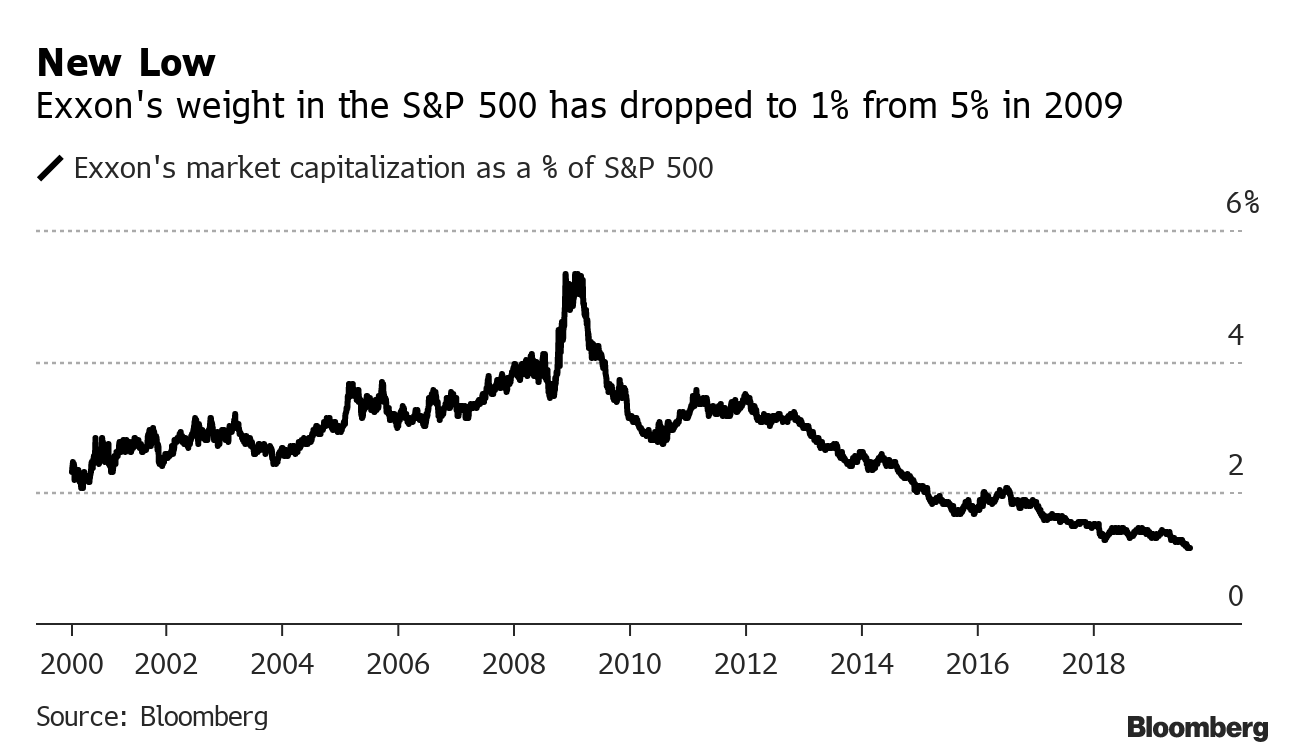

| Inside: Exxon drops out of the S&P 500's Top Ten. Dorian is part of a new crop of slower, wetter hurricanes. Ball Corp. goes for more sustainable beer pong. A tech billionaire backs a resolution to halt coal lobbying at BHP. Vanguard and BlackRock think their climate meetings with companies are working. — Emily Chasan Sustainable Finance Exxon Mobil fell out of the S&P 500 Index's 10 biggest companies for the first time since the index's inception some 90 years ago. Exxon expects oil demand to grow at 0.6% a year so CEO Darren Woods is eyeing oil and gas M&A to pump up growth as he expects the world's clean energy shift to take decades.The company's slip to the 12th-largest stock in the index came amid other signs that the ground is shifting in energy. The oil industry's big summit "Oil & Money" is rebranding itself after four decades as the "Energy Intelligence Forum, " saying its old name "didn't suit the times."  Investors including Harvard University's endowment, the Church of England and Calstrs, are asking oil and gas companies to ignore the Trump administration's plan to let them off the hook for monitoring —and stopping — methane leaks.

