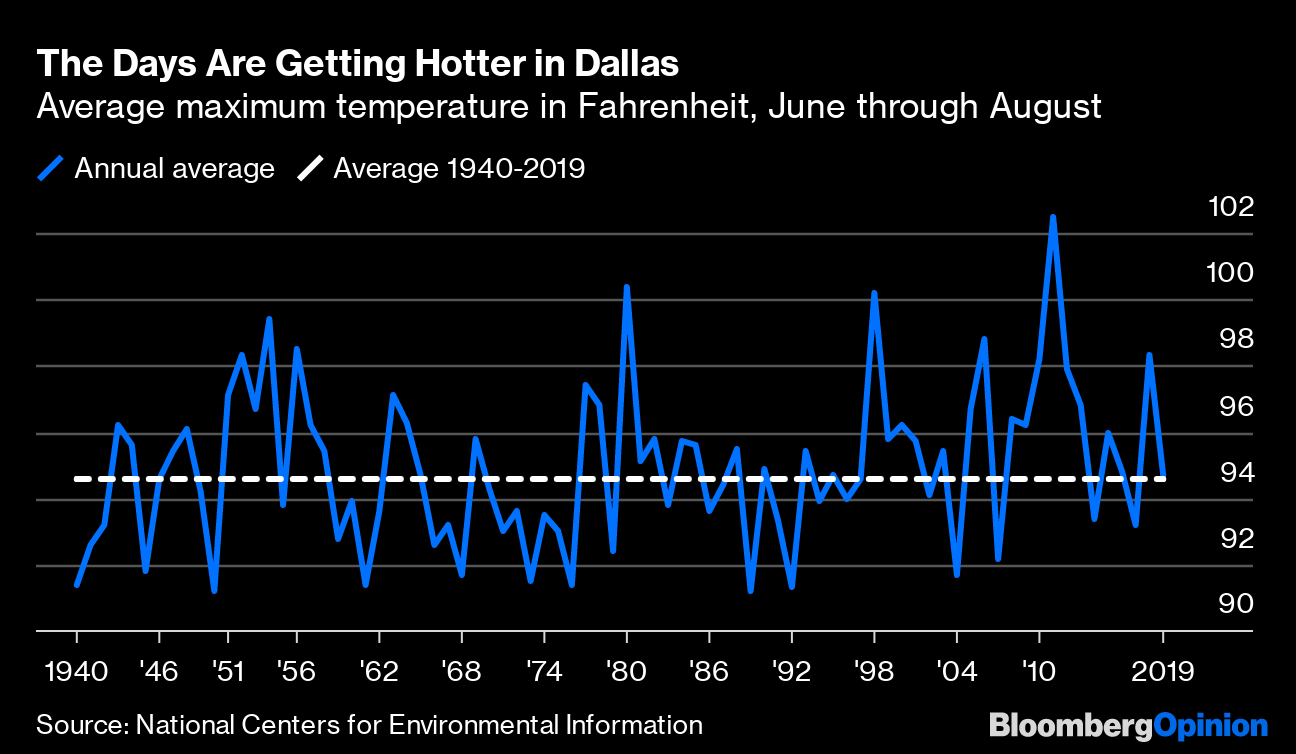

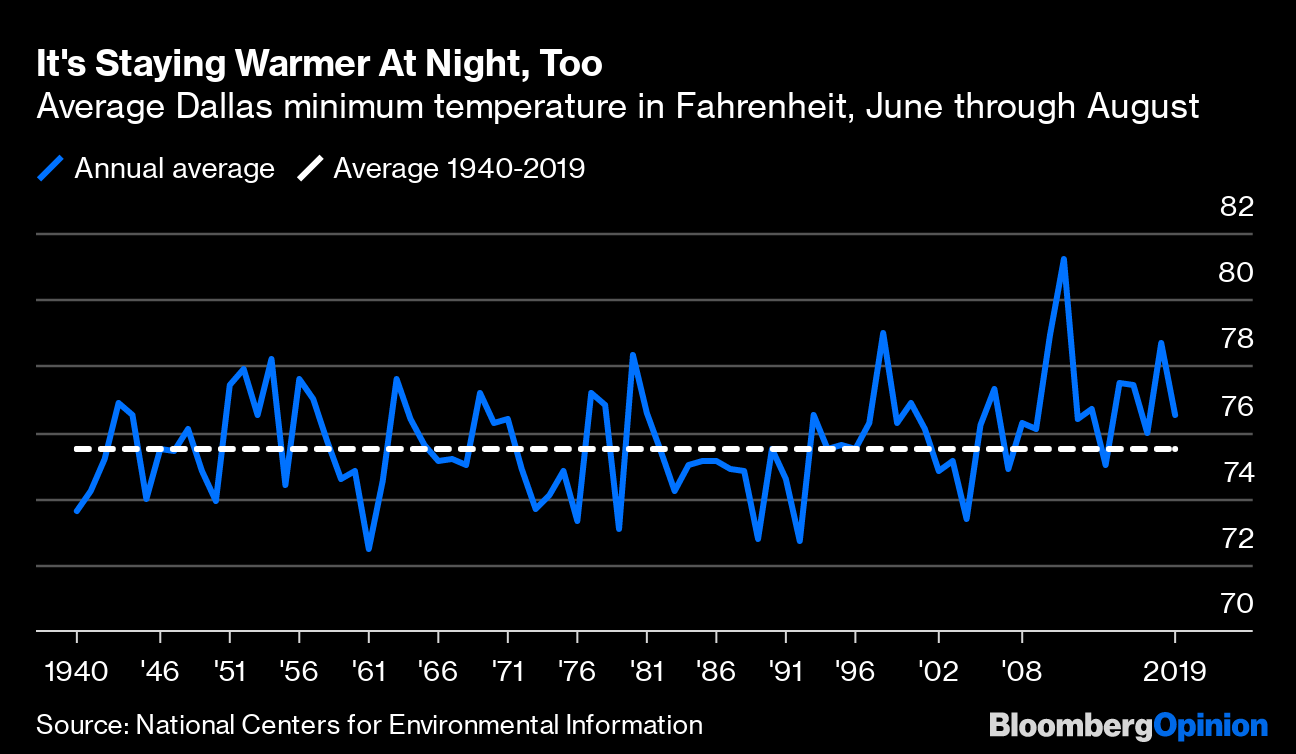

Today's Agenda  Recession Flag Puts Fed, GE, Nation on Alert In June 2009, General Electric Co. was worth about $140 billion and the U.S. economy and factory sector were digging out of a deep hole. A decade later, GE's value has been cut nearly in half, and the economy is on the cusp of falling back into that hole. The Institute for Supply Management today said its index of U.S. factory activity fell to its lowest level since June 2009, which also happens to mark the technical last month of the Great Recession. Manufacturing is just a small part of the U.S. economy, so this doesn't mean it's time to raise the Recession Alert level to DEFCON 1. Still, it probably means the Federal Reserve will have to cut interest rates yet again when it meets later this month, just weeks after suggesting it really didn't want to, writes Brian Chappatta. The best-laid plans and all that. This also makes for a bittersweet anniversary for GE CEO Larry Culp, who took over the former American corporate icon a year ago today, notes Brooke Sutherland. His task was to stop the company's bleeding and make the tough decisions necessary to restore GE's credibility with the market. He has partly succeeded, Brooke notes, but the stock is still cheaper than it was a year ago. The trouble is, Culp has by now made all of the easy changes. To fully win back the market's trust, he must make the hardest change of all and start giving investors a clearer picture of GE's numbers. A factory downturn, if not a full-blown recession, will ramp up the degree of difficulty for him and everybody else. Bond Market Tastes Central-Bank Neglect, Doesn't Care For It The stock market reacted to the recession signal as you'd expect, by falling many points. Stock bulls will tell you this reaction is dumb, even though stocks are historically expensive, because super-low interest rates make stocks better bargains. But Gary Shilling warns low rates are harbingers of an economic downturn that will hurt profits and valuations. In fact, weirdly, bonds didn't rally much today (meaning interest rates didn't fall), as you'd expect them to do after a recession signal. That's partly because the Bank of Japan is trying this crazy new experiment of actually raising some interest rates — indirectly, anyway, by dialing back its support for longer-term debt. It's trying to steepen the "yield curve," or the gap between long- and short-term interest rates, to support its long-suffering banks, notes Robert Burgess. Banks like to borrow short and lend long, and they can't make any money when there's no difference between the two. Could it be that (some) higher interest rates actually help the economy? Further Investment Reading: For all the hype it gets, passive investing is still just a tiny part of the investing universe. – Barry Ritholtz Boris Johnson Keeps Making Own Life More Difficult Boris Johnson got good news and bad news today, just 30 days from his Brexit deadline. The good news is that