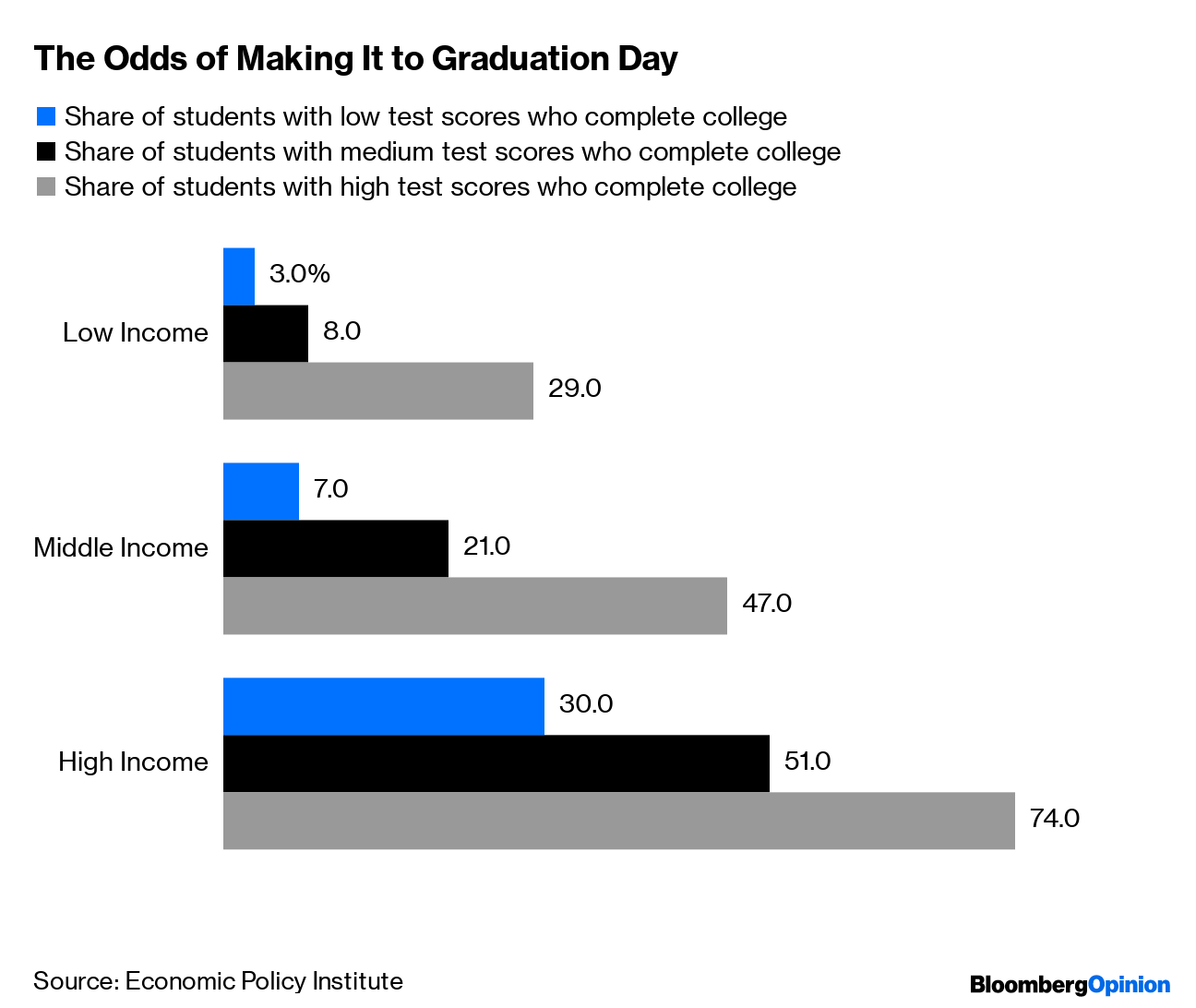

Today's Agenda  A Modest Fed Proposal President Donald Trump has the Federal Reserve in an impossible spot. His constant backseat-driving of monetary policy encroaches on its political independence. And his relentless trade warring hurts the economy, pushing the Fed to cut rates just as Trump wants — which also makes it easier for him to keep trashing global trade. Former New York Fed President Bill Dudley suggests the Fed put its foot down. It should resist encouraging Trump's trade aggression with lower interest rates, he writes, because a prolonged trade war will only make economic conditions much worse in the long run. He also proposes the Fed engage in a different sort of resistance, one of the #Resistance variety. Given that the economy's biggest threat is the current occupant of the White House, the Fed should consider whether it really wants him to still be there in 2021, he writes. That second part is not something you hear every day from central bankers, current or former! The Fed immediately rejected it. Many on Bloomberg Opinion's roster of Fed watchers — including Jim Bianco, Clive Crook, Mohamed El-Erian, Narayana Kocherlakota, Ramesh Ponnuru and Michael Strain — disagreed with some or all of the piece. Mohamed, for example, says it's reasonable to suggest the Fed cannot magically offset the bad effects of Trump's trade war. But calling for it to influence the election, in this case by actively hurting the economy, would validate Trump's most fevered tweets and vaporize any trace of Fed independence, Mohamed and the others write. What's more likely is that the Fed remains stuck. Further Trade-War Reading: Sue 'Em if You Got 'Em Big Pharma may be about to experience what Big Tobacco went through 20 years ago. Johnson & Johnson yesterday got slapped with a $572 million verdict for its (arguably minor) role in America's opioid crisis. Noah Feldman suggests the lawsuit against J&J was based on a dubious reading of the law, but we're in the early stages of a uniquely American ritual, in which we sue companies to redistribute money from them to the state to address some public-health crisis. It's not efficient and doesn't bring justice, Noah writes, but this is how we do things here in the U.S. of A. Altria Group Inc., formerly known as Philip Morris Inc., was part of the mammoth settlement that effectively ended Big Tobacco's version of this Kabuki theater. About a decade after that settlement, Altria spun off Philip Morris International Inc. Now, a decade later, the two are talking about getting back together again. The deal, which would shatter industry records, would help