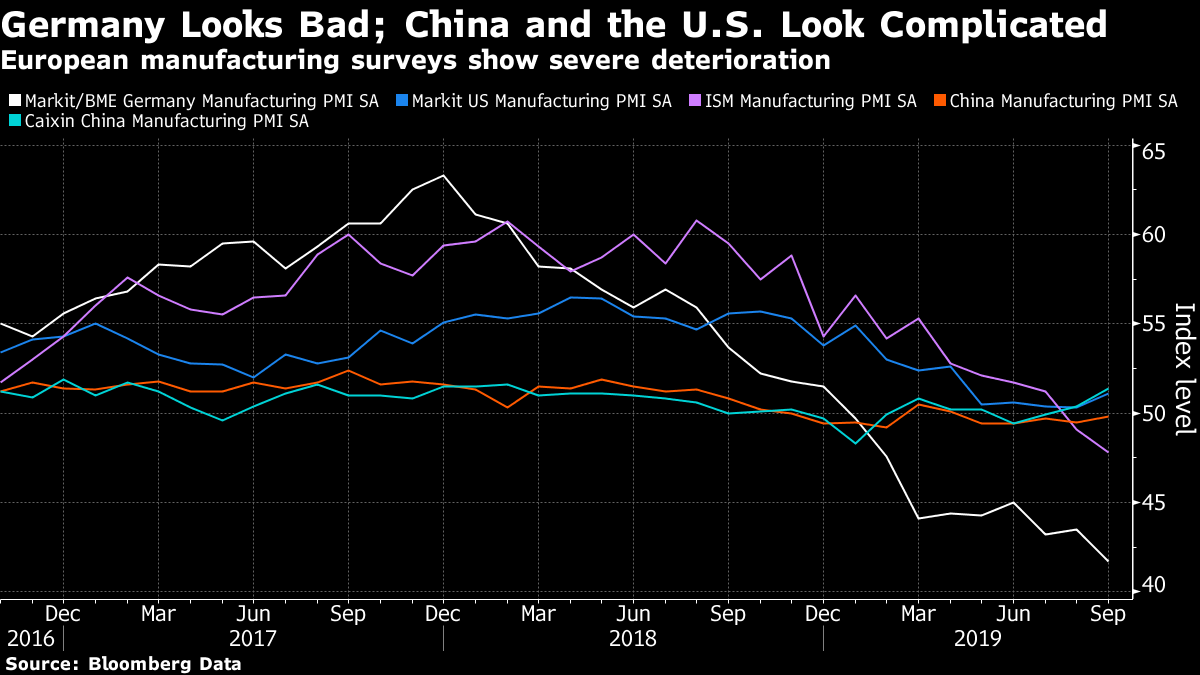

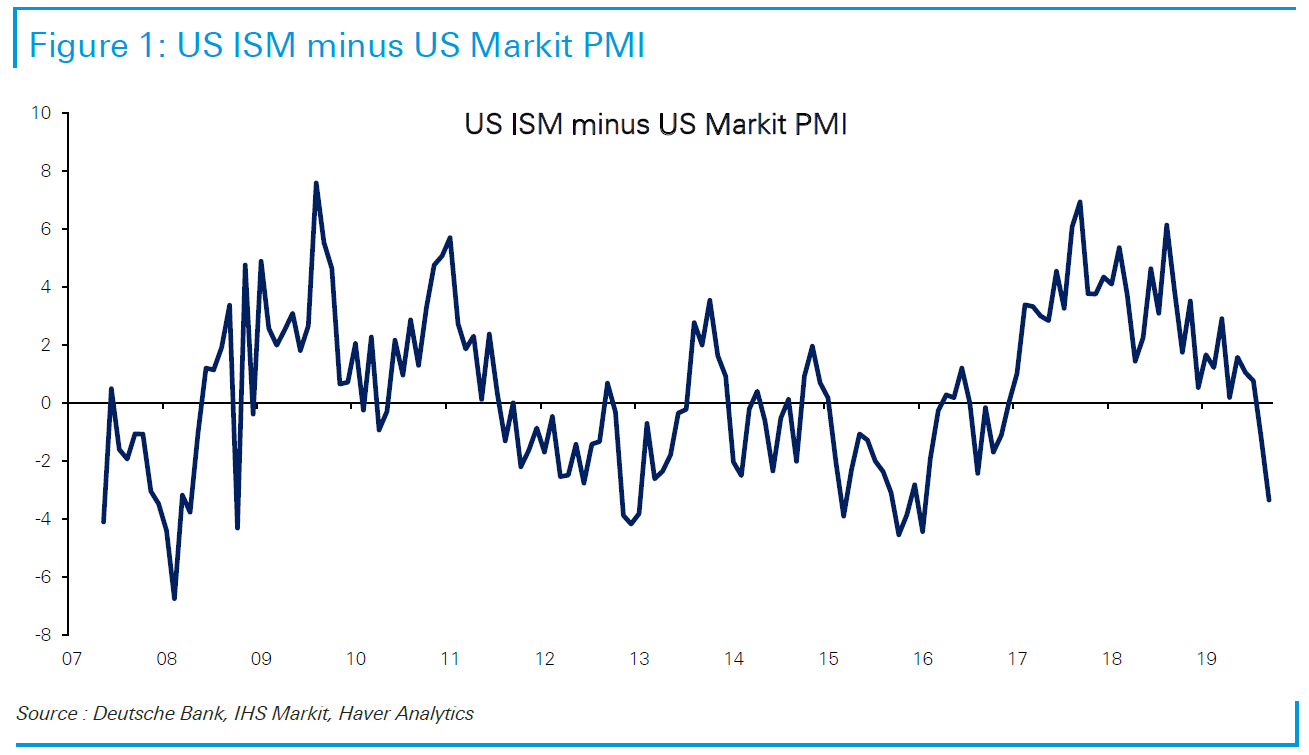

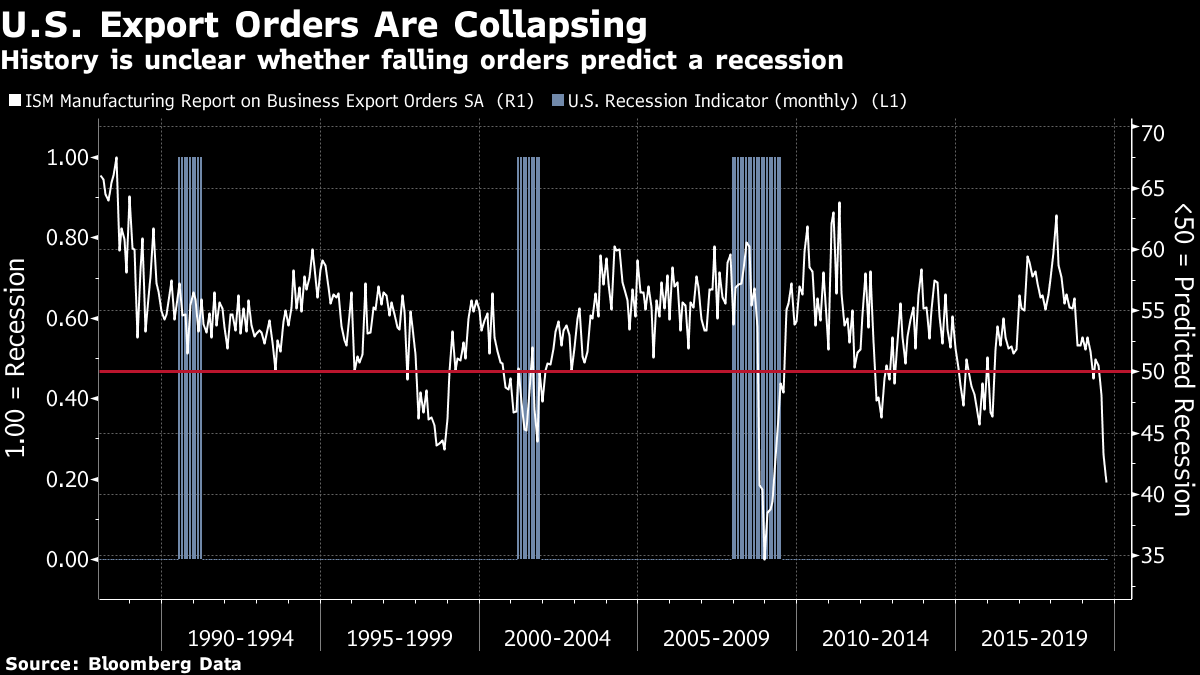

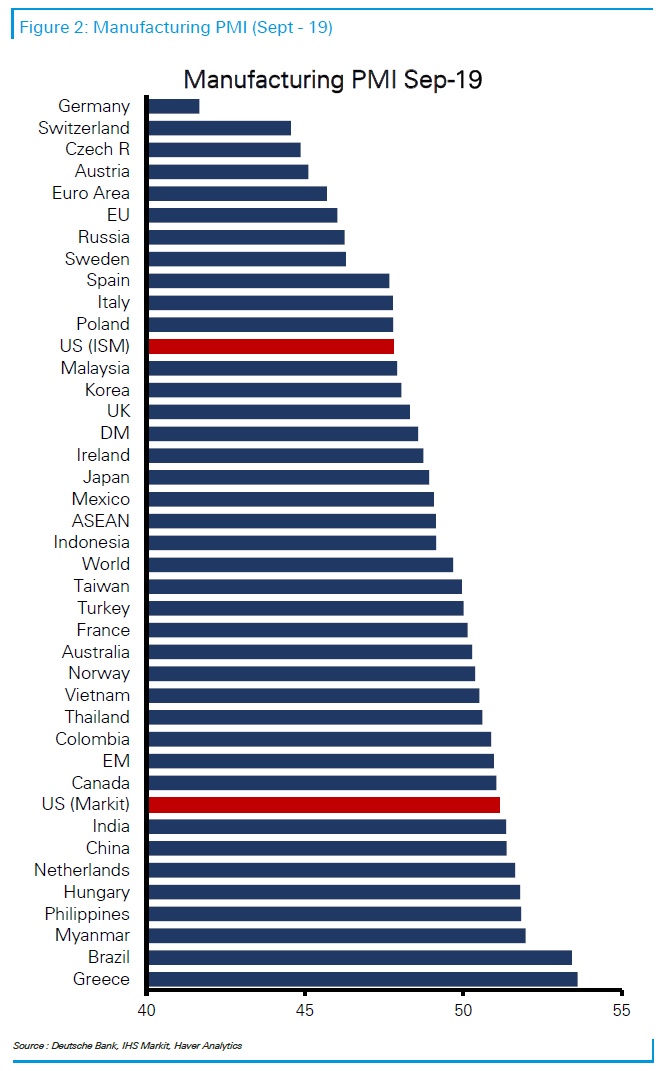

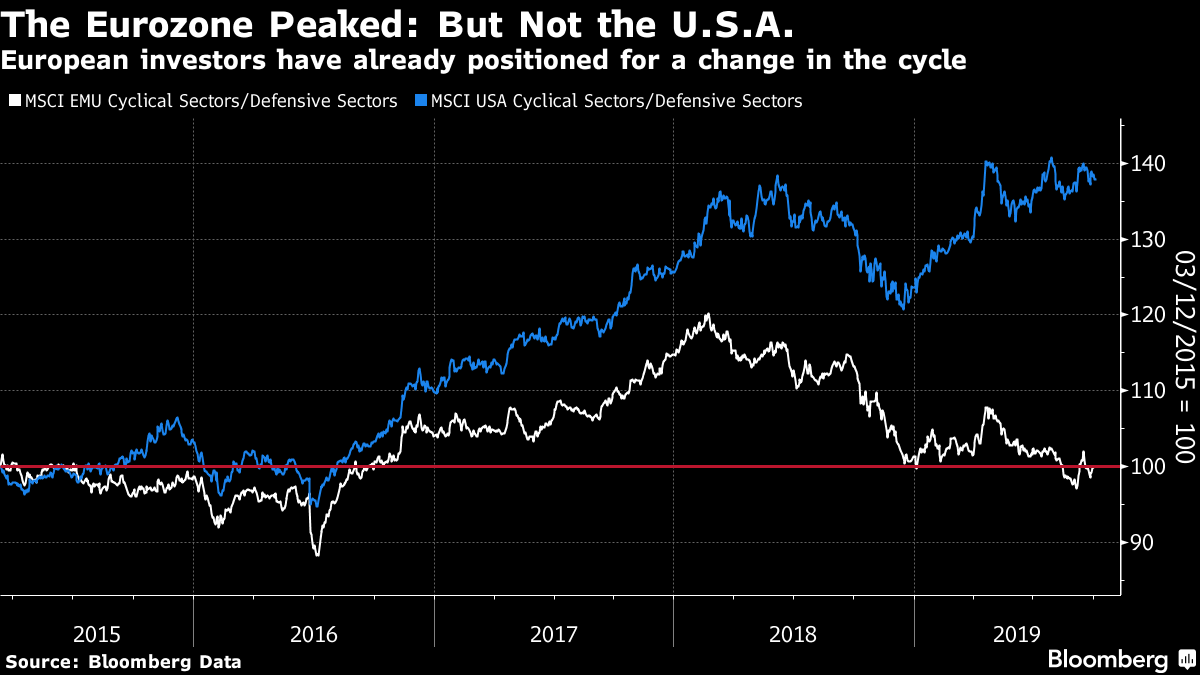

Jurassic Stock Markets This is a time when only a dinosaur analogy will do. Equity markets around the world are suddenly moving to price in the alarm about slowing global growth that has been evident in bond markets for many months. Why? Jeremy Grantham, the founder of Boston-based GMO, likened the stock market to a dinosaur with a tiny brain: "As yet the equity market seems totally unaffected, with volatile and risky stocks still making the running. Although the brontosaurus has been bitten on the tail, the message has not yet reached its tiny brain, but is proceeding up the long backbone, one vertebra at a time." This comment beautifully encapsulates what is now happening. What is alarming is that Grantham didn't say that this week or even this year. He made this remark way back in July 2007 at a point when we now know the financial world was about to tip into crisis. Of many people I spoke to at the time for a piece you can find here, he proved to have by far the greatest foresight. What has bitten the brontosaurus's tail this time? The most obvious culprit was the ISM supply manager survey data that came out earlier this week. The numbers for German manufacturing were undeniably terrible. The numbers for the U.S. and China, which are both covered by two rival surveys, were ambiguously bad. Nothing in the numbers was cause for comfort:  The two surveys