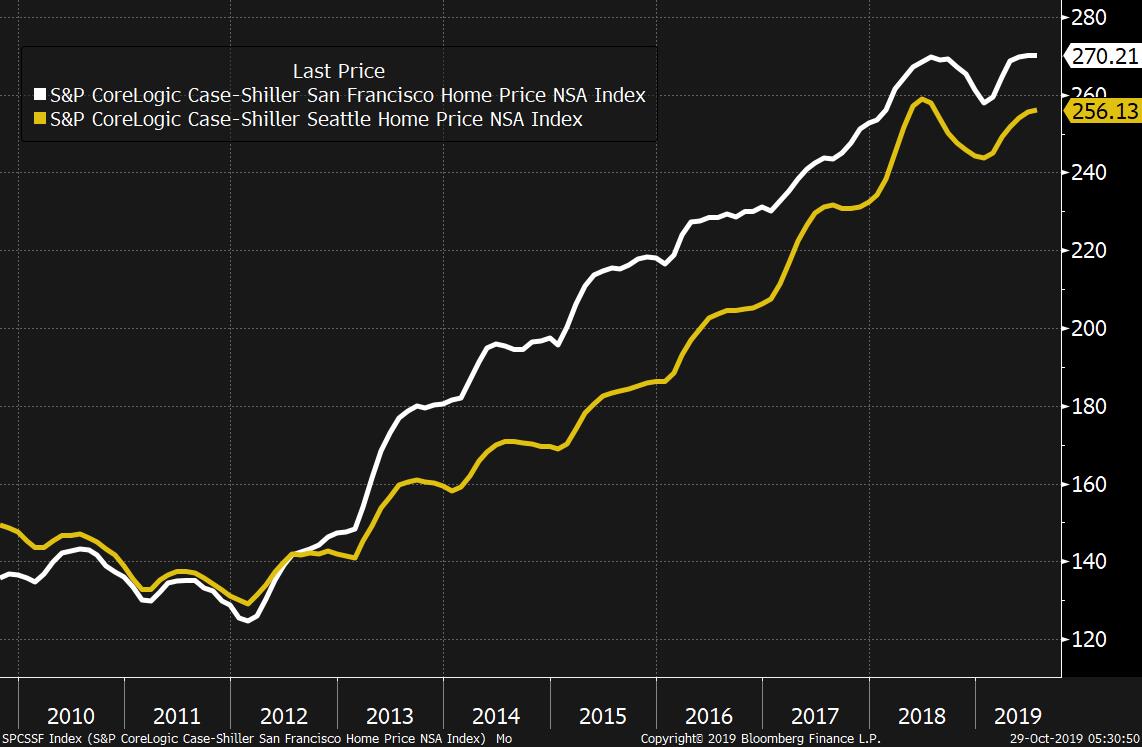

Trump is having a bad week, Boris is switching tactics, and earnings are mixed. Trump's bad weekTariff Man has had a rough start to the week. First the World Series jeers, and then House Speaker Nancy Pelosi's announcement that the full House will vote in the coming days on the next steps for the impeachment inquiry. Today the committees running the inquiry are set to get a key piece of evidence when a former army officer assigned to the White House National Security Council testifies that he listened to President Donald Trump's July telephone call with Ukraine's president -- and was so disturbed by the conversation that he reported it to the NSC's legal counsel. Elsewhere, a former reality-TV star who claims Trump forcibly kissed and groped her before he was president reached an agreement with the Trump Organization to unseal nine more pages of documents that she says corroborate her story. If at third you don't succeed...Turkeys don't tend to vote for Thanksgiving, so it wasn't much of a shock when British Members of Parliament on Monday voted against an early election for the third time. Prime Minister Boris Johnson, who wants a Conservative majority so that he can push through the U.K.'s exit from the European Union, will change tactics today by proposing a very basic piece of legislation that would move the date set in law for the next election to December. It would mean he needs a simple majority instead of the two-thirds "super-majority" previous attempts required. The Liberal Democrats and Scottish National Party have indicated they are willing to back a motion along similar lines, though their support is not yet certain. The opposition Labour Party says it doesn't want an election until the threat of a no-deal Brexit is off the table, but it's possible polling that shows their support is ebbing has a little to do with it. Of records and earningsThe S&P 500 Index just closed at the most-highest-est ever, so everything is just fine and dandy, right? Well honestly it depends if you're a glass-half-full kind of daily email newsletter, or a glass half-empty-because-I-spilled-it-all-over-my-keyboard type newsletter. It's not clear how useful a glance at the big earnings really is, but here you are anyway: On Monday after the close, Alphabet Inc. disappointed after its quarterly earnings were dented by heavy investment in Google's cloud-computing business. This morning BP Plc reported profit that beat analyst estimates as a strong refining performance offset the effect of lower oil and natural gas prices. And Nomura Holdings Inc. posted pretax profit in retail, wholesale and asset management segments, but vowed to continue cost cuts in the face of a shrinking domestic retail business that has increased reliance on volatile global operations. MarketsOvernight the MSCI Asia Pacific Index climbed 0.5% as Japan's Topix index rallied 0.9%. In Europe, the Stoxx 600 Index was down 0.5% at 5:45 a.m. Eastern Time as investors weighed earnings and took a breather after six days of gains. S&P 500 futures pointed to a directionless open, the 10-year Treasury yield was at 1.830% and gold was steady. Coming up…The earnings are rolling in, and today's big names include Pfizer Inc., Merck & Co Inc., General Motors Co., ConocoPhillips, Mastercard Inc. and more. The data front is relatively quiet; pending home sales are at 10 a.m. alongside the Conference Board Consumer Confidence number. The Federal Reserve faces arguably its biggest decision of the week when they gather to agree where to order lunch from. It's the first day of their two-day gathering that will likely conclude tomorrow with a rate cut. What we've been readingThis is what's caught our eye over the last 24 hours. And finally, here's what Joe's interested in this morningIn the wake of the financial crisis, one set of data I always got excited about was the monthly Case-Shiller home price report. With housing and home prices central to the collapse, stabilizing data was crucial to a recovery. As things progressed I stopped paying as close attention to it. I've been thinking about it again though, in a different context. It's hard to believe, in retrospect, but just this past spring there were stories about how a new wave of IPOs could mint all these millionaires who would drive up the price of real estate in San Francisco. That was supposed to be a big 2019 theme. Well we know how the 2019 IPO class worked out and there's no point in rehashing it here. And when you look at the housing data, the two worst-performing major cities over the last year (of the 20 it tracks) are Seattle and San Francisco. So much for IPO real estate madness. It's been just the opposite. As you can see in the chart, it's not as though San Francisco and Seattle are exactly hurting, they remain right near their all-time highs in two measures of the index. Nonetheless, it'll be interesting to see if the recent pummeling in the asset values of once red-hot growth names continues to bleed through to tech city real estate underperformance. The next Case-Shiller is out today at 9 a.m., so we'll know more shortly.  Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. |

Simplest advise would be go to lynda.com and watch some tutorials in After Effects would give you a good start on becoming a motion graphics designer. You will also need to know photoshop, illustrator, and a 3d program like cinema 4d. Find out more: https://qaiserm.com/motion-graphics-designer/

ReplyDelete