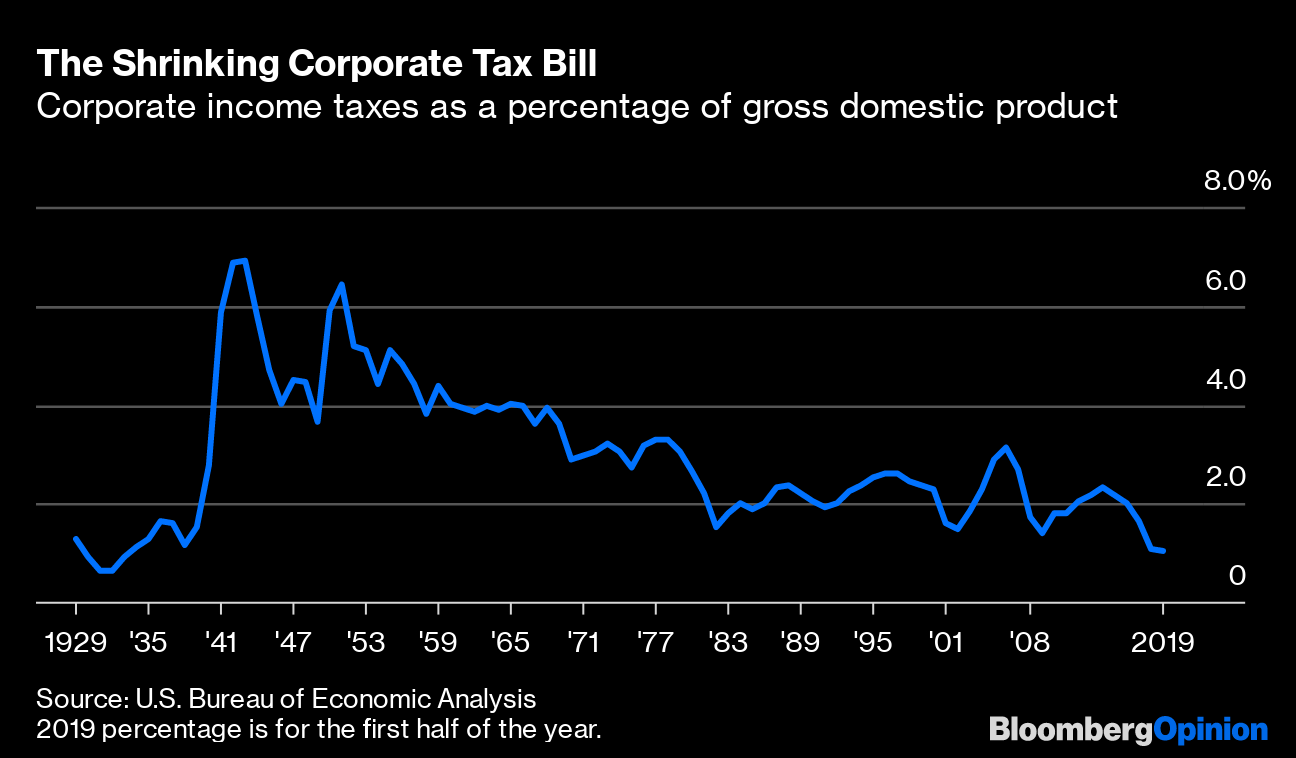

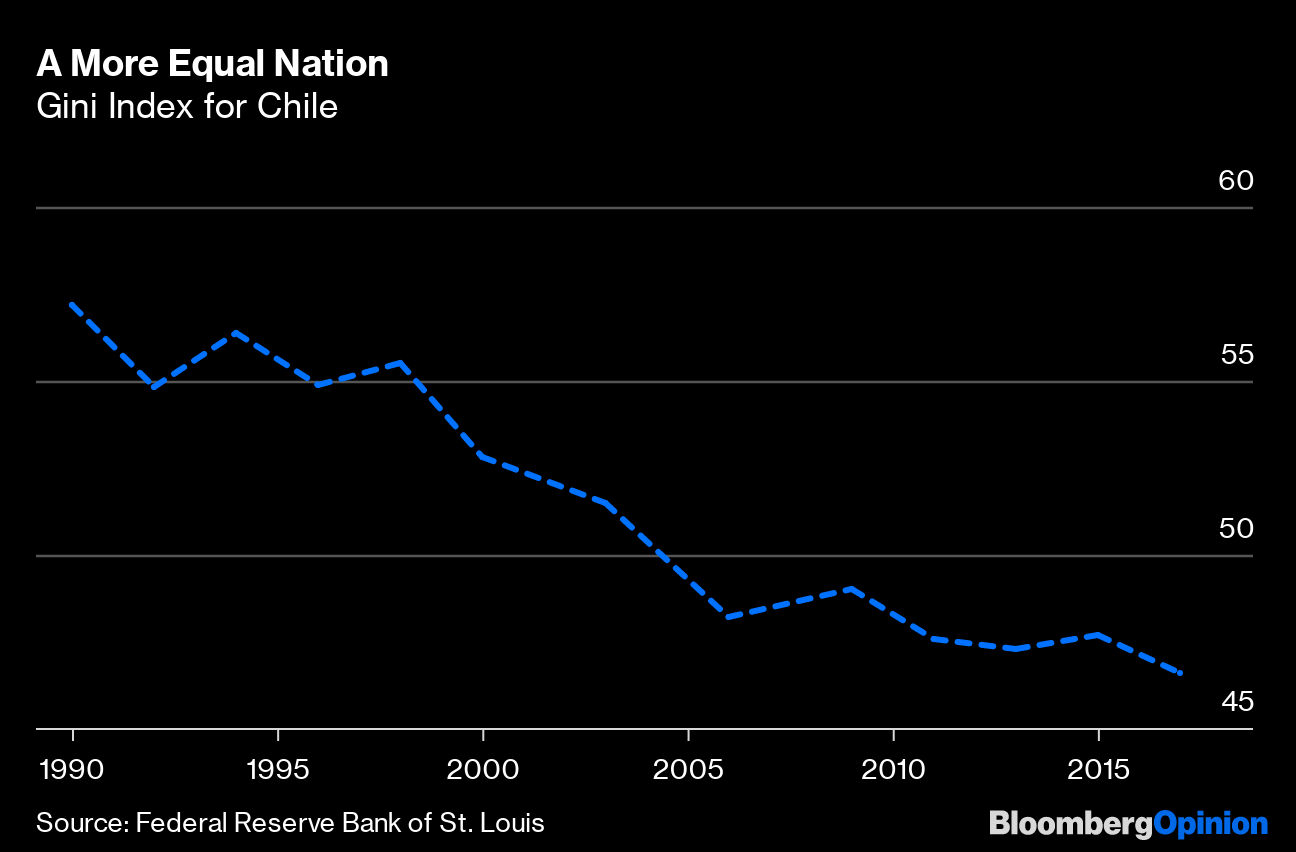

| This is Bloomberg Opinion Today, a mashup of Bloomberg Opinion's opinions. Sign up here. We're looking for your feedback to help improve this newsletter. Please follow this link to our survey, which will take only a few minutes. Today's Agenda  Trump Takes Pages From China's Playbook When fighting a war, knowing your enemy is important. Becoming your enemy is a bit self-defeating. But President Donald Trump keeps displaying some of the least-desirable traits of his primary trade-war enemy, China. Yesterday, for example, we learned he wants final say over U.S. automakers' supply chains as part of his NAFTA replacement deal, USMCA. This is just the sort of government control and favoritism for which people rightly criticize China, writes Brooke Sutherland. It would raise costs for automakers and put them at risk of becoming political footballs. Amazon.com Inc. already knows how it feels to get kicked around. The company was once the favorite to win a Defense Department cloud-computing contract. But then it unexpectedly lost to Microsoft Inc., which lacks Amazon's cloud-computing chops, notes Joe Nocera. It will not shock you to learn Trump repeatedly grumbled about Amazon getting the contract, part of his tireless crusade against the company owned by Jeff Bezos, who also owns the Washington Post, which routinely makes Trump angry. Maybe you're a former bookseller or retailer or Amazon warehouse worker and find it hard to muster a tear for Bezos. But Trump routinely plays politics with Corporate America, Joe notes. He's eroding faith in the government's ability to be a fair referee and making it harder for companies to do business. He's also undermining his own argument for the trade war. Further Corporate-Woe Reading: The Fed Would Like to Stop Cutting Rates Now As widely expected, the Federal Reserve cut interest rates again today, but also suggested it was headed for the showers after cutting rates three times this year. Chairman