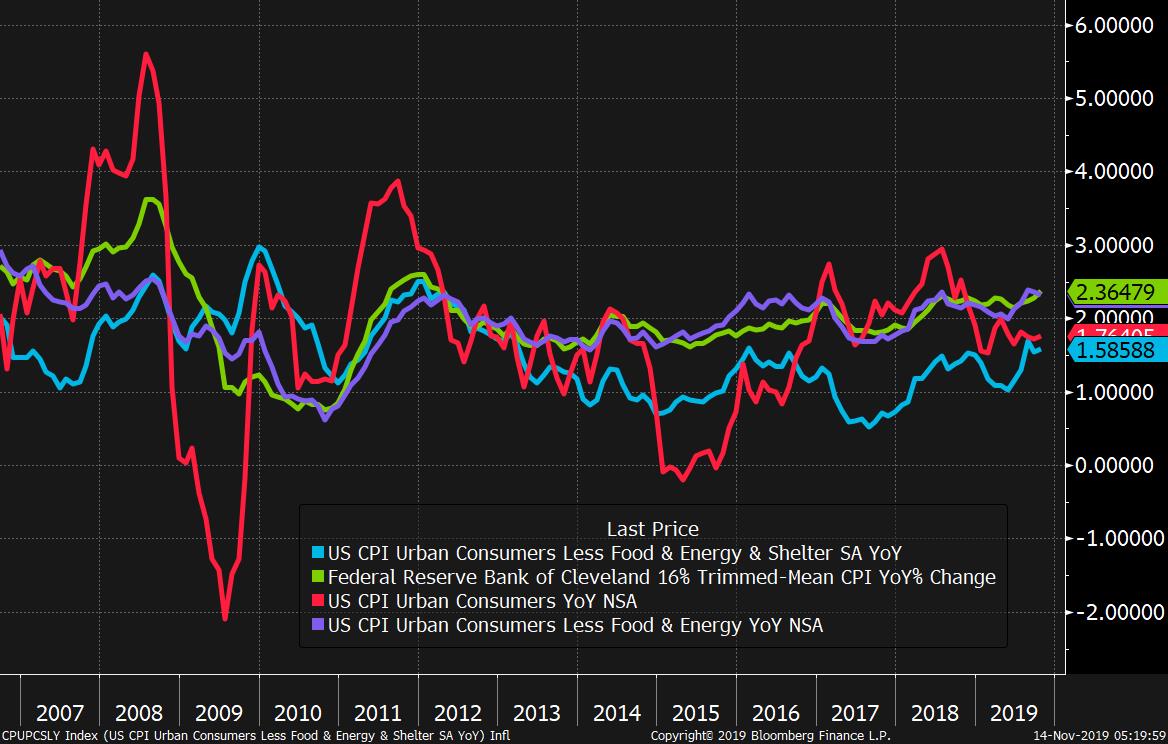

| Mixed global growth picture, impeachment hearings signal battles ahead, and Hong Kong unrest continues. Dodging recession Germany's economy eked out 0.1% growth in the third quarter, narrowly averting recession against expectations. Growth for the euro area was just 0.2%, as the manufacturing slump in the region's largest economy takes its toll. There were also signs of weakness in the latest figures from China: Industrial output and retail sales expanded less than forecast and fixed-asset investment dropped to the lowest since at least 1998. Economists are warning that China's economy may slow further, with the risk of job cuts likely to hit consumer spending. Everything continues to come down to a trade deal, progress on which does not seem to be going well at the moment. Impeachment The first day of public hearings in Washington brought to light some new details of the Trump administration's dealings with Ukraine. Republicans have sprung to the president's defense, calling the testimony hearsay and pointing out that none of the witnesses have first-hand knowledge of the critical calls between Donald Trump and Ukraine's leader. U.S. ambassador to the country Marie Yovanovitch is scheduled to give testimony tomorrow, with eight more witnesses on the calendar for next week. Hong Kong Confusion on Twitter compounded tensions in Hong Kong when China's state-owned Global Times used the social feed to warn of a curfew by the city's government this weekend and then deleted the message. The unrest is continuing to hurt the economy, with more and more cancelled events darkening the outlook. Concerns are also increasing about capital flight from the regional hub, as Hong Kong's money markets signal fears of vanishing liquidity. Markets mixed Disappointing data from China and Hong Kong's troubles weighed on the region's markets with the MSCI Asia Pacific Index slipping 0.5% overnight and the Hang Seng Index closing 0.9% lower. Things are quieter in Europe where the Stoxx 600 Index was down 0.1% by 5:45 a.m. Eastern Time in a session where automakers again came under pressure. S&P 500 futures pointed to little change at the open, the 10-year Treasury yield was at 1.85% and gold climbed. Coming up… At 8:30 a.m. producer price inflation data for October and the weekly jobless claims number are published. Fed Chairman Jerome Powell is in Congress for a second day of testimony. There are no fewer than eight regional Fed presidents speaking today, so keep an eye out for any hints at policy changes. Even Bank of Canada Governor Stephen Poloz makes an appearance later in San Francisco. Walmart Inc., Nvidia Corp. and Viacom Inc. report earnings. Today is also the deadline for 13F filings. What we've been reading This is what's caught our eye over the last 24 hours. And finally, here's what Joe's interested in this morning At his recent press conference, FOMC Chairman Jay Powell gave cheer to the bulls by saying that in order for the Fed to hike rates again, they'd need to see a "really significant move up in inflation that's persistent." Based on yesterday's latest CPI reading we appear to be far from any pickup like that, as core inflation actually ticked down sequentially on a year-over-year basis. But ever since that press conference, I've been wondering just how credible that claim really is, that the Fed won't hike again until inflation really gathers steam. After all, if you take this literally it looks like a departure from recent history, which saw multiple hikes to offset fairly mild consumer-price growth. Also, if you're waiting for inflation to actually happen before worrying, then you're throwing out all the models which attempt to anticipate inflation in advance. Discarding them may be a very good thing, but it's still a departure. Furthermore, Powell's comment about waiting for this inflation came halfway through the speech, so it didn't seem like he was making a priority to get this message across. University of Oregon Professor and Bloomberg Opinion contributor Tim Duy wrote a good piece last week, reminding people that the Fed has made rapid policy pivots in the past, and there's no reason they can't do so again if the economic conditions turn brighter. For now it feels like the Fed is out of the picture, and that investors can focus on trade and whether there really is a trough or rebound in the global economy. But if things keep getting better, we'll see if Powell & Co. can really sit on their hands.  Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. |

Post a Comment