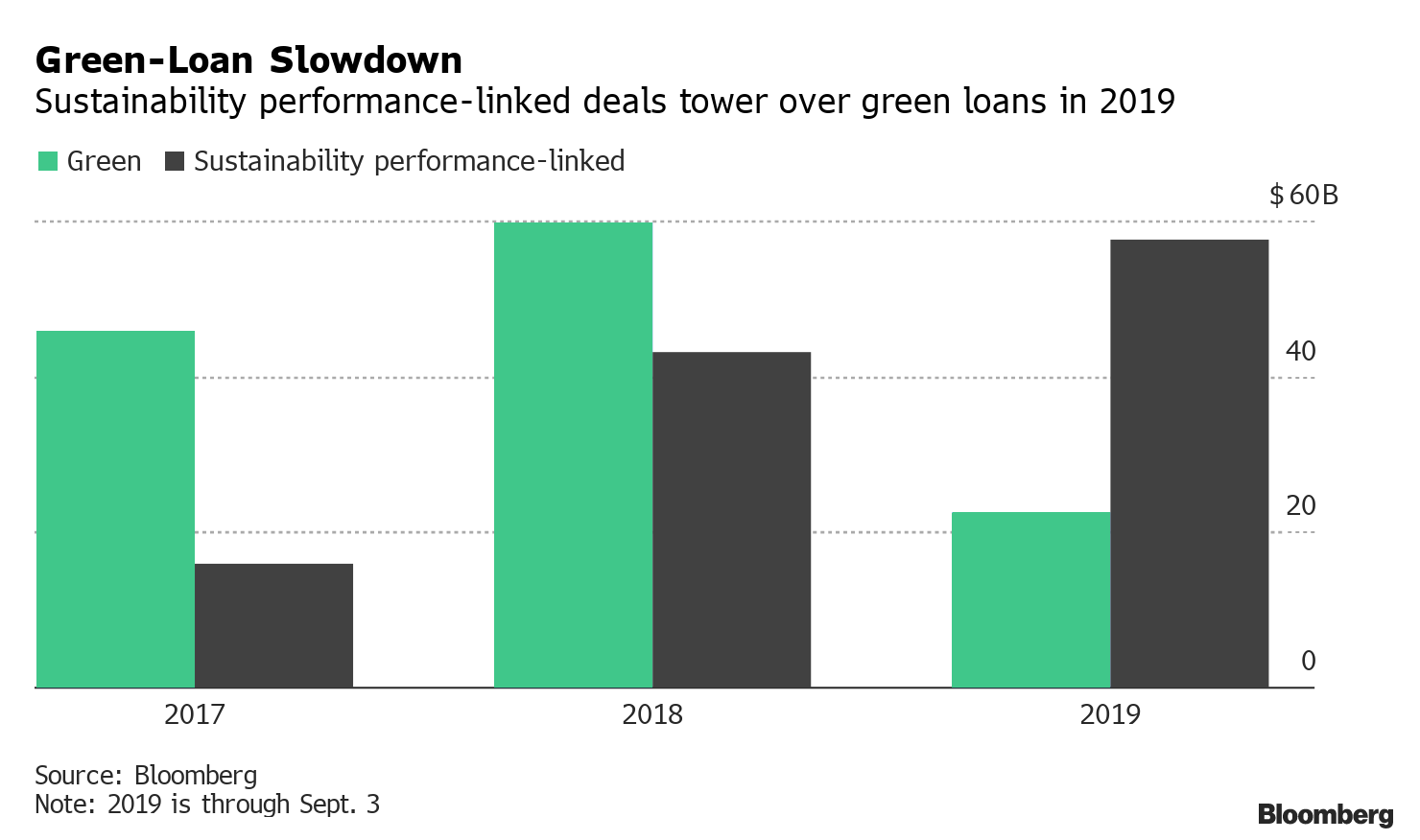

The global green-loan boom has come to a halt, as borrowers turn to less-restrictive sustainability-linked deals. Issuance of green loans has tumbled 38% so far this year to $22.6 billion, setting up the first annual decline since the market went mainstream in 2013, according to data compiled by Bloomberg. By contrast, sales of loans tied to environmental, social and governance targets have surged to $57.5 billion.  In Brief - Australia's $94 billion IMF Investors pledged to cut its carbon footprint on infrastructure across the nation by 10%.

- UBS said it raised $225 million from clients for KKR's Global Impact Fund and hired Bank of England adviser Huw van Steenis to lead a new sustainable finance push.

- Fintech startup T-Rex, which makes software aimed at analyzing renewables projects raised $15 million in a new funding round.

