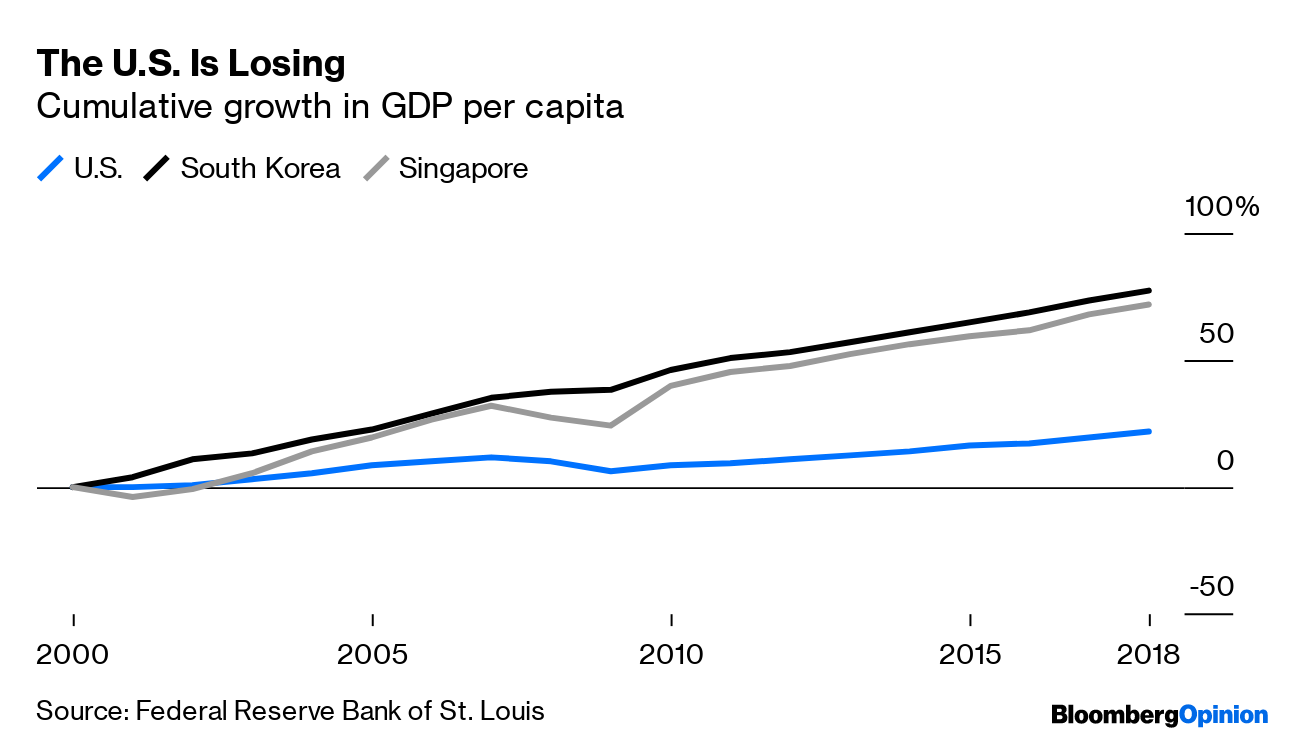

Today's Agenda  Walmart's Big Political Stand By one count, there have been 30 mass shootings in America since President Donald Trump took office. During that time, the Republican-controlled government hasn't lifted a finger to end the carnage. Walmart Inc., of all things, has stepped into the breach. The big-box behemoth – whose stores have suffered two mass shootings since last November – yesterday said it would curb some ammo sales and asked people not to openly carry guns in its stores. Four years ago, it also stopped selling assault-style rifles. These may not be monumental moves, but they will impact gun sales, other retailers and perhaps the national conversation on guns, writes Sarah Halzack. Walmart has bucked Trump and Republicans in Congress to do the right thing for the country. It's not alone. Several other companies have rejected Trump's fervor for slashing environmental regulations, notes Cass Sunstein. These companies, which include automakers and oil giants – not exactly known for bleeding-heart liberalism – realize some regulation benefits them. They also realize some deregulation, just like some regulation, is nothing more than political posturing. This all comes as the Business Roundtable – again, no left-wing refuge – has declared companies should serve no longer serve just shareholders but "stakeholders," including broader society. Ramesh Ponnuru suggests this is just more posturing, as companies have always considered the community along with profits. Alfred Rappaport says the Roundtable should be more specific about how companies will manage what seem to be new priorities. But Walmart and other real-world examples suggest they're already figuring out when doing good is good for business. Central Banking's Big Dilemmas A week ago, former New York Federal Reserve President Bill Dudley chucked a stink bomb into the Fed-watching garden party. Now he's back to explain himself to the teary-eyed crowd. In his prior column, Dudley not only urged central bankers to resist helping Trump fight his reckless trade war by cutting interest rates, he also seemed to suggest the Fed should consider how helping the economy would help reelect Trump – the biggest threat to the economy the Fed safeguards. Central bankers, in other words, should not just resist, but #Resist Trump, he seemed to say. Today, in answer to the many cries of outrage this elicited, Dudley explains he didn't mean the Fed should purposefully tank the economy or become political. He just meant the Fed should "be aware" of all the possible repercussions of its policy. Good luck figuring those out, though. Trump thinks slashing rates is an unalloyed good, as he rage-tweets pretty much daily. Markets used to feel the same way, but lately seem to have gone wobbly. The Fed and the European Central Bank are expected to cut rates later this month to appease market hopes, Mohamed El-Erian notes; and we can only assume markets would throw a tantrum if central bankers disappointed them. But Mohamed also points out there's a growing consensus that cutting rates won't help