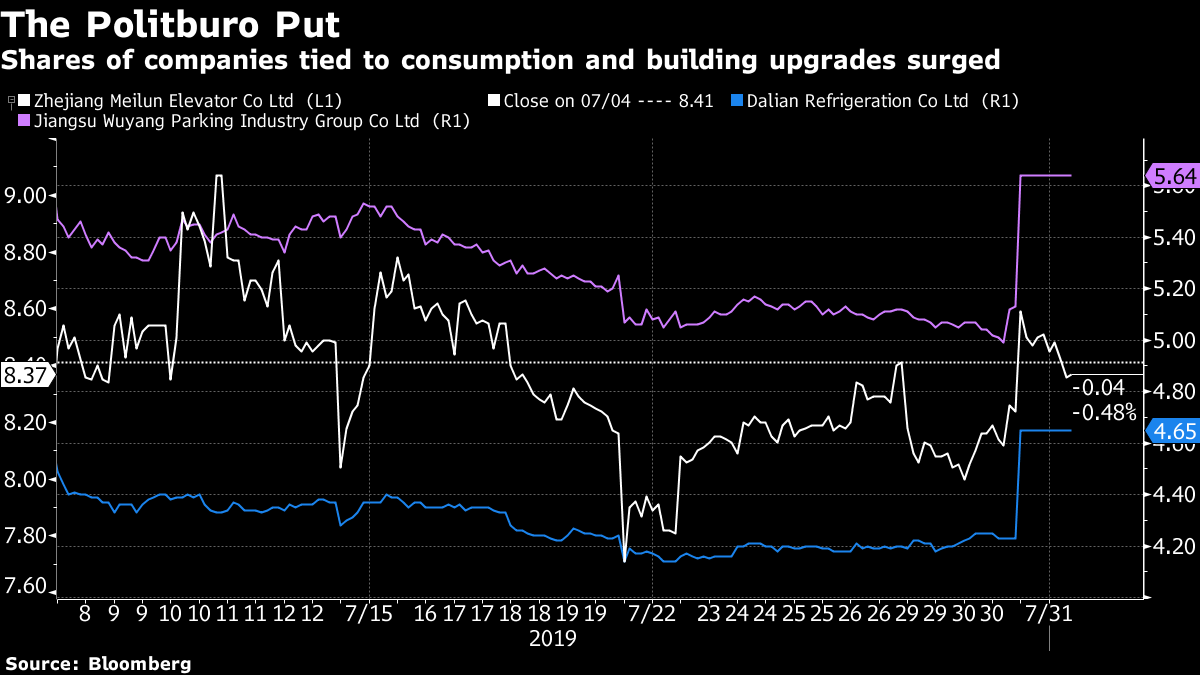

| The Fed cut interest rates, surprising no one. Trade talks between the U.S. and China will return to Washington in September. And the U.S. charged a Chinese billionaire for evading levies on aluminum. Here are some of the things people in markets are talking about today. Snip, Snip The Fed cut, as widely expected, lowering the target range for the federal funds rate 25 basis points to 2% to 2.25%. Policy makers based their decision on global developments and "muted" inflation pressures and left the door open to further reductions. Chairman Jerome Powell said the cut was designed to "insure against downside risks" rather than signal the start of a lengthy cycle of monetary policy easing. "It's not the beginning of a long series of rate cuts," he said, adding: "I didn't say it's just one" cut. No matter how he couched it, it wasn't going to be enough to mollify Donald Trump. "As usual, Powell let us down," the U.S. president tweeted. Markets Sink Asian equity futures pointed lower after the Fed announcement, following a sharp move downward by U.S. stocks. All three major indexes fell more than 1%, with the S&P 500 dipping as much as 1.8% before paring losses to close down 1.1%. The Treasury curve flattened as short-end yields rose, driving the gap between 2- and 10-year yields to its lowest levels since March. Gold sank, the dollar gained and oil rose to its highest in more than two weeks. Trade Talks U.S.-China trade talks will resume in September in Washington. The Shanghai negotiations included China's confirmation of a pledge to boost purchases of farm goods—a key U.S. demand—the White House said. Other topics included technology transfers, IP and non-tariff barriers. Tariffs or no tariffs, Chinese companies will probably show little interest in buying American corn. That's because the jump in Chicago benchmark futures since May has wiped out the price advantage over domestic supplies, according to Yigu Info Consulting. Billionaire Charged U.S. prosecutors have charged a Chinese billionaire in what they believe is one of the largest tariff-related cases ever brought by the Justice Department. Zhongtian Liu was accused of scheming to avoid $1.8 billion in American levies on aluminum, prosecutors said. He and others with China Zhongwang Holdings, Asia's largest aluminum extrusion company, lied to customs agents to avoid duties imposed in 2011 on certain types of extruded aluminum imported into the U.S. from China. Troubled Waters Southeast Asia's foreign ministers warned in a communique that continued incidents in the South China Sea have "eroded trust" and may undermine regional stability. They aired their concerns the same day Chinese Foreign Minister Wang Yi touted a preliminary draft on a code of conduct meant to manage the decades-long conflict over the disputed waters. What we've been reading This is what's caught our eye over the last 24 hours. And finally, here's what Tracy's interested in this morning The Fed will no doubt steal the limelight this week, but there was another policy gathering that might have a big effect on markets. China's politburo held its midyear meeting a day before the U.S. central bank's decision. That meeting was held against a backdrop of trade tensions with the U.S. but also an upcoming domestic political event: Oct. 1 marks the 70th anniversary of the founding of the People's Republic of China. China's leaders tend to promote growth and stability ahead of such politically significant dates. "In the run-up to the 70th anniversary of the founding of Socialist China, economic and social stability will only become more important," Citigroup analysts wrote on Wednesday. "Given the policy put, we see the event as positive to market sentiment."  While the politburo meeting didn't unveil a huge new stimulus program or press for lots more monetary easing, policy makers did pledge to boost domestic demand and revitalize some older neighborhoods. And so we saw a bunch of stocks tied to consumption and building—think refrigerator and elevator companies—jump after the meeting. The question is now whether additional policy measures could be on the way ahead of Oct. 1. You can follow Bloomberg's Tracy Alloway at @tracyalloway. The best in-depth reporting from Asia Pacific and beyond, delivered to your inbox every Friday. Sign up here for The Reading List, a new weekly email coming soon. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. |

Post a Comment