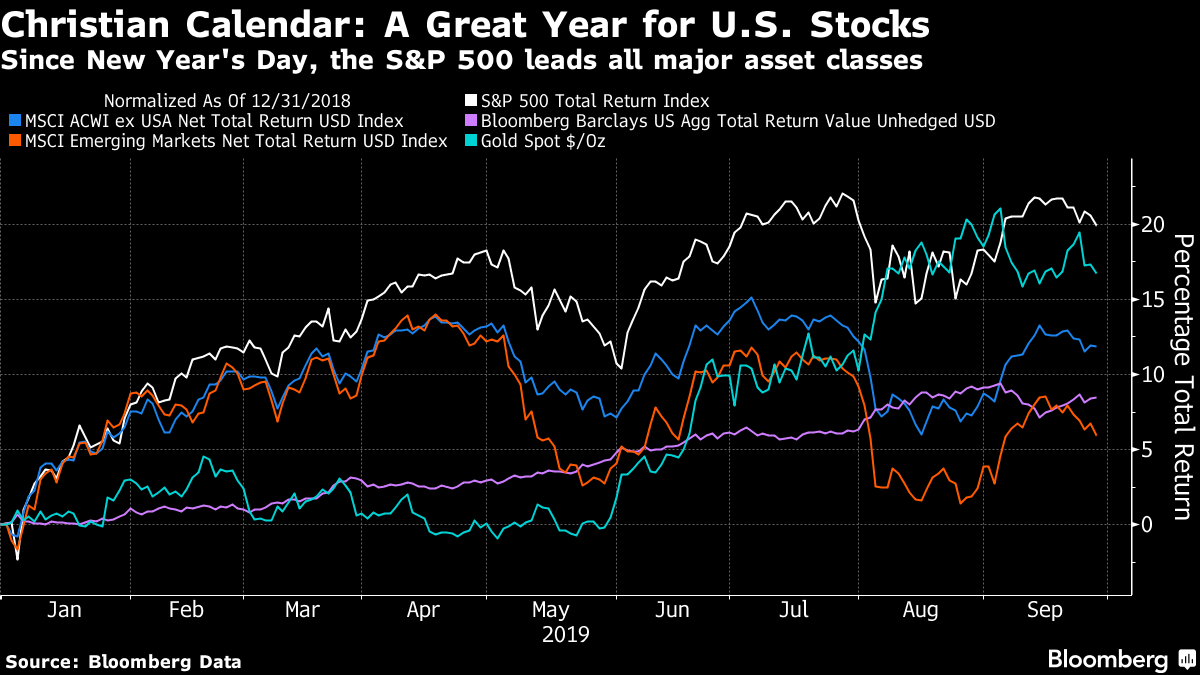

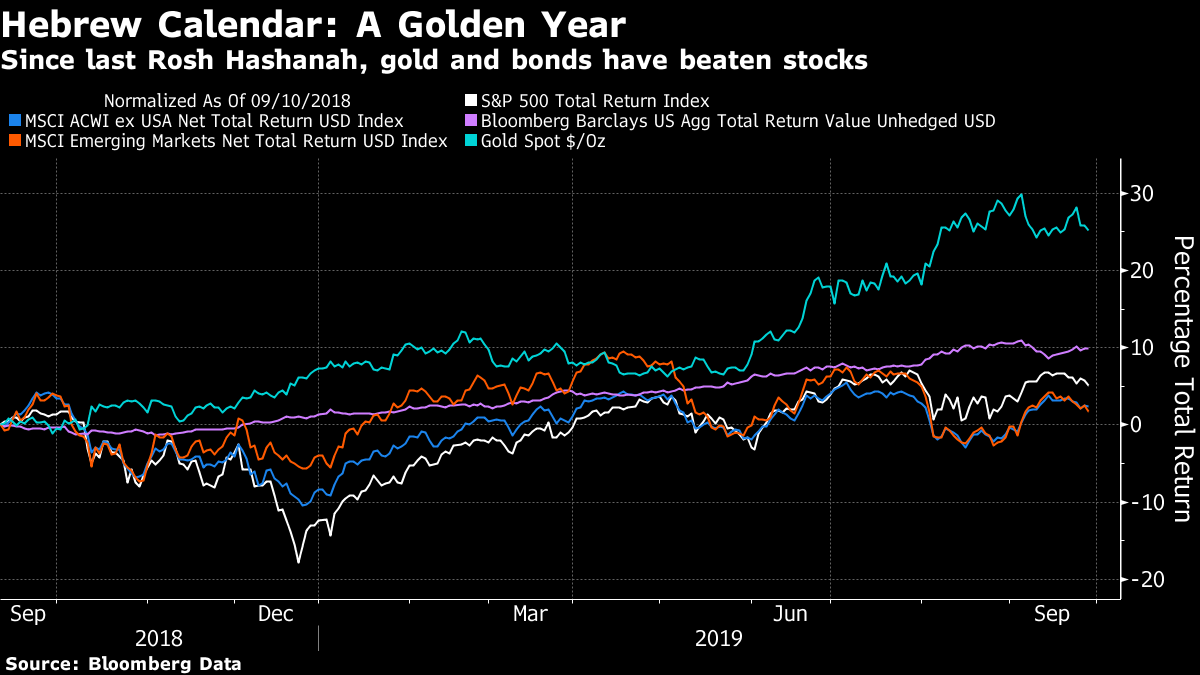

Capital Wars: Will the Empire Strike Back? President Trump believes that trade wars are good, and easy to win. Many disagree. But what about capital wars? Friday brought the revelation by Bloomberg News that the White House was considering measures to limit portfolio capital flows into China. We've since had a clarification that this wouldn't mean blocking Chinese companies from listing in the U.S., while Chinese authorities have vowed to continue opening their markets to foreign capital. This is plainly an important development, which provoked an immediate response. The main index of Chinese American depositary receipts, kept by Bank of New York Mellon Corp., dropped sharply on the news, as did a broad index of emerging market currencies. This is what happened to prices as the Bloomberg story was released at 11:30 a.m. Friday:  Still, the reaction was restricted to markets that would be directly affected. There was no big move toward "risk-off" allocation, as seen after previous escalations in the U.S.-China conflict, and little move in Asian markets Monday morning. Initial reactions from Wall Streeters suggest nobody quite knows what to think about it. Here is what I think, at least for now: The threat is serious. It has already been trailed by senators from both parties, after all. And as I have pointed out in the past, the dominance of indexing and the popularity of ESG strategies, which exclude particular companies or sectors, make it very easy to do. It would be painless for American investors – initially. Investment in mainland Chinese assets is in its infancy. Mainstream institutions take their cues from broader benchmarks. MSCI added mainland A shares to its emerging markets index only in 2018, after years of concerns over whether investors had sufficient protections against issues such as arbitrary trading halts. As a result, exposure is not great. It can be done easily. As the rest of the emerging world tends to correlate with China, switching from one benchmark to another would make little difference. This is how the iShares exchange-traded fund that tracks emerging markets excluding China has fared compared to the main emerging markets ETF since inception in 2017:  It can readily be justified. This can be couched as defending investors from opaque markets with inadequate protections. It took MSCI long enough to include Chinese stocks in benchmarks. U.S. authorities could easily reverse this. Writing a year ago, John Paul Smith, veteran emerging markets analysis at Ecstrat Ltd., an equity strategy consultancy in the U.K., said: US institutional investors especially state pension funds and major endowments will increasingly have to take the geopolitical dimension into account when setting their international allocations. The very high levels of moral hazard present in China's local markets increase the onus on the US authorities to set the appropriate parameters to prevent a potentially massive misallocation of resources leading to very high levels of impairment. This now looks prophetic. In the current political climate, trustees might come under pressure from members to exclude China, without direct rulings from the U.S. government. Any action would have serious consequences for China: Chinese regulators' lobbying of MSCI, and the recent move to lift restrictions on foreign investment in equities, show that authorities