Jerome Powell said Fed policy was in "a good place," not to be confused with The Good Place. Time will tell if it has done enough to avoid a recession, but the bond market seems content with the Fed standing pat for now, notes Brian Chappatta. Then again, merely avoiding a recession isn't enough for the Fed, argues Karl Smith. The central bank still routinely fails to meet its stated target of 2% inflation. So why doesn't it just keep cutting rates until all the slack is gone from the labor market and inflation rises? Further Interest Rate Reading: Wall Street doesn't realize low rates and low inflation aren't always the experiences of Main Street Americans. — Brian Chappatta Don't Believe the Brexit Calm It was an unusually quiet day on the Brexit front, with parliamentary wrangling giving way to praise for the retiring John Bercow. But don't let the calm fool you: Contrary to what Prime Minister Boris Johnson may believe, the upcoming election may not offer a clear way out of the Brexit impasse, warns Bloomberg's editorial board. As John Authers notes, the election only raises the level of uncertainty around Brexit, with wildly divergent outcomes still possible. Johnson sought the election, but his predecessors can tell him how easily elections can backfire. Bonus Editorial: Alberto Fernandez must resist the pull of left-wing populism and find real solutions to Argentina's economic disaster. (Mac Margolis's idea: Adopt the dollar.) India's Taking the Wrong Economic Medicine India's economic slowdown has politicians there pushing for more protectionism, but this is exactly the wrong response, warns Bloomberg's editorial board. What the country needs is more trade and to update its economy, both of which could be helped a lot by joining 15 other major Asian economies in the Regional Comprehensive Economic Partnership. In another self-defeating policy mistake, India is trying to milk its major telecom companies for cash they really don't have, while also pummeling them with low-cost competition, notes Mihir