some European officials are considering limiting the time in which the U.K. must maintain an "Irish backstop," the controversial condition the EU has required for any Brexit deal. The bad news is the European Commission is still officially shooting this idea down. Even worse news is that Johnson's political situation keeps getting more perilous, largely because of his own behavior. He faces new allegations about his personal conduct that will be harder to shake than past tabloid scandals were, writes Therese Raphael. Theresa May's worst sin was running through fields of wheat, and she couldn't get Brexit done. Currently, Britain is still on schedule to crash out of the EU without a deal, which would be disastrous for the economy, but would certainly make many hedge funds happy, writes Lionel Laurent. Further Knifecrime Island Reading: Both Tories and Labour have made raising the minimum wage part of their election pitch, though Brexit complicates such promises. – Ferdinando Giugliano Telltale Charts: Sweaty Texas Rangers Edition Major League Baseball's Texas Rangers have a very nice ballpark that is only 15 years old. The trouble is, it forces human beings to spend several hours outdoors in Texas in the summer. That's always been a recipe for discomfort, but Justin Fox points out it has gotten even more miserable in recent years, both during the daytime …  … and at night. So the Rangers are building a new, climate-controlled stadium right next door to the old one.  Further Reading Two bipartisan bills are languishing in Congress that would help do away with massive surprise medical bills, but lobbyists are working hard to keep them sidelined. – Bloomberg's editorial board The People's Republic of China has survived for 70 years by adopting the West's way of thinking, which makes its victory hollow; it needs to be more Chinese. – Pankaj Mishra Rare among the world's economies, South Korea's fiscal policy is expansive, but its central bank is twiddling its thumbs. Turns out this combo doesn't work either. – Dan Moss Credit Suisse has ostensibly cleared CEO Tidjane Thiam of wrongdoing in its spying scandal, but clouds will linger over his leadership. – Elisa Martinuzzi Ukrainian President Volodymyr Zelenskiy came to power promising to curb corruption and end the war with Russia, and he's struggling to make progress on either. – Leonid Bershidsky It took massive disasters to finally get Americans worried about climate change. – Faye Flam ICYMI President Donald Trump pushed for the Ukraine whistle-blower's unmasking. Police shot a Hong Kong protester. It's a midcentury modern world; we just live in it. Kickers Japan's last pager provider shuts down. (h/t Mike Smedley) Octopus changes colors while asleep, possibly dreaming. (h/t Scott Kominers) We're due for a disastrous solar superstorm. Great apes appear to have a "theory of mind." Note: Please send pagers and complaints to Mark Gongloff at mgongloff1@bloomberg.net. New to Bloomberg Opinion Today? Sign up here and follow us on Twitter and Facebook. |

Post a Comment