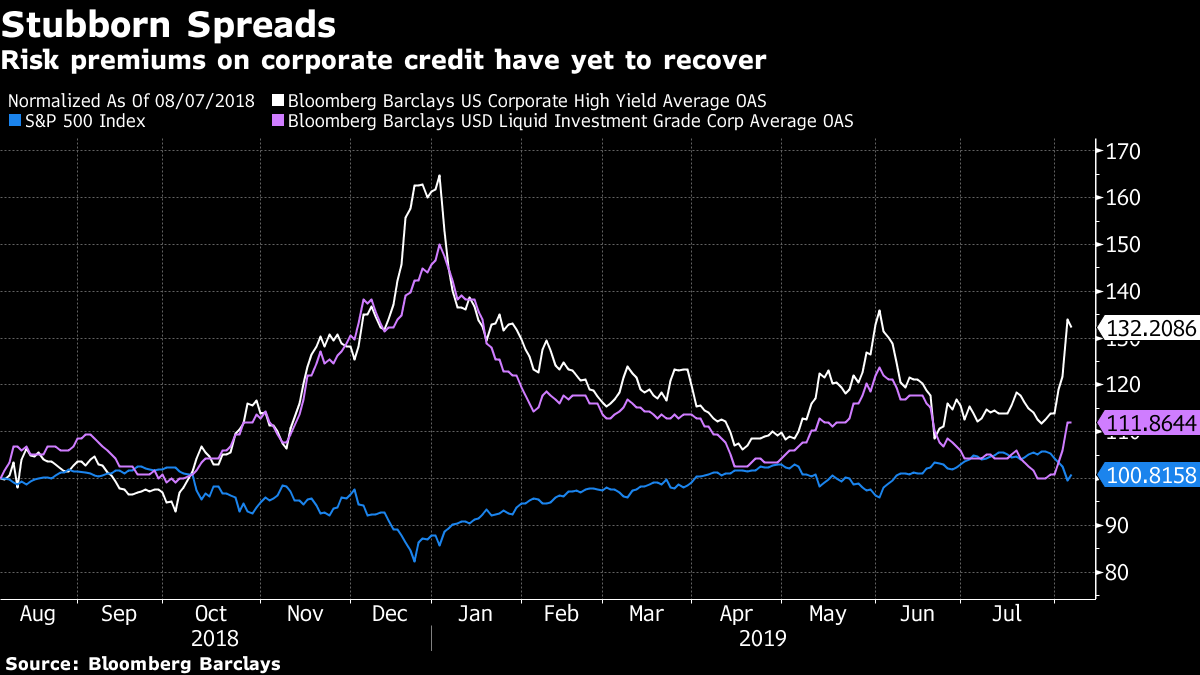

| Equity markets had smoother sailing thanks to reassuring words from the White House and PBOC. North Korea wants to hack your crypto account. And China ups the pressure on India's Kashmir decision. Here are some of the things people in markets are talking about today. Serenity Now Asian equity futures are mixed after U.S. stocks recovered somewhat from Monday's bloodbath, with all major indexes gaining more than 1%. The White House put an optimistic spin on the trade friction, with Larry Kudlow saying the administration still expects Beijing's negotiators to come to Washington for talks in September and will look at China's steps to support the yuan. Meanwhile, the PBOC reassured a number of foreign exporters the currency won't continue to weaken significantly. But the half-baked sell-off has traders worried the worst is yet to come. Trump and Xi's Big Bets Despite a market recovery, ties between the U.S. and China are at their lowest point in decades. A big part of the problem is that neither country's leader believes the other is serious about making a trade deal: China sees Trump as posturing ahead of the 2020 election, while U.S. officials think Xi is looking to wait him out for a better deal. Either way, the political space for compromise is diminishing as hardliners take center stage, prompting investors to weigh the potential economic fallout. As the world waits to see what comes next, here's why the U.S. made its latest move. Master Hacker North Korea has mastered hacking into financial systems, stealing about $2 billion from banks and cryptocurrency exchanges for its nuclear weapons programs, a new UN report found. Pyongyang also has overseas representatives controlling bank accounts. Newly unsealed court documents show the U.S. is probing transactions involving three big Chinese banks that allegedly helped finance North Korea's nuclear program. Kashmir Tensions Rise Beijing criticized India's decision to withdraw the autonomous status of Kashmir, which borders China, accusing New Delhi of undermining the state's territorial sovereignty. (The region includes two areas that are controlled by China and claimed by India.) Pakistani PM Imran Khan said the move may lead to war, and the nation's army pledged to go to "any extent" to defend the people of the disputed state. Rate Cuts Coming New Zealand and India will probably both cut rates by 25 basis points Wednesday, while the Bank of Thailand is expected to hold. The RBNZ is seeking to support the labor market and reduce upward pressure on the kiwi and may hint at further easing, economists said. The RBI's reduction will be its fourth in a row, amid calls from investors and the government to do more to boost growth. What we've been reading This is what's caught our eye over the last 24 hours. And finally, here's what Tracy's interested in this morning The sell-off in equities has stolen the limelight this week, but take a look at what's been going on in credit. U.S. junk bond spreads saw their biggest one-day move in eight years on Monday after China allowed the yuan to devalue — with risk premiums blowing out by 40 basis points to 439bps over U.S. Treasuries. It was a similar story for investment-grade debt.  Interestingly, those spreads have yet to come in, even as stocks have notched a slight recovery. The good news (if you're looking for it) is that tension in credit is exactly the kind of thing that will get the Federal Reserve's attention. In fact, there's a theory that the dovish pivot central bank took earlier in the year was all about late 2018's mayhem in credit feeding into the wider economy. The bad news is that we just had a reminder of how fast credit can re-rate when concerns surface about the direction of the global economy — and that in itself can end up fueling those concerns further. You can follow Bloomberg's Tracy Alloway at @tracyalloway. The best in-depth reporting from Asia Pacific and beyond, delivered to your inbox every Friday. Sign up here for The Reading List, a new weekly email coming soon. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. |

Post a Comment