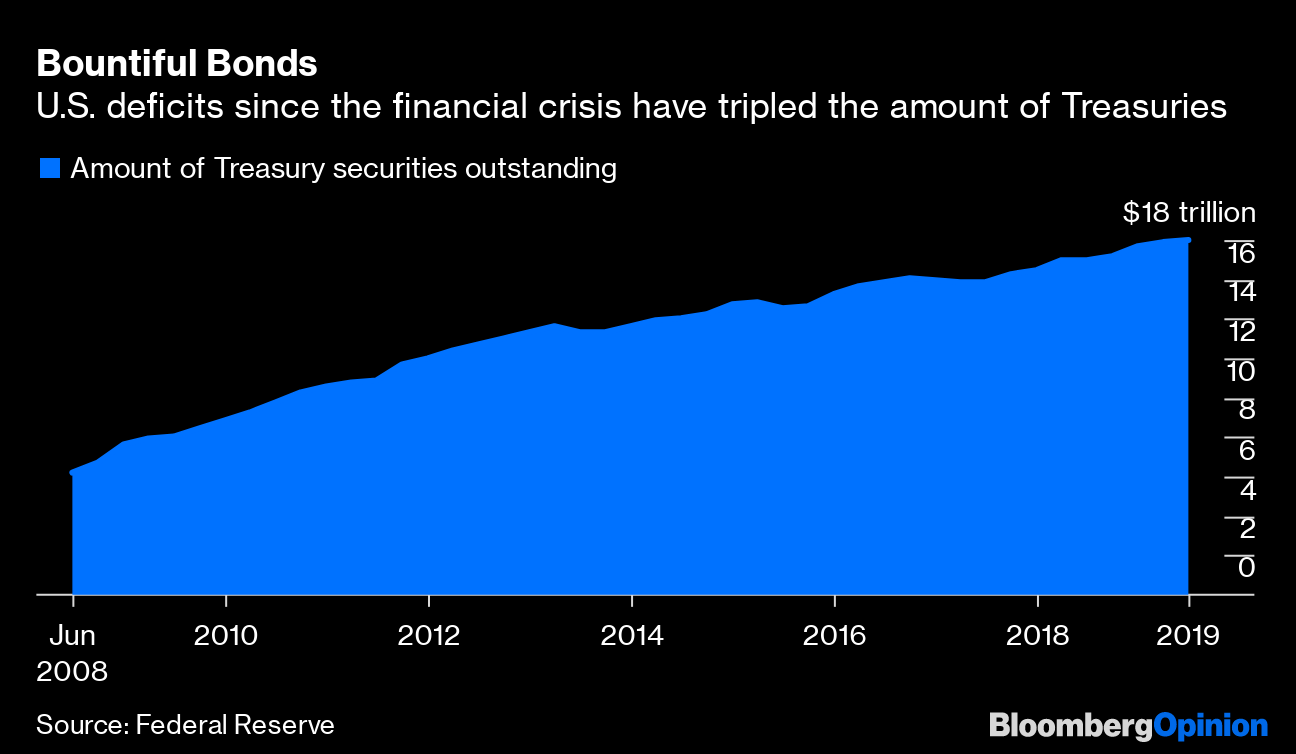

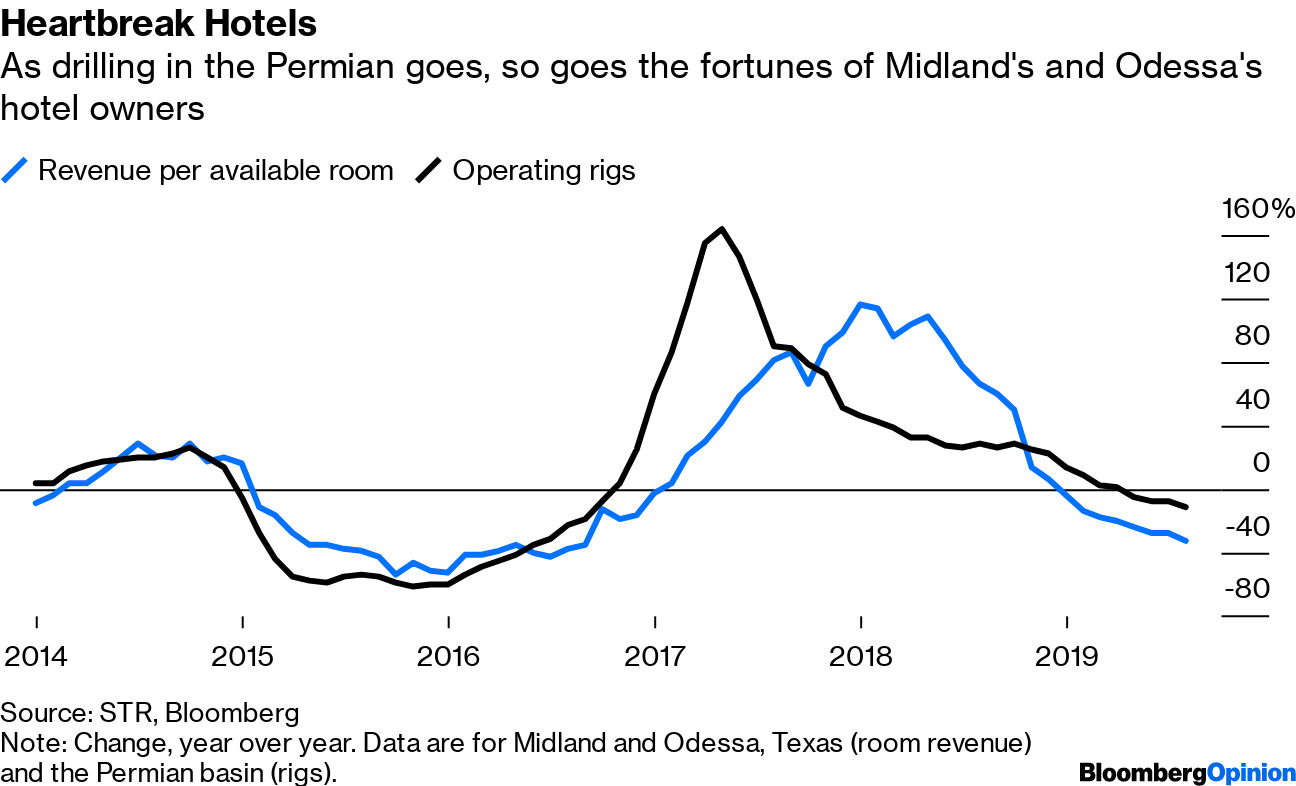

Today's Agenda What's Melting Down the Repo Market?The overnight repo market is not exactly like a nuclear reactor. But it suffered something of a meltdown last week, and the Fed has been busy trying to contain the damage ever since. The repo market powers the global financial system by letting banks briefly swap Treasury debt and other securities for cash. For several days now, the central bank has pumped it with liquidity to ease a cash shortage that briefly caused rates to spike to dangerous levels. All this might change once the fiscal quarter ends, but clearly something is not working. A little-remarked factor could be the walloping federal budget deficit, writes Brian Chappatta. Massive Treasury borrowing is flooding the market with more bonds than it can handle, which is forcing the Fed to mop it up to avoid a true market meltdown. Maybe deficits do matter after all?  The Impeachment Train Gains SpeedThe presidential scandal that still needs a name (The Ukraine Scandal? UkraineGate? Ukraine-Contra?) moved along at breakneck speed today. The Director of National Intelligence was flambéed by the House Intelligence Committee. President Donald Trump suggested the whistleblower who kicked off the whole thing should maybe be killed? And most importantly, that whistleblower's report became public. And boy, was it a doozy. It broadened the scandal far beyond the scope of the July 25 call between Trump and Ukraine President Volodymyr Zelenskiy, the memo of which was released yesterday. And all of it was damning, writes Noah Feldman: It showed more evidence of the quid pro quo Trump's defenders claim wasn't there. It showed that White House officials immediately realized how bad the call was and tried to hide the verbatim transcript of it (and not for the first time). Mostly, it credibly told a story of possibly criminal acts and kept the train rolling toward what now seems