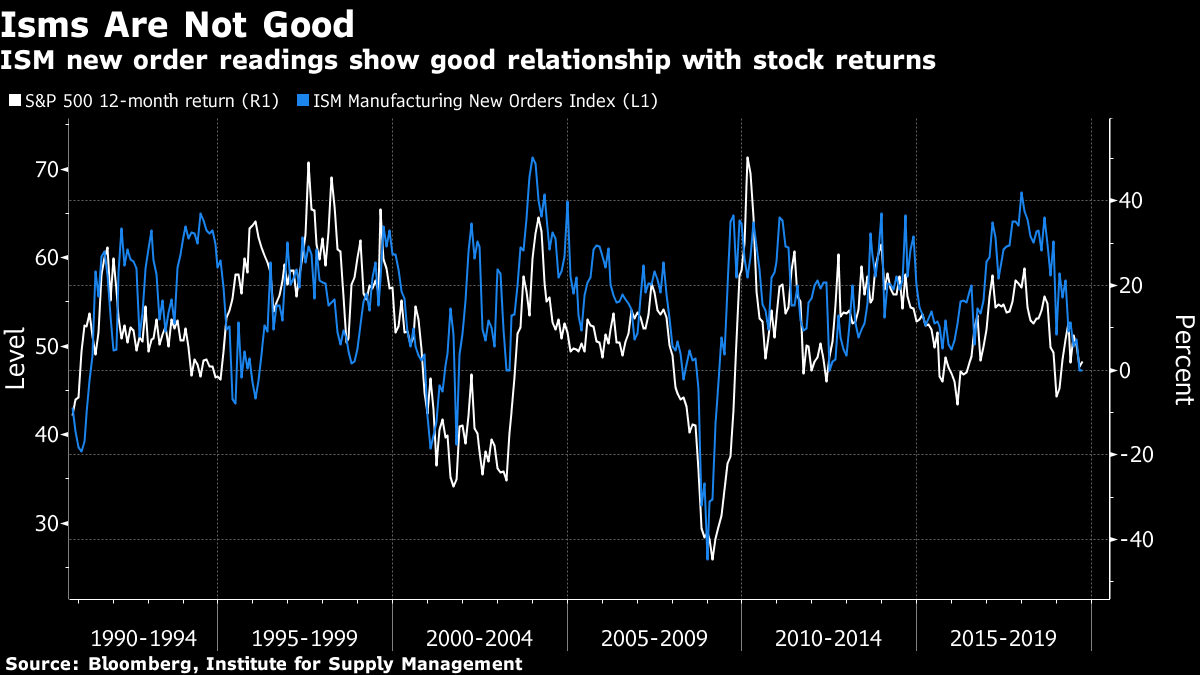

| More bad signs in the market, increasing tension in Hong Kong, and an onion crisis in India. Here are some of the things people in markets are talking about today. Slowdown Fears Good news is hard to come by in markets right now. The S&P 500 has suffered its first back-to-back drops of more than 1% this year and questions are floating about recession, after U.S. private payrolls fell short of expectations Wednesday, and a key U.S. manufacturing gauge dropped to the lowest in a decade and car sales sank a day earlier. Meanwhile, investors are getting tetchy over the fact that the stock market hasn't budged for almost two years, after the S&P 500 losses just undid weeks and months of progress. Elsewhere, Hong Kong retail sales suffered a record slump in August, while Kyle Bass has predicted a "severe" economic decline there. Markets to Slide Asian stocks looked set to follow U.S. stocks down amid increased concerns about a global slowdown. Futures pointed lower in Japan, Australia and Hong Kong, with markets in China and South Korea closed for holidays. The 10-year Treasury yield fell for a fifth straight day to 1.6% on U.S. hiring numbers. The yen rose versus the dollar and gold spiked above $1,500. Elsewhere, oil fell to the lowest level in almost two months after swelling inventories in the world's biggest economy added to a pessimistic and weakening economic backdrop. Shooting Anger Tensions in Hong Kong are probably going to escalate, if the words of protest organizers are anything to go by. The Civil Human Rights Front will plan "large-scale mobilization" to respond to an escalation of use of force by police which ended in one teenage demonstrator being shot at close range on Tuesday, according to a Facebook post. The incident could now help drive momentum for the protests until local elections in November — the next big date on the city's political calendar. Demonstrators hit the streets again on Wednesday, following the release of the violent images of the shooting, which also show the protester striking the police officer with a metal rod. Onion Crisis Onions may seem like an unlikely source for controversy, yet here we are. In India — where the vegetable is as ubiquitous in cooking as spices — prices surged more than 200% in September from previous months. Heavy monsoon rains are being blamed for damaged crops and reduced supplies. The government has banned onion exports and is cracking down on hoarding to lower prices, angering farmers who took to the streets on Monday in protest. Meanwhile, India's worsening banking problems are adding a new layer of complication to the central bank's monetary policy as it looks to spur economic growth. The Reserve Bank of India is set to lower its benchmark repurchase rate for a fifth time this year on Friday, days after it reassured the public that the banking system is "safe and stable." It also recently imposed withdrawal curbs on a small bank and lending restrictions on another lender. This Or Nothing: Johnson Boris Johnson told the European Union to compromise on the controversial backstop arrangement or watch the U.K. walk away from Brexit talks. Under the British prime minister's latest proposal, Northern Ireland would remain in regulatory alignment with the EU for agricultural products and manufactured goods, but would be able to exit the arrangements if it wanted following a vote every four years. Johnson's plan includes enough compromises to keep the EU at the negotiating table, but European Commission President Jean-Claude Juncker said it had "problematic points." On Thursday, Johnson will start the work of winning support in Parliament for a deal that, until recently, would have been rejected both by Brexit hardliners in his own Conservative Party and by members of Parliament from Northern Ireland. What We've Been Reading This is what's caught our eye over the past 24 hours. And finally, here's what Cormac's interested in this morning Another beginning to a month, another wave of unexpectedly poor manufacturing indicators. This time it was the U.S. ISM that took the headlines. The factory index fell to the lowest since June 2009, missing all estimates in a Bloomberg survey that was looking for a rebound. Similar reports in Germany, Spain and Italy all showed manufacturing activity contracting. Stocks in Europe and the U.S. headed south in sympathy.  While many strategists have pointed out that equities have done OK through previous episodes of ISM weakness, it's fair to argue that it at least has to signal some risk to earnings — particularly at a time of elevated economic uncertainty. But it also suggests an even greater market focus on services indicators, given the argument that manufacturing has become a much smaller part of developed economies. That means any sign the current manufacturing weakness is spilling over into services would likely kick off a much bigger slide. Cormac Mullen is a Cross-Asset reporter and editor for Bloomberg News in Tokyo. The best in-depth reporting from Asia Pacific and beyond, delivered to your inbox every Friday. Sign up here for The Reading List, a new weekly email. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. |

Post a Comment