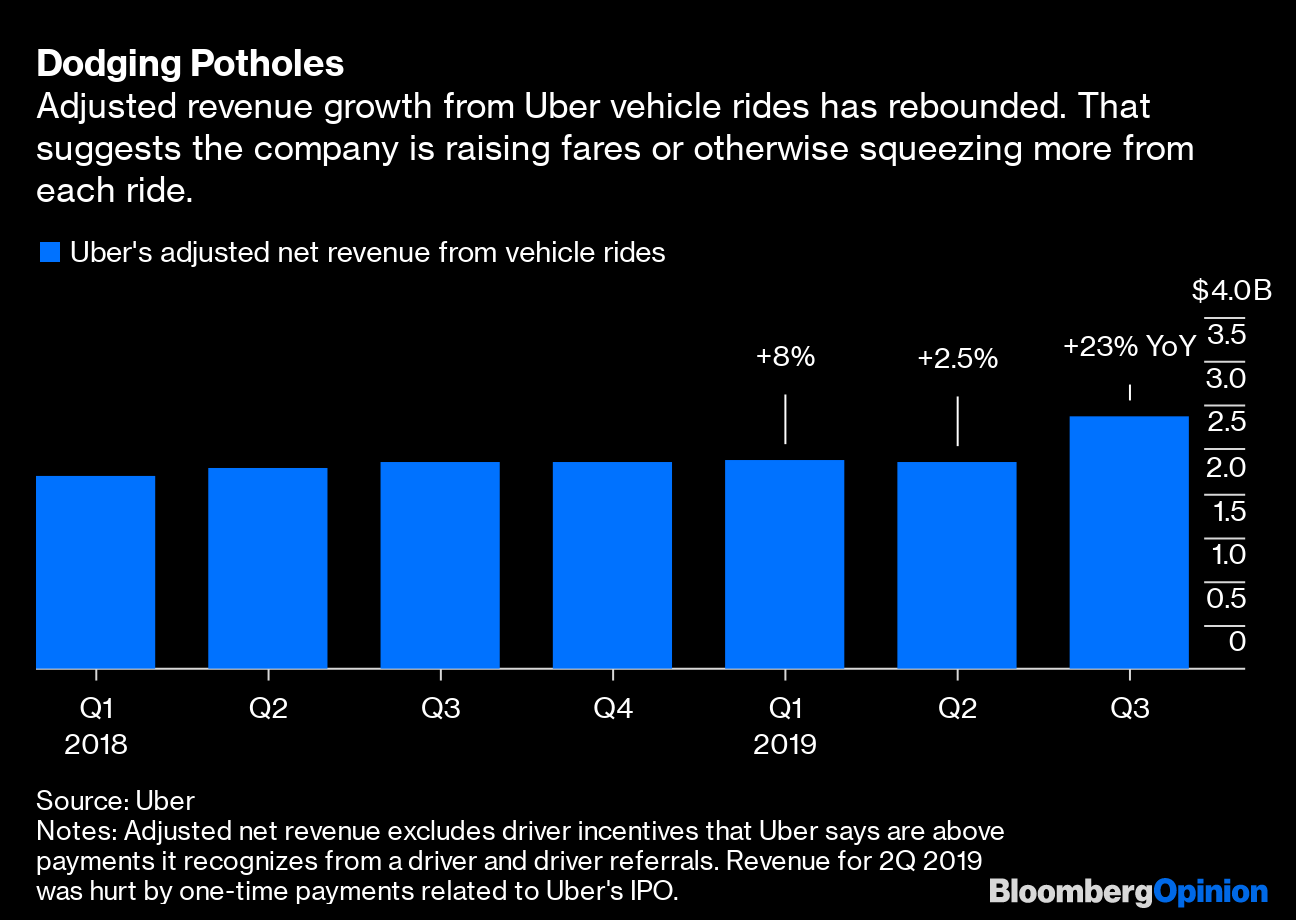

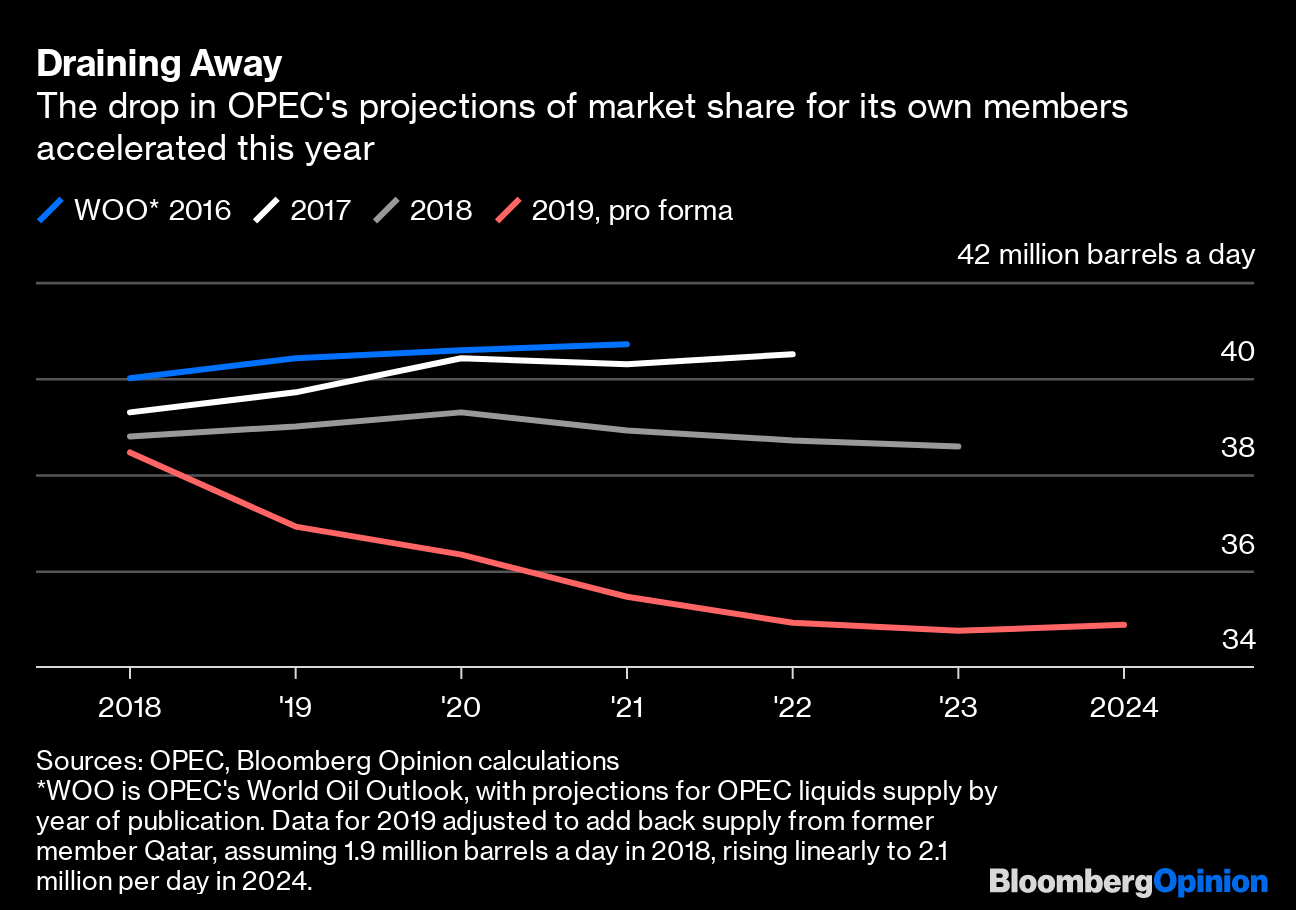

This is Bloomberg Opinion Today, an étouffée of Bloomberg Opinion's opinions. Sign up here. We're looking for your feedback to help improve this newsletter. Please follow this link to our survey, which will take only a few minutes. It's the last day to tell us what you think. Today's Agenda This Is What It Sounds Like When Wall Street CriesThere was a brief moment this summer when Wall Street's long-time loathing of Senator Elizabeth Warren seemed to ebb. It was "warming to her," however reluctantly, we were told. The honeymoon didn't last long: Financiers are now openly weeping on television over the idea of her in the White House. Warren's wealth-tax and Medicare for All plans draw the most ire, threatening tax hikes that Wall Street types say will wreck the economy and markets. But a President Warren would probably end up like most other presidents, with little direct influence over GDP or the S&P 500, writes Nir Kaissar. Barring an unlikely filibuster-proof Democratic majority in the Senate, Warren probably couldn't pass big, politically divisive tax plans. Her plan to clamp down on private equity, on the other hand — subtly dubbed the "Stop Wall Street Looting Act" — could be a much easier political sell, particularly if the economy keeps struggling, Nir writes. As highly leveraged buyouts sour, layoffs will mount and calls for change will increase, along with Wall Street's tears. But another Warren idea with some popular support could cut in the other direction for finance: her call to cancel much of the nearly $1.5 trillion in outstanding student-loan debt. This could free up more than $1 trillion in debt relief, amounting to