an inevitable impeachment. In just a few short pages, Noah writes, it did much more than the Mueller Report managed to do over hundreds.Two names featured prominently in both the July 25 call memo and the whistleblower's report: Trump's favorite lawyers, Rudy Giuliani and Bill Barr, ostensibly the nation's attorney general. Tim O'Brien writes neither will be able to easily shake this scandal. There's still much more to learn, but what's known fits a long pattern of impeachable behavior by Trump, Bloomberg's editorial board writes. Calling Trump to account for it is necessary, but Democrats and Republicans must treat the process with the gravity it deserves. The rest of us can make up silly names. Further Ukraine Scandal Reading: No Easy Brexit AnswersAcross the pond, U.K. Prime Minister Boris Johnson faces a similar existential crisis, in that he has no governing majority and little hope of striking a deal to leave the European Union in an orderly fashion. About the best anybody can hope for now is that Johnson will cave in to Parliament's demands that he extend the Brexit deadline, writes Lionel Laurent. That will lead to another election, but the outlook beyond that remains hazy, and a deal with the EU is still a distant dream. The British pound, meanwhile, happily floats along on a belief that a no-deal Brexit is impossible, writes John Authers. This looks like wishful thinking. E-Cigarettes in CrisisThe e-cigarette industry is in the middle of its own fast-moving crisis, as the number of mysterious vaping-related lung illnesses keeps rising. Yesterday it cost the CEO of Juul Labs Inc. his job. The new CEO is a veteran of Altria Group Inc., which has a big stake in Juul. Critics might say this reveals e-cigarettes are really just the slightly upgraded face of Big Tobacco. But Joe Nocera argues this could be what saves the industry; Big Tobacco has long experience with regulations and bad publicity. It also has the resources to make e-cigarettes a truly