Sharma. Telecom has been a backbone of Indian industry, and the government's attacks belie its claim that it wants to make India a hotbed of entrepreneurship. Telltale Charts Maybe it's not so crazy to expect the rich and corporations to pay more in taxes, writes Justin Fox. They've done it before, and we can close loopholes that help them avoid paying.  Chile may be a victim of its own success, writes Noah Smith; decades of improvement have stalled lately, disappointing raised expectations.  Further Reading The NCAA's surrender on paying college players for the use of their name, image and likeness is just the first step to paying all players. And no, it won't ruin college sports. — Joe Nocera Trump's impeachment isn't just about Ukraine evidence, which is bad enough, but the whole political context; and that should worry him. — Jonathan Bernstein Trump supporters' attacks on Lt. Col. Alexander Vindman fit a long, shameful, wrongheaded tradition. — Leonid Bershidsky Peugeot SA could be a good fit with Fiat Chrysler Automobiles NV. — Chris Bryant Though Fiat may need a sweetener to make the deal a true merger of equals. — Chris Hughes TikTok owner ByteDance may want to hurry up with its IPO before the political heat on it gets too hot. — Tim Culpan Medicare for All would almost certainly cut access to health care. — Ramesh Ponnuru There's a psychological reason we're so quick to think other people are lying. — Sarah Green Carmichael ICYMI Twitter Inc. is banning political ads. Wall Street says Elizabeth Warren will kill stocks, just like Trump and Obama did. Here are New York's six best non-Peter Luger steakhouses. Kickers One-legged man makes amazing Halloween costumes. (h/t Scott Kominers) Evolution explains why our brains love to hear screams. (h/t Mike Smedley) America's sex recession could lead to an economic one. Ten horror shows to stream this Halloween. Note: Please send screams and complaints to Mark Gongloff at mgongloff1@bloomberg.net. Sign up here and follow us on Twitter and Facebook. |

Post a Comment