the economy much and may not even tamp down financial volatility. And that's before we get into the many possible bad effects of super-lower rates – without even considering their impact on the 2020 election. BoJo's Big Gamble Speaking of elections, Boris Johnson today proposed a snap one in the U.K., following an epic day in which he lost his majority in the middle of a speech, Parliament stripped him of control of Brexit, and he purged 21 rebels from his party. Today, he was denounced as a racist in Parliament, had to deny rumors he planned to resign, and then watched as Parliament voted to delay the Brexit deadline again to avoid the no-deal departure he seeks. Johnson's performance so far has been roundly and justifiably mocked. Then again, a snap election could be an act of political jiu jitsu that takes advantage of the clarity of Johnson's message against an often muddled and underwhelming opposition, writes Therese Raphael. It could all fail spectacularly, of course, but there's still a chance Johnson gets the last laugh. Further Brexit Reading: It's time for Europe to start tapping its Brexit relief fund. – Lionel Laurent Pence's Big Spending Pity Vice President Mike Pence. He's in hot water simply for doing what so many others have done during the Trump presidency: making it rain for his boss. On a recent Ireland trip, Pence stayed in a Trump property 125 miles from Dublin, where he had official meetings. Unlike the Trump cabinet members ousted after being accused of wetting their beaks too often, Pence knows the way to Trump's heart is through his wallet, Tim O'Brien writes. The veep has drawn an unusual amount of attention for it this time, partly because he at one point seemed to blame Trump for parking him in Doonbeg instead of Dublin. Further Politics Reading: Telltale Charts Ramping up R&D spending in strategically located research parks could boost the U.S. economy while fending off its obsolescence, writes Noah Smith.  Further Reading Trump's plan to house immigrant families indefinitely is cruel and unworkable. There are much cheaper, more humane alternatives. – Bloomberg's editorial board Saudi Aramco's management changes aren't reassuring. – Ellen Wald Italy's new governing coalition is on shaky ground already. – Ferdinando Giugliano The South Korea-Japan spat is about failure to communicate. – Japanese Foreign Affairs Minister Kono Taro Trump should reject a new proposal for peace with the Taliban. – Eli Lake ICYMI Hong Kong's Carrie Lam withdrew a controversial extradition bill. Michael Burry explained why index funds are like subprime CDOs. Porsche unveiled a $150,000 Tesla killer. Kickers Area man returns "smart" light bulbs, finds he can still control them in somebody else's house. Thanks, Brexit: Meat-eating plants return to the U.K. (h/t Scott Kominers for the first two kickers) How Keith Olbermann and Dan Patrick's "SportsCenter" changed TV forever. Note: Please send meat-eating plants and complaints to Mark Gongloff at mgongloff1@bloomberg.net. New to Bloomberg Opinion Today? Sign up here and follow us on Twitter and Facebook. |

Post a Comment