of China show its manufacturing sector close to the level of 50, which is meant to show the difference between recession and expansion. There are always graver doubts over data from China than for other countries, but at least they do not show marked deterioration. In the U.S., the Institute of Supply Management's number is diving into recessionary territory, while the rival number produced by Markit is above 50. The problem here, as shown by this chart from Deutsche Bank's Alan Ruskin, is that the ISM survey is more variable, and tends to undershoot Markit when times are genuinely bad:  The most alarming element of the data, as pointed out by Ruskin's colleague Torsten Slok, is that new export orders are in a true collapse. Since the series started in 1988, they have been worse only during the toughest months of the Great Recession. However, the U.S. economy isn't as sensitive to exports as other big industrial nations, such as Germany (which is particularly vulnerable to the latest round of trade hostilities), so this worrying number isn't a clear recession warning:  All ISM surveys are set with 50 as the dividing line for a recession, so they enable comparisons. This chart, from Deutsche Bank's Ruskin, suggests the world as a whole could be in much worse shape, but that Germany and the countries around it appear to be in imminent danger of a recession:  These data helped shift sentiment in the rates market. Fed funds futures now price in another 25-basis-point rate cut at the end of this month, while a fourth reduction this year, in December, is now viewed as 50-50. That is justified both by the manufacturing data, and by moves in the bond market. The 10-year inflation break-even for the U.S. has traded below 1.5% in each of the last three days. It had not previously been this low since the brief scare that followed the Brexit referendum in the summer of 2016. On its face, this is a clear warning that investors are braced once again for the U.S. to turn Japanese.  But now Grantham's brontosaurus raises its ugly head. If we look at MSCI's index of the more cyclical U.S. sectors compared with its gauge of more defensive sectors since 1999, we see that cyclicals are performing as well as they have ever done in that period, bar the dot-com bubble. They appear to be touching a plateau, but they haven't started to fall.  The EU isn't like this. MSCI has run similar indexes for the euro zone since March 2015. In that period, cyclical stocks have outperformed more in the U.S. than in Europe, which is no surprise as American cyclical stocks include recent stock market darlings like Amazon.com Inc., Apple Inc. and Google's parent Alphabet Inc. But the difference between the two charts is still remarkable. Cyclicals peaked at the turn of 2018 in Europe, just as the German ISM was reaching a high, and have since erased all their outperformance since 2015. But U.S. cyclicals went on a fresh tear after their Christmas Eve scare:  So it looks as though the American brontosaurus has some pain ahead – although this doesn't necessarily mean that the market will unravel as it did in 2007. Stock market dinosaurs will now be more anxious