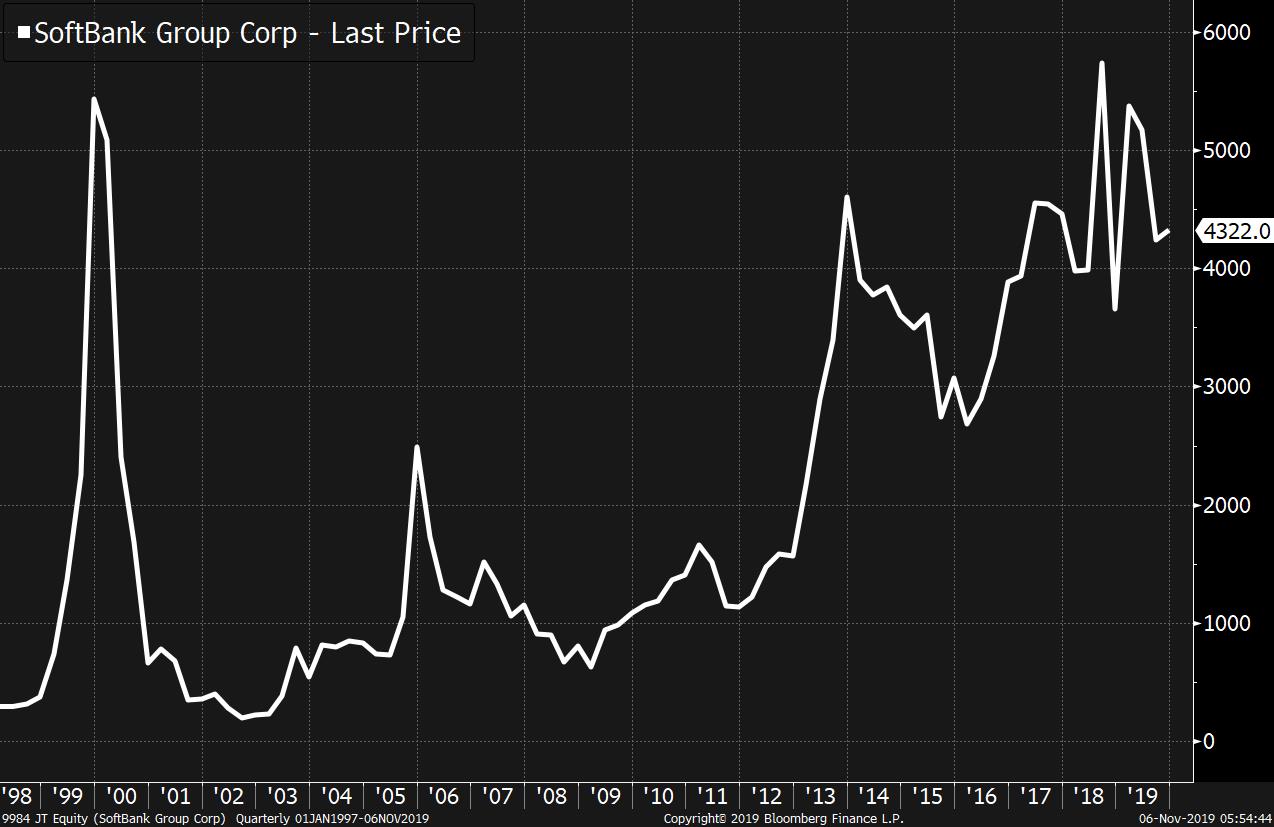

Trump's impeachment defense takes a knock, euro-area economy stays near stagnation, and some big corporate news. Quid pro quoTranscripts of Gordon Sondland's testimony to House impeachment panels undermine the assertions by President Donald Trump and his allies that there was nothing unusual about the administration's contacts with Ukraine. Sondland, a Trump donor serving as ambassador to the European Union, testified that by early September he presumed that withholding $400 million of aid was tied to getting Ukraine to announce an investigation into Joe Biden's son's activities in the country. There was also bad news for the president in off-year elections in Virginia where Democrats seized control of both houses of the legislature from Republicans for the first time in 26 years. StagnationThe IHS Markit composite Purchasing Managers' Index for the euro area edged up to 50.6 in October, showing growth prospects for the common currency region remain in the doldrums. While the biggest drag on the reading continues to be German manufacturing, there were some early signs of improvement in factory orders data this morning. The stand-out performer is France, with the country's progress particularly stark when compared to its larger neighbor. M&A?Xerox Holdings Corp. is considering a cash-stock offer for the $27 billion PC giant HP Inc., according to a report by the Wall Street Journal. It is unclear how Xerox would fund the acquisition of a company several times its market value, but the board did decide recently to sell its stake in Fuji Xerox for $2.3 billion. Elsewhere, Walgreens Boots Alliance Inc. is looking at a potential deal to take the company private in what could become the largest leveraged buyout in history. Markets quietWithout any new trade developments to give extra impetus to the rally, markets are having a quiet session. Overnight, the MSCI Asia Pacific Index slipped 0.1% while Japan's Topix index closed broadly unchanged. In Europe, the Stoxx 600 Index was down 0.1% at 5:45 a.m. Eastern Time. S&P 500 futures pointed to a flat open, the 10-year Treasury yield was at 1.846% and gold was slightly higher. Coming up…Dallas Fed President Robert Kaplan yesterday said that he sees the steepening yield curve as a sign monetary policy is in the right place. Today we hear from Chicago Fed President Charles Evans, New York Fed President John Williams and Philadelphia Fed President Patrick Harker. In oil news, the EIA releases its crude investory report at 10:30 a.m. while Brazil is set to auction oil prospects in giant offshore fields. Earnings today come from Qualcomm Inc., CVS Health Corp, and The New York Times Co., among many others. Also keep an eye on Uber Technologies Inc. shares, with the lockup period ending today possibly leading to a flood of shares in the ride hailing giant hitting the market. What we've been readingThis is what's caught our eye over the last 24 hours. And finally, here's what Joe's interested in this morningSuddenly you can't avoid hearing people talk about how important profits are. After Softbank reported dismal earnings last night, its CEO Masayoshi Son said that a lesson learned from the WeWork debacle is that companies need to have a clear path to profits. Goldman Sachs CEO David Solomon said the same thing in a Bloomberg TV interview yesterday, telling Matt Miller, "It's important for people to grow, but there's got to be a clear and articulated path to profitability." And of course in public markets, there's been a reckoning for companies with uncertain prospects of making money. Making (and saving) money, of course, is a good thing except that one company's expenditures are another revenue. While WeWork prioritizes cash preservation, it's been retrenching or considering retrenching in cities like Hong Kong, Dublin, and London. So that means property owners take a hit, and so on. All that being said, you have to be impressed with the markets here. If you had known at the start of 2019 that several major IPOs would be a disaster (or not even happen) and that some of the most popular growth names in the market would fall out of bed (like several of the SaaS names), you probably would not have guessed that U.S. stocks would be at all-time highs. For now at least, while obviously some entities lose out when everyone is focusing on profits, it looks like there's no wider economic spillover.  Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. |

Post a Comment