want to attract portfolio flows. According to the Institute for International Finance, the MSCI decision triggered massive movement last year, with $60.7 billion flowing into China while $43.7 billion exited all other emerging markets. A reversal would damage confidence, and lead more Chinese to try to get capital out. Potential retaliation would be horrendous. As is often pointed out, China is sitting on a pile of treasury bonds. Should it sell them, yields would rise. Chinese entities are also enthusiastic buyers of U.S. equities. Retaliation would hurt the value of the U.S. securities that they still held, so it would inflict pain on China as well. But it could be done, and quickly. Even without retaliation, longer term effects would be horrendous. China's manufacturing difficulties have affected the entire global industrial sector. Limiting capital to China would thereby hurt the rest of the emerging world. The developed world also responds with alarm when China starts using up its reserves. The last time China hit difficulties and spent a fifth of its foreign exchange reserves, it triggered a global equity sell-off that reached a trough in early 2016.  That incident was followed by a weakening of the dollar, which relieved the pressure on China, and which appeared orchestrated by central banks in the so-called "Shanghai Accord." Would central banks be able to react in the same way again? In short, if you liked the idea of a trade conflict with China, then you should like this even more. And if you disliked the trade war, then the notion of a capital war should be even scarier. The safest bet is that this proposal will amp up volatility and nervousness still further, across the globe. Authers notes: Have a sweet new year. For those who thought it was only the last day of September, I should explain that today is the Jewish new year, Rosh Hashanah, determined by the lunar calendar. It gives Jewish people around the world an excuse to dip apples in honey, and make resolutions for the next 12 months – which, like most new year resolutions, are unlikely to be fulfilled. When exactly we choose to celebrate a new year is, of course, completely arbitrary. But that raises a key point for investors, which is that much of our judgment of investment performance is also arbitrary. We divide time into annual increments, and treat investment as a horse race that starts each Jan. 1. And that is arbitrary. This year makes the point clearly. So far in the Christian calendar for 2019, the story is of a continued bull market in U.S. stocks, while emerging markets wilt:  Now let us repeat the exercise, starting on Rosh Hashanah 2018, which fell on Sept. 9. In this version of the year, gold is triumphant, bonds beat stocks, and U.S. equities are in line with the rest of the world:  Neither is "correct" – unless you are the CIO of an organization that only permits you to invest money on Rosh Hashanah or at the beginning of January. But the difference between the two is instructive. Academic studies of investment returns almost never look at an annual horse races, and this shows why. And adding the extra four months in this case, thanks to the Christmas Eve sell-off, helps make clear why Sharpe Ratio analysis, taking into account volatility, is so popular. Bond returns look far more enticing when the full volatility of stocks is visible. And with that, have a happy new year Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment