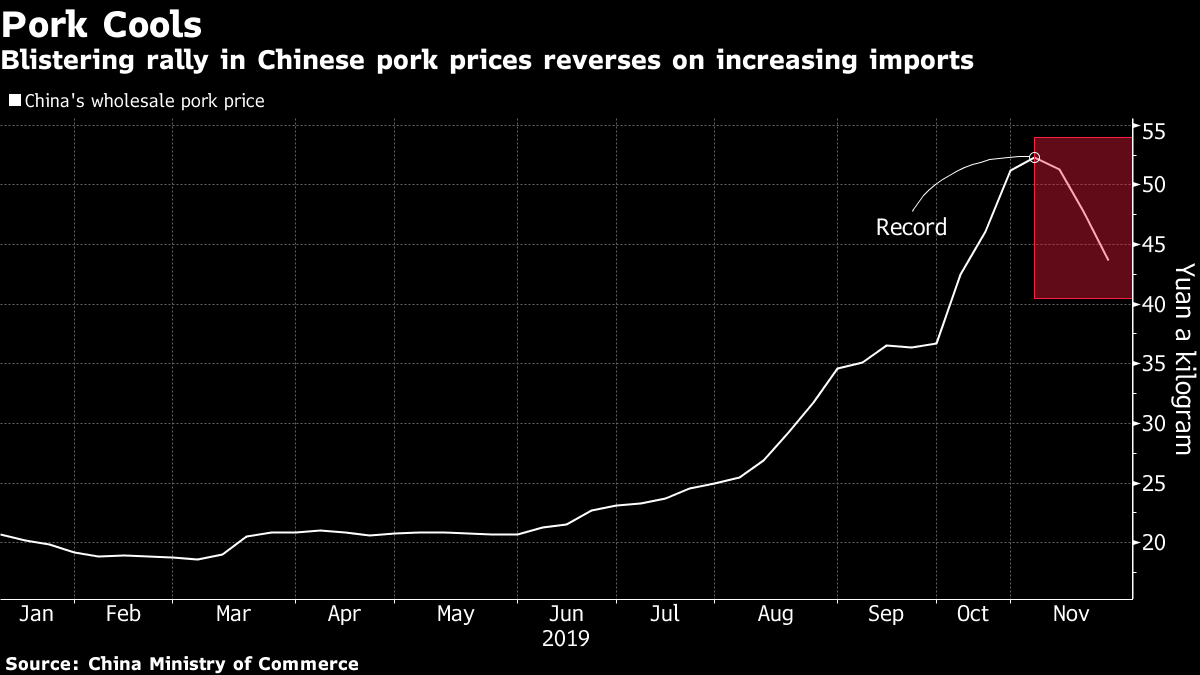

| It turns out trade wars are not just painful but also very loud, so much so that they can drown out some fairly consequential things. One of those is debt. And in the Chinese context, we should note that there is a lot of it and it has increased very quickly. Bloomberg Economics estimates that the country's total debt ballooned about five-fold in the decade through 2018 to roughly $35 trillion.  It's a problem that's been variously described as a mountain, a horror movie and a ticking bomb, but also one that's gone less noticed in the past two years as Washington and Beijing have volleyed tariffs at one another. Now might be time to start paying attention again. One sign of that is Tewoo Group, a commodities trader that looks poised to become the most-high profile state-owned company to default on a dollar bond in more than two decades. A default by Tewoo would highlight Beijing's growing willingness to let state-owned companies fail. And while that's something many economists have long said China needs to do to strengthen its economy, it will be plenty painful nonetheless. Ultimately, the question is if China's policy makers can get its debt problem under control without precipitating some magnitude of financial crisis. So far so good, but given the enormity of the challenge, that's no reason to feel at ease about the matter, especially during the trade war. The economic hit from Washington's tariffs means China's self-styled de-risking campaign has a lot less room for error. But Beijing also feels compelled to press forward, haunted by the prospect of repeating Japan's fate if debt is left unchecked. Whatever the outcome, it's a space worth watching no matter how deafening the trade war gets. Deal, No Deal The deal-no-deal trade barometer whipsawed back and forth this week before settling finally on who-the-heck-knows. Chinese Vice Premier Liu He spoke by phone with U.S. Trade Representative Robert Lighthizer and Treasury Secretary Steven Mnuchin, during which they "reached consensus on properly resolving relevant issues," according to a brief readout Beijing issued. In Washington, President Donald Trump told reporters that a deal was in its "final throes." But Trump would go on to inject significant uncertainty. First, he told former Fox News host Bill O'Reilly in a later interview that he was holding up the deal because it was too even and that he wouldn't accept an agreement unless it was one in which America did "much better." That won't sit well with Xi Jinping, who had stressed just days earlier that any deal had to treat both sides equally. Trump then of course signed into law legislation supporting Hong Kong's protesters, a bill China has vowed to retaliate against. While it seems unlikely that Beijing's displeasure over the bill will derail trade talks, it's also not an outcome that can be ruled out. Hong Kong Tensions in Hong Kong de-escalated this week after a record turnout for local district council elections that had morphed into a referendum on the city's government. And while the district councils have little power themselves, it was hard not to see the results as a stunning repudiation of Hong Kong's leaders. Pro-democracy candidates won 85% of seats up for contention while pro-establishment parties, which had taken 65% in the previous election in 2015, won just 13%. It was not immediately clear, however, if the results would push the government to adopt a new tack in dealing with the unrest that's wracked Hong Kong for almost half a year. In her first public comments after the election, Chief Executive Carrie Lam conceded that the vote reflected "unhappiness" but also offered no new concessions. Beijing and Chinese state media, meanwhile, have barely acknowledged the results, doubling down instead of the need to restore order and to stop the violence.  Crypto Squeeze China has made it very clear that while it may be keen on developing blockchain as a technology, it is far from keen on cryptocurrencies. In November, at least five local exchanges have either halted operations or announced that they'll no longer serve domestic users after Chinese regulators issued a series of warnings and notices against the trading of digital currencies. That's a stark turn in sentiment from late October, when it was announced that Xi and other members of the Politburo had met to study blockchain, prompting some to wonder if Beijing might be getting ready to soften its stance on crypto. It now appears that that was probably an overly optimistic reading of the situation. Pork Relief China seems to finally be taming the country's pork problem. Data this week showed prices for the country's main staple meat fell 16% this month from a record. That's good news for Chinese consumers, who have seen the cost of pork double in the past year after African swine fever decimated the country's hog herds. It should also help turn down stress levels in Beijing, where policy makers had already been harried enough by slowing economic growth, the trade war and protests in Hong Kong.  What We're Reading: And finally, some other things that got our attention: |

Post a Comment