a big tax cut, writes Brian Chappatta. Some critics suggest this would mainly benefit the wealthy, but to Wall Street types that would seem to be a feature, not a bug. Handicapping Trump's Election Chances All of this talk about what Warren will and won't do as president may well be moot; a bunch of election-forecasting models based on economic data predict an easy re-election for President Donald Trump. But these models are based mainly on national data and ignore regional differences that could swing the Electoral College, writes Karl Smith. In some manufacturing-heavy swing states, the outlook for Trump is much less rosy, thanks partly to his own trade war. Further Election Reading: Our political system is not ready for more foreign attacks in 2020. — James Stavridis Free Trade Is Still an Endangered SpeciesAnxiety about the political cost of a manufacturing slowdown gives Trump incentive to end that trade war. Thus the White House has lately made a bunch of stock-boosting happy talk about how close it is to a truce with China. But an interim trade deal won't be nearly enough to reverse a clear macro trend toward less free trade, warns David Fickling. The latest example is the Regional Comprehensive Economic Partnership in Asia. India declined to join, which is a boon for the U.S., but another step backward for India's economy, writes Mihir Sharma. And the RCEP carves out another trading sphere dominated by China, to go along with the Trans-Pacific Partnership, David writes. The world is increasingly splitting into competing economic camps, in an unhappy repeat of the Cold War.Further New Cold War Reading: Telltale ChartsUber Technologies Inc. got back to growth in the latest quarter, but in a way that may limit its future growth, writes Shira Ovide, adding to questions about the company's long-term viability.  OPEC's grim new outlook helps explain why Saudi Aramco is selling itself more like a bond than a stock, writes Liam Denning.  Further ReadingThe Trump administration, led by Education Secretary Betsy DeVos, is gutting rules that hold for-profit colleges accountable and keep them from bilking students and taxpayers. — Bloomberg's editorial board Central bankers can't ignore climate change, but they shouldn't make climate policy. That's what politicians should be doing. — Ferdinando Giugliano The new Speaker of the House of Commons should probably avoid channeling predecessor John Bercow, who bent the course of Brexit a little more than the role would dictate. — Therese Raphael Emerson Electric Co. has staved off an activist challenge, but fundamental problems aren't so easily fixed. — Brooke Sutherland Glass-bottomed tourist bridges are the latest example of China pumping too much money into a shoddy product. — Adam Minter Robinhood Markets Inc. users figured out how to give themselves infinite leverage, which seems wrong. — Matt Levine ICYMIGordon Sondland said there was a Ukraine quid pro quo after all. UnitedHealth Group Inc. is housing the homeless to cut medical bills. The return of Popeye's spicy chicken sandwich turned deadly. KickersMore than 11,000 climate scientists declared a global climate emergency. Lego's new braille bricks help kids learn braille. Separating gifted kids doesn't help kids. The streaming-TV "binge release" is slowly dying. Note: Please send chicken sandwiches and complaints to Mark Gongloff at mgongloff1@bloomberg.net. Sign up here and follow us on Twitter and Facebook. |

Post a Comment