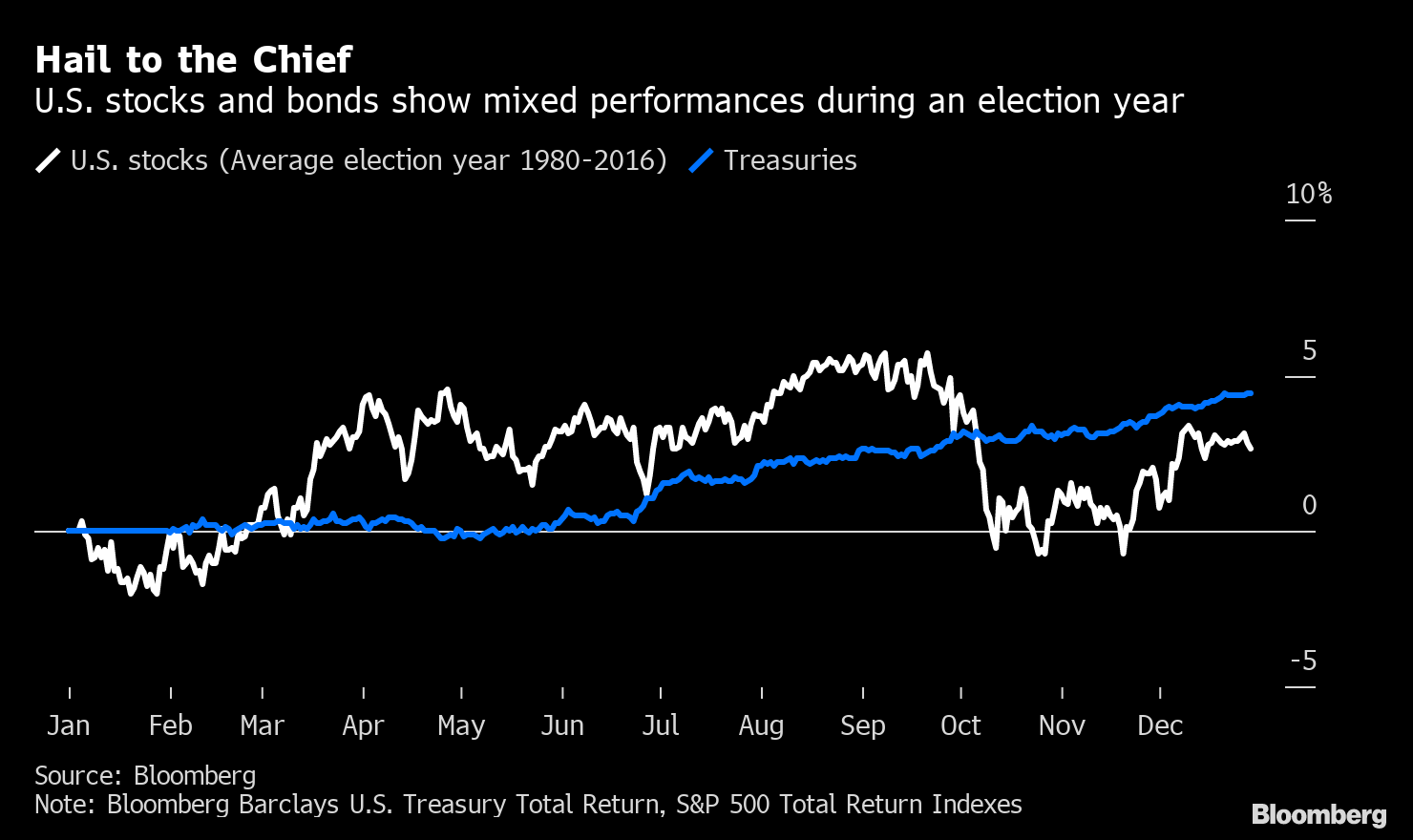

| Welcome to your morning markets update, delivered every weekday before the European open. Good morning. The Federal Reserve cut rates, a new auto giant may be created in Europe and some of the biggest of Big Tech reported results. Here's what's moving markets. Fed Cuts The Federal Reserve cut interest rates by a quarter-point and signaled that policy is just about where officials want it to be, so there may not be any further reductions on the way. That's prompted traders to trim their bets on any imminent further easing, all of which is unlikely to offer any salve to Fed critic President Donald Trump, who on Tuesday said the Fed "doesn't have a clue!" The decision complicates the outlook for many Asian central banks and eyes will turn once again to the European Central Bank and its new leader, Christine Lagarde, as skepticism grows about negative rates. Auto Giant It's looking like a done deal: The boards of Peugeot owner PSA Group and Fiat Chrysler Automobiles NV have signed off on a merger that would create a new behemoth in the European auto industry, according to people familiar with the matter. The plan calls for paying a special dividend of 5.5 billion euros to Fiat investors and for PSA to spin off to its shareholders a 3-billion-euro stake in parts maker Faurecia SE. Importantly, the French government is backing the deal. As much as anything, the talks demonstrate the pressures on an auto industry dealing with a slowdown in sales, trade wars and an expensive switch to more environmentally friendly, electric and autonomous vehicles. Big Tech Apple Inc.'s prediction of holiday sales that were ahead of expectations was taken well by the market. The company continues to find ways to juice iPhone sales even in a saturated smartphone market, though there remains at least a degree of skepticism about any return to its glory days. Arch-rival Samsung Electronics Co.'s profit also beat expectations and it forecast a gradual recovery in the memory chip market to boot. Elsewhere in giant tech news, social network Facebook Inc. also topped expectations, demonstrating how its business can navigate through relentless criticism, including a thinly-veiled swipe from a rival, over its reach and influence. Trading Barbs The U.K. election campaign starter gun has unquestionably been fired and the first significant speech from Labour Party leader Jeremy Corbyn will arrive on Thursday. He'll reiterate many of the pledges already made by his party, including re-nationalizing swathes of British industry, and will attack a "corrupt system" filled with "tax dodgers" and "bad bosses." Traders, however, are more worried about the threat posed by Brexit champion Nigel Farage than by the socialist agenda of Corbyn while companies face a difficult choice too. Consumer confidence, by the way, has hit a six-year low with Britons fretting about their finances. Coming Up… Asian stocks were mixed after the Federal Reserve decision and as corporate earnings continue to pour in, while gains in U.S. Treasuries petered out over the session. We'll have euro-area GDP data to digest later and another huge earnings day, topped by the likes of oil major Royal Dutch Shell Plc, U.K. lender Lloyds Banking Group Plc and French drugmaker Sanofi. Note too that China's factory outlook dimmed once more amid lingering uncertainty over the trade picture and that the Bank of Japan strengthened its forward guidance on interest rates but left current policy unchanged. What We've Been Reading This is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morning U.S. investors looking ahead to 2020 and the upcoming presidential election shouldn't get too optimistic about their portfolios -- at least for the first few months of the year. On average, both stocks and bonds have struggled in the first part of election years going back to 1980, according to data compiled by Bloomberg. The S&P 500 Index posted negative total returns for much of the first quarter, while the Bloomberg Barclays U.S. Total Return Index traded little changed for most of the first half of the average year. The analysis shows while both stocks and bonds finished the average election year with positive total returns, the Treasury gauge outperformed its equity counterpart. Still, it's worth remembering the 2000 and 2008 elections coincided with major stock sell-offs, while Treasuries were enjoying an multi-decade bull market. Uncertainty over the result of the election is likely the main cause of the sluggish market performance, according to Wells Fargo Investment Institute strategist John LaForge. Prominent investors have already warned of steep losses for stocks should Democrat Elizabeth Warren get elected. Hedge fund manager Paul Tudor Jones said the S&P 500 could plunge 25%, while billionaire Leon Cooperman told CNBC earlier this month that the market would drop 25% if Warren or Bernie Sanders win. However, strategists said similar things about Presidents Obama and Trump, so that brand of analysis doesn't have such a great recent track record.  Cormac Mullen is a cross-asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. |

Post a Comment