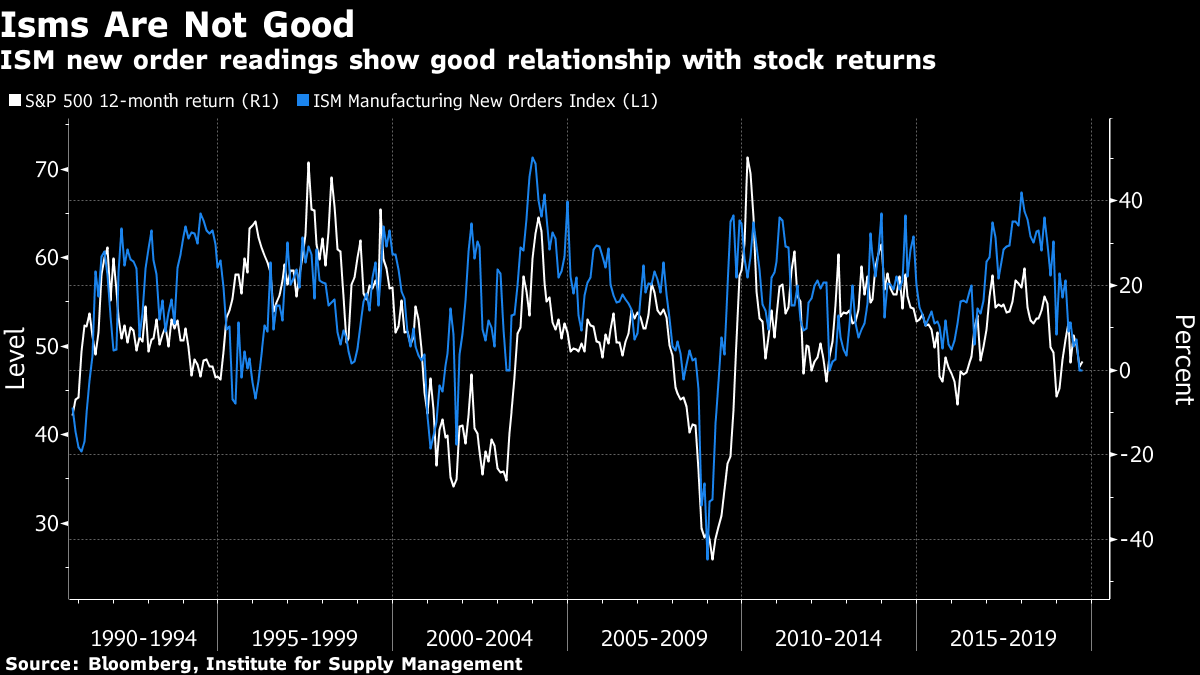

| Welcome to your morning markets update, delivered every weekday before the European open. Good morning. Headwinds for global markets continue to mount as details of U.K. Prime Minister Boris Johnson's Brexit plan emerge, global data show further warning signs of a manufacturing contraction and protests in Hong Kong persist. Here's what's moving markets. Moment of Truth U.K. Prime Minister Boris Johnson will present his new plan for a Brexit deal later Wednesday, which proposes scrapping the so-called Irish border backstop, people familiar with the matter told Bloomberg. Here's the details of the proposal, which has already been rubbished by Ireland's foreign minister. The pound briefly gained late yesterday on a story saying the European Union may be open to a time limit on the backstop, but erased the move amid conflicting reports on the matter. Johnson's speech closes the Conservative Party conference later. Grim Data Signs of a slowdown in global manufacturing keep on coming. With the outlook in Asia already bleak, the U.S. Institute for Supply Management's factory index notched-up its weakest reading for a decade on Tuesday, while statistics showed German factory orders suffered their sharpest contraction in almost seven years in September. "Increasingly grim" was how data firm Markit described the latter reading, while the World Trade Organization warned Tuesday that the ongoing trade war could lead to a "destructive cycle of recrimination" for the global economy. Hong Kong Disruption Protests in Hong Kong continue to hurt sentiment in Asia. Demonstrators are planning a fresh round of disruption on Wednesday after violent clashes led police to shoot a demonstrator for the first time since the unrest began in June. The friction weighed on share prices of European banks with big operations in the former British colony, like HSBC Holdings Plc, and owners of luxury brands that are popular there, like LVMH and Hermes. Here's Bloomberg's refresher on why the protests haven't come to an end. Stocks Red With plenty of headwinds keeping investors at bay, European stocks recorded their worst session since mid-August on Tuesday, and the declines continued in the U.S. and Asia. To top it all off, North Korea has fired what appeared to be a submarine-based ballistic missile, risking renewed U.S. tensions. Elsewhere, oil rebounded to snap a six-day losing run after a report pointed to a substantial draw-down in U.S. crude inventories in the past week. Coming Up... Following yesterday's dour data, U.S. ADP employment numbers will act as precursor to Friday's non-farm payrolls report, while in Europe we'll get construction purchasing managers' index data from the U.K., along with an interest rate decision from Poland. Tesco Plc is the only large-cap earnings report on our radar this morning. What We've Been Reading This is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morning Another beginning to a month, another wave of unexpectedly poor manufacturing indicators. This time it was the U.S. ISM that took the headlines with the factory index falling to the lowest since June 2009, missing all estimates in a Bloomberg survey that was looking for a rebound. Similar reports in Germany, Spain and Italy all showed manufacturing activity contracting. Stocks in Europe and the U.S. headed south in sympathy, though not by much more than a percent or so. While many strategists have pointed out that equities have done ok through previous episodes of ISM weakness, it's fair to argue that it at least has to signal some risk to earnings -- particularly at a time of elevated economic uncertainty. But it also suggests an even greater market focus on services indicators, given the argument that manufacturing has become a much smaller part of developed economies. That means any sign the current manufacturing weakness is spilling over into services would likely kick off a much bigger slide than seen Wednesday.  Cormac Mullen is a cross-asset reporter and editor for Bloomberg News in Tokyo. Bloomberg Invest London | Oct. 8 Join global institutional investors and corporate leaders at Bloomberg Invest London on Oct. 8 at Bloomberg's European headquarters. Speakers include CEOs Anne Richards, Fidelity International; Emmanuel Roman, PIMCO; Bill Winters, Standard Chartered; Andreas Utermann, Allianz Global Investors; and Lorenzo Bini Smaghi,Societe Generale. For more information, go here. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. |

Post a Comment