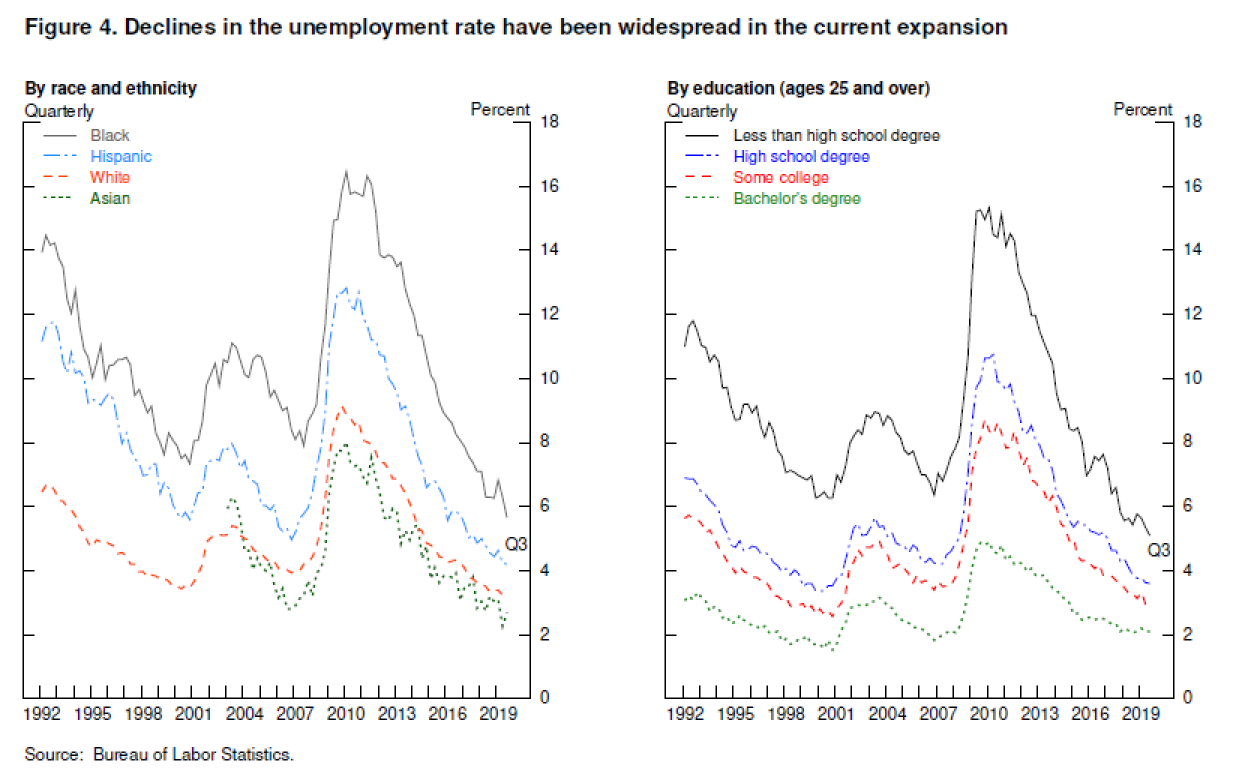

| Phone call points to progress on trade deal, Powell is a glass-half-full guy, and Hong Kong calm may be short-lived. Reaching consensus Chinese and U.S. top trade negotiators held another phone call this morning Beijing time in which consensus was reached on properly resolving issues holding up the phase-one trade deal, according to a Chinese Ministry of Commerce statement. Should they fail to reach an agreement by Dec. 15, President Donald Trump will have to decide whether to carry out his threat of further tariffs on the Asian nation. Market reaction to the statement has been muted, with Rabobank strategists including Richard McGuire writing that markets now view positive announcements with "healthy skepticism given how long this has dragged out." Optimistic Federal Reserve Chairman Jerome Powell signaled interest rates would probably remain on hold, saying that he sees "the glass as much more than half full." He restated his well-worn caveat that interest rates are not on a preset course, and the Fed would adjust if there were a "material" change to its outlook. Investors and economists meanwhile are touting a further steepening of the yield curve in their hot 2020 trades for Wall Street. No concessions Despite the huge victory for pro-democracy candidates in the weekend election, Hong Kong leader Carrie Lam did not make any new concessions to protesters in her first weekly press briefing since the vote. She restated her September proposal for community dialogue, with many predicting her failure to move will lead to more violence. A team searching the Hong Kong Polytechnic University, the site of much of the recent violence, only found one person hiding on the premises. Markets drift Global stock markets seem to be treating the latest trade news with something of a "boy who cried wolf" attitude. Overnight, the MSCI Asia Pacific Index rose less than 0.1% while Japan's Topix index closed 0.2% higher, easing from an early-session 13-month high. In Europe, the Stoxx 600 Index was broadly unchanged at 5:50 a.m. Eastern Time after hitting the highest level since 2015 in yesterday's trade. S&P 500 futures also point to very little change at the open, the 10-year Treasury yield was at 1.745% and gold was higher. Coming up… U.S. October wholesale inventories data is released at 8:30 a.m., with September house prices at 9:00 a.m. Both consumer confidence and home sales are expected to show improvement when they are published at 10:00 a.m. Fed Governor Lael Brainard is due to speak in New York. Earnings today have a tech theme, with VMware Inc., Dell Technologies Inc., HP Inc. and Analog Devices Inc. all announcing results. What we've been reading This is what's caught our eye over the last 24 hours. And finally, here's what Joe's interested in this morning Fed Chairman Jay Powell gave a speech last night in Rhode Island, and it probably won't get a lot of attention because it didn't say a whole lot new about the current state of monetary policy and it didn't move the market. But you should still check it out and read the last third of the speech under the section 'Spreading the Benefits of Employment' where he talks about the positive social impact of a sustained expansion that provides work for more people. As he notes, because the expansion has gone on as long as it has, we've seen major gains in the unemployment rate among minorities, the disabled, and people who don't have degrees. Crucially, he's not declaring victory. "But as the people at our Fed Listens events emphasized, this is just a start: There is still plenty of room for building on these gains. The Fed can play a role in this effort by steadfastly pursuing our goals of maximum employment and price stability," said Powell. It's in that context that you should check out the recent Bloomberg News article from Matt Boesler about the work that Neel Kashkari and the economist Abigail Wozniak are doing at the Minneapolis Fed, exploring how monetary policy can be used to fight inequality. Previously the conventional wisdom was that monetary policy could only have a cyclical effect. But think about the long-lasting benefits of a strong labor market: Employers pay for training, which naturally happens more when businesses have to compete for workers, and companies employ people who would otherwise be marginalized. It's therefore intuitive that there are real, structural benefits to making sure the labor market is tight and that the expansion lasts.  Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. |

Post a Comment