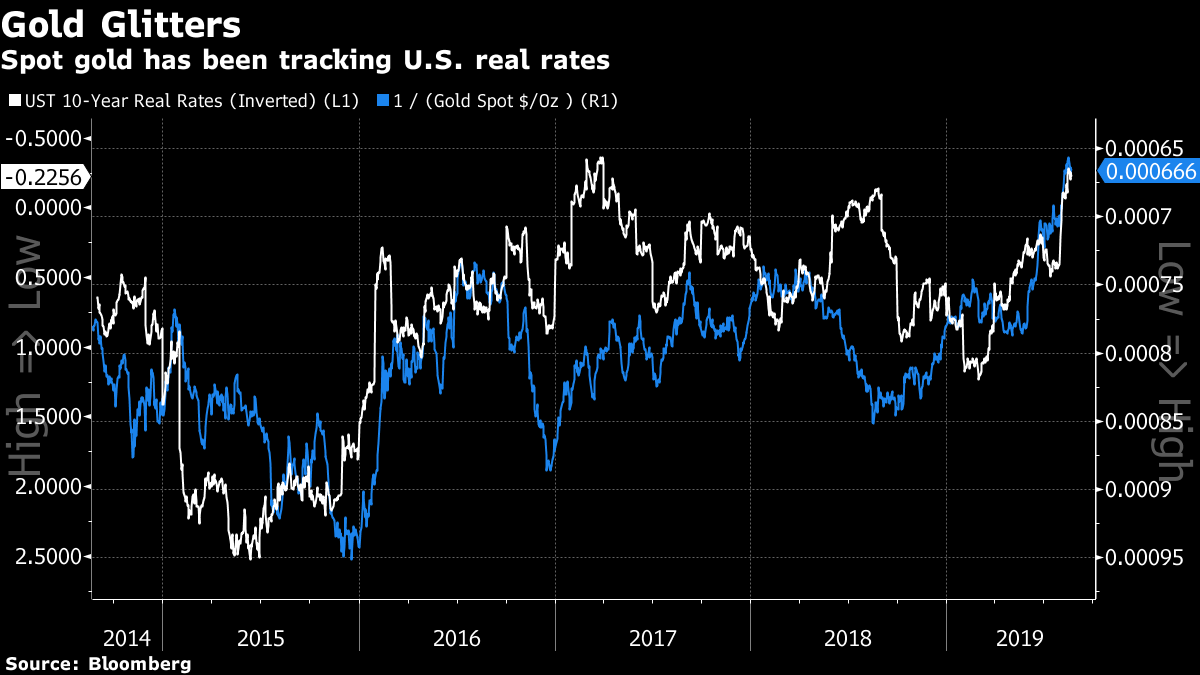

Demonstrators in Hong Kong clash with police. The Hang Seng Index is on track for its worst quarter since 2015. And Donald Trump says he's "the chosen one." Here are some of the things people in markets are talking about today. Dispatch From Hong Kong Hong Kong protesters confronted police again. A group set off fire extinguishers at a railway station in the Yuen Long district — the site of a mob attack against demonstrators last month — before dispersing. There was a smaller "Save Simon Cheng" rally in support of the U.K. Consulate General employee, who China confirmed was being detained on the mainland. Cathay Pacific said another pilot had left in connection with the unrest and that it expects "significant impact" on its revenue as travel demand gets bruised by the months-long protests. Here's why hitting tycoons where it hurts might appease the protesters. Stocks SufferAsia stocks are poised for modest gains Thursday, but Hong Kong stocks are poised for their worst quarter since 2015 and corporate earnings are unlikely to save them. After a sell-off erased more than $600 billion from the city's equities, attractive valuations stood as a potential bright spot. But those multiples don't look so good when analysts keep slashing their profit forecasts for 2019. Their call for an average 19% slump in operating income would be the biggest contraction for Hang Seng Index companies since the global financial crisis, data compiled by Bloomberg show. QE Down UnderAustralia and New Zealand's central banks are pondering what until recently seemed unthinkable: deploying the types of extreme monetary policies that were spawned globally by the 2008 financial crisis. Bond-purchase programs and negative interest rates were for years seen down under as the preserve of countries that had gorged on risky derivatives and been reckless with debt. Now, the Antipodeans are at the forefront of what appears to be a race to the bottom—where even interest rates at zero may not be low enough. Divided They StandUnity at the U.S. Federal reserve is fraying. FOMC officials argued over whether to lower rates and by how much at last month's meeting, minutes showed. Overall, the committee viewed the quarter-point cut as insurance against too-low inflation and falling business investment. But two members voted against the move and "a couple" participants sought a half-point reduction. The Chosen OneHere's the latest from Trump: The U.S. president has no immediate plans to cut taxes on capital gains and "probably" will reach a trade deal with China. "I am the chosen one" to take on Beijing, he said. He also blamed his cancelled visit to Denmark on Prime Minister Mette Frederiksen for calling his interest in buying Greenland absurd. Finally, Trump repeated his contention that Jews who vote for Democrats are disloyal to Israel, a trope that many Jewish groups find anti-Semitic. What we've been readingThis is what's caught our eye over the last 24 hours. And finally, here's what Tracy's interested in this morningIs gold a Rorschach test of the market's biggest fears? When people were concerned that quantitative easing would lead to a huge increase in inflation back in 2009, they talked about gold as a hedge against currency debasement. When people worry about market volatility, they say gold is a stable safe haven in times of turmoil. And now that people fret about negative interest rates, gold is being described as an opportunity-cost play.  The comparative advantage of gold is said to have increased as interest rates remain low (so you can put money in a non-interest-bearing lump of metal instead of an interest-bearing asset like bonds). I don't have strong opinions about it either way, but it's interesting to see how the bull arguments change over time. And, if you look at the chart below, gold has been tracking real rates on U.S. Treasuries pretty closely. You can follow Bloomberg's Tracy Alloway at @tracyalloway. The best in-depth reporting from Asia Pacific and beyond, delivered to your inbox every Friday. Sign up here for The Reading List, a new weekly email coming soon. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. |

Post a Comment