Environment Flying shame is boosting Spotify-like apps that are jumping into the $200 million million-a-year carbon offsetting business. Even Prince Harry is trying to "greenify" the tourism industry, while the sustainable tourism market is predicted to grow by $340 billion, or 10%, within the next four years.  Droughts and floods that destroyed harvests have 12 million people in the Southern part of Africa facing hunger. The meat and dairy sector is increasingly feeling climate change, but the industry is abnormally quiet about its own role as a leading source of emissions in the crisis, according to a new report from the Fairr Initiative. Animal agriculture is a key feature of the so-called Anthropocene era and admitting humanity's role in creating the problem is the first step to solving it, writes Bloomberg Opinion's Faye Flam. Currently, researchers estimate, 96% of mammals today are humans or livestock, and only 4% are wild animals.

Porsche unveiled its first all-electric sports car.

Space for solar in Europe is right on top of our heads. Satellite researchers said Europeans could tap a quarter of Europe's rooftops to massively expand low-cost solar generation.

Dow , which invented styrofoam, is partnering with a Dutch startup to turn hard-to-recycle plastics back into oil. Dow CEO Jim Fitterling told a conference in China that he's spending 25% of his time now on sustainability issues like plastics.

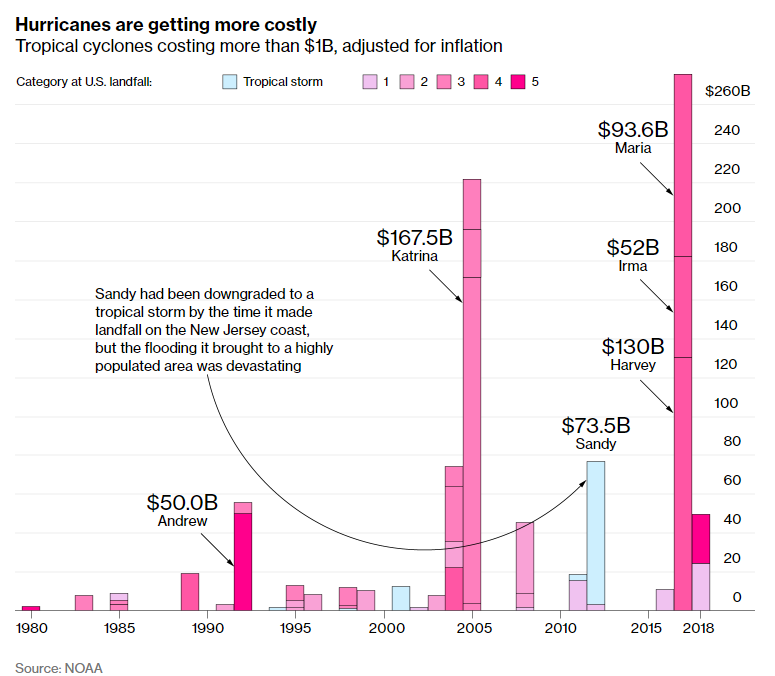

Hurricanes are growing much more costly as storms become slower and wetter while population density in coastal areas is surging.  Social Walmart said it would stop selling some types of ammunition and is asking customers not to openly carry firearms into its stores. The retailer is walking a fine line, but the small move could push competitors to adopt similar changes, writes Bloomberg Opinion's Sarah Halzack.

Uniqlo's billionaire founder wants a woman to succeed him as CEO.

WeWork added a woman to its all-male board as it readies for an IPO roadshow.

Lots of socially-conscious investors eschew companies that sell alcohol, but this activist wine maker is a B Corp. Also, packaging company Ball Corp. is ready to reinvent beer pong with more sustainable aluminum cups. Governance Australian billionaire Mike Cannon-Brookes' private investment vehicle is among backers of a new shareholder resolution at miner BHP Group to suspend ties with coal lobbying industry groups that are seen as hindering efforts to meet global climate change goals. Investors might have reason to feel confused about the lobbying BHP itself is forecasting coal's last stand, write Bloomberg Opinion's Nathaniel Bullard and David Fickling.

In their annual investment stewardship reports, Vanguard and BlackRock said they are meeting more with companies on how they are responding to climate change. Vanguard said its team met with 250 energy-related companies and backed 7 climate proposals in the last proxy season. BlackRock's team met with 232 companies and said it voted for four climate risk proposals. But the $5 trillion investor also slammed shareholder proposals, saying that while the votes get a lot of attention, meeting with companies is broader and more effective. The big investors' approach is butting heads with other investors groups that tried to pass resolutions this year that asked Exxon Mobil to create an independent board chair or Duke Energy to be more transparent about its lobbying but didn't win without the backing of the two big investment firms.  Note: Please send tips, suggestions and feedback to Emily Chasan at echasan1@bloomberg.net. New subscribers can sign up here. To see this on the web, click here. |

Post a Comment