the two companies defend themselves against a steady global decline in smoking, writes Tara Lachapelle. How will they do it? By getting us to suck nicotine into our bodies in other ways, along with maybe some marijuana. A New Hole in the Volcker Rule The Volcker Rule, the part of Dodd-Frank that aimed to half-revive Glass-Steagall by preventing federally insured banks from proprietary trading — or gambling in the market with their own money — has always been a little slippery. What is prop trading, exactly? Who decides whether a bank is trading to win yachts for itself or its customers? After years of haggling and various problematic approaches, the Trump administration seemed to have come up with a way to split this baby, by focusing on the outcomes of trading, rather than trying to read traders' minds. But then, after still more complaining from banks, Trump's rule-makers carved out a $600 billion exception. This, Bloomberg's editorial board writes, would defeat Volcker's whole purpose. There's still time for regulators and the public to oppose this change; otherwise the Volcker Rule is useless. Telltale Charts One big reason low-income students don't go to college is that the application process is simply too expensive and difficult. Making college application universal and cheap could do more than free tuition to right this wrong, suggests Noah Smith.  Further Reading Two recent gun panics at Missouri Walmarts show just how absurd our open-carry laws are. – Francis Wilkinson Trump's pitch to hold the next G-7 meeting at his golf course is the latest example of his habitual grifting. – Jonathan Bernstein Slowly but surely, Russia is revealing the truth of what happened in the White Sea nuclear accident. – Leonid Bershidsky Trump's latest negotiating stance on Iran is a near-total retreat to Obama's position. – Eli Lake We can't just stop denying terrorists safe havens; our experience in Afghanistan, Syria and elsewhere proves it. – Hal Brands Late Volkswagen AG Chairman Ferdinand Piech was a flawed genius, and sometimes that's what it takes. – Chris Bryant ICYMI China doesn't trust Trump on trade. Libor's days are numbered. House flippers are selling Long Island real estate to each other. Kickers Florida Man allegedly sells Trump-shaped ecstasy pills. (h/t Scott Kominers) The behavior of chemically active droplets could explain life's origin. Your internal monologue is more complicated than you think. Daydreams shape our sense of self. Note: Please send daydreams and complaints to Mark Gongloff at mgongloff1@bloomberg.net. New to Bloomberg Opinion Today? Sign up here and follow us on Twitter and Facebook. |

Post a Comment