than before about Friday's employment data. Brexit Breaks It Amid a bad day for world stocks, Britain stood out. Wednesday's sell-off was the worst in percentage terms since the day after the referendum in 2016:  Why? Multinationals such as BP Plc and Royal Dutch Shell Plc led the selling. But it was still a bad day for U.K. stocks relative to FTSE's index for the world excluding the U.K. The U.K.'s manufacturing sector appears to be in better shape than industry across the Channel, despite concerns over Brexit. So it's interesting that confidence continues to evaporate:  The day's big British news was the latest proposal from Boris Johnson to break the logjam. The prime minister's suggested compromise on the Irish border was poorly received in Brussels, albeit not rejected out of hand. However, it seems to have ended any great hope that he could somehow reach a negotiated deal to leave the EU by the end of this month. According to the Predictit prediction market, the chances of exiting on schedule were as high as 58% back in August, when Johnson appeared to be in control of the situation. Those odds dropped on Wednesday to 23%. The issue of Ireland, still largely absent from the debate in the U.K., remains intractable. (For an explanation of why, I recommend A Short History of Brexit by Kevin O'Rourke.) That implies that the agony of indecision will be extended yet further. And the carnivorous dinosaurs driving the U.K. market seem much more alert to the danger than their herbivorous American cousins. Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment