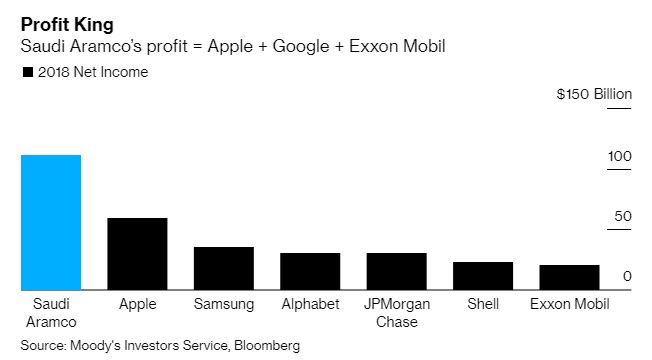

Trade optimism lifted by Xi, OPEC sees its market share falling for years, and Wall Street gets a reprieve. Opening doorsPresident Xi Jinping reiterated China's commitment to the global trading order in a keynote speech in Shanghai where he said the country will "continue to lower tariffs and institutional transaction costs." He didn't mention the current trade negotiations with the U.S. or President Donald Trump in his remarks. Those negotiations are continuing, with optimism increasing over a phase-one deal that might be ready for signatures in the coming weeks. Also in China, the central bank reduced the cost of one-year funds for banks in an effort to calm nerves about tightening liquidity. The yuan traded past 7 per dollar for the first time since August. OPEC slipPotential investors in Saudi Aramco's long-awaited IPO got something else to factor into their calculations this morning when OPEC slashed its estimates for the amount of oil it will need to pump in the coming years. The producer group expects demand for its crude to slide by about 7% over the next four years amid a flood of U.S. shale supplies. This could compel members, including Saudi Arabia, to reduce output even further from already agreed levels. In the market, crude remained steady as the recent rise on the back of trade optimism held. MiFID delayThe Securities and Exchange Commission announced that American securities firms will get a further three-year reprieve from Europe's tough investment research rules, saying it needs additional time to evaluate the measures. Relief granted from the rules in 2017 was due to expire in July of next year, so Wall Street banks now have a pass until 2023. Some brokerages have been in favor of adopting European rules in the U.S. as maintaining two separate business models is proving costly. Markets riseOvernight the MSCI Asia Pacific Index climbed 0.9%, while Japan's Topix index closed 1.7% higher as trade optimism dominated the gauge's first trading session of the week. Europe's Stoxx 600 Index was 0.1% higher at 5:50 a.m. Eastern Time as stocks in the region held on to yesterday's rally held. U.S. stock futures point to further record highs at the open, the 10-year Treasury yield was at 1.812% and gold slipped. Coming up…The U.S. September trade balance is published at 8:30 a.m. October services and composite PMI is at 9:45 a.m., with ISM non-manufacturing at 10:00 a.m. Today's Federal Reserve speakers are Richmond Fed President Thomas Barkin, Dallas Fed President Robert Kaplan and Minneapolis Fed President Neel Kashkari. Allergan Plc, Mylan NV and Newmont Goldcorp Corp are among the companies reporting earnings. What we've been readingThis is what's caught our eye over the last 24 hours. And finally, here's what Joe's interested in this morningI've been reading the 2014 book Fragile By Design by Charles Calomiris and Stephen Haber, which argues that a country's banking system will inevitably reflect its political system. The theory is that aspects of a country's politics (such as its degree of populism) explain the regular outbreak of banking crises (like in the U.S) while in others they're extremely rare (such as in Canada). One intriguing point made by Calomiris and Haber is that in authoritarian countries, bank valuations are inherently low because the government can't credibly promise not to raid the banks at some point in the future. If troubled times hit, and there's no rule of law, there's no mechanism preventing the government from expropriating value from shareholders, who's going to stop them? I've been thinking about this in the context of the forthcoming IPO of Saudi Aramco, which made a staggering $111.1 billion in profit last year, more than Apple, Google, and Exxon Mobile combined. Estimates for proper market value are all over the place, as Matt Levine explains here. Prince Mohammed had apparently wanted a $2 trillion valuation, though that seems unlikely. All kinds of considerations go into placing a price on a company, but one big question for investors will be the degree to which they are confident that they will get to keep future profits. The net-present value of a cash flow stream in any monarchy may be valued less than that same stream in a political system with a strong rule of law, checks, and balances that make profits more difficult to seize or tax away.  Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. |

Post a Comment