safe alternative to traditional smokes. The controversy, which today caused Britain's Imperial Brands Plc to cut its sales and profit forecast, could push some e-cig users back to regular cigarettes, notes Andrea Felsted. But Big Tobacco needs e-cigs and other alternative products to succeed, to counter the broad slowdown in smoking. Telltale ChartsOpponents of health-care reform say people want to keep their employer-based health plans, but those plans keep getting more and more expensive and less and less useful, writes Max Nisen.  Falling hotel-room rates in Midland and Odessa, Texas, are signs of hard times coming for the fracking industry, writes Liam Denning.  Further ReadingThere's a reason Trump's trade-war wins so far mainly favor agriculture over manufacturing. – David Fickling Rather than eat a sour lemon of a WeWork IPO, SoftBank is doubling down on its investment to hopefully make lemonade. – Tim Culpan Amazon.com Inc. could do much more to protect user privacy, but it should be praised for even acknowledging privacy is an issue. – Shira Ovide European leaders seem finally to have reached the end of their tolerance of Iran's shenanigans. – Bobby Ghosh Now the Democratic presidential debate rules are narrowing the field too quickly. – Jonathan Bernstein Karachi has promise, but must clean up its act, literally. – Tyler Cowen ICYMIPeloton Interactive Inc.'s IPO crashed out of the gate. Venezuela has a Bitcoin stash and no clue what to do with it. For sale: WeWork's private jet. KickersScience makes glow-in-the-dark cats, but for good reason. (h/t Alistair Lowe) Bacteria seem to strip off their cell walls to avoid antibiotics. (h/t Scott Kominers) Octopuses are intelligent aliens living among us. Prehistoric babies drank animal milk from bottles. Note: Please send glow-in-the-dark cats and complaints to Mark Gongloff at mgongloff1@bloomberg.net. New to Bloomberg Opinion Today? Sign up here and follow us on Twitter and